This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

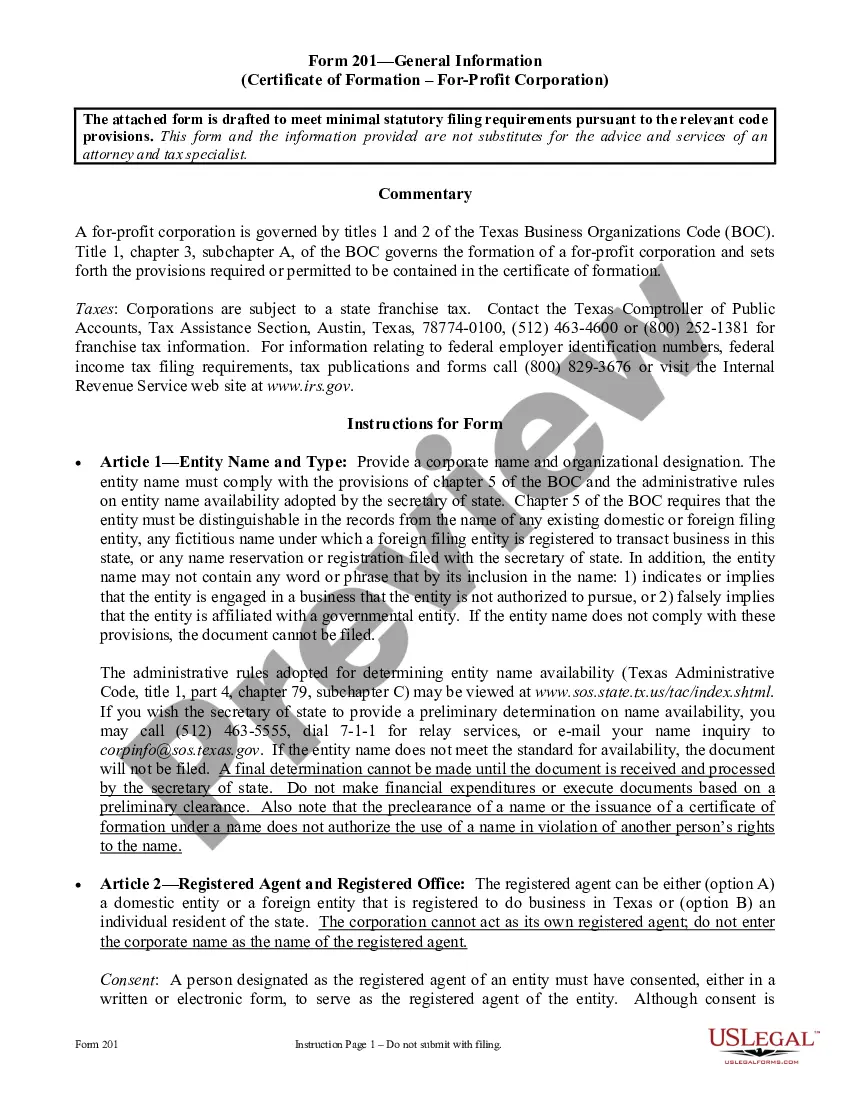

The Corpus Christi Texas Articles of Incorporation for Domestic Nonprofit Corporation refers to the legal document that is filed with the Texas Secretary of State in order to establish and register a domestic nonprofit corporation in the city of Corpus Christi, Texas. This document serves as the foundation for the corporation's existence and sets forth essential information pertaining to its operation, governance, and purpose. The Corpus Christi Texas Articles of Incorporation for Domestic Nonprofit Corporation typically require the inclusion of certain key elements. These elements may include: 1. Name of the Corporation: The proposed name of the nonprofit corporation, which must comply with the state's naming requirements and should not be confusingly similar to any existing corporation or trademark. 2. Purpose: A clear and concise statement of the corporation's purpose, often emphasizing its nonprofit, charitable, educational, or social goals. 3. Registered Agent: The name and address of the registered agent who will act as the corporation's official point of contact for legal matters and will receive official government correspondence on behalf of the corporation. 4. Directors: The names and addresses of the individuals who will initially serve as the corporation's directors, responsible for overseeing its activities and ensuring compliance with regulations. 5. Members or Shareholders: If applicable, details of the members or shareholders, including their rights, privileges, and responsibilities. 6. Duration: The intended duration of the corporation, which is usually indicated as perpetual unless specified otherwise. 7. Dissolution Provisions: Guidelines on how the corporation can be dissolved, its assets distributed, and any remaining obligations fulfilled if it ceases to exist. 8. Amendments: A provision stating how the Articles of Incorporation can be amended in the future, typically by a vote of the directors or members, as applicable. In addition to the standard Corpus Christi Texas Articles of Incorporation for Domestic Nonprofit Corporation, there may be other specialized versions tailored to specific types of nonprofit organizations. These may include: 1. Religious Corporation: This type of nonprofit corporation may have additional provisions related to religious doctrines, membership, religious rites, or specific practices. 2. Educational Corporation: Nonprofit corporations focused primarily on educational activities may have specific requirements regarding curriculum, certification, student enrollment, or degree-granting authorities. 