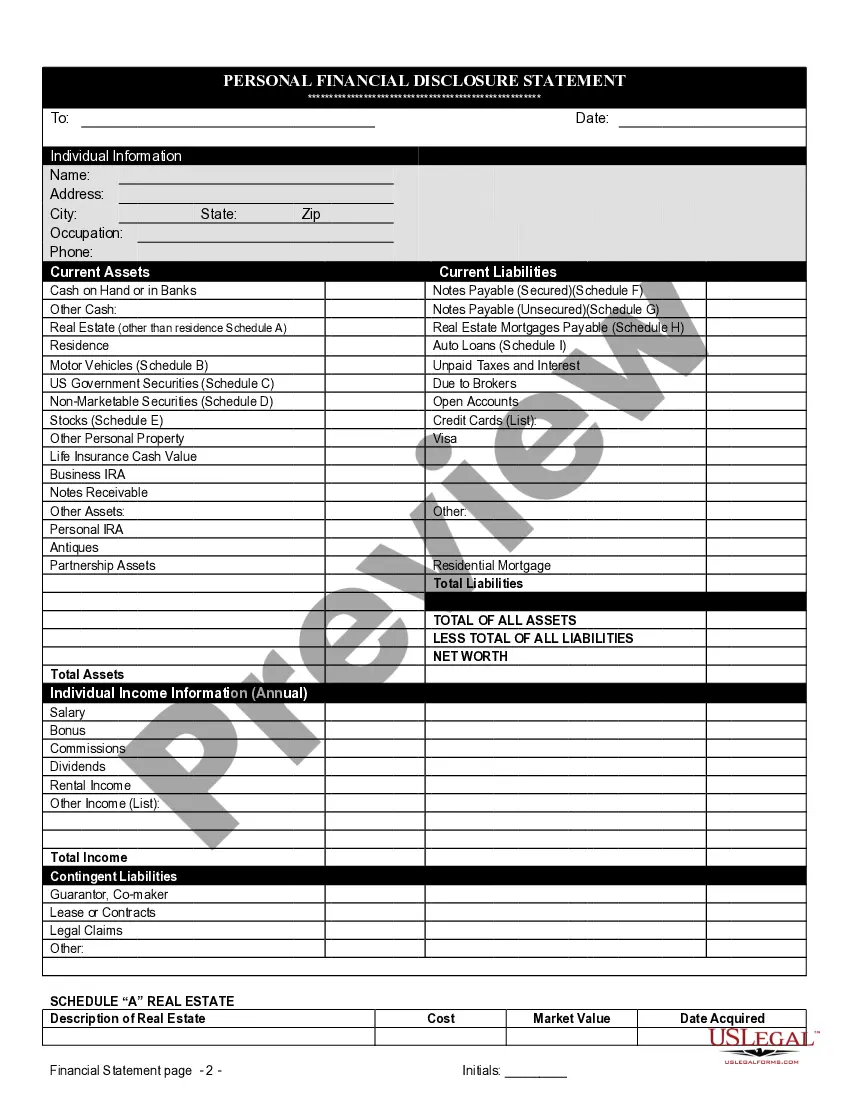

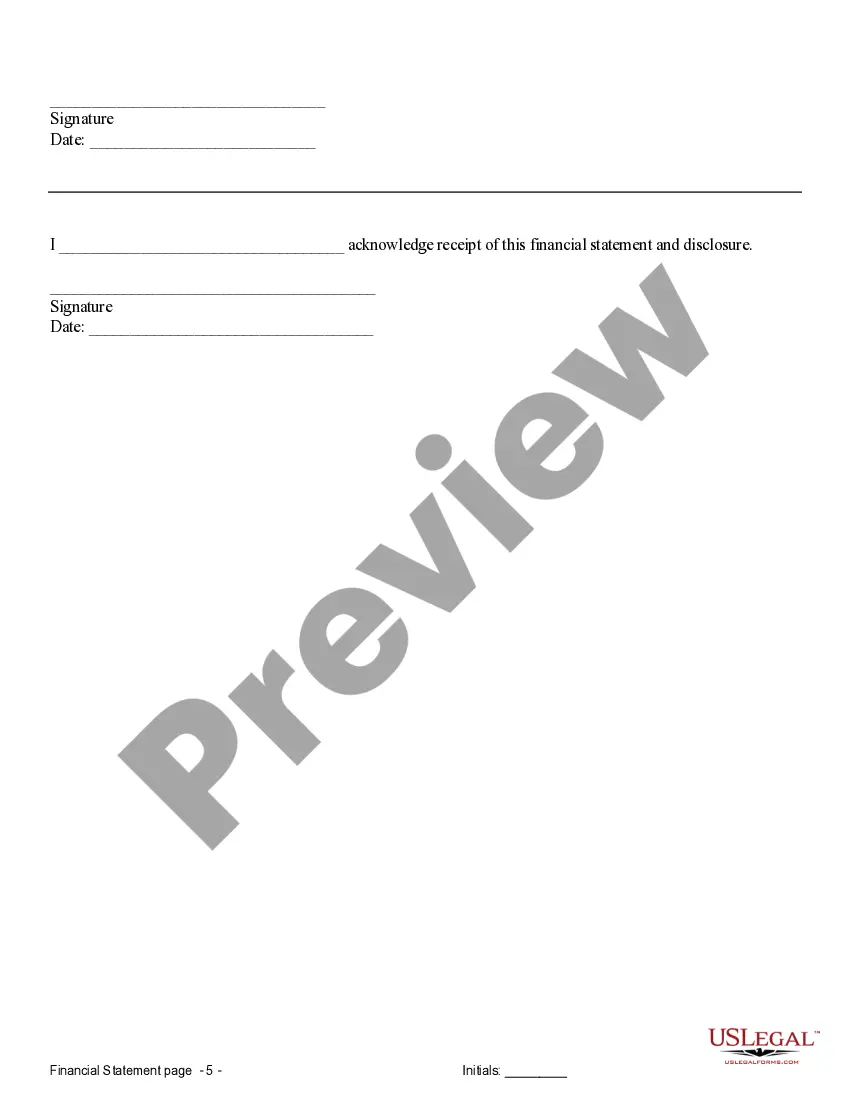

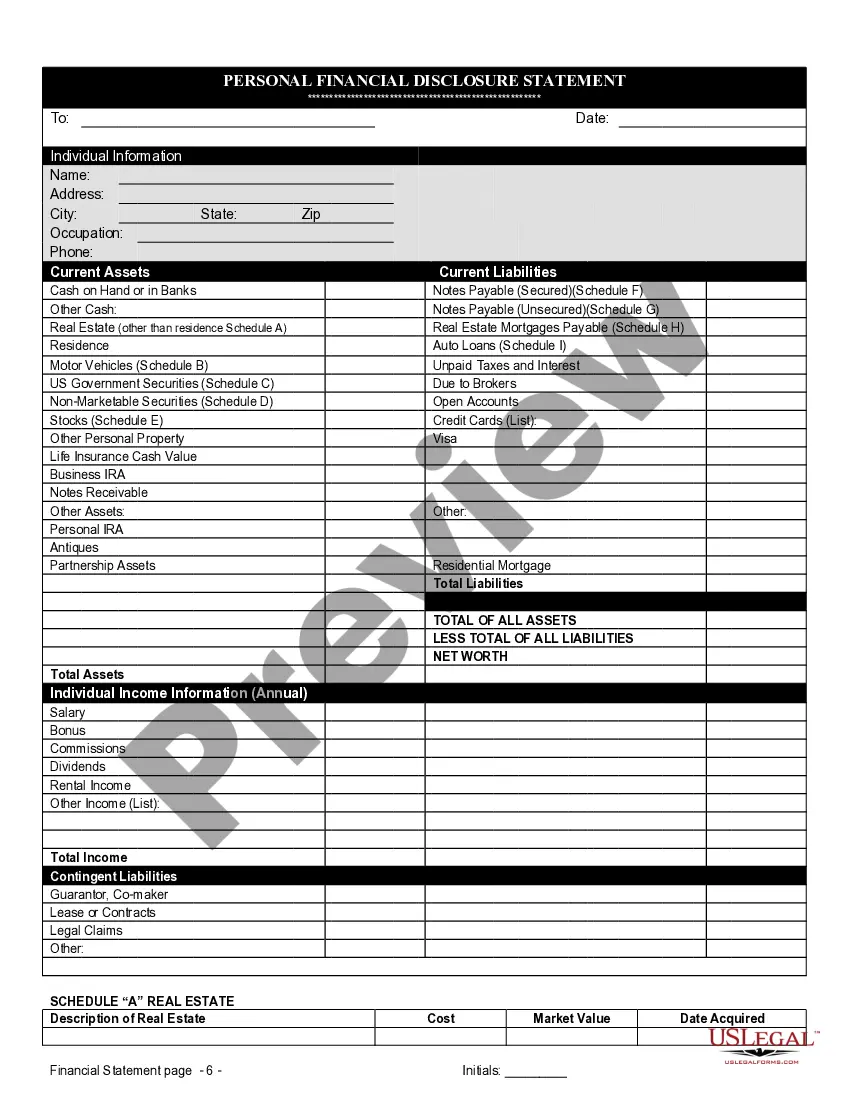

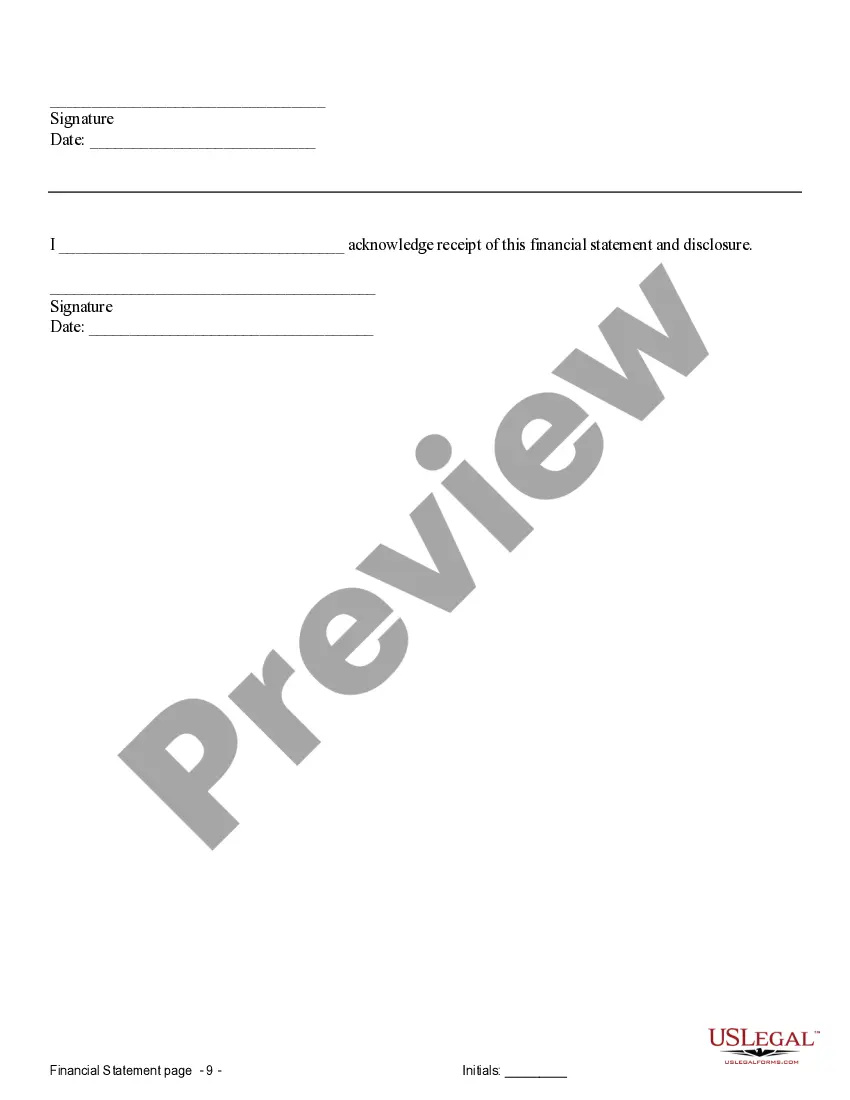

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

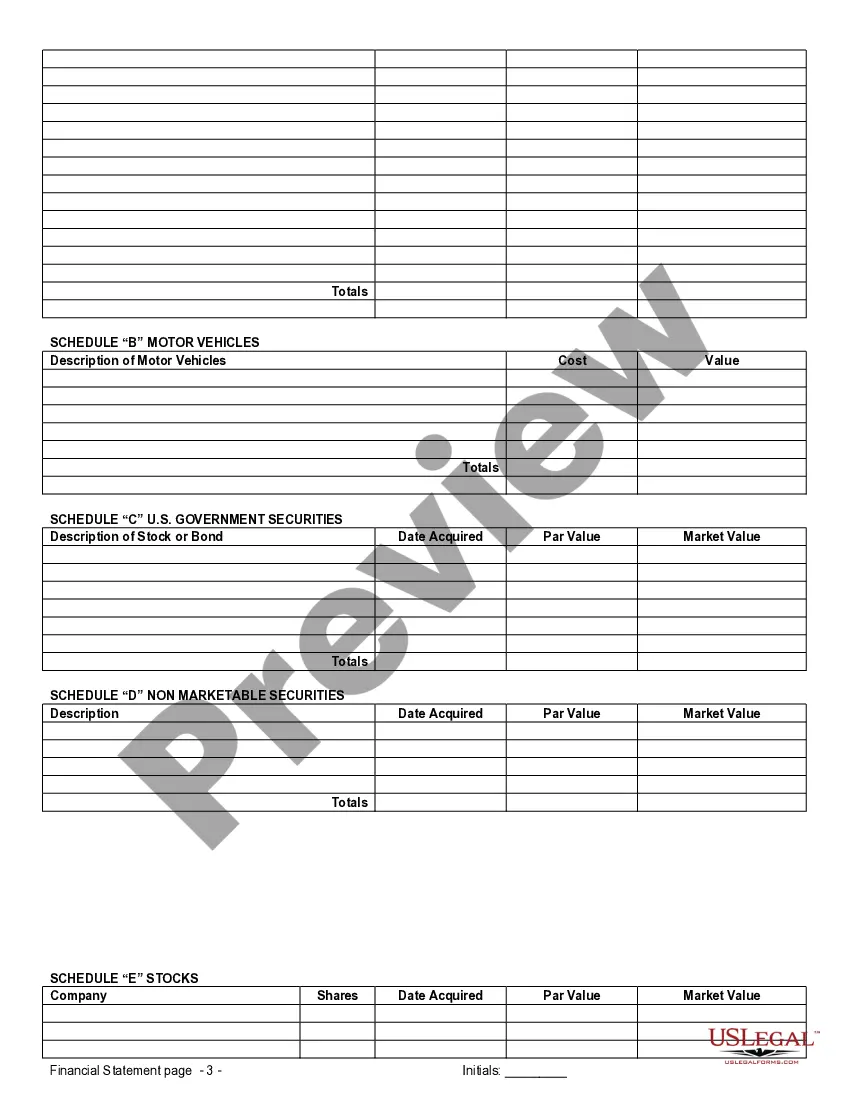

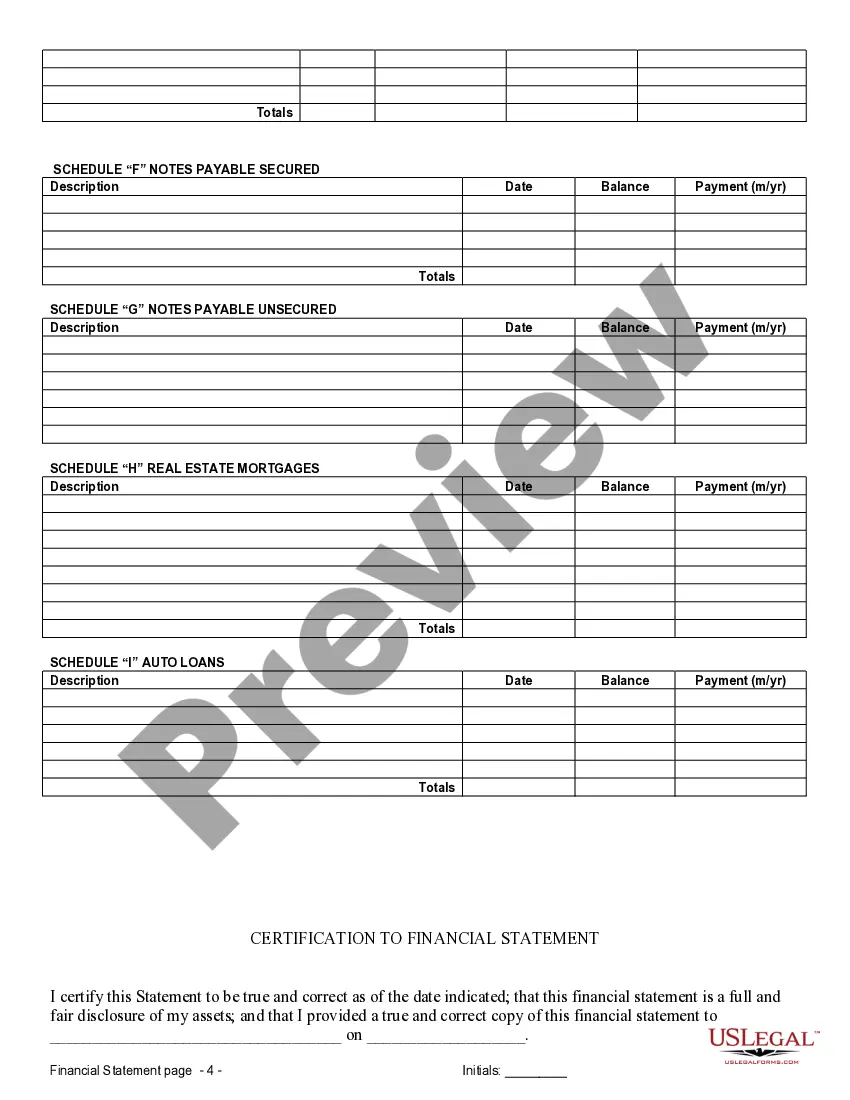

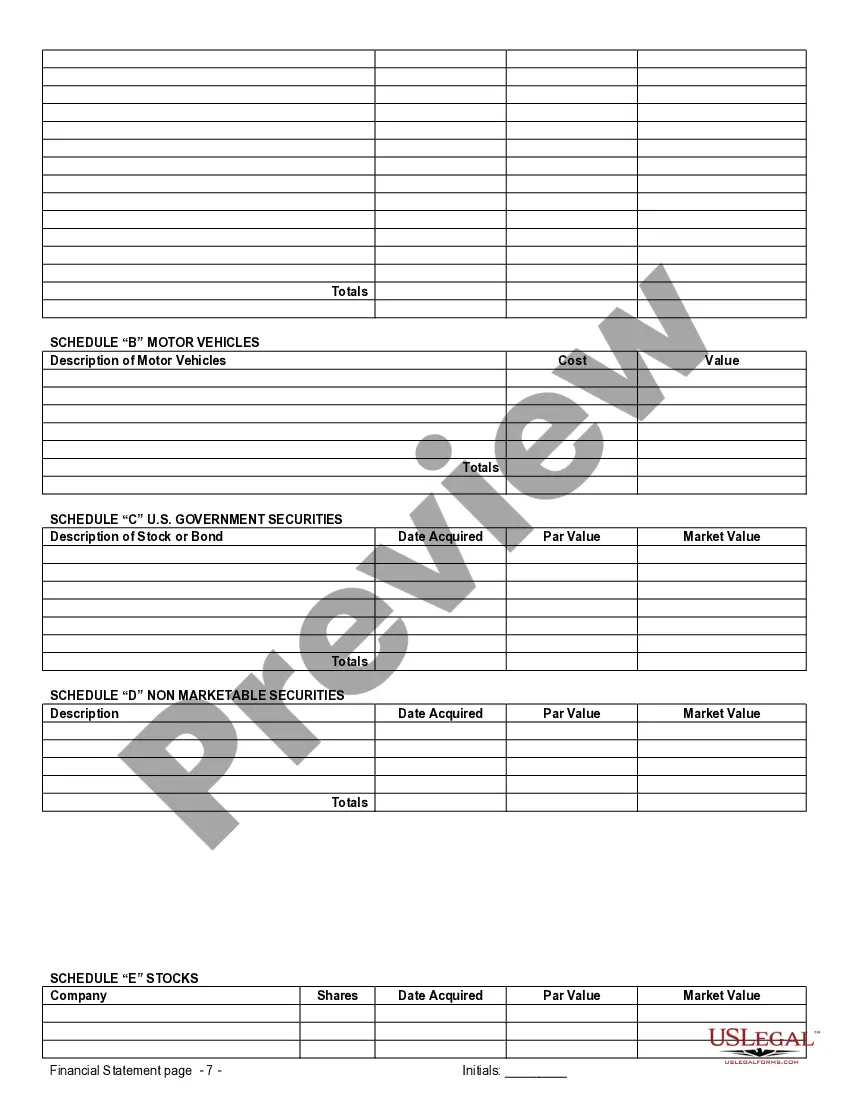

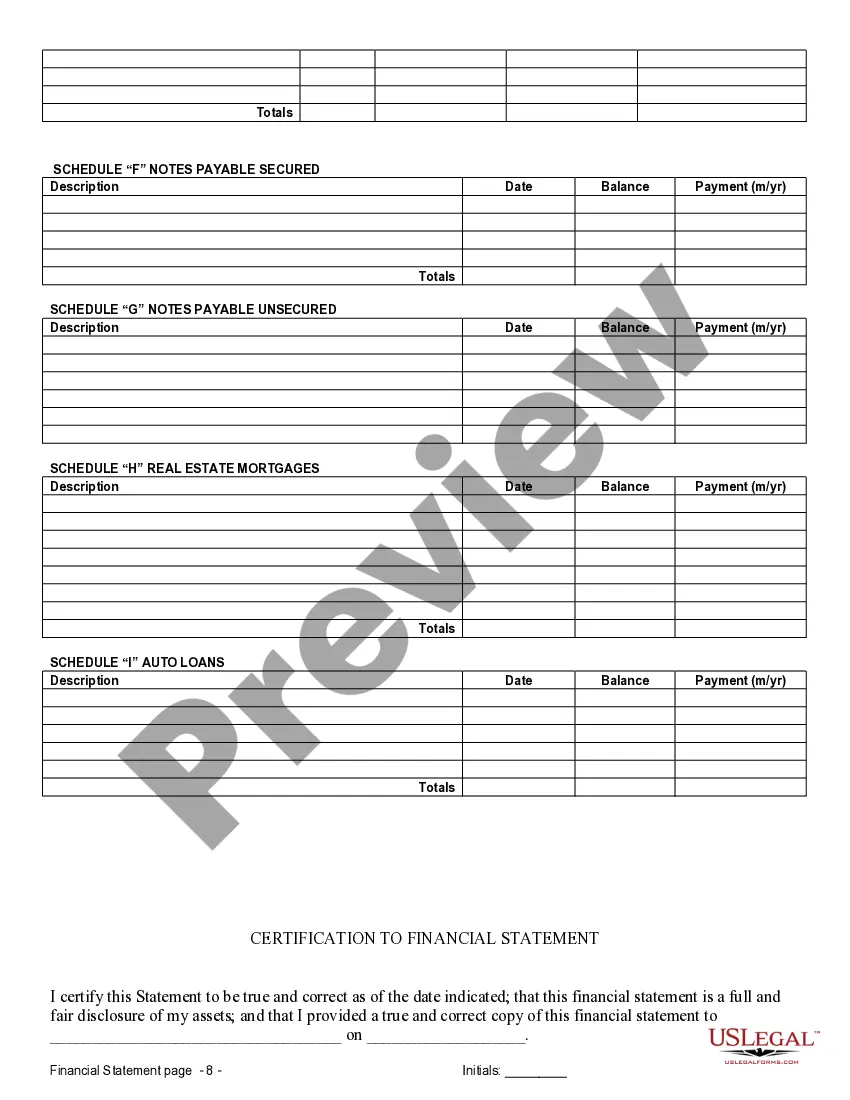

Mesquite Texas Financial Statements in Connection with Prenuptial Premarital Agreement provide a comprehensive overview of an individual's or couple's financial situation before entering into a marriage. These statements are essential in outlining the financial rights, obligations, and expectations of each party involved. They serve as a legally binding document that helps protect the interests of both spouses in the event of a divorce or separation. Below, we explore