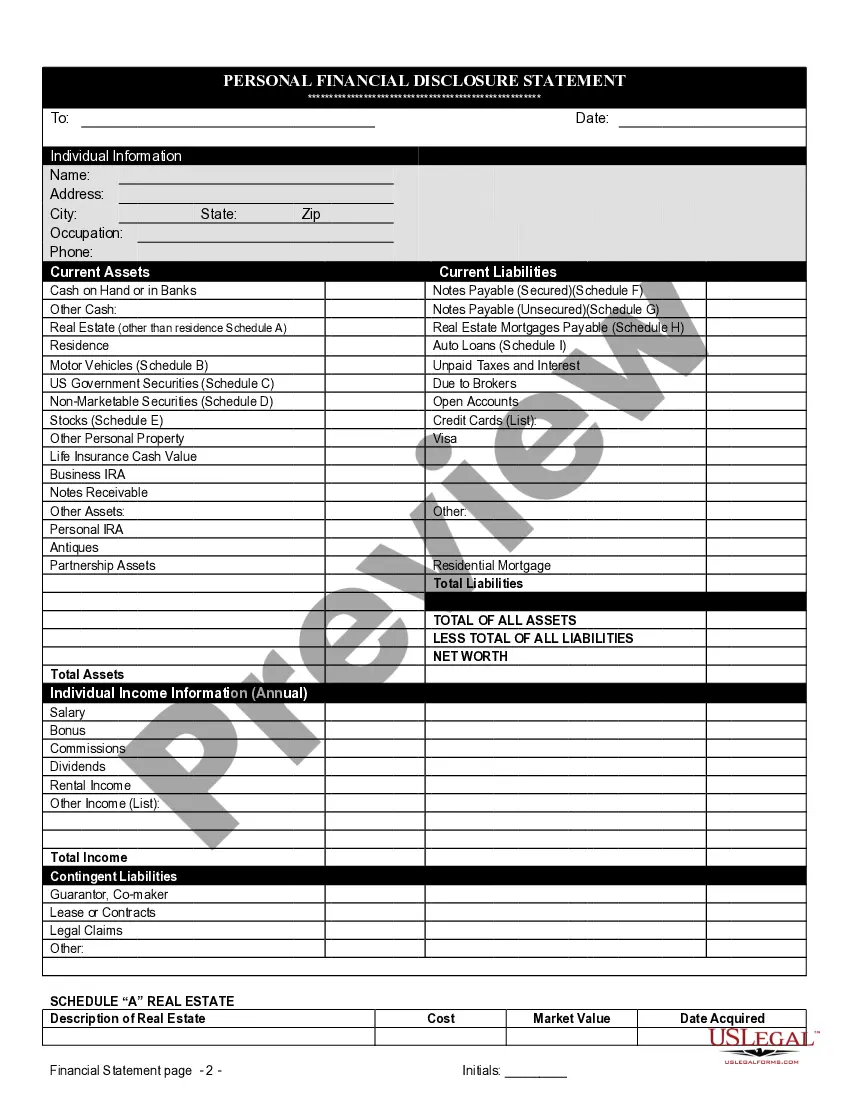

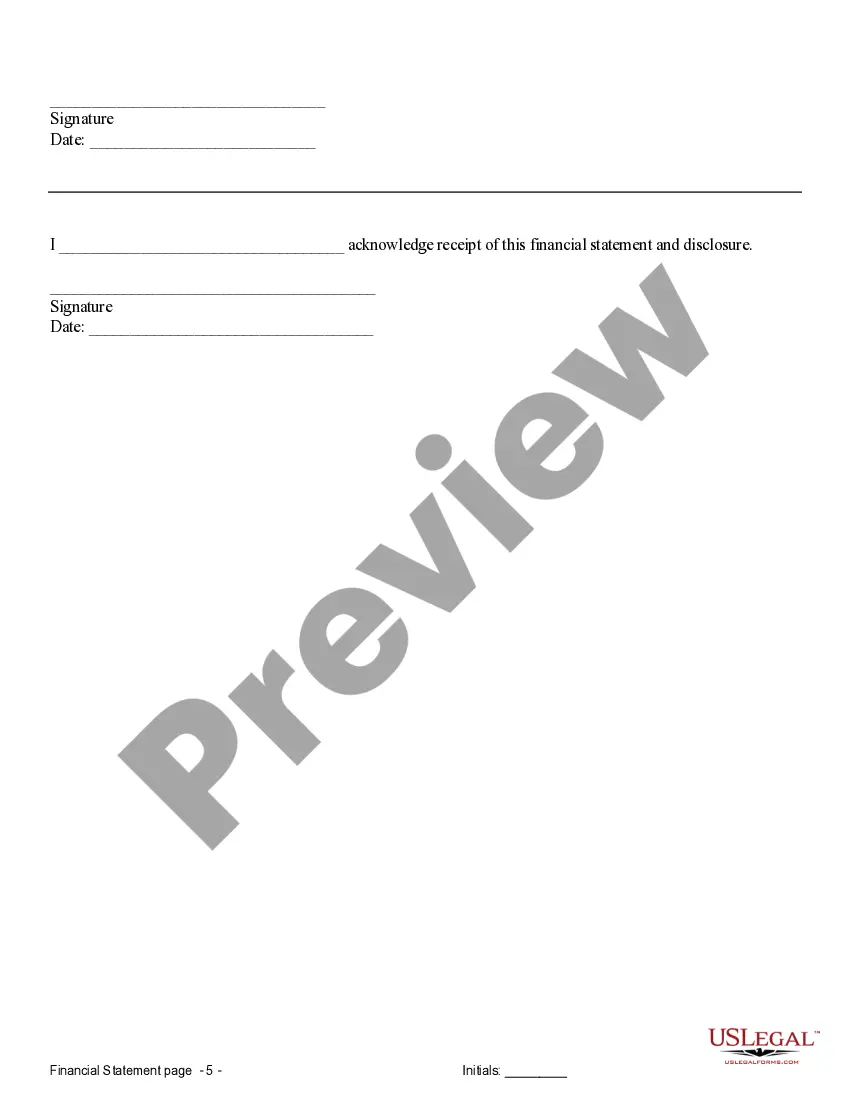

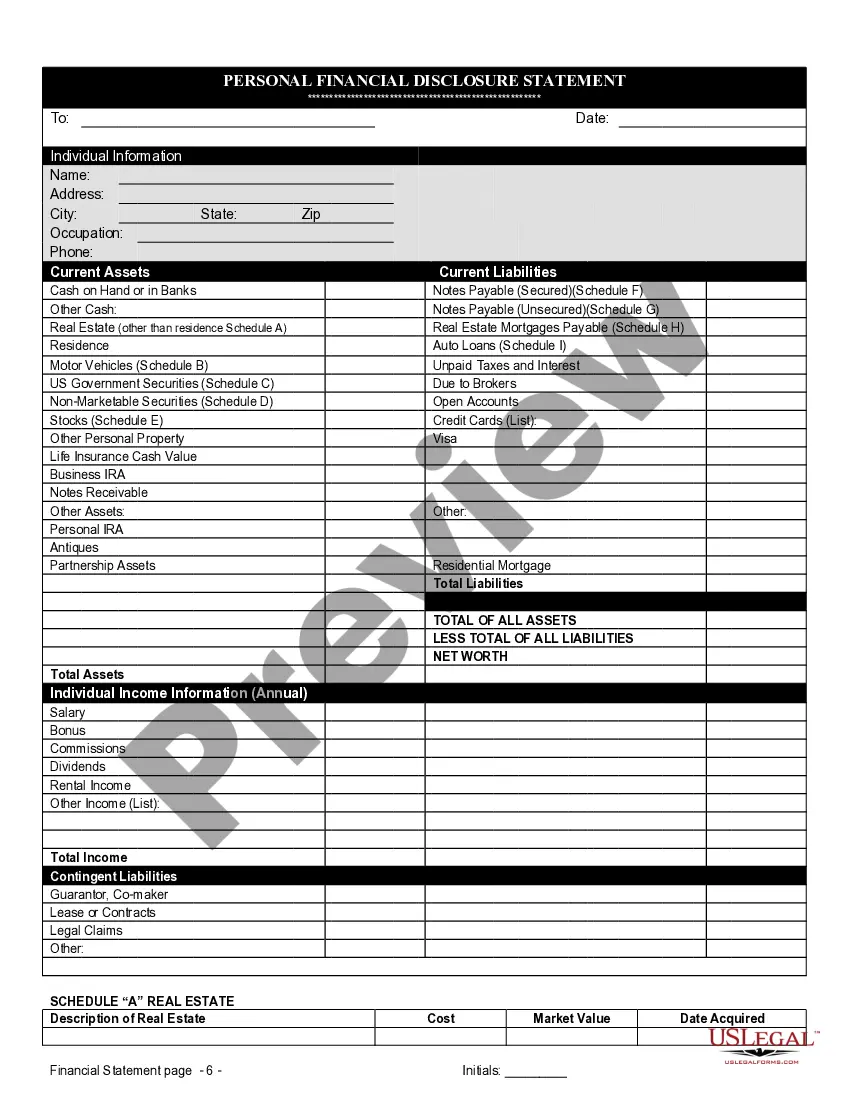

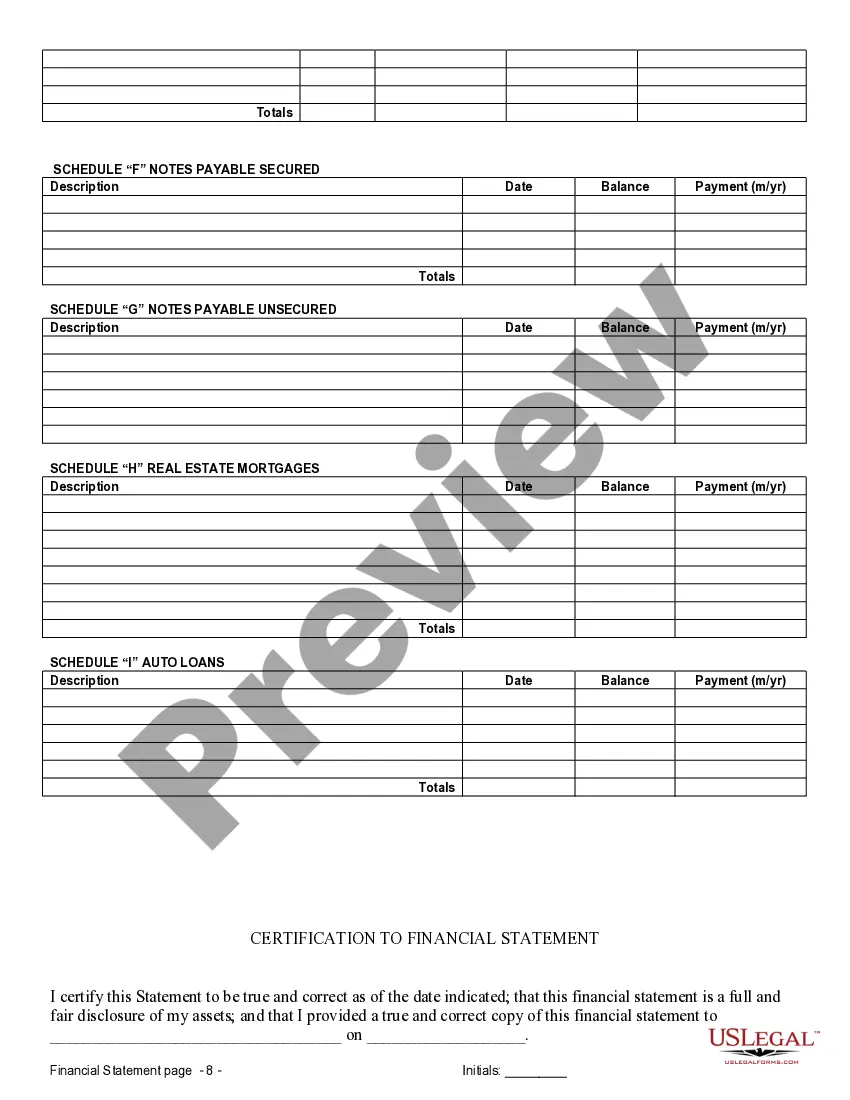

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

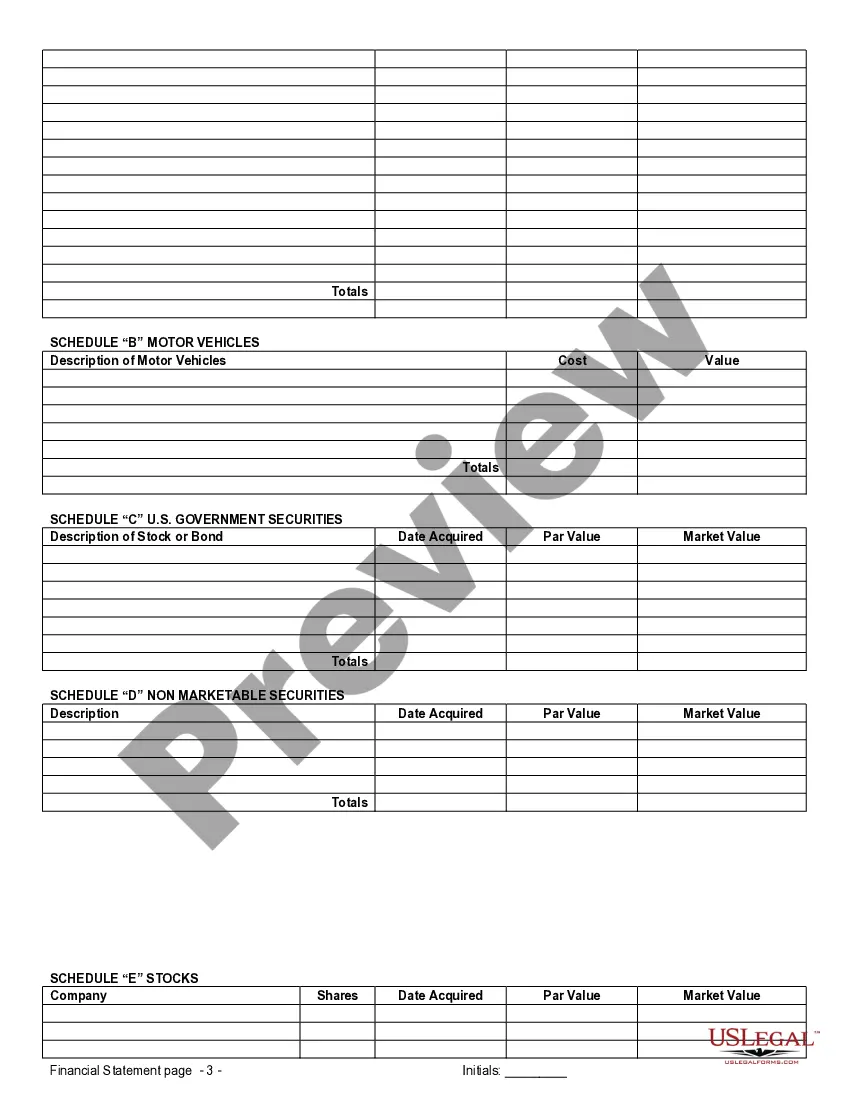

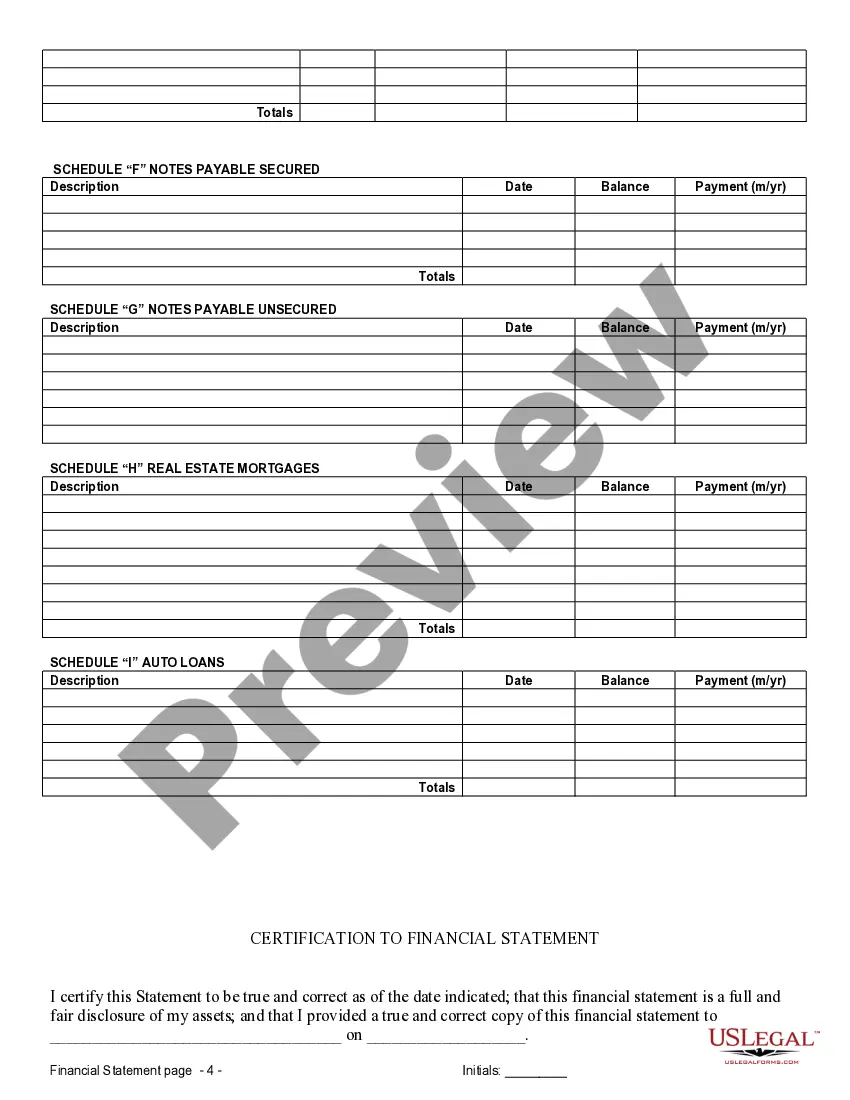

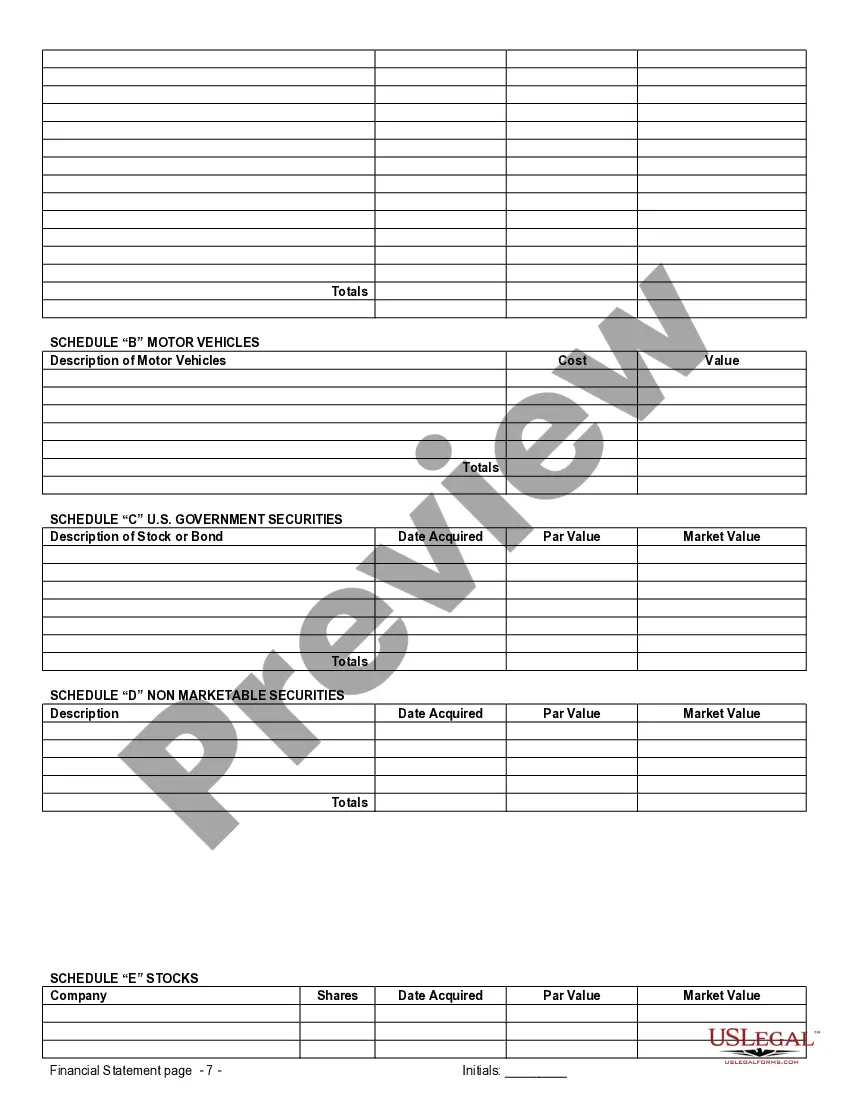

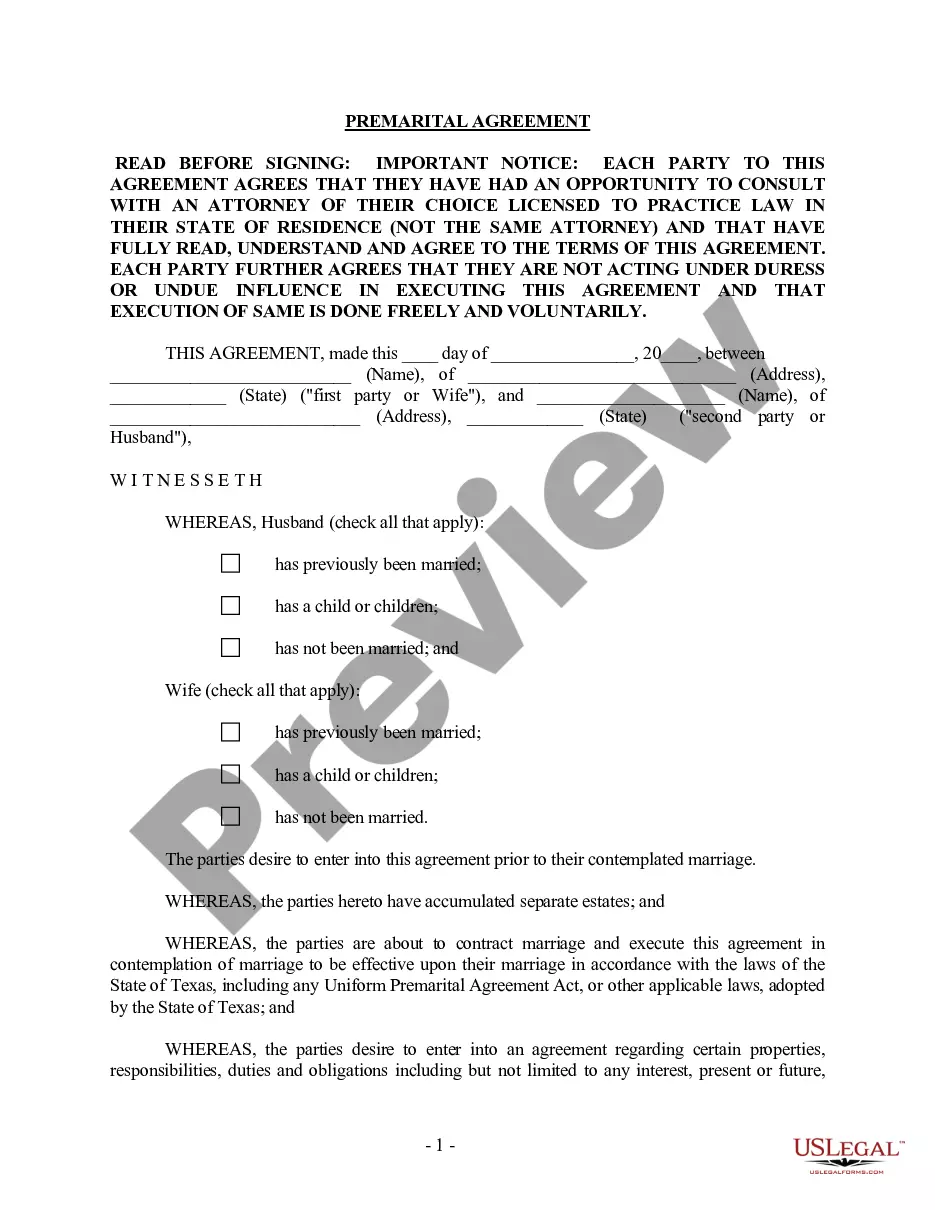

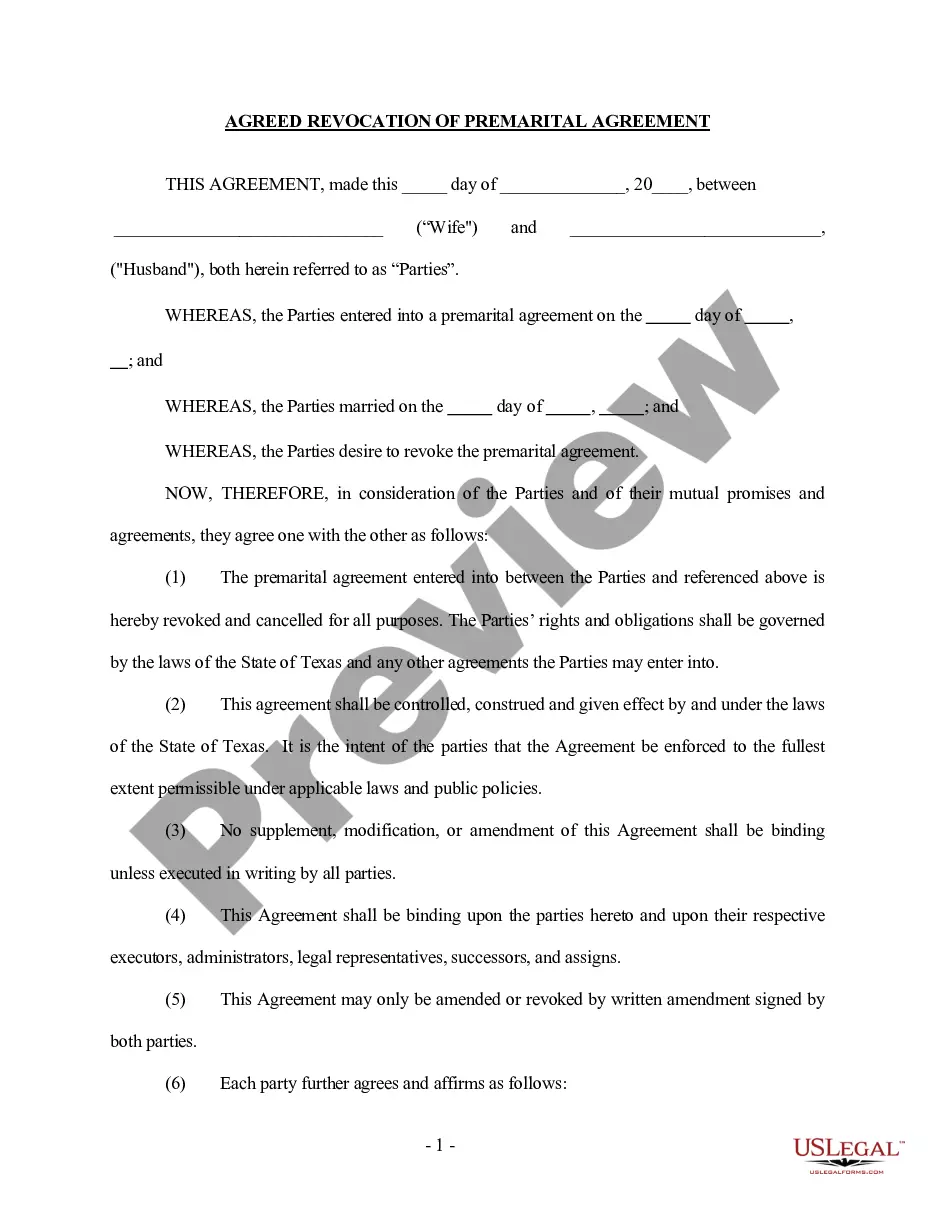

Plano Texas Financial Statements are an important component of prenuptial or premarital agreements in the state of Texas. These documents provide a detailed overview of an individual's financial status and play a critical role in determining the distribution