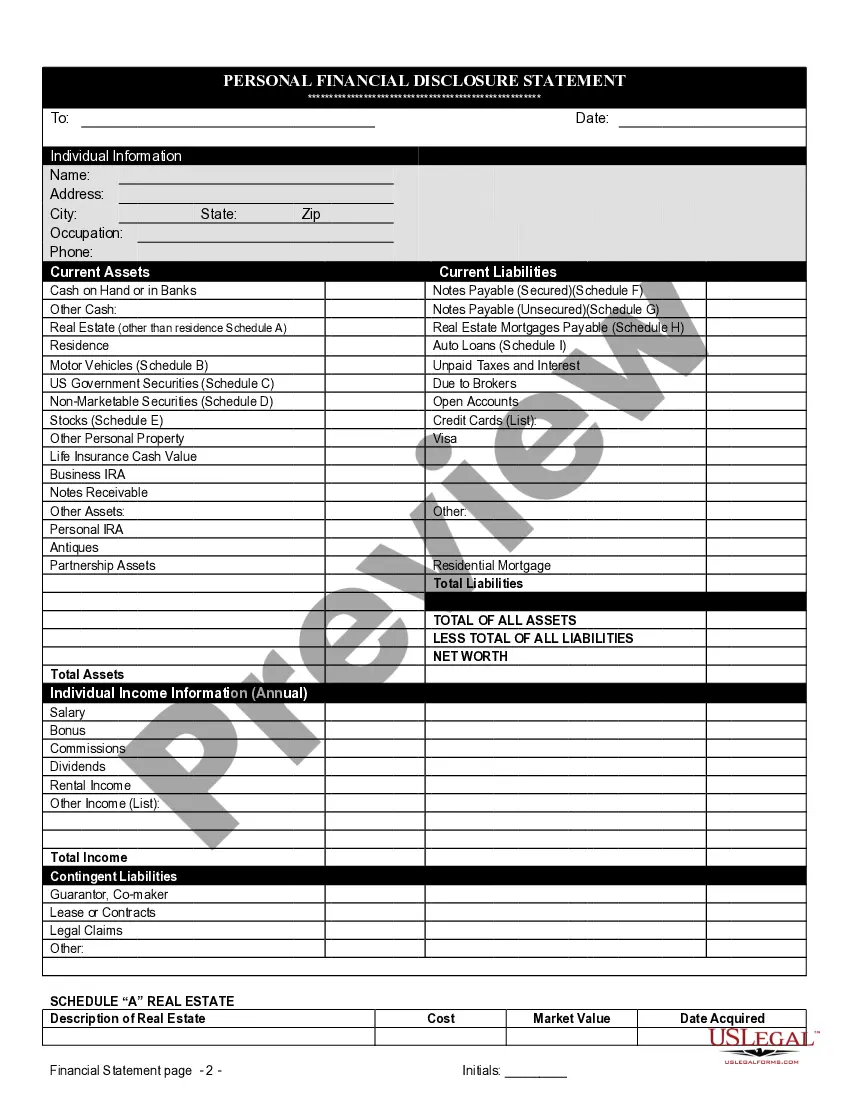

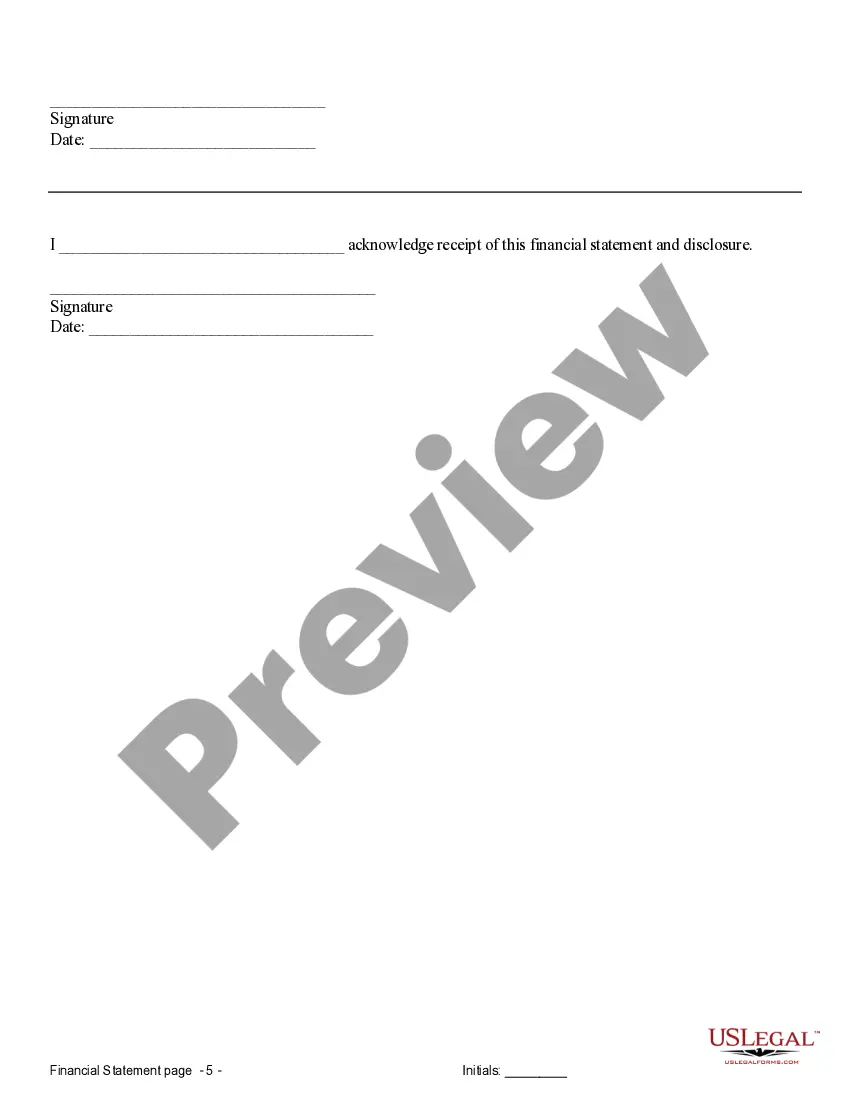

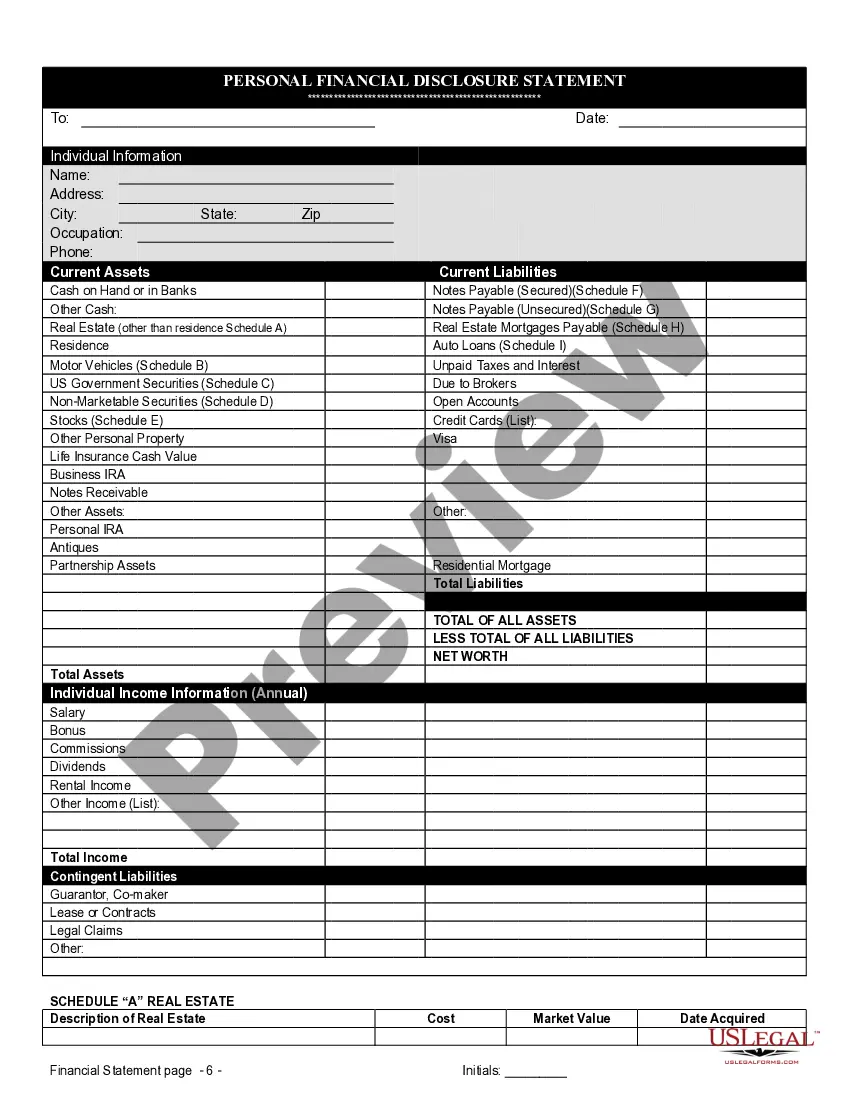

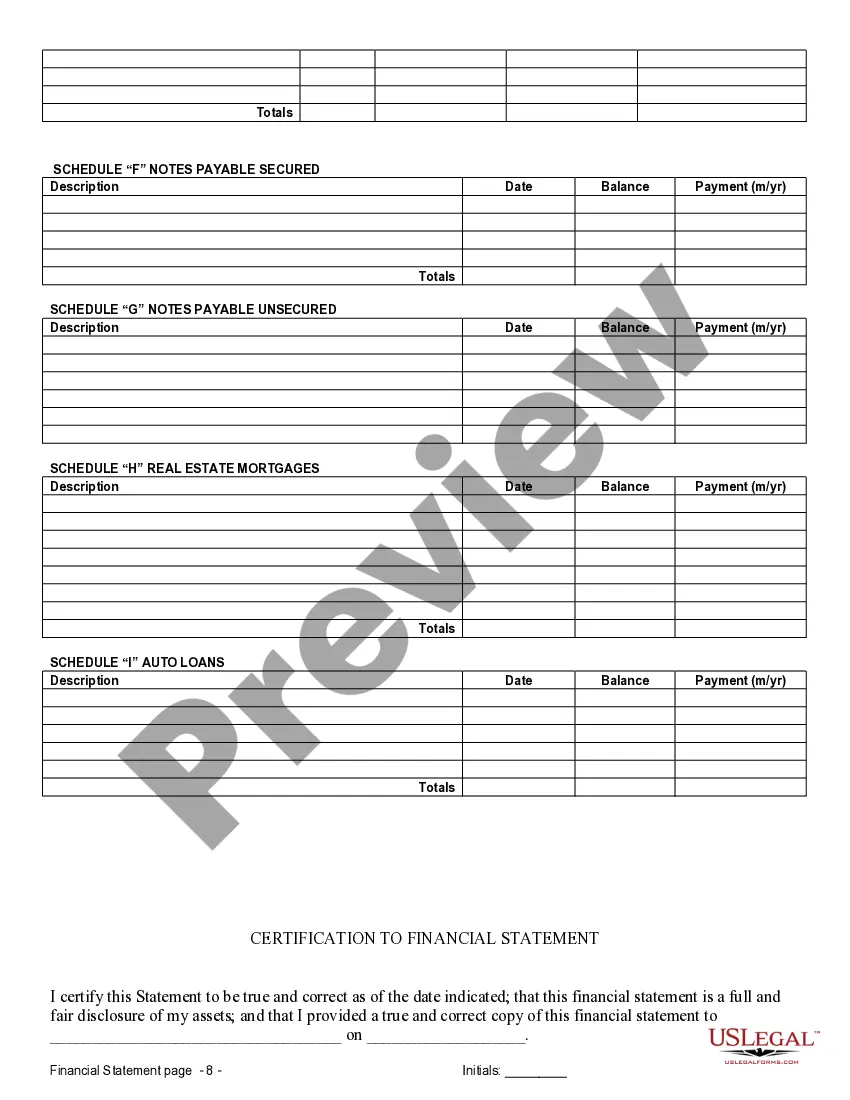

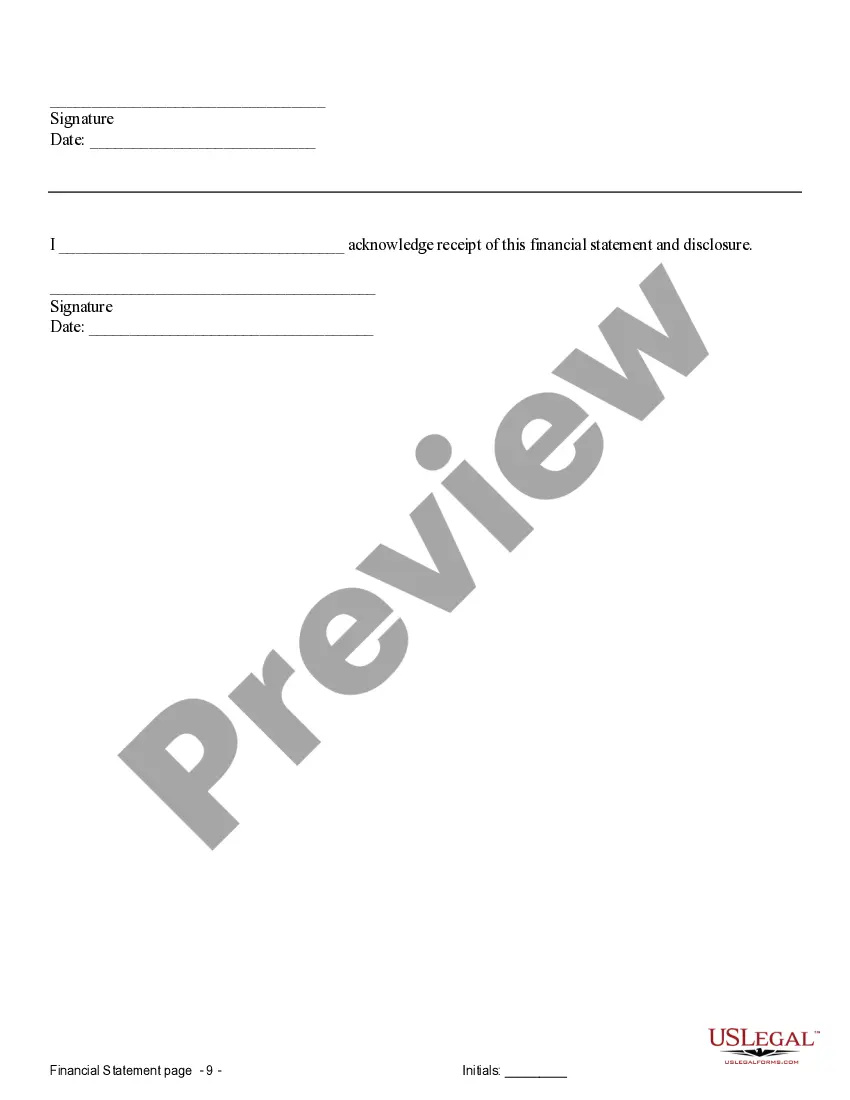

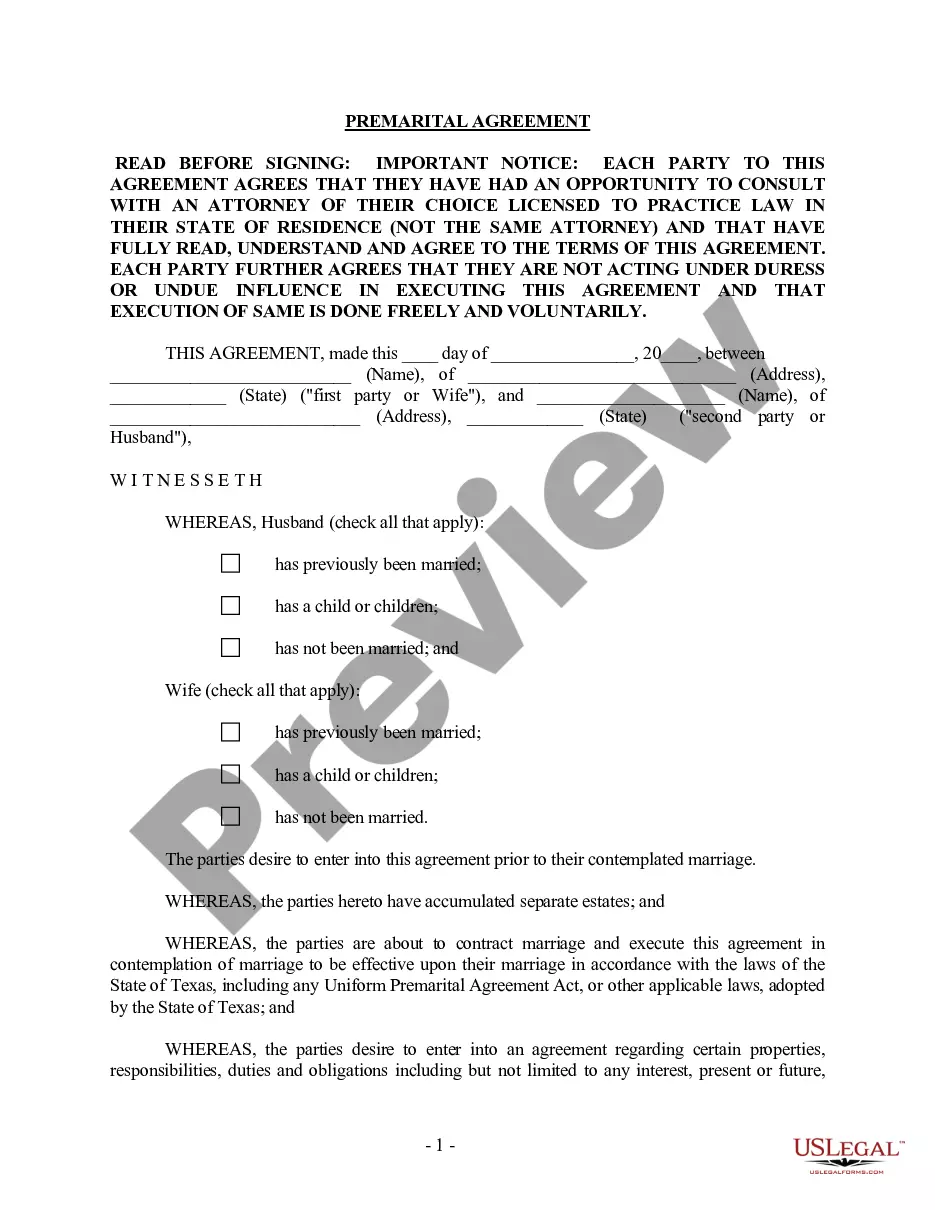

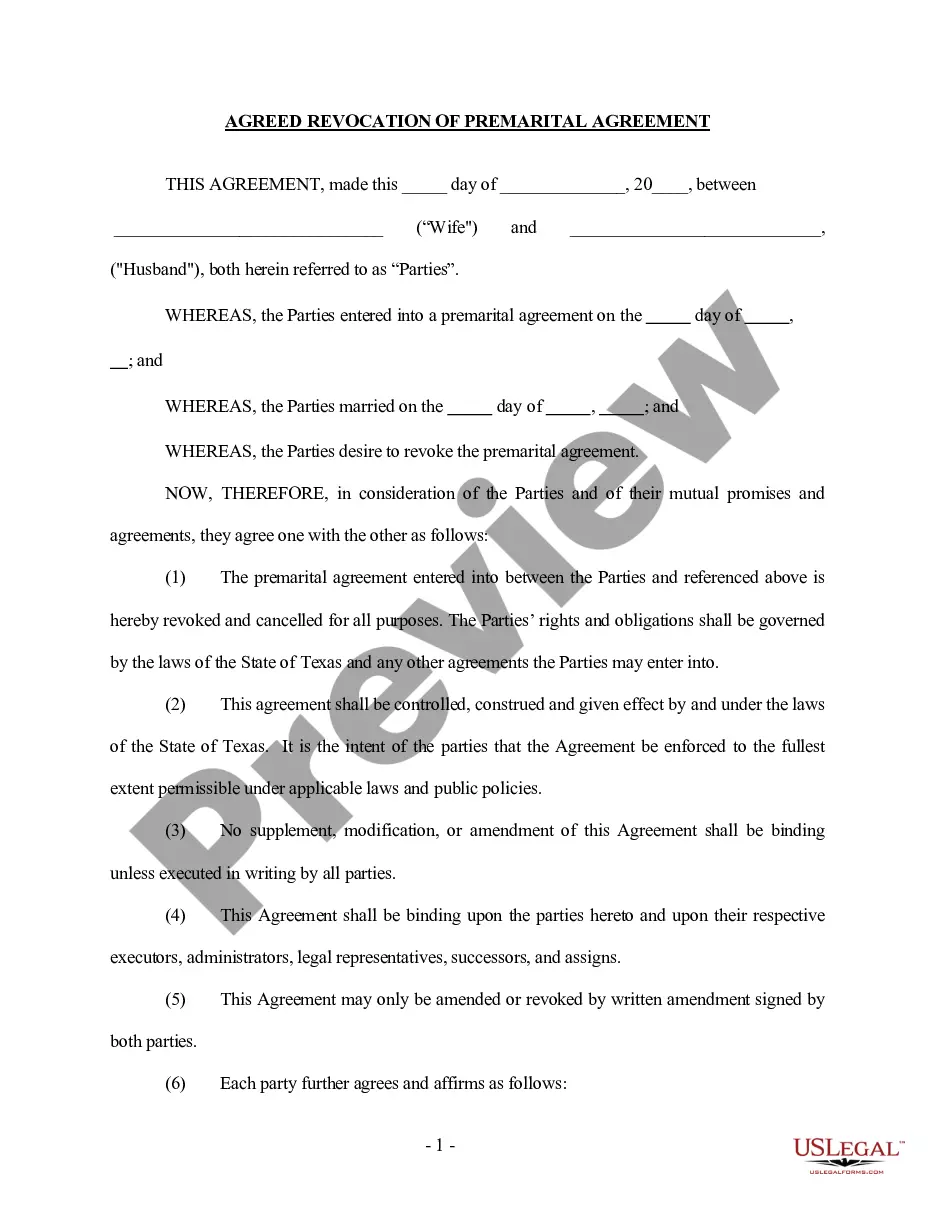

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

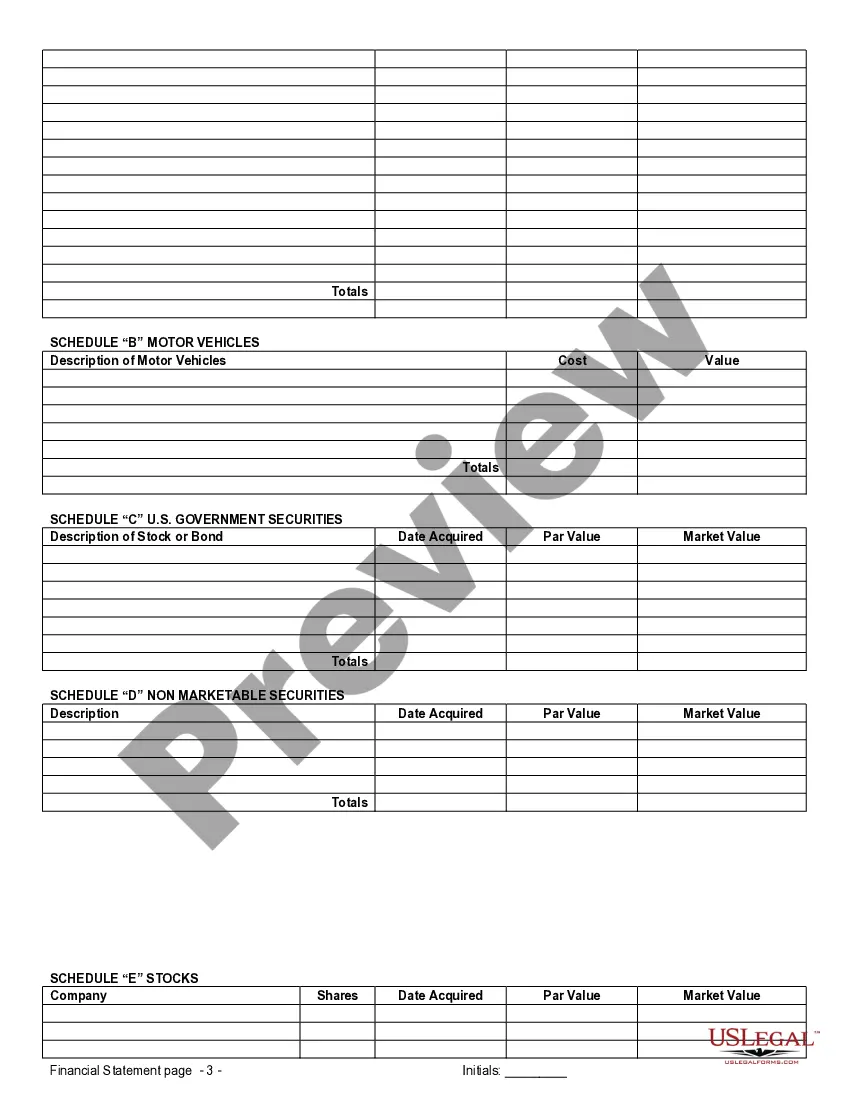

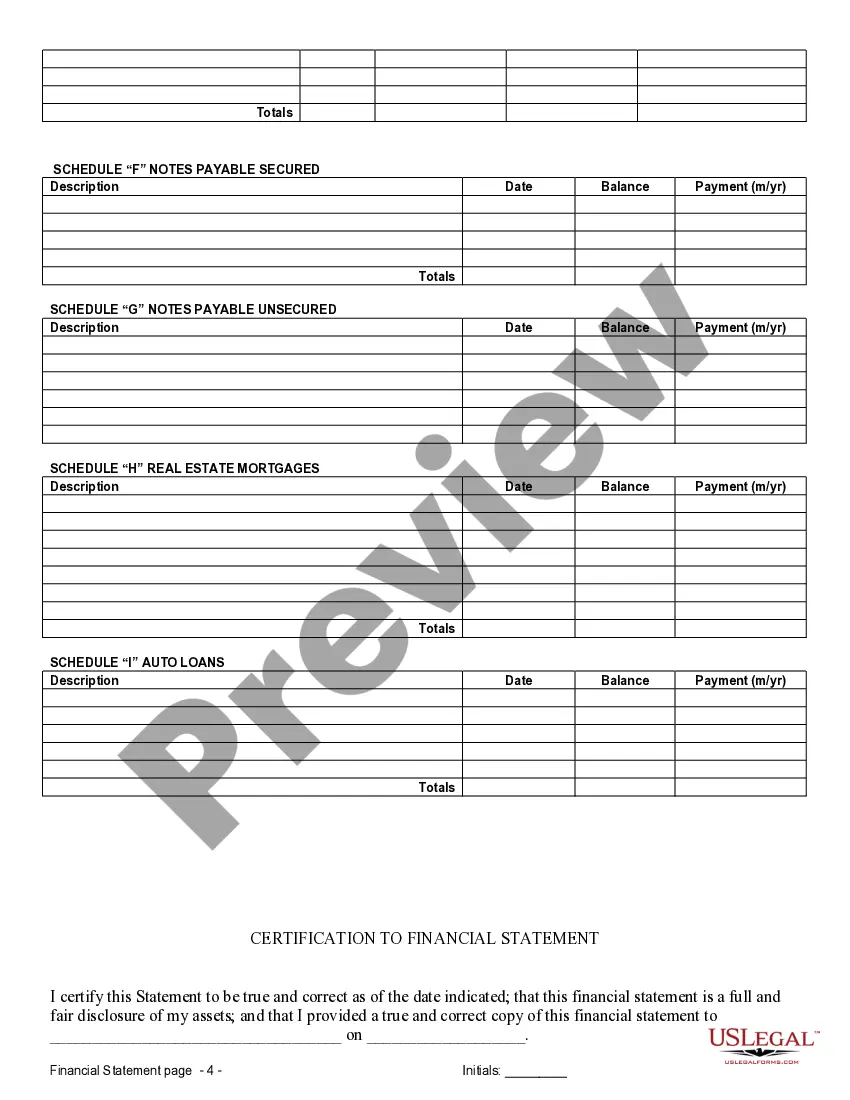

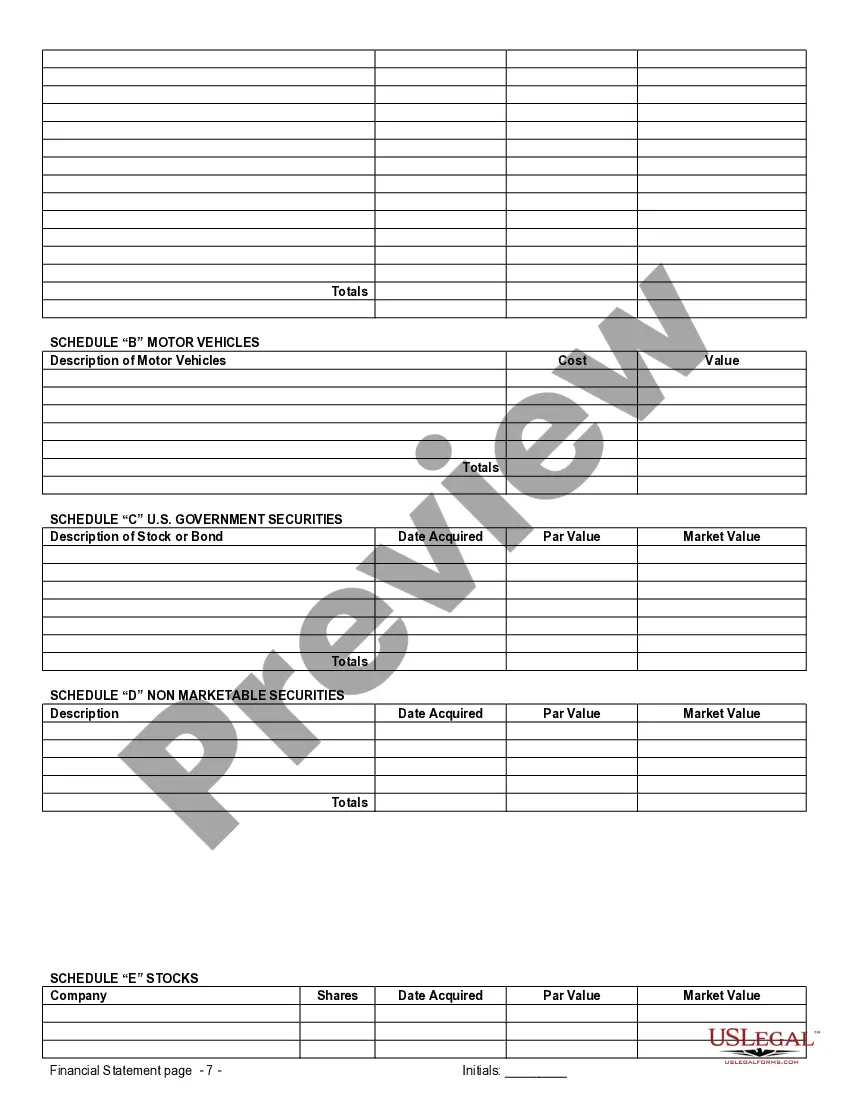

Round Rock Texas Financial Statements in Connection with Prenuptial Premarital Agreement When entering into a prenuptial or premarital agreement in Round Rock, Texas, it is crucial to include accurate and comprehensive financial statements. These statements serve as essential documentation providing an accurate snapshot of each party's financial situation. Here, we will delve into the details of Round Rock Texas Financial Statements only in Connection