different types of financial statements used in connection with prenuptial agreements in Mesquite, Texas: 1. Personal Balance Sheet: This statement provides a snapshot of an individual's assets, liabilities, and net worth. It includes details of bank accounts, investments, real estate, personal property, loans, and debts. 2. Income Statement: This statement outlines an individual's income, including details of employment earnings, business profits, investments, royalties, and any other sources of income. 3. Tax Returns: Tax returns for the past few years are often required to provide a comprehensive picture of one's financial status. These documents help determine an individual's tax liability and provide evidence of income sources. 4. Bank Statements: Bank statements for all personal and joint accounts demonstrate the flow of funds, account balances, and transaction history. These statements help assess an individual's spending habits and provide an overview of short-term liquidity. 5. Investment Statements: These statements offer a detailed breakdown of an individual's investment portfolio, including stocks, bonds, mutual funds, retirement accounts, and any other securities or investments. 6. Debt Statements: These documents outline an individual's outstanding debts, including credit card debt, mortgages, student loans, car loans, and any other liabilities. 7. Business Financial Statements: If one or both spouses own a business, financial statements related to the business may be required. These statements detail the revenue, expenses, assets, and liabilities of the business. 8. Real Estate Documents: Property deeds, mortgage statements, and any other ownership documentation regarding real estate owned by either party should be included to provide a comprehensive understanding of each individual's property ownership. These financial statements play a crucial role in determining property division, spousal support, and other financial aspects of a divorce or separation. They need to be accurate, transparent, and up to date to ensure fairness for all parties involved. It is advisable for couples seeking a prenuptial agreement in Mesquite, Texas, to consult an attorney specializing in family law to ensure the financial statements are prepared correctly, meet legal requirements, and protect everyone's rights and interests.Mesquite Texas Financial Statements in Connection with Prenuptial Premarital Agreement provide a comprehensive overview of an individual's or couple's financial situation before entering into a marriage. These statements are essential in