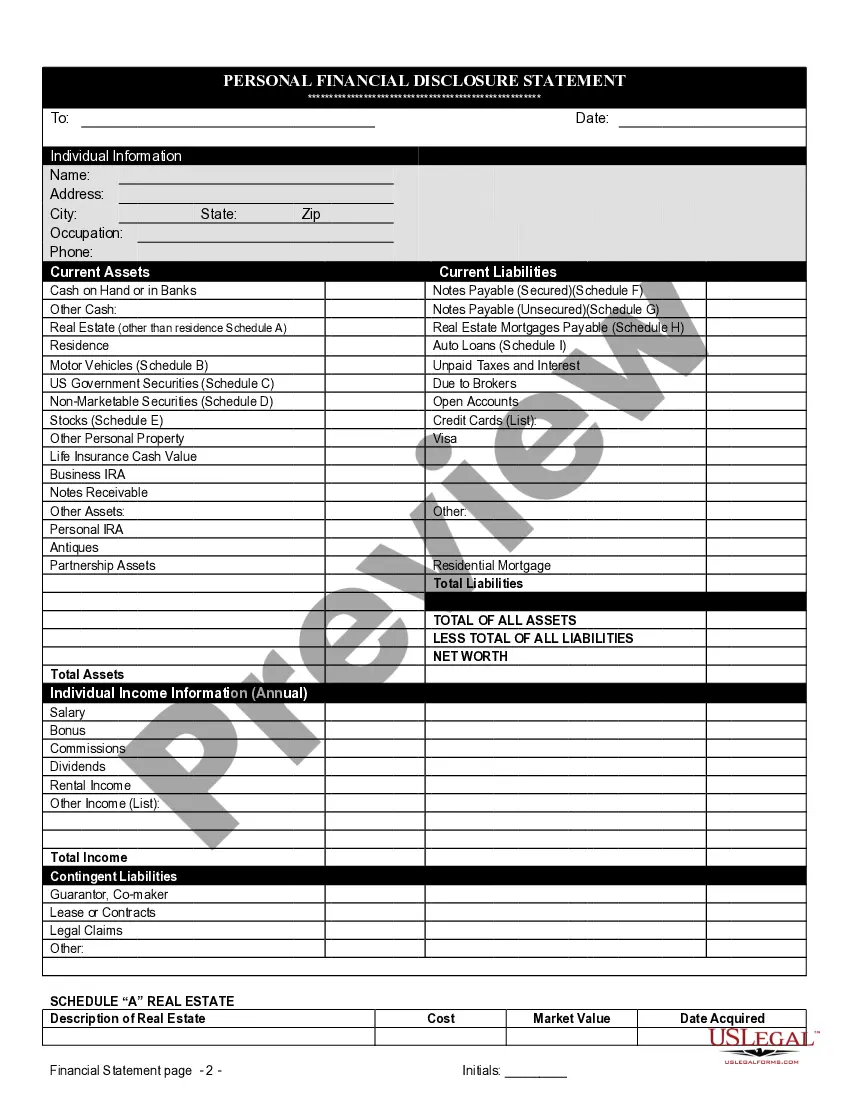

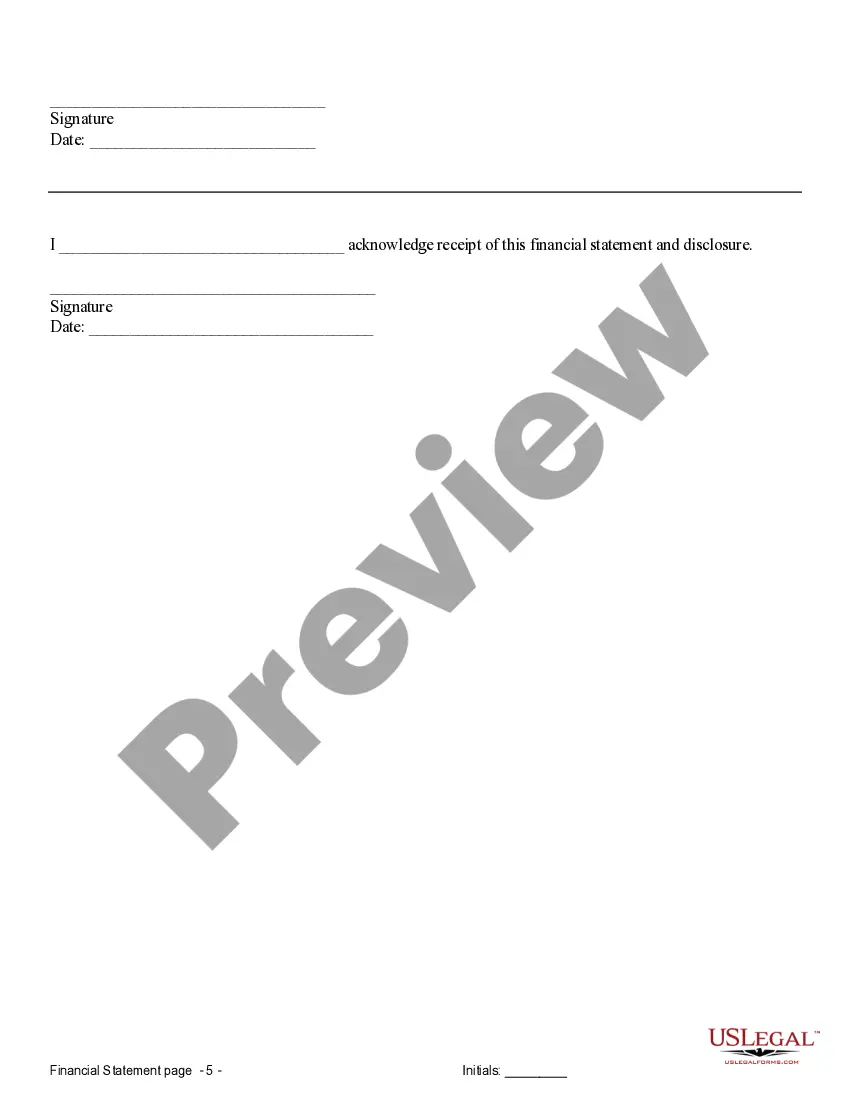

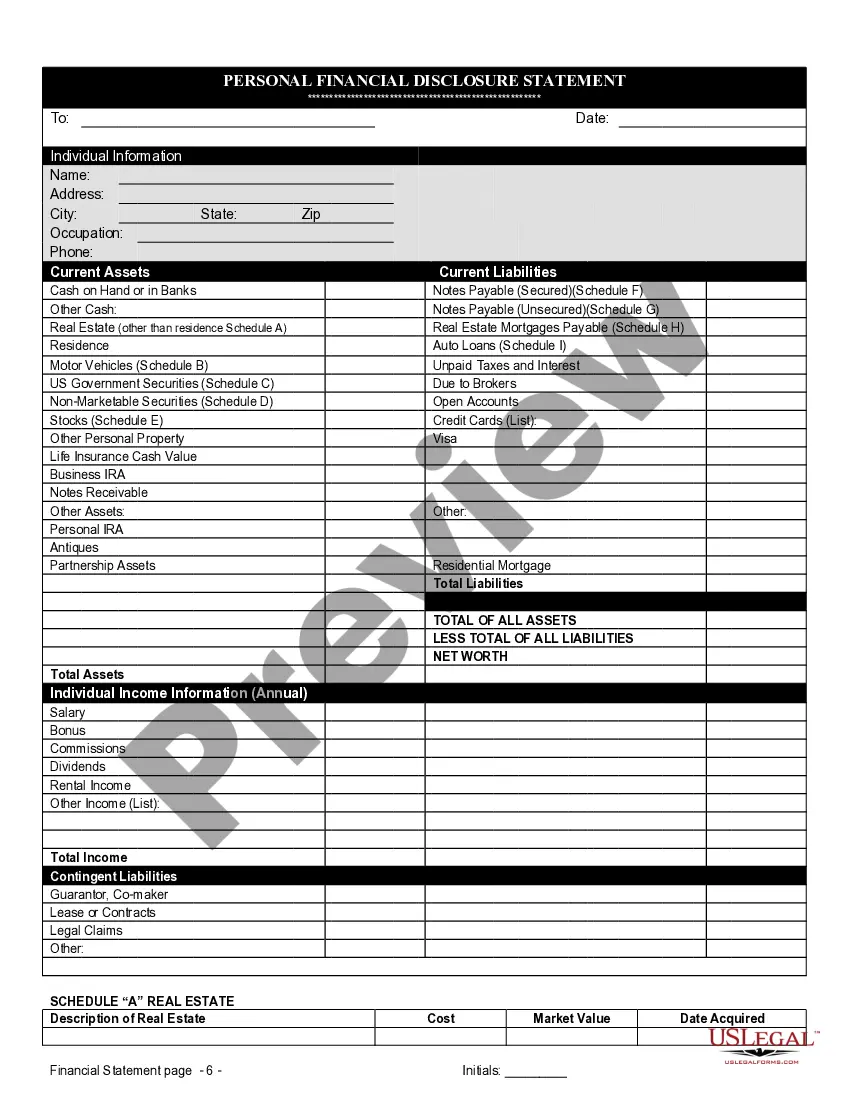

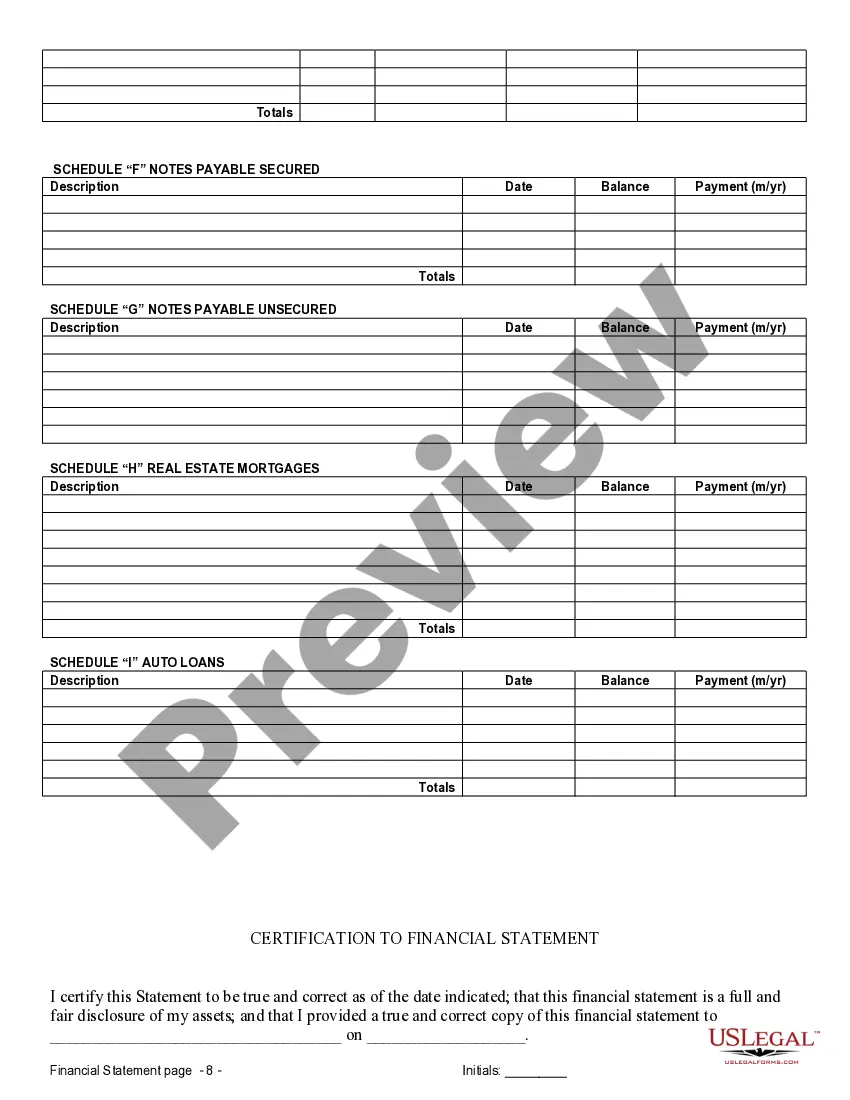

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

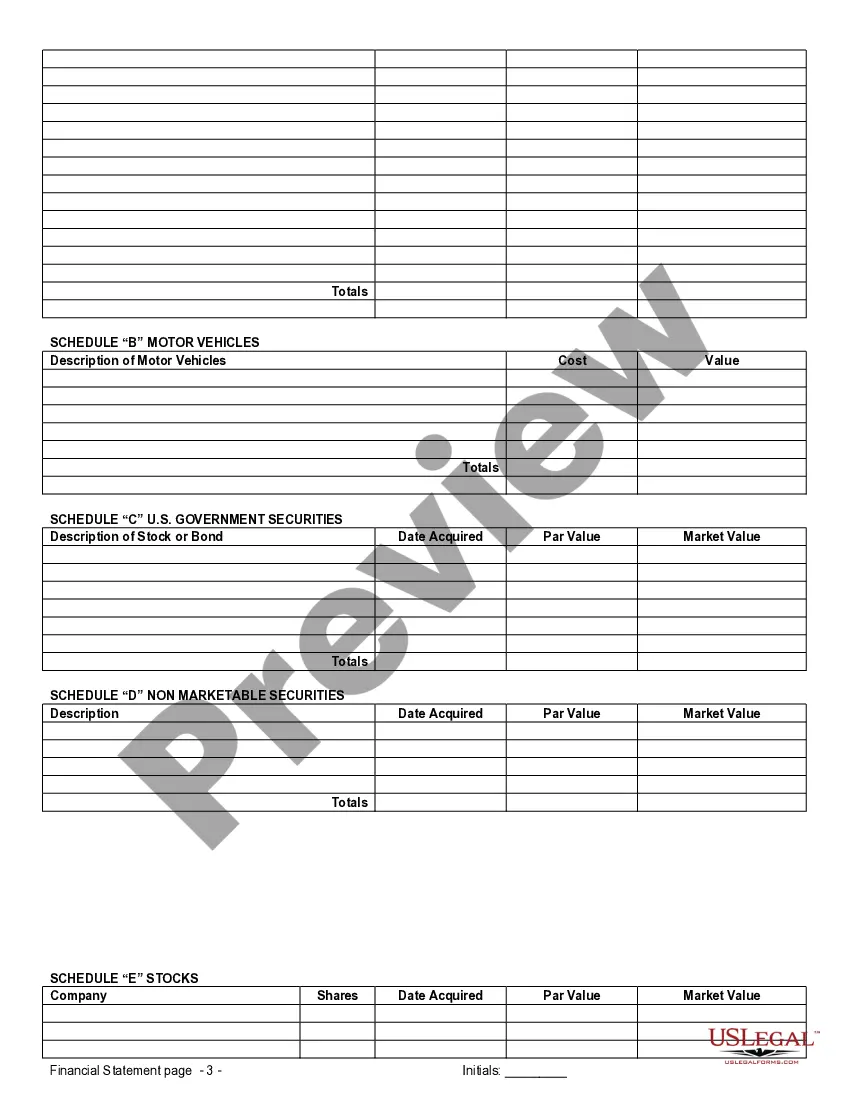

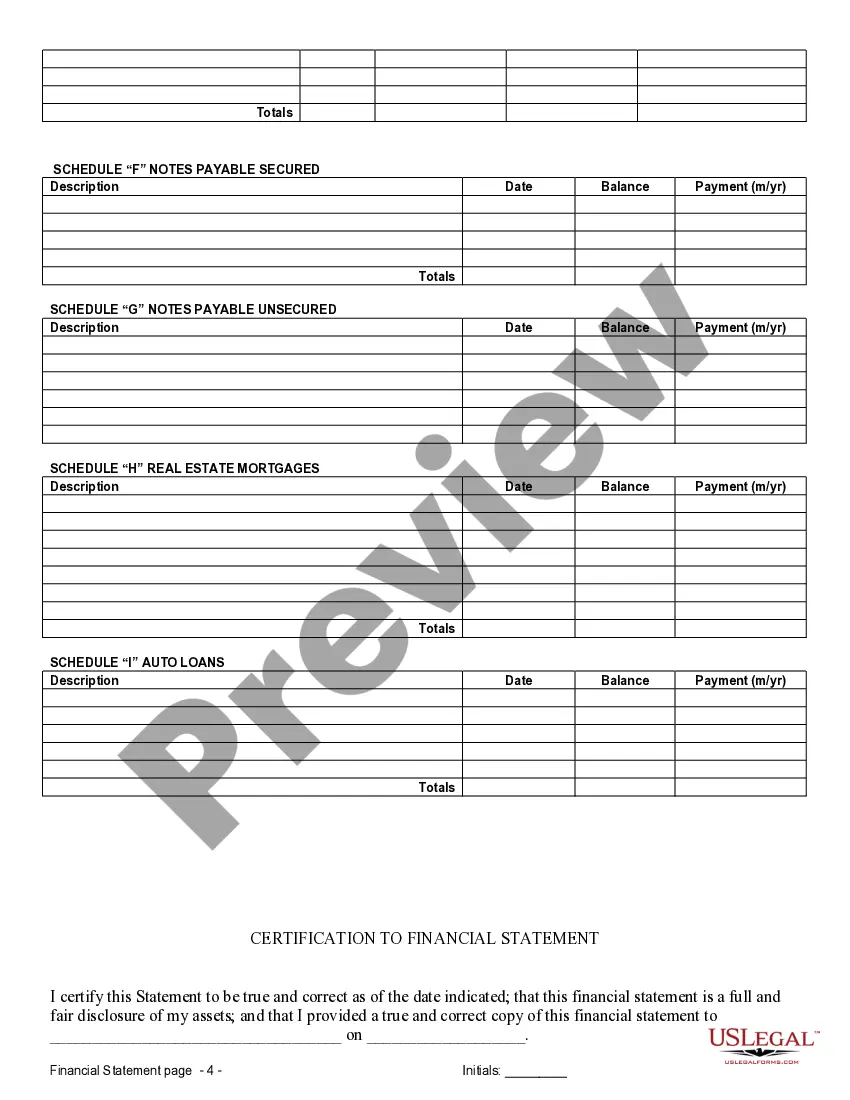

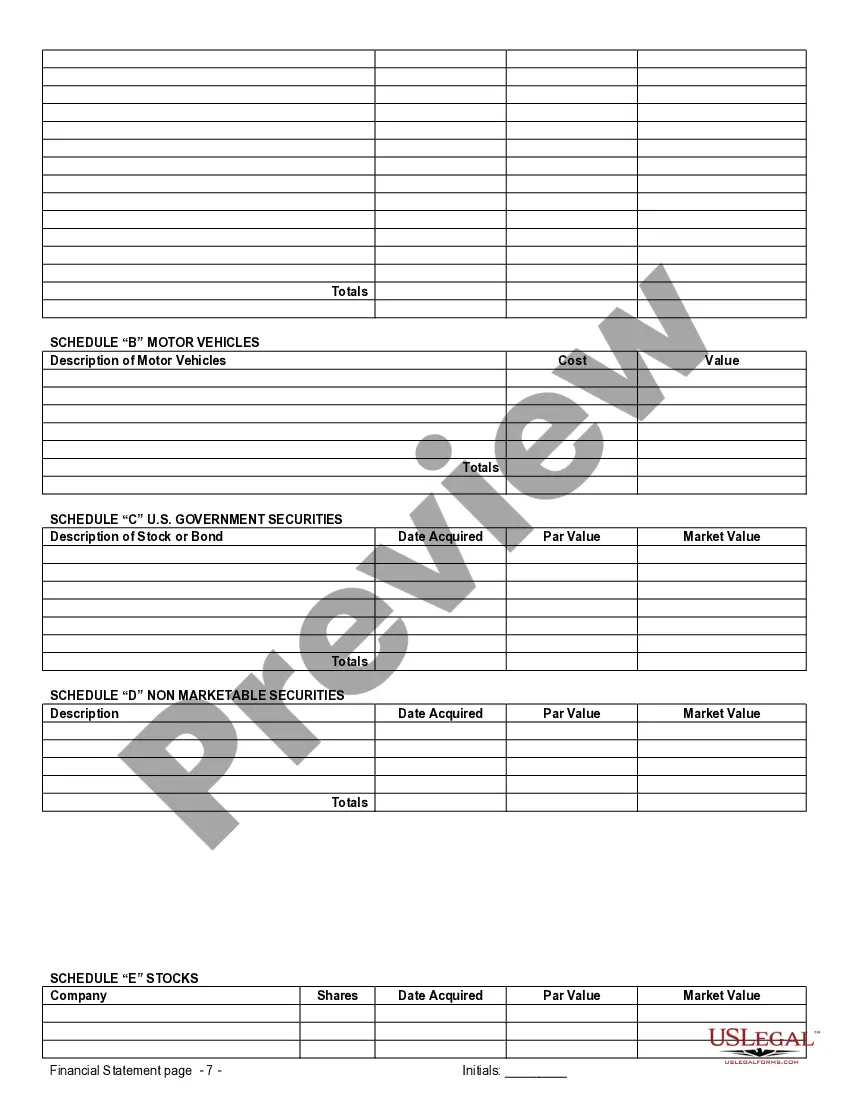

Pasadena Texas Financial Statements only in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview In Pasadena, Texas, financial statements play a crucial role when it comes to prenuptial or premarital agreements. These statements aim to outline the financial positions of both parties involved, ensuring transparency and fairness in the event of a divorce or separation. Let's explore what these financial statements entail and why they are important in such agreements. What are Pasadena Texas Financial Statements? Pasadena Texas Financial Statements, in the context of prenuptial or premarital agreements, consist of detailed financial disclosures provided by each party prior to marriage. These statements outline the