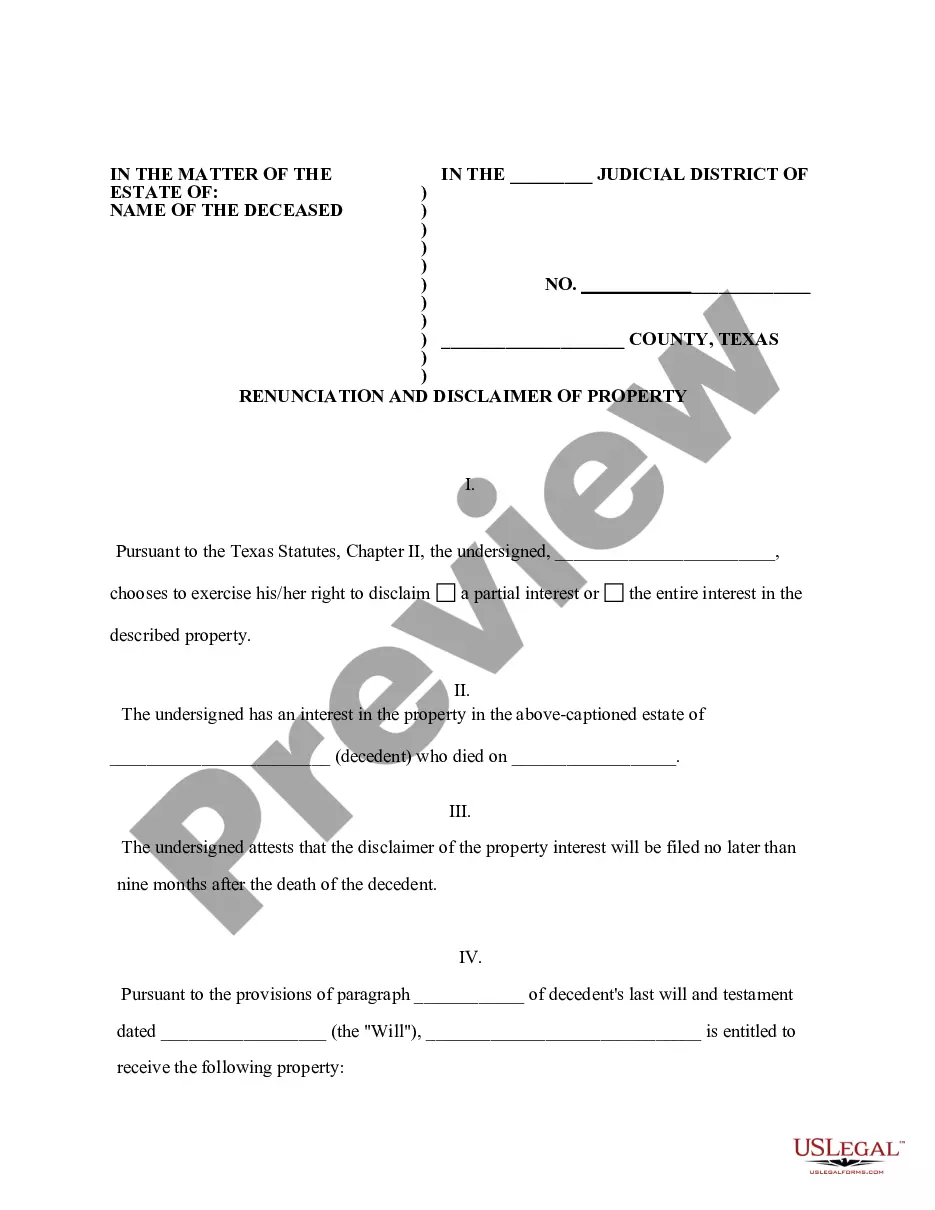

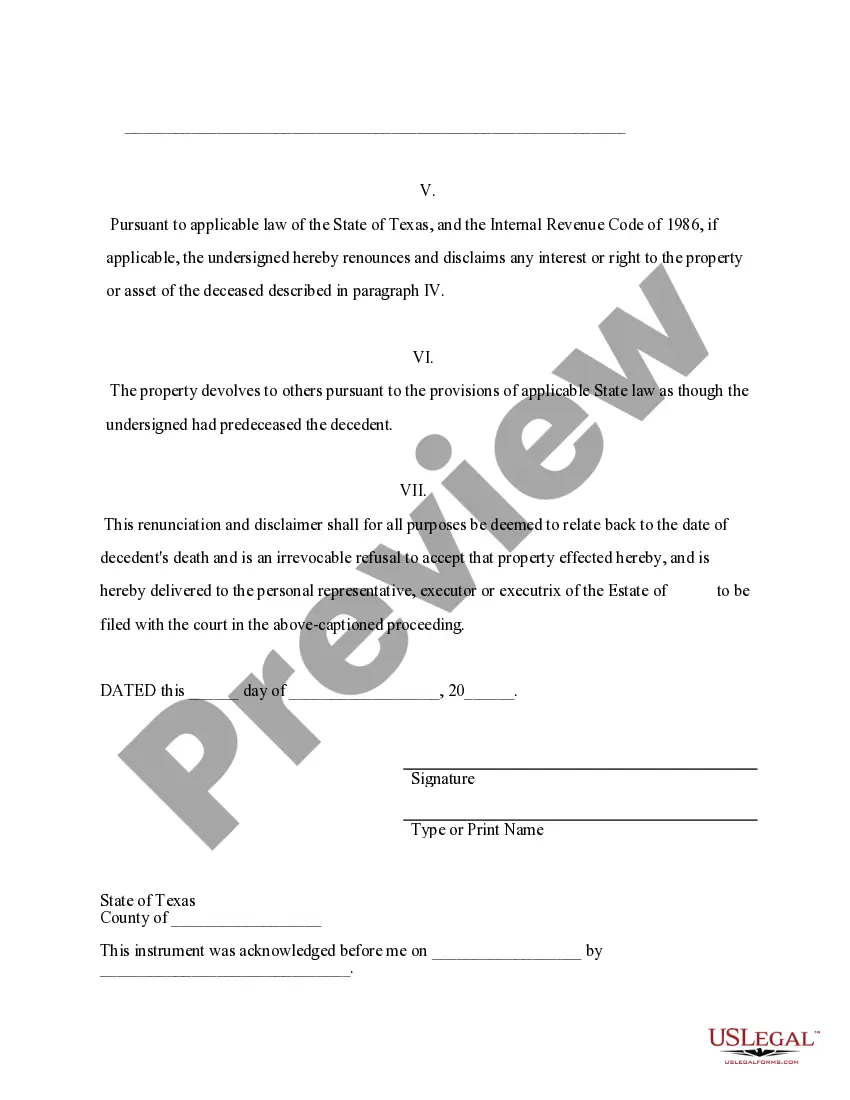

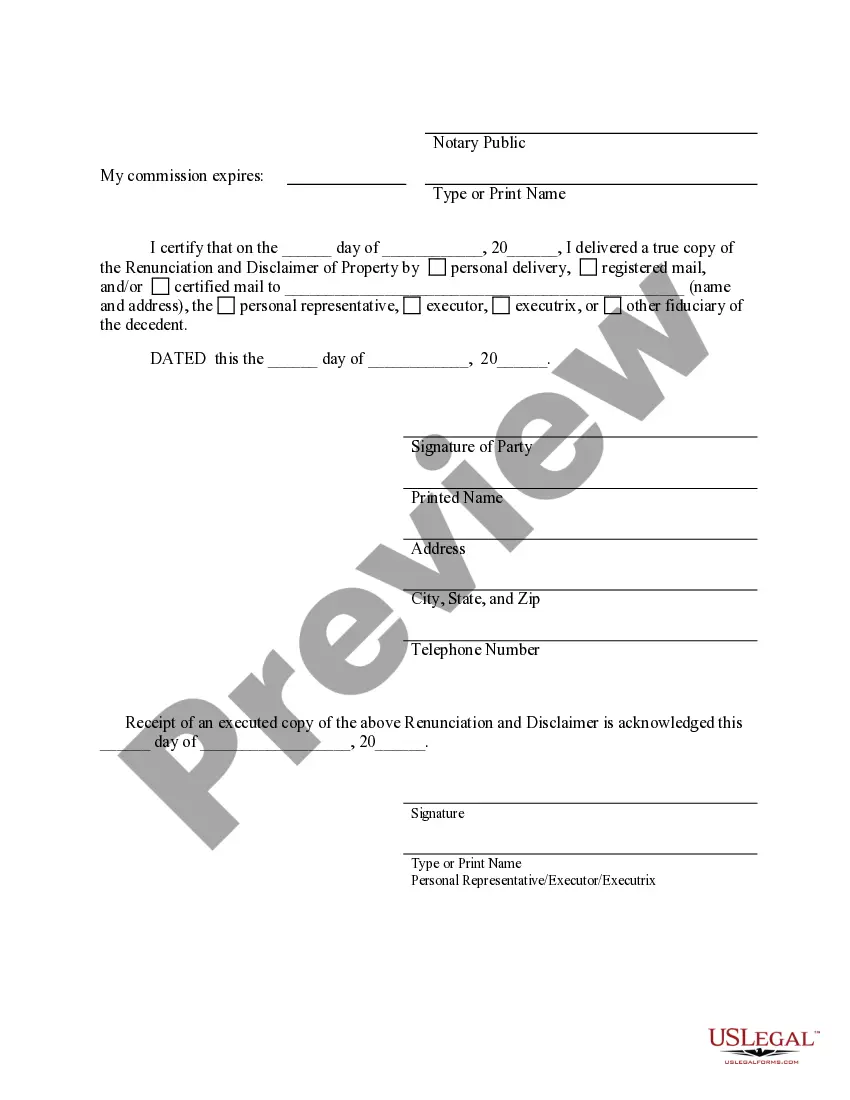

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent where the beneficiary gained an interest in the property upon the death of the decedent, but, will terminate a portion of or the entire interest of the property pursuant to the Texas Statutes, Chapter II. The beneficiary attests that he/she will file the disclaimer no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate of delivery.