with Prenuptial Premarital Agreement and explore their significance. Types of Round Rock Texas Financial Statements in Connection with Prenuptial Premarital Agreement: 1. Personal Balance Sheet: A personal balance sheet is a summarization of an individual's financial assets, liabilities, and net worth. For a prenuptial agreement, this statement helps outline each party's wealth, investments, properties owned, outstanding debts, and business interests. It aids in determining the fair and equitable division of assets in the event of a divorce or separation. 2. Income Statement: An income statement showcases an individual's earnings, including salary, bonuses, commissions, rental income, dividends, and any other sources of income. Disclosing this statement in a prenuptial agreement ensures transparency regarding each party's financial strengths and obligations. 3. Bank Statements: Bank statements are crucial in providing a detailed overview of each party's financial transactions, including deposits, withdrawals, and balances across various accounts. This information aids in understanding spending habits, creditworthiness, and any potential undisclosed liabilities. 4. Tax Returns: Including tax returns in a prenuptial agreement provides a clearer picture of each party's income, deductions, and overall financial standing. This document helps establish an accurate baseline to determine future financial obligations, such as alimony or child support. 5. Debt Statements: Debt statements outline any outstanding liabilities, including mortgages, loans, credit card debt, or any other financial obligations. Disclosing this information ensures both parties are aware of existing debts and can plan accordingly in the event of a divorce. 