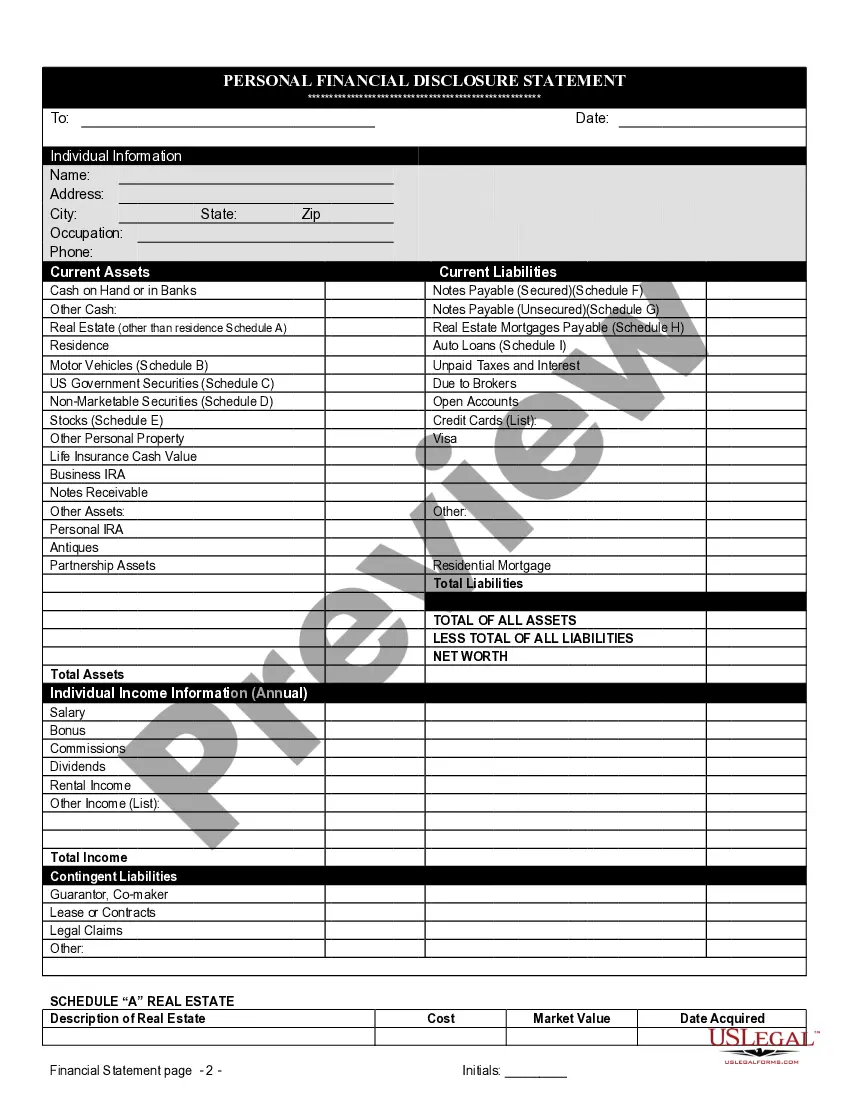

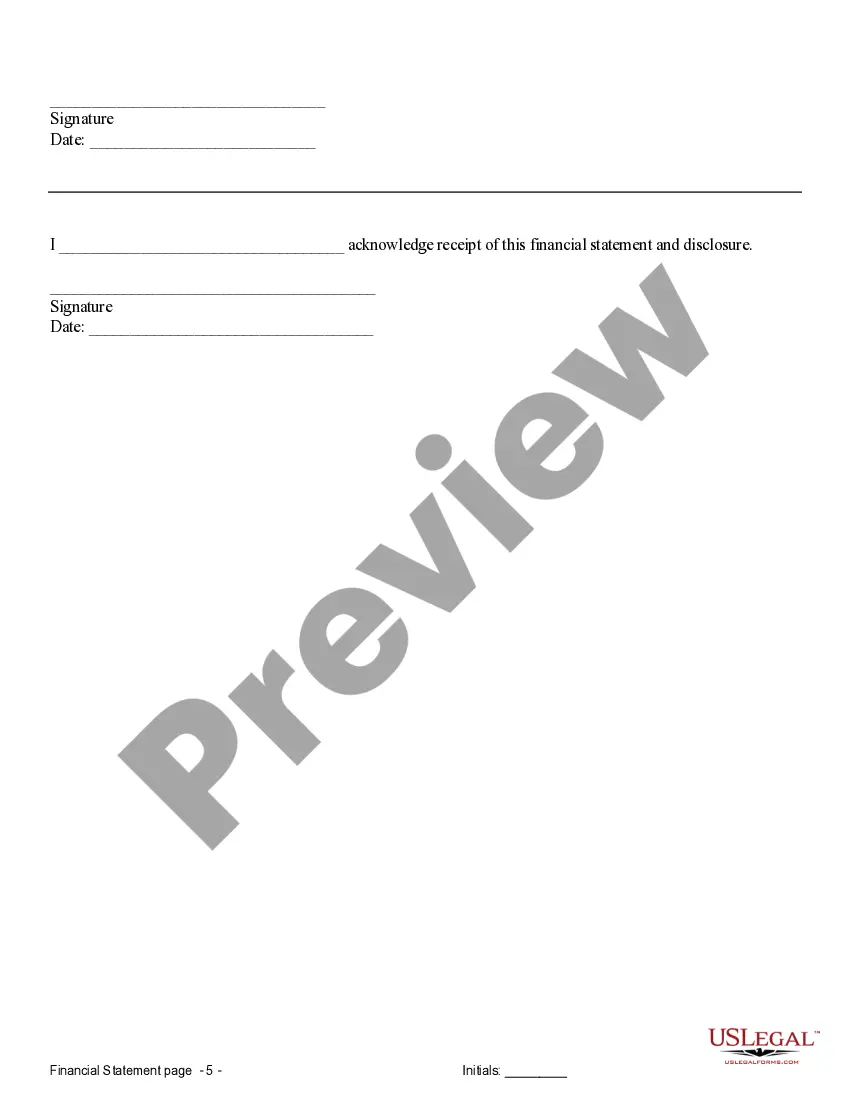

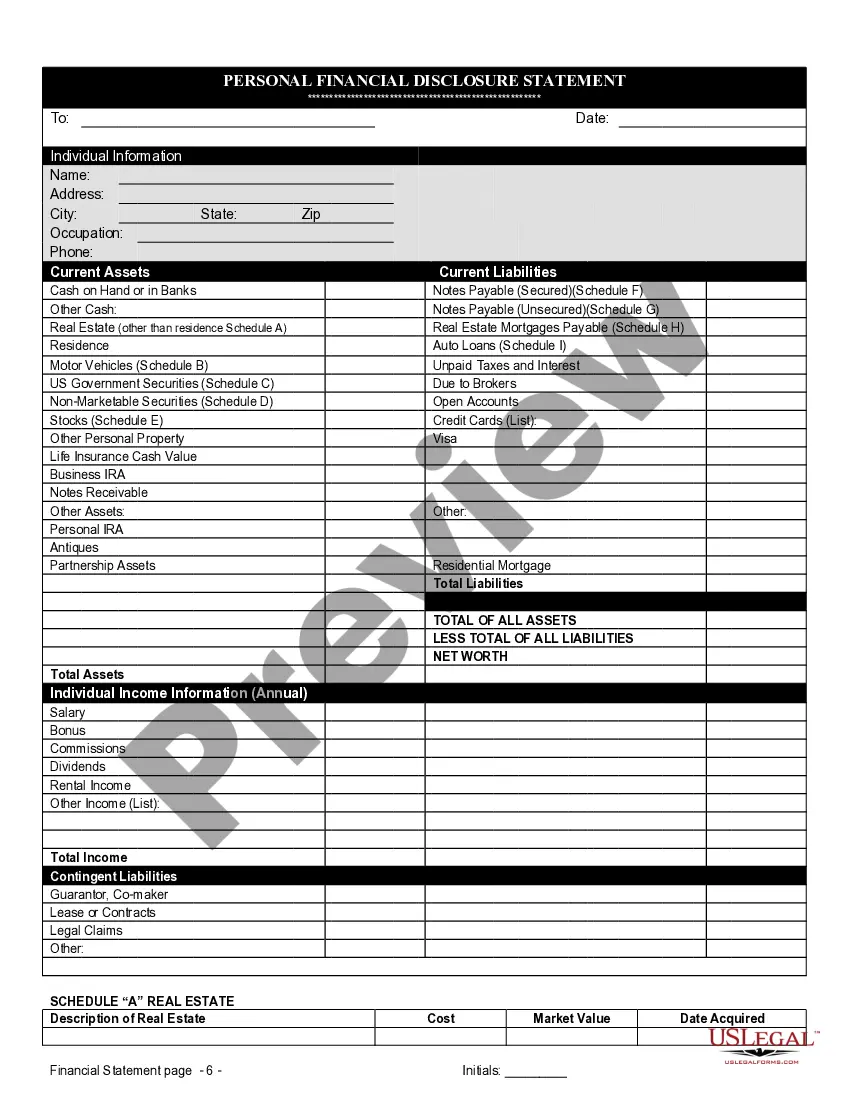

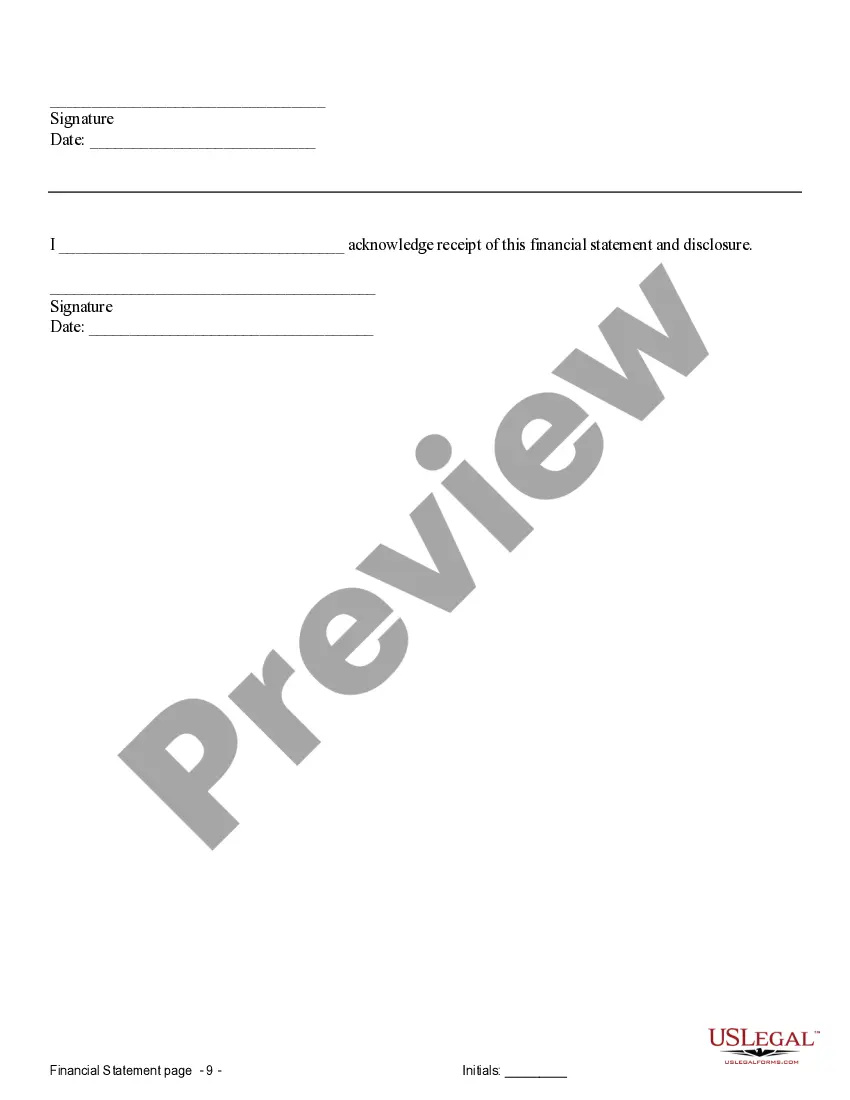

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

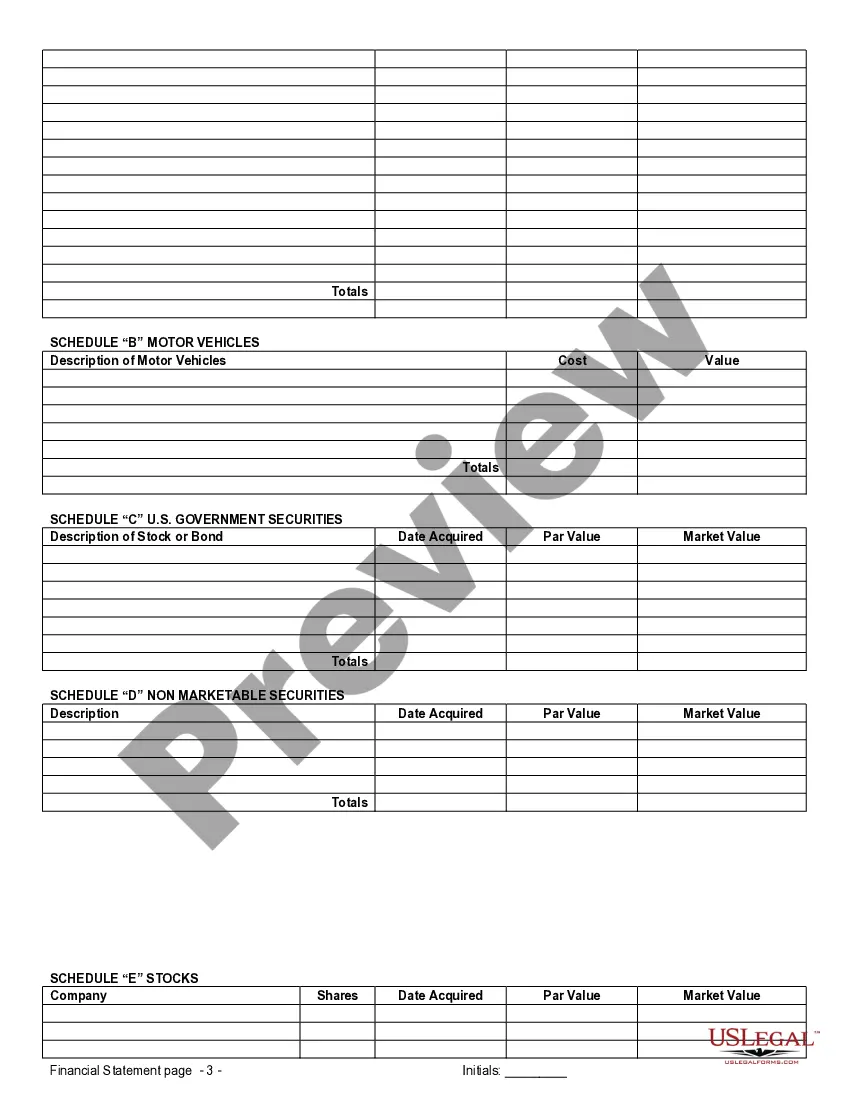

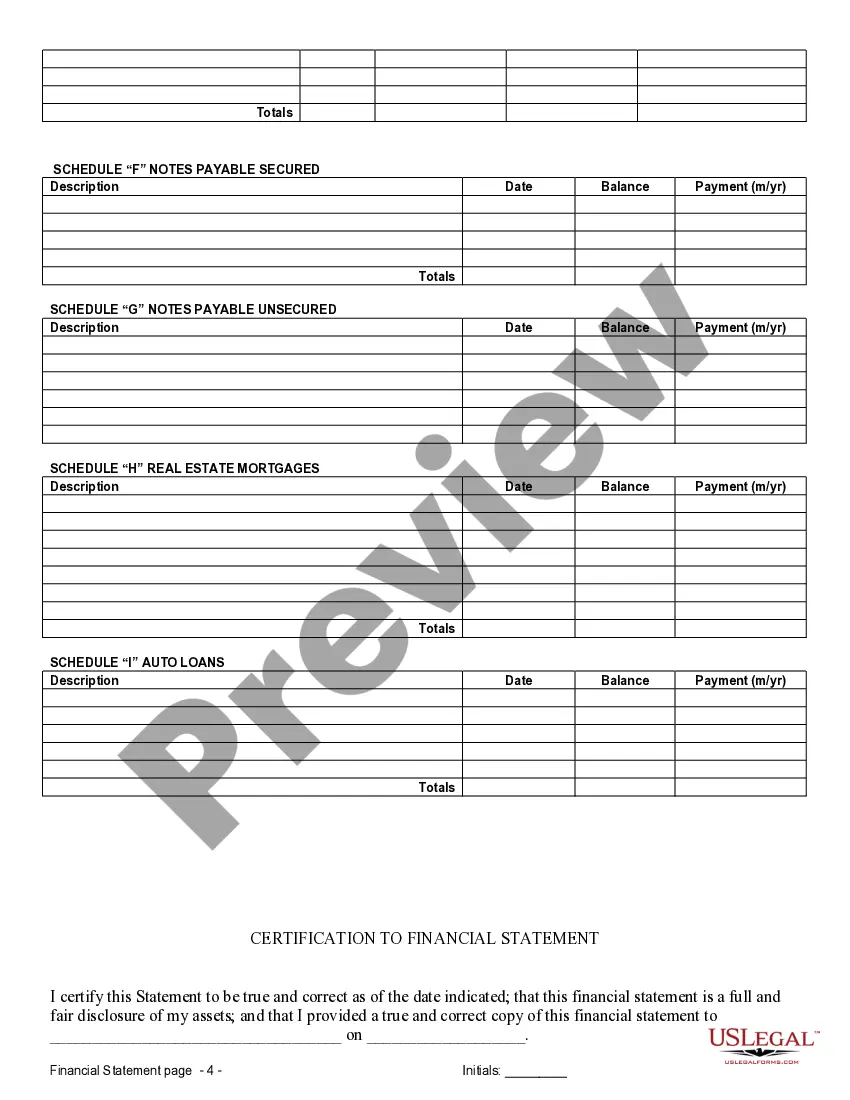

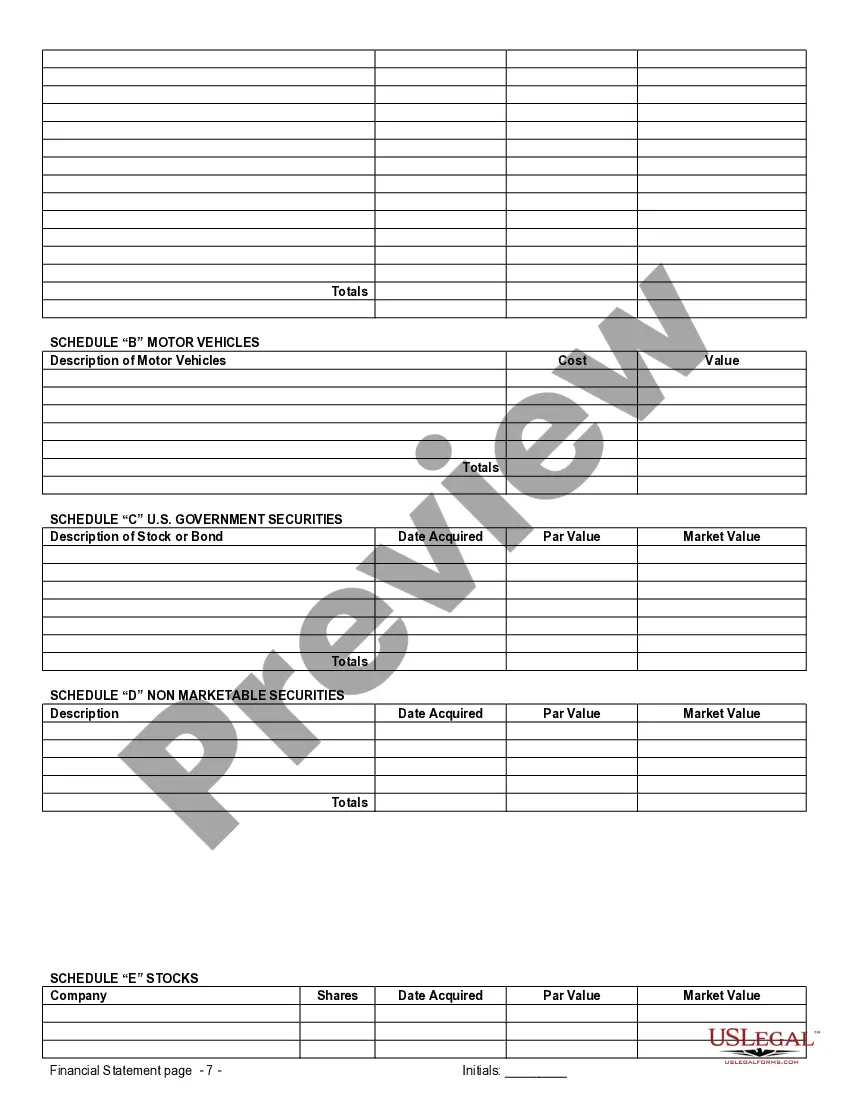

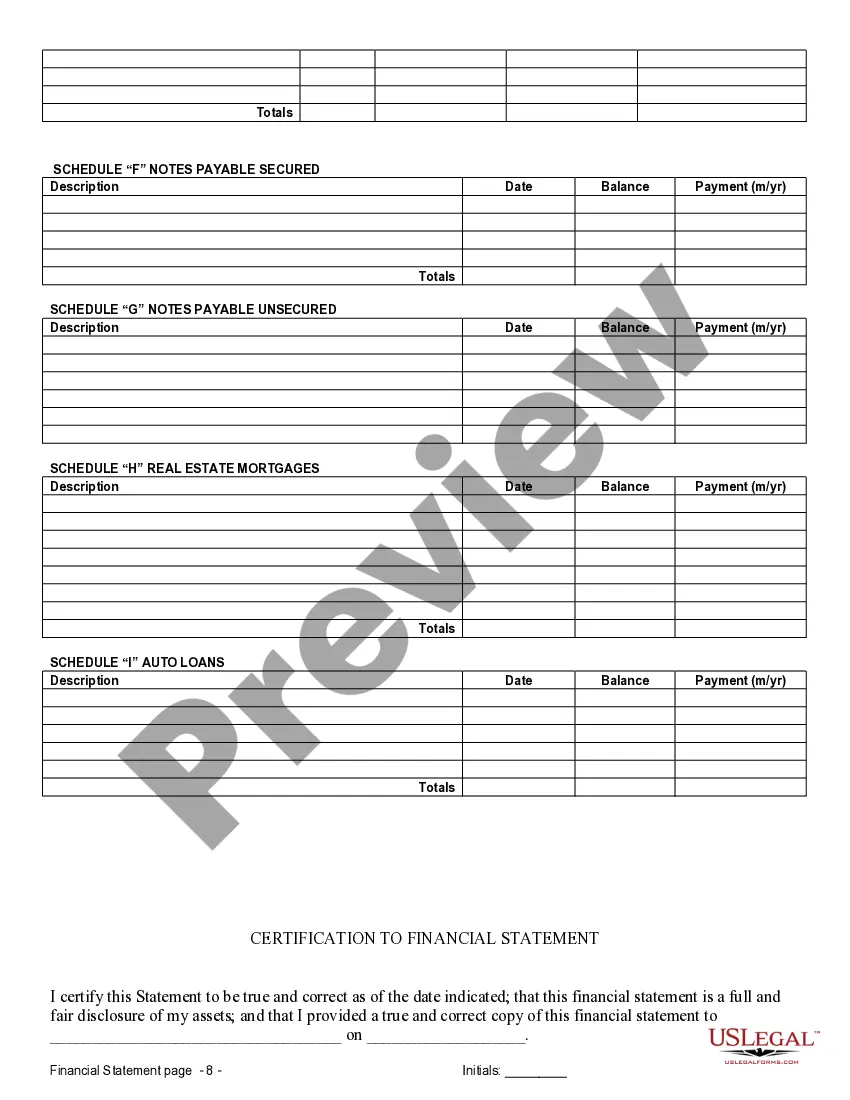

Odessa Texas Financial Statements in Connection with Prenuptial Premarital Agreements: A Comprehensive Overview When it comes to prenuptial or premarital agreements, financial statements play a vital role in ensuring transparency and protection for both individuals entering into a marriage. Odessa, Texas offers various types of financial statements that are integral to the process. This article will delve into the details of these statements and shed light on their importance. 