of assets and liabilities in case of divorce or separation. When it comes to including financial statements in prenuptial agreements, Plano, Texas offers a range of options tailored to meet the specific needs of the parties involved. Here are some distinct types of Plano Texas Financial Statements commonly used in connection with prenuptial or premarital agreements: 1. Personal Financial Statements: These statements outline an individual's financial position, including income, expenses, assets, and debts. They provide a comprehensive snapshot of a person's financial standing at a given point in time. 2. Business Financial Statements: In case one or both parties own a business, it becomes necessary to include business financial statements in the prenuptial agreement. These documents detail the financial health of the business, including its assets, liabilities, revenues, and expenses. 3. Real Estate Financial Statements: If either party owns real estate properties, it is essential to include separate real estate financial statements. These statements provide information on property values, outstanding mortgages, rental income, and other relevant details. 4. Investment Portfolio Statements: Individuals with substantial investments, such as stocks, bonds, mutual funds, or retirement accounts, should include investment portfolio statements. These financial statements offer an overview of the investment performance, account balances, and any associated income or losses. 5. Tax Returns and Statements: Tax returns and related documents are crucial for understanding an individual's income sources and financial history. Including past tax returns to the prenuptial agreement enables a clearer analysis of income levels and potential tax liabilities. Plano Texas Financial Statements only in connection with prenuptial or premarital agreements are meant to ensure transparency and clarity in the financial matters of both parties. Accuracy, completeness, and up-to-date information are vital elements while preparing these statements. It