This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new corporation. The form contains basic information concerning the corporation, normally including the corporate name, number of shares to be issued, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

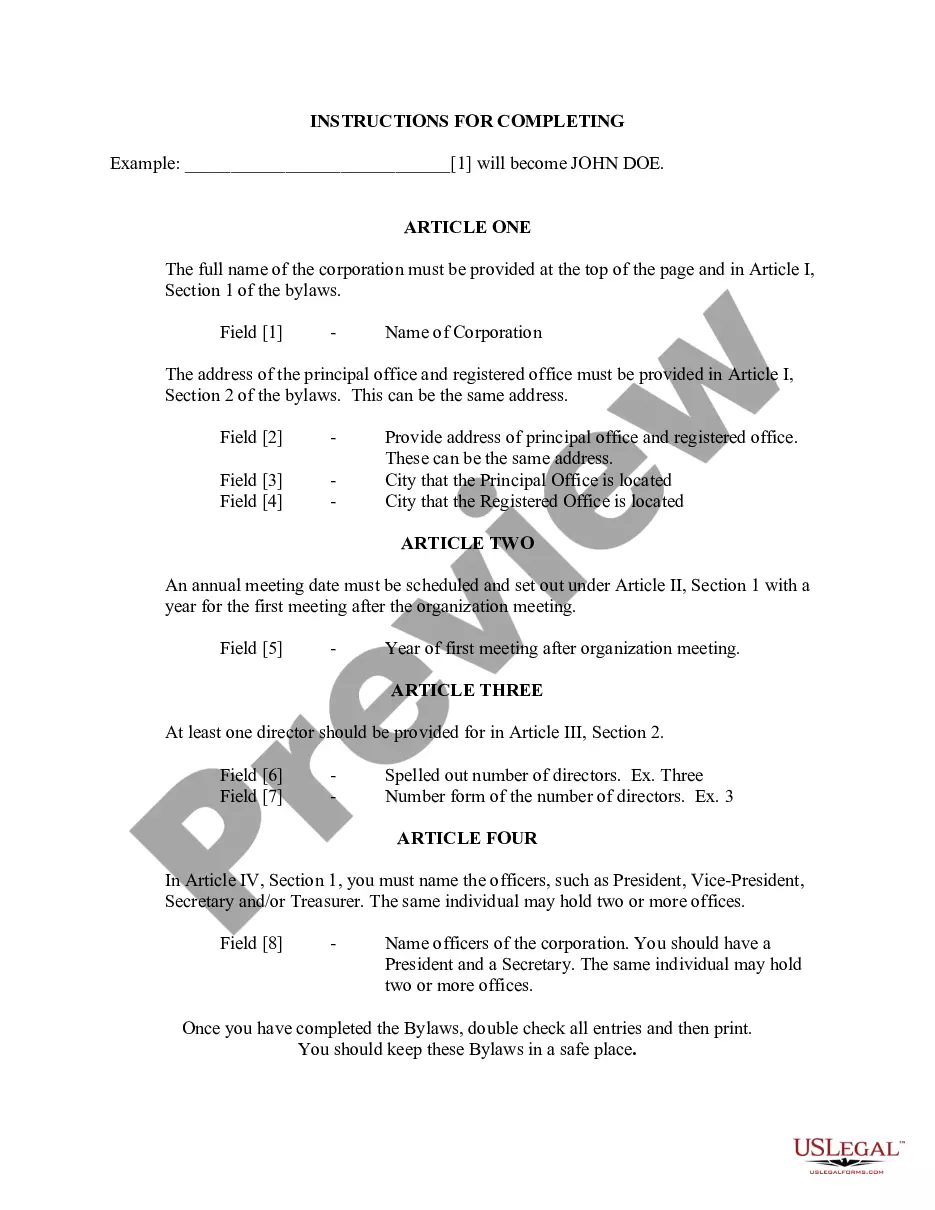

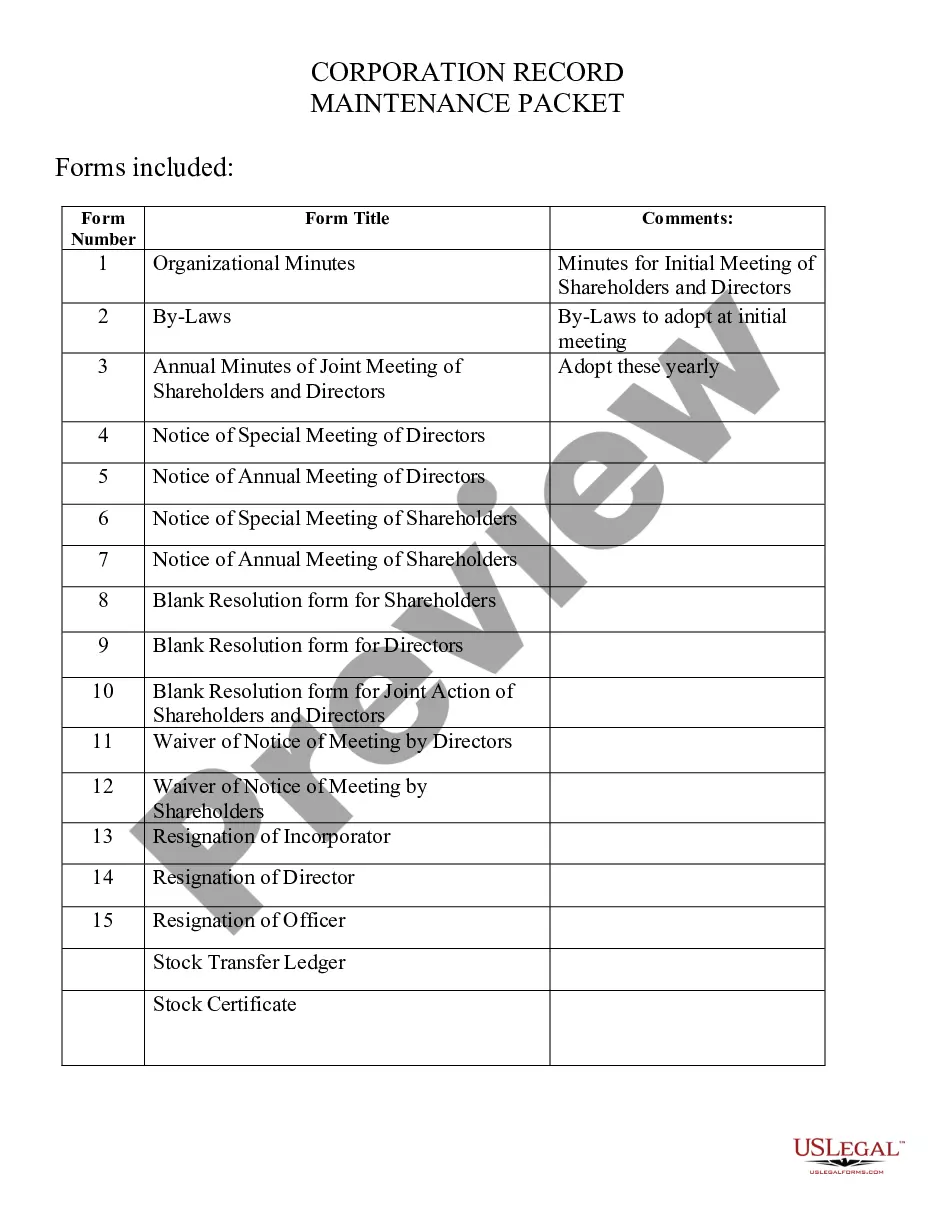

Title: Understanding the Waco Texas Articles of Incorporation for Domestic For-Profit Corporation Introduction: The Waco Texas Articles of Incorporation for Domestic For-Profit Corporation serve as a legal document that outlines the necessary information and requirements for forming and operating a for-profit corporation within the state of Texas. These articles play a crucial role in the establishment and governance of businesses in Waco, ensuring compliance with state laws and regulations. This article will delve into the details of Waco Texas Articles of Incorporation for Domestic For-Profit Corporation, providing an in-depth understanding for potential business owners. Key Elements of Waco Texas Articles of Incorporation for Domestic For-Profit Corporation: When filing the Articles of Incorporation in Waco, it is important to include the following key elements: 1. Corporate Name: Choose a unique name for your corporation that has not been previously registered in the state of Texas. Ensure the name includes an identifier such as "Corporation," "Incorporated," "Company," etc. 2. Registered Agent and Office: Designate a registered agent who will serve as the primary point of contact for legal correspondence and accept service of process on behalf of the corporation. Provide the address of the registered office, which must be a physical location within the state of Texas. 3. Purpose of the Corporation: Clearly define the purpose of the corporation, explaining the general nature of its business activities or operations. 4. Share Capital: Specify the authorized share capital of the corporation, including the number and classes of shares that the corporation is authorized to issue. 5. Incorporates: Identify the individuals or entities responsible for incorporating the corporation by their names and addresses. 6. Duration: State the duration of the corporation, whether it is perpetual or for a specific term. 7. Directors: Mention the initial directors of the corporation, their names, and addresses. 