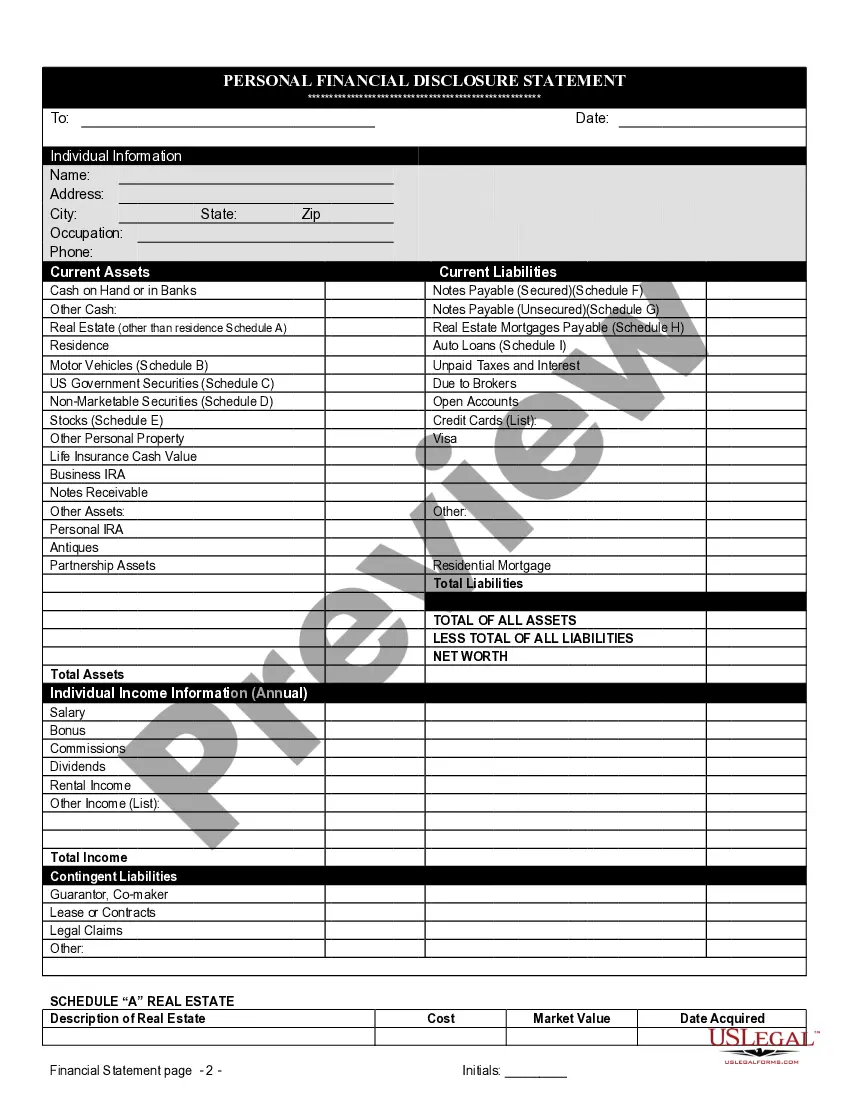

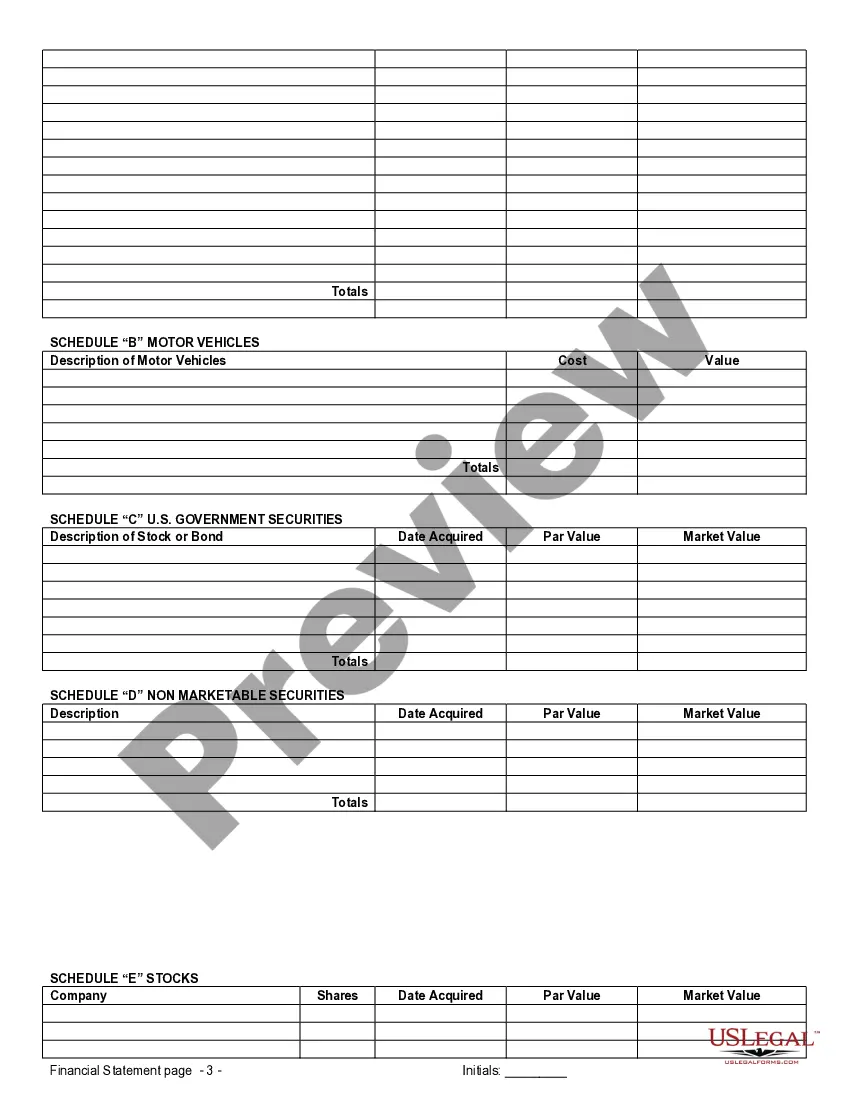

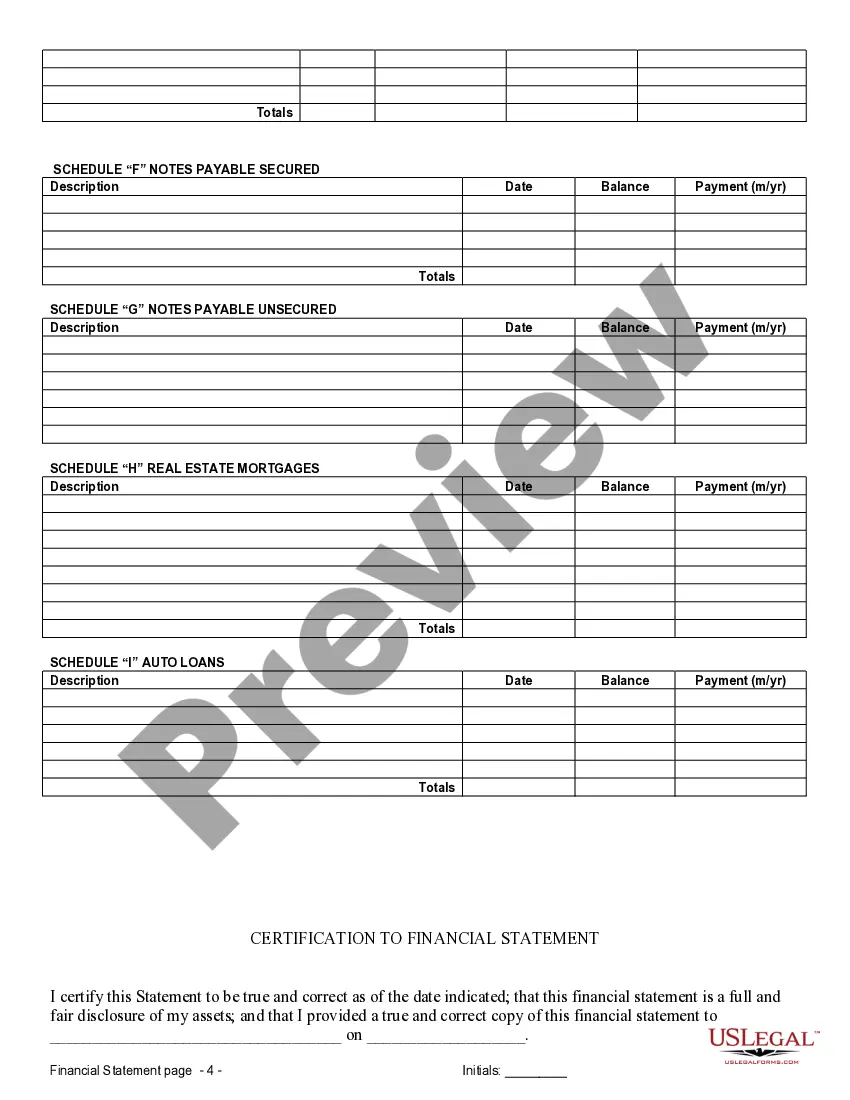