6. Business Financial Statements: If either party owns a business or has a significant stake in one, it is essential to include business financial statements such as income statements, balance sheets, and cash flow statements. These documents help evaluate the value and viability of the business and establish how it may be impacted by the prenuptial agreement. 7. Retirement Account Statements: Including retirement account statements, such as 401(k), IRAs, or pension plans, is crucial to assess the value and future distribution of these funds based on the prenuptial agreement terms. The inclusion of these various financial statements in Round Rock Texas when drafting a prenuptial agreement ensures complete transparency and allows both parties to fully understand each other's financial status. This disclosure provides a strong foundation for a fair and equitable agreement that protects the interests of both individuals involved. It is advisable to seek the guidance of a qualified attorney specializing in family law when drafting the prenuptial agreement and compiling the financial statements. They will ensure all necessary information is included, complying with Round Rock Texas laws and regulations, ultimately providing a solid foundation for your financial future.

Round Rock Texas Financial Statements in Connection with Prenuptial Premarital Agreement When entering into a prenuptial or premarital agreement in Round Rock, Texas, it is crucial to include accurate and comprehensive financial statements. These statements serve as essential documentation providing an accurate snapshot of each party's financial situation. Here, we will delve into the details of Round Rock Texas Financial Statements only in Connection with Prenuptial Premarital Agreement and explore their significance. Types of Round Rock Texas Financial Statements in Connection with Prenuptial Premarital Agreement: 1. Personal Balance Sheet: A personal balance sheet is a summarization