1. Personal Financial Statement: One of the primary types of financial statements used in prenuptial or premarital agreements is the personal financial statement. This statement provides a detailed breakdown of an individual's assets, liabilities, income, expenses, and net worth. It serves as a snapshot of one's financial standing, allowing the parties involved to gain a clear understanding of each other's financial situation. 2. Income Statement: In Odessa, Texas, an income statement may be required as part of the financial statements for a prenuptial or premarital agreement. This statement outlines an individual's earnings, including salary, investment income, rental income, or any other sources of income. It presents a comprehensive overview of one's financial stability and the ability to contribute to shared financial responsibilities. 3. Balance Sheet: A balance sheet is another crucial financial statement in connection with a prenuptial or premarital agreement. It provides a comprehensive snapshot of an individual's financial position by detailing assets, such as real estate properties, investments, cash, and liabilities like loans, mortgages, or credit card debt. This statement helps ensure transparency and fairness when it comes to dividing assets and liabilities in the event of a divorce or separation. 4. Tax Returns: In some cases, prenuptial or premarital agreements may require the inclusion of tax returns from both parties. Tax returns provide an in-depth analysis of an individual's income, deductions, credits, and tax liabilities. Analyzing tax returns assists in evaluating the financial circumstances and potential tax obligations of each party. 5. Investment Statements: Odessa, Texas Financial Statements in connection with prenuptial or premarital agreements may also encompass investment statements. These statements outline the details of an individual's investments such as stocks, bonds, mutual funds, retirement accounts, and other investments. By