8. Bylaws: Outline that the corporation will adopt bylaws to govern its internal affairs, including rules and procedures for conducting meetings, electing directors, etc. Different Types of Waco Texas Articles of Incorporation for Domestic For-Profit Corporation: While the Waco Texas Articles of Incorporation for Domestic For-Profit Corporation generally follow a uniform format, there can be specific variations based on individual business requirements. Some common types of Waco Texas Articles of Incorporation for Domestic For-Profit Corporation include: 1. Professional Corporation: For corporations offering professional services, such as legal, medical, engineering, or accounting services. They require compliance with additional regulations and licensing requirements. 2. Close Corporation: Intended for corporations with a limited number of shareholders, typically family-owned or closely held businesses. Close corporations have more flexibility in terms of governance and shareholder agreements. 3. Non-Profit Corporation: For corporations organized to serve charitable, religious, educational, or other nonprofit purposes. The Waco Texas Articles of Incorporation for Non-Profit Corporations have distinct requirements and objectives compared to for-profit corporations. Conclusion: Familiarizing oneself with the Waco Texas Articles of Incorporation for Domestic For-Profit Corporation is an essential step when starting a business in Waco. This legal document serves as the foundation for the corporation's formation and sets out important provisions regarding its structure, purpose, and governance. By understanding the key elements and the potential variations based on business type, aspiring entrepreneurs can ensure compliance with regulations and successfully establish their for-profit corporation in Waco, Texas.Title: Understanding the Waco Texas Articles of Incorporation for Domestic For-Profit Corporation Introduction: The Waco Texas Articles of Incorporation for Domestic For-Profit Corporation serve as a legal document that outlines the necessary information and requirements for forming and operating a for-profit corporation within the state of Texas. These articles play a crucial role in the establishment and governance of businesses in Waco, ensuring compliance with state laws and regulations. This article will delve into the details of Waco Texas Articles of Incorporation for Domestic For-Profit Corporation, providing an in-depth understanding for potential business owners. Key Elements of Waco Texas Articles of Incorporation for Domestic For-Profit Corporation: When filing the Articles of Incorporation in Waco, it is important to include the following key elements: 1. Corporate Name: Choose a unique name for your corporation that has not been previously registered in the state of Texas. Ensure the name includes an identifier such as "Corporation," "Incorporated," "Company," etc. 2. Registered Agent and Office: Designate a registered agent who will serve as the primary point of contact for legal correspondence and accept service of process on behalf of the corporation. Provide the address of the registered office, which must be a physical location within the state of Texas. 