of an individual's financial assets, liabilities, and net worth. For a prenuptial agreement, this statement helps outline each party's wealth, investments, properties owned, outstanding debts, and business interests. It aids in determining the fair and equitable division of assets in the event of a divorce or separation. 2. Income Statement: An income statement showcases an individual's earnings, including salary, bonuses, commissions, rental income, dividends, and any other sources of income. Disclosing this statement in a prenuptial agreement ensures transparency regarding each party's financial strengths and obligations. 3. Bank Statements: Bank statements are crucial in providing a detailed overview of each party's financial transactions, including deposits, withdrawals, and balances across various accounts. This information aids in understanding spending habits, creditworthiness, and any potential undisclosed liabilities. 4. Tax Returns: Including tax returns in a prenuptial agreement provides a clearer picture of each party's income, deductions, and overall financial standing. This document helps establish an accurate baseline to determine future financial obligations, such as alimony or child support. 5. Debt Statements: Debt statements outline any outstanding liabilities, including mortgages, loans, credit card debt, or any other financial obligations. Disclosing this information ensures both parties are aware of existing debts and can plan accordingly in the event of a divorce. 6. Business Financial Statements: If either party owns a business or has a significant stake in one, it is essential to include business financial statements such as income statements, balance sheets, and cash flow statements. These documents help evaluate the value and viability of the business and establish how it may be impacted by the prenuptial agreement. 7. Retirement Account Statements: Including retirement account statements, such as 401(k), IRAs, or pension plans, is crucial to assess the value and future distribution of these funds based on the prenuptial agreement terms. The inclusion of these various financial statements in Round Rock Texas when drafting a prenuptial agreement ensures complete transparency and allows both parties to fully understand each other's financial status. This disclosure provides a strong foundation for a fair and equitable agreement that protects the interests of both individuals involved. It is advisable to seek the guidance of a qualified attorney specializing in family law when drafting the prenuptial agreement and compiling the financial statements. They will ensure all necessary information is included, complying with Round Rock Texas laws and regulations, ultimately providing a solid foundation for your financial future.