understanding a person's investment portfolio, parties can make informed decisions concerning their shared future. In summary, Odessa, Texas Financial Statements in connection with prenuptial or premarital agreements include personal financial statements, income statements, balance sheets, tax returns, and investment statements. These statements aim to promote transparency, protect individuals' interests, and facilitate fair decision-making during a divorce or separation. By including these financial statements in prenuptial or premarital agreements, individuals can lay a solid foundation based on financial clarity, understanding, and trust for their future together.Odessa Texas Financial Statements in Connection with Prenuptial Premarital Agreements: A Comprehensive Overview When it comes to prenuptial or premarital agreements, financial statements play a vital role in ensuring transparency and protection for both individuals entering into a marriage. Odessa, Texas offers various types of financial statements that are integral to the process. This article will delve into the details of these statements and shed light on their importance. 1. Personal Financial Statement: One of the primary types of financial statements used in prenuptial or premarital agreements is the personal financial statement. This statement provides a detailed breakdown of an individual's assets, liabilities, income, expenses, and net worth. It serves as a snapshot of one's financial standing, allowing the parties involved to gain a clear understanding of each other's financial situation. 2. Income Statement: In Odessa, Texas, an income statement may be required as part of the financial statements for a prenuptial or premarital agreement. This statement outlines an individual's earnings, including salary, investment income, rental income, or any other sources of income. It presents a comprehensive overview of one's financial stability and the ability to contribute to shared financial responsibilities. 