3. Charitable Corporation: Nonprofit corporations engaged in charitable activities, such as providing humanitarian aid, philanthropy, or community support, might require specific provisions related to fundraising, distribution of funds, or charitable grant-making procedures. It is important to consult the Texas Secretary of State's website or legal counsel to ensure compliance with the specific requirements and instructions for filing Corpus Christi Texas Articles of Incorporation for Domestic Nonprofit Corporation.The Corpus Christi Texas Articles of Incorporation for Domestic Nonprofit Corporation refers to the legal document that is filed with the Texas Secretary of State in order to establish and register a domestic nonprofit corporation in the city of Corpus Christi, Texas. This document serves as the foundation for the corporation's existence and sets forth essential information pertaining to its operation, governance, and purpose. The Corpus Christi Texas Articles of Incorporation for Domestic Nonprofit Corporation typically require the inclusion of certain key elements. These elements may include: 1. Name of the Corporation: The proposed name of the nonprofit corporation, which must comply with the state's naming requirements and should not be confusingly similar to any existing corporation or trademark. 2. Purpose: A clear and concise statement of the corporation's purpose, often emphasizing its nonprofit, charitable, educational, or social goals. 3. Registered Agent: The name and address of the registered agent who will act as the corporation's official point of contact for legal matters and will receive official government correspondence on behalf of the corporation. 4. Directors: The names and addresses of the individuals who will initially serve as the corporation's directors, responsible for overseeing its activities and ensuring compliance with regulations. 5. Members or Shareholders: If applicable, details of the members or shareholders, including their rights, privileges, and responsibilities. 6. Duration: The intended duration of the corporation, which is usually indicated as perpetual unless specified otherwise. 7. Dissolution Provisions: Guidelines on how the corporation can be dissolved, its assets distributed, and any remaining obligations fulfilled if it ceases to exist. 8. Amendments: A provision stating how the Articles of Incorporation can be amended in the future, typically by a vote of the directors or members, as applicable. In addition to the standard Corpus Christi Texas Articles of Incorporation for Domestic Nonprofit Corporation, there may be other specialized versions tailored to specific types of nonprofit organizations. These may include: 1. Religious Corporation: This type of nonprofit corporation may have additional provisions related to religious doctrines, membership, religious rites, or specific practices. 2. Educational Corporation: Nonprofit corporations focused primarily on educational activities may have specific requirements regarding curriculum, certification, student enrollment, or degree-granting authorities. 3. Charitable Corporation: Nonprofit corporations engaged in charitable activities, such as providing humanitarian aid, philanthropy, or community support, might require specific provisions related to fundraising, distribution of funds, or charitable grant-making procedures. It is important to consult the Texas Secretary of State's website or legal counsel to ensure compliance with the specific requirements and instructions for filing Corpus Christi Texas Articles of Incorporation for Domestic Nonprofit Corporation.