outlining the financial rights, obligations, and expectations of each party involved. They serve as a legally binding document that helps protect the interests of both spouses in the event of a divorce or separation. Below, we explore different types of financial statements used in connection with prenuptial agreements in Mesquite, Texas: 1. Personal Balance Sheet: This statement provides a snapshot of an individual's assets, liabilities, and net worth. It includes details of bank accounts, investments, real estate, personal property, loans, and debts. 2. Income Statement: This statement outlines an individual's income, including details of employment earnings, business profits, investments, royalties, and any other sources of income. 3. Tax Returns: Tax returns for the past few years are often required to provide a comprehensive picture of one's financial status. These documents help determine an individual's tax liability and provide evidence of income sources. 4. Bank Statements: Bank statements for all personal and joint accounts demonstrate the flow of funds, account balances, and transaction history. These statements help assess an individual's spending habits and provide an overview of short-term liquidity. 5. Investment Statements: These statements offer a detailed breakdown of an individual's investment portfolio, including stocks, bonds, mutual funds, retirement accounts, and any other securities or investments. 6. Debt Statements: These documents outline an individual's outstanding debts, including credit card debt, mortgages, student loans, car loans, and any other liabilities. 7. Business Financial Statements: If one or both spouses own a business, financial statements related to the business may be required. These statements detail the revenue, expenses, assets, and liabilities of the business. 8. Real Estate Documents: Property deeds, mortgage statements, and any other ownership documentation regarding real estate owned by either party should be included to provide a comprehensive understanding of each individual's property ownership. These financial statements play a crucial role in determining property division, spousal support, and other financial aspects of a divorce or separation. They need to be accurate, transparent, and up to date to ensure fairness for all parties involved. It is advisable for couples seeking a prenuptial agreement in Mesquite, Texas, to consult an attorney specializing in family law to ensure the financial statements are prepared correctly, meet legal requirements, and protect everyone's rights and interests.