is advisable to consult a qualified attorney or financial advisor specializing in family law to assist in creating comprehensive and legally sound financial statements for a prenuptial agreement in Plano, Texas.Plano Texas Financial Statements are an important component of prenuptial or premarital agreements in the state of Texas. These documents provide a detailed overview of an individual's financial status and play a critical role in determining the distribution of assets and liabilities in case of divorce or separation. When it comes to including financial statements in prenuptial agreements, Plano, Texas offers a range of options tailored to meet the specific needs of the parties involved. Here are some distinct types of Plano Texas Financial Statements commonly used in connection with prenuptial or premarital agreements: 1. Personal Financial Statements: These statements outline an individual's financial position, including income, expenses, assets, and debts. They provide a comprehensive snapshot of a person's financial standing at a given point in time. 2. Business Financial Statements: In case one or both parties own a business, it becomes necessary to include business financial statements in the prenuptial agreement. These documents detail the financial health of the business, including its assets, liabilities, revenues, and expenses. 3. Real Estate Financial Statements: If either party owns real estate properties, it is essential to include separate real estate financial statements. These statements provide information on property values, outstanding mortgages, rental income, and other relevant details. 4. Investment Portfolio Statements: Individuals with substantial investments, such as stocks, bonds, mutual funds, or retirement accounts, should include investment portfolio statements. These financial statements offer an overview of the investment performance, account balances, and any associated income or losses. 5. Tax Returns and Statements: Tax returns and related documents are crucial for understanding an individual's income sources and financial history. Including past tax returns to the prenuptial agreement enables a clearer analysis of income levels and potential tax liabilities. Plano Texas Financial Statements only in connection with prenuptial or premarital agreements are meant to ensure transparency and clarity in the financial matters of both parties. Accuracy, completeness, and up-to-date information are vital elements while preparing these statements. It is advisable to consult a qualified attorney or financial advisor specializing in family law to assist in creating comprehensive and legally sound financial statements for a prenuptial agreement in Plano, Texas.