3. Balance Sheet: A balance sheet is another crucial financial statement in connection with a prenuptial or premarital agreement. It provides a comprehensive snapshot of an individual's financial position by detailing assets, such as real estate properties, investments, cash, and liabilities like loans, mortgages, or credit card debt. This statement helps ensure transparency and fairness when it comes to dividing assets and liabilities in the event of a divorce or separation. 4. Tax Returns: In some cases, prenuptial or premarital agreements may require the inclusion of tax returns from both parties. Tax returns provide an in-depth analysis of an individual's income, deductions, credits, and tax liabilities. Analyzing tax returns assists in evaluating the financial circumstances and potential tax obligations of each party. 5. Investment Statements: Odessa, Texas Financial Statements in connection with prenuptial or premarital agreements may also encompass investment statements. These statements outline the details of an individual's investments such as stocks, bonds, mutual funds, retirement accounts, and other investments. By understanding a person's investment portfolio, parties can make informed decisions concerning their shared future. In summary, Odessa, Texas Financial Statements in connection with prenuptial or premarital agreements include personal financial statements, income statements, balance sheets, tax returns, and investment statements. These statements aim to promote transparency, protect individuals' interests, and facilitate fair decision-making during a divorce or separation. By including these financial statements in prenuptial or premarital agreements, individuals can lay a solid foundation based on financial clarity, understanding, and trust for their future together.