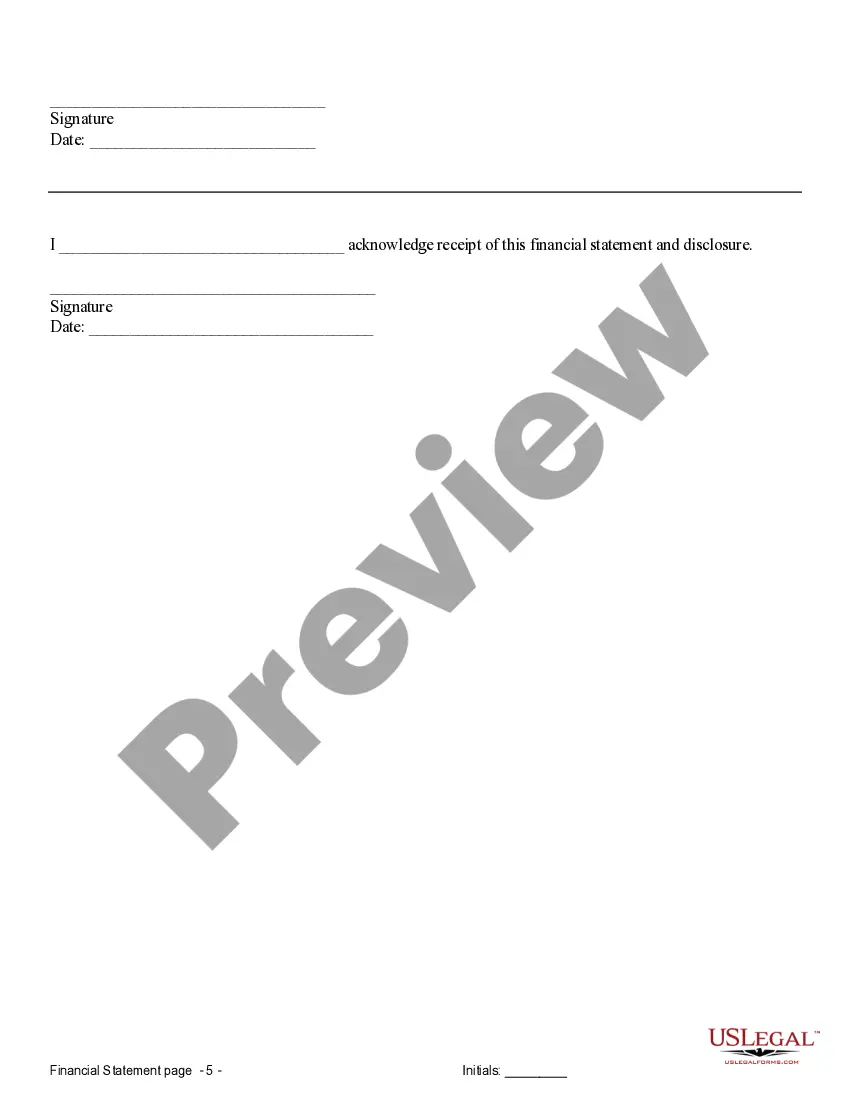

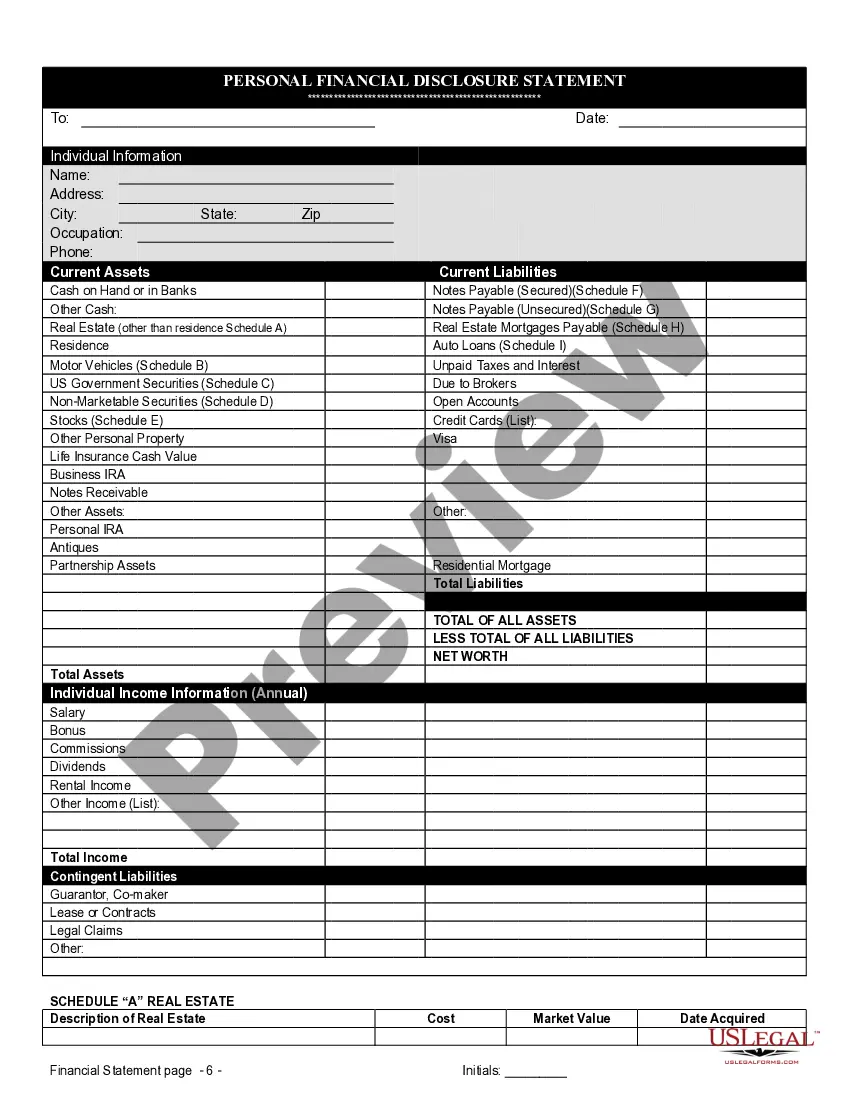

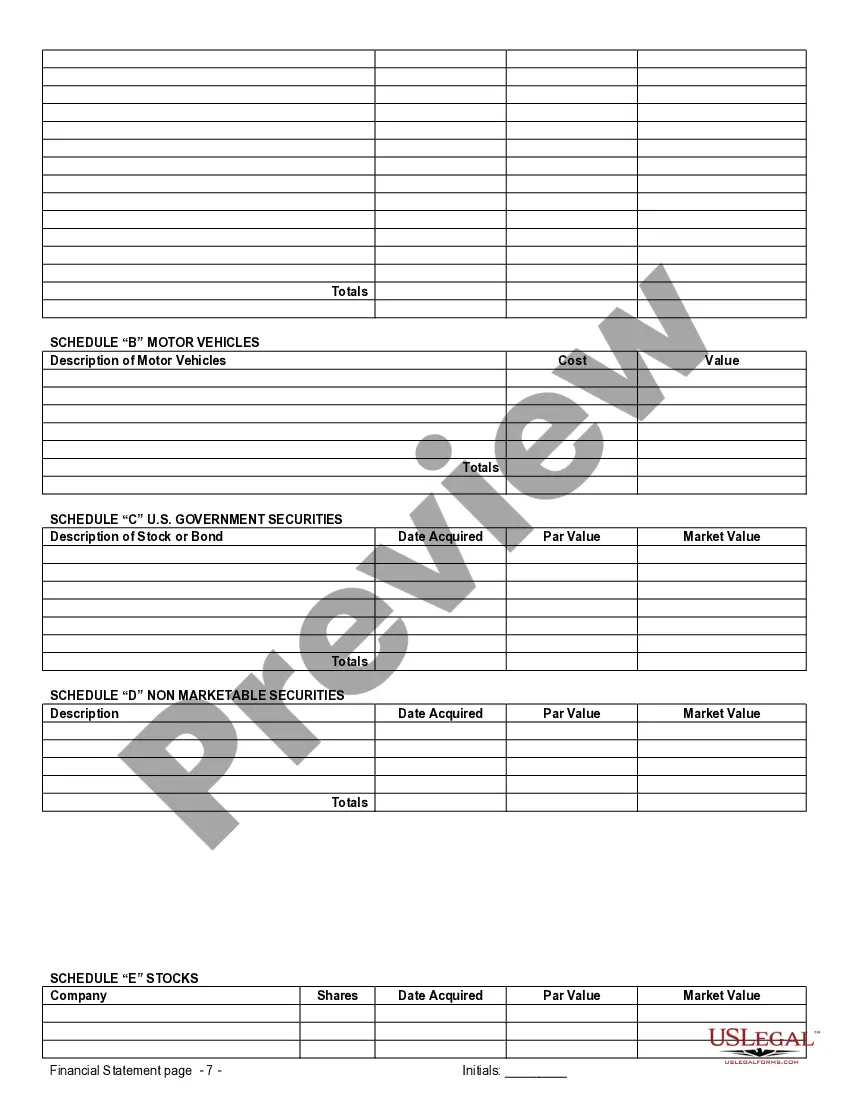

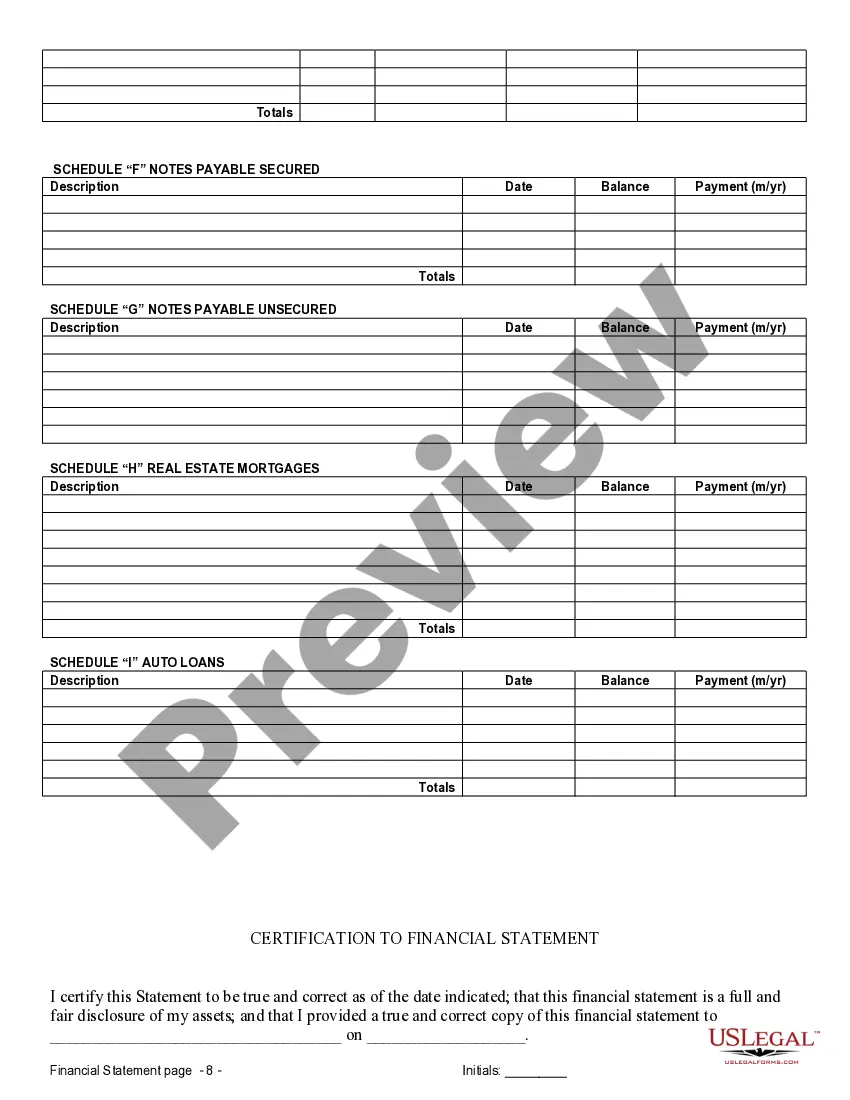