assets, debts, income, expenses, and financial obligations of each party. They provide a clear snapshot of the financial situation before entering into a legal commitment. Why are Pasadena Texas Financial Statements necessary in Prenuptial Premarital Agreements? 1. Transparency: These statements promote openness between partners, ensuring that both individuals are aware of each other's financial positions before entering into a marriage. This transparency helps prevent disputes arising from hidden assets or debts, fostering trust in the relationship. 2. Asset Protection: By disclosing their assets and debts through financial statements, individuals can protect their pre-existing property and investments. Such protection becomes crucial in case of divorce, as it helps to distinguish between marital and separate property. 3. Debt Allocation: Financial statements assist in determining the distribution of any pre-existing debts of both parties. This includes student loans, credit card debts, or mortgages taken prior to the marriage. The statements help outline responsibilities and prevent one party from shouldering the entirety of the debt burden. Types of Pasadena Texas Financial Statements for Prenuptial Premarital Agreement: 1. Personal Balance Sheet: This statement provides an overview of an individual's assets and liabilities. It includes details of real estate holdings, investments, bank accounts, retirement funds, vehicles, personal belongings, and any outstanding debts such as loans or credit card debts. 2. Income Statement: This statement highlights an individual's income sources, including employment, business ownership, rental income, or investments. It also includes information about monthly expenses such as rent/mortgages, utilities, insurance, and other financial obligations. 3. Tax Returns: Tax returns serve as essential documents for determining individual income and financial history. They provide a comprehensive overview of income, deductions, and potential tax liabilities. 