3. Purpose of the Corporation: Clearly define the purpose of the corporation, explaining the general nature of its business activities or operations. 4. Share Capital: Specify the authorized share capital of the corporation, including the number and classes of shares that the corporation is authorized to issue. 5. Incorporates: Identify the individuals or entities responsible for incorporating the corporation by their names and addresses. 6. Duration: State the duration of the corporation, whether it is perpetual or for a specific term. 7. Directors: Mention the initial directors of the corporation, their names, and addresses. 8. Bylaws: Outline that the corporation will adopt bylaws to govern its internal affairs, including rules and procedures for conducting meetings, electing directors, etc. Different Types of Waco Texas Articles of Incorporation for Domestic For-Profit Corporation: While the Waco Texas Articles of Incorporation for Domestic For-Profit Corporation generally follow a uniform format, there can be specific variations based on individual business requirements. Some common types of Waco Texas Articles of Incorporation for Domestic For-Profit Corporation include: 1. Professional Corporation: For corporations offering professional services, such as legal, medical, engineering, or accounting services. They require compliance with additional regulations and licensing requirements. 2. Close Corporation: Intended for corporations with a limited number of shareholders, typically family-owned or closely held businesses. Close corporations have more flexibility in terms of governance and shareholder agreements. 3. Non-Profit Corporation: For corporations organized to serve charitable, religious, educational, or other nonprofit purposes. The Waco Texas Articles of Incorporation for Non-Profit Corporations have distinct requirements and objectives compared to for-profit corporations. Conclusion: Familiarizing oneself with the Waco Texas Articles of Incorporation for Domestic For-Profit Corporation is an essential step when starting a business in Waco. This legal document serves as the foundation for the corporation's formation and sets out important provisions regarding its structure, purpose, and governance. By understanding the key elements and the potential variations based on business type, aspiring entrepreneurs can ensure compliance with regulations and successfully establish their for-profit corporation in Waco, Texas.