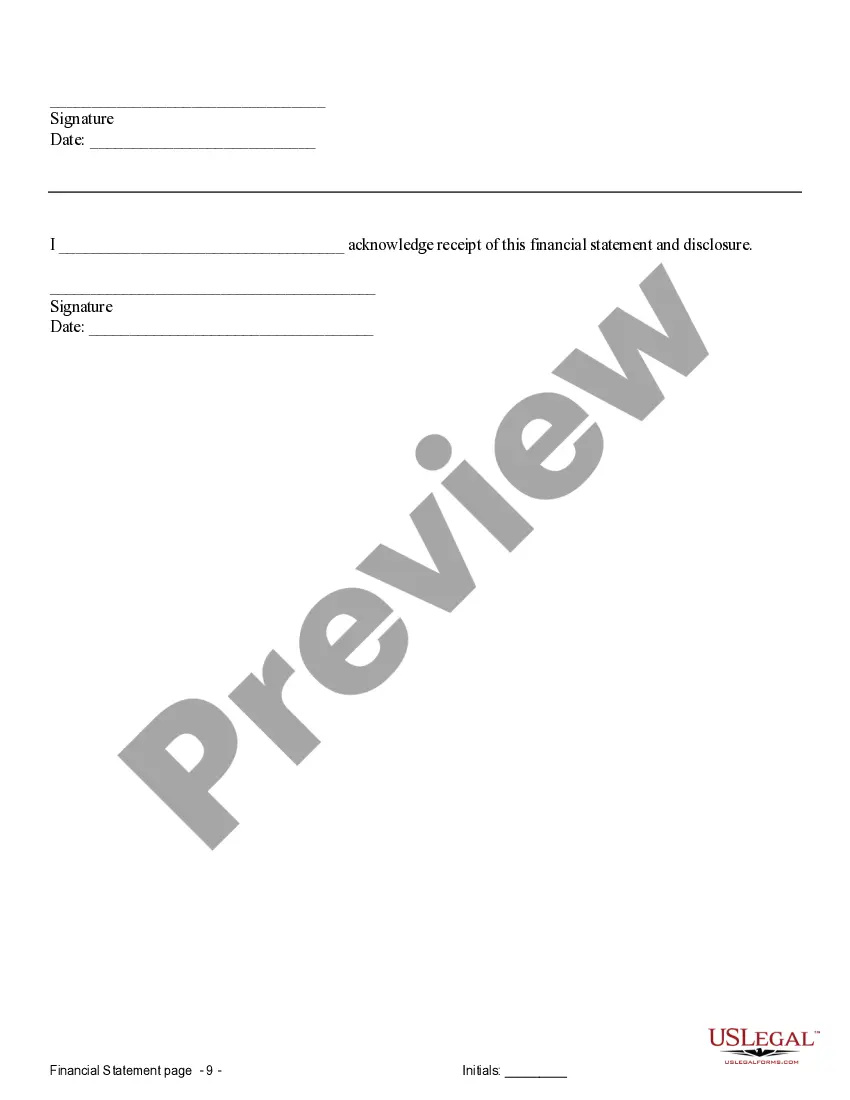

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

McKinney Texas Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Texas Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Irrespective of social or professional standing, finalizing legal documents is a regrettable requirement in today's society.

Frequently, it's nearly impossible for someone lacking any legal expertise to compose such documents from the beginning, primarily due to the intricate terminology and legal nuances they involve.