4. Business Financial Statements: In cases where one or both parties own businesses, additional financial statements such as profit and loss statements, balance sheets, and cash flow statements may be necessary. These statements establish the value of the business and ensure accuracy in financial disclosure. By incorporating these detailed financial statements in prenuptial or premarital agreements, individuals in Pasadena, Texas, can safeguard their interests, protect assets, and establish a foundation of transparency, promoting a healthy and secure marital relationship. Note: It is important to consult with a qualified attorney specializing in family law or a financial advisor when navigating prenuptial or premarital agreements and the inclusion of financial statements to ensure compliance with relevant laws and regulations in Pasadena, Texas.Pasadena Texas Financial Statements only in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview In Pasadena, Texas, financial statements play a crucial role when it comes to prenuptial or premarital agreements. These statements aim to outline the financial positions of both parties involved, ensuring transparency and fairness in the event of a divorce or separation. Let's explore what these financial statements entail and why they are important in such agreements. What are Pasadena Texas Financial Statements? Pasadena Texas Financial Statements, in the context of prenuptial or premarital agreements, consist of detailed financial disclosures provided by each party prior to marriage. These statements outline the assets, debts, income, expenses, and financial obligations of each party. They provide a clear snapshot of the financial situation before entering into a legal commitment. Why are Pasadena Texas Financial Statements necessary in Prenuptial Premarital Agreements? 1. Transparency: These statements promote openness between partners, ensuring that both individuals are aware of each other's financial positions before entering into a marriage. This transparency helps prevent disputes arising from hidden assets or debts, fostering trust in the relationship. 2. Asset Protection: By disclosing their assets and debts through financial statements, individuals can protect their pre-existing property and investments. Such protection becomes crucial in case of divorce, as it helps to distinguish between marital and separate property. 3. Debt Allocation: Financial statements assist in determining the distribution of any pre-existing debts of both parties. This includes student loans, credit card debts, or mortgages taken prior to the marriage. The statements help outline responsibilities and prevent one party from shouldering the entirety of the debt burden. Types of Pasadena Texas Financial Statements for Prenuptial Premarital Agreement: 1. Personal Balance Sheet: This statement provides an overview of an individual's assets and liabilities. It includes details of real estate holdings, investments, bank accounts, retirement funds, vehicles, personal belongings, and any outstanding debts such as loans or credit card debts. 2. Income Statement: This statement highlights an individual's income sources, including employment, business ownership, rental income, or investments. It also includes information about monthly expenses such as rent/mortgages, utilities, insurance, and other financial obligations. 3. Tax Returns: Tax returns serve as essential documents for determining individual income and financial history. They provide a comprehensive overview of income, deductions, and potential tax liabilities. 4. Business Financial Statements: In cases where one or both parties own businesses, additional financial statements such as profit and loss statements, balance sheets, and cash flow statements may be necessary. These statements establish the value of the business and ensure accuracy in financial disclosure. By incorporating these detailed financial statements in prenuptial or premarital agreements, individuals in Pasadena, Texas, can safeguard their interests, protect assets, and establish a foundation of transparency, promoting a healthy and secure marital relationship. Note: It is important to consult with a qualified attorney specializing in family law or a financial advisor when navigating prenuptial or premarital agreements and the inclusion of financial statements to ensure compliance with relevant laws and regulations in Pasadena, Texas.