This is where US Legal Forms can come to the rescue.

Confirm that the template you have selected is appropriate for your locality, as the regulations of one state or county may not be applicable in another.

Preview the document and review a brief summary (if available) of scenarios for which the paperwork can be utilized.

- Our service offers an extensive library containing over 85,000 ready-to-use state-specific documents that cater to almost any legal circumstance.

- US Legal Forms also acts as a valuable resource for paralegals or legal advisors seeking to enhance their efficiency using our DIY forms.

- Whether you require the McKinney Texas Financial Statements solely in relation to a Prenuptial Premarital Agreement or any other documentation valid in your state or region, US Legal Forms has everything at your disposal.

- Here's how to quickly acquire the McKinney Texas Financial Statements strictly in association with a Prenuptial Premarital Agreement using our dependable service.

- If you are already a registered user, you can proceed to Log In to your account to retrieve the necessary form.

- However, if you are a newcomer to our repository, please ensure you follow these procedures before securing the McKinney Texas Financial Statements for your Prenuptial Premarital Agreement.

Form popularity

FAQ

In Texas, a marriage may be deemed invalid due to factors such as lack of capacity, fraud, coercion, or if one party did not legally consent. Additionally, if either party is already married, the second marriage is automatically invalid. To protect your interests and clarify your situation, consider discussing your circumstances with an expert familiar with McKinney Texas Financial Statements only in Connection with Prenuptial Premarital Agreement.

To avoid community property designations, couples can enter into a prenuptial agreement that specifies how property will be classified and managed. Keeping assets separate and clearly documenting financial agreements can also help. By consulting McKinney Texas Financial Statements only in Connection with Prenuptial Premarital Agreement, you can create a solid foundation for your financial future.

It is advisable to have a prenuptial agreement signed at least a few weeks before the wedding. This timeframe allows both parties to review the agreement thoroughly without the pressure of an impending wedding day. Planning ahead with your McKinney Texas Financial Statements only in Connection with Prenuptial Premarital Agreement ensures everything is in order.

A prenuptial agreement can dictate how property will be classified and divided, even overriding community property laws if properly structured. This flexibility allows couples to establish their own terms regarding assets and obligations. Utilizing McKinney Texas Financial Statements only in Connection with Prenuptial Premarital Agreement can help ensure that your wishes are clearly documented.

Prenuptial agreements are generally enforceable in Texas as long as they meet certain legal requirements. These include being written, signed by both parties, and entered into voluntarily without fraud or coercion. To strengthen the enforceability of your prenup, detail your McKinney Texas Financial Statements only in Connection with Prenuptial Premarital Agreement accurately.

Yes, in Texas, both husbands and wives can own community property equally. This means that any property acquired during the marriage belongs to both parties, regardless of whose name is on the title. Clear documentation, including McKinney Texas Financial Statements only in Connection with Prenuptial Premarital Agreement, helps to navigate these ownership issues effectively.

Under Texas law, unless specified otherwise in a prenuptial agreement, the division of property may involve community property principles. If the house was purchased during the marriage, it may be considered community property, even if only in your name. Addressing this concern with detailed McKinney Texas Financial Statements only in Connection with Prenuptial Premarital Agreement can provide clarity.

A prenup may be deemed invalid if one party did not voluntarily sign it, if there was fraud or a lack of full disclosure of assets, or if the terms are unconscionable. It's essential that both parties understand the agreement and its implications fully. By utilizing McKinney Texas Financial Statements only in Connection with Prenuptial Premarital Agreement, you can clarify your financial positions and help avoid challenges.

In Texas, a prenup, or prenuptial agreement, remains valid as long as both parties adhere to its terms and obligations. A well-drafted agreement can last for decades, provided it does not violate public policy or any laws. It's crucial to review the McKinney Texas Financial Statements only in Connection with Prenuptial Premarital Agreement regularly to ensure they align with your current circumstances.

Yes, a prenup is generally enforceable in Texas as long as it meets certain legal requirements outlined in the Texas Family Code. The agreement must be fair and not obtained through fraud, coercion, or undue influence. Including detailed and accurate McKinney Texas Financial Statements only in Connection with Prenuptial Premarital Agreement strengthens the enforceability of your prenup, making it less likely to face challenges in court.