Beaumont Texas Renunciation and Disclaimer of Property from Will by Testate is a legal process that allows a designated beneficiary to formally decline their right to inherit property as determined by a testate will. This renunciation and disclaimer is a legally binding declaration through which an individual voluntarily relinquishes their claim to certain assets or properties. In Beaumont, Texas, there are two main types of renunciation and disclaimer of property from a testate will: partial renunciation and complete renunciation. 1. Partial Renunciation: This type of renunciation refers to the partial disclaimer of specific assets or properties mentioned in the testate will. The beneficiary may choose to renounce specific items or portions of the inheritance while accepting others. This process allows them to selectively forfeit certain assets, which are then distributed among the other beneficiaries as per the will's instructions. 2. Complete Renunciation: Complete renunciation involves turning down the entire inheritance mentioned in the testate will. By renouncing the entire estate, the beneficiary willingly waives all rights to the property, which subsequently passes to the alternate beneficiary or beneficiaries listed in the will. This comprehensive renunciation implies that the individual does not desire to receive anything from the deceased person's estate. The Beaumont Texas Renunciation and Disclaimer of Property from Will by Testate requires specific steps to be followed, ensuring the process adheres to legal standards. The individual intending to renounce or disclaim their rights must timely submit a written statement expressing their decision to the court overseeing probate proceedings. This statement should clearly outline the testate will's details, the renouncing beneficiary's information, and the specific assets or properties being renounced. It is crucial to consult an attorney experienced in estate law to ensure all legal obligations are met. It's important to note that Beaumont Texas Renunciation and Disclaimer of Property from a testate will cannot be made by an individual who has previously accepted any benefits from the estate or acted in a manner consistent with having accepted the inheritance. Additionally, this process only applies to a testate (with a valid will) situation and not to cases of intestacy (where the deceased person did not leave a valid will). In conclusion, Beaumont Texas Renunciation and Disclaimer of Property from Will by Testate allows designated beneficiaries to formally decline their right to inherit specific assets or the entire estate as dictated by a testate will. This legal process enables a smooth distribution of the deceased person's property among the remaining beneficiaries in line with their wishes.Beaumont Texas Renunciation and Disclaimer of Property from Will by Testate is a legal process that allows a designated beneficiary to formally decline their right to inherit property as determined by a testate will. This renunciation and disclaimer is a legally binding declaration through which an individual voluntarily relinquishes their claim to certain assets or properties. In Beaumont, Texas, there are two main types of renunciation and disclaimer of property from a testate will: partial renunciation and complete renunciation. 1. Partial Renunciation: This type of renunciation refers to the partial disclaimer of specific assets or properties mentioned in the testate will. The beneficiary may choose to renounce specific items or portions of the inheritance while accepting others. This process allows them to selectively forfeit certain assets, which are then distributed among the other beneficiaries as per the will's instructions. 2. Complete Renunciation: Complete renunciation involves turning down the entire inheritance mentioned in the testate will. By renouncing the entire estate, the beneficiary willingly waives all rights to the property, which subsequently passes to the alternate beneficiary or beneficiaries listed in the will. This comprehensive renunciation implies that the individual does not desire to receive anything from the deceased person's estate. The Beaumont Texas Renunciation and Disclaimer of Property from Will by Testate requires specific steps to be followed, ensuring the process adheres to legal standards. The individual intending to renounce or disclaim their rights must timely submit a written statement expressing their decision to the court overseeing probate proceedings. This statement should clearly outline the testate will's details, the renouncing beneficiary's information, and the specific assets or properties being renounced. It is crucial to consult an attorney experienced in estate law to ensure all legal obligations are met. It's important to note that Beaumont Texas Renunciation and Disclaimer of Property from a testate will cannot be made by an individual who has previously accepted any benefits from the estate or acted in a manner consistent with having accepted the inheritance. Additionally, this process only applies to a testate (with a valid will) situation and not to cases of intestacy (where the deceased person did not leave a valid will). In conclusion, Beaumont Texas Renunciation and Disclaimer of Property from Will by Testate allows designated beneficiaries to formally decline their right to inherit specific assets or the entire estate as dictated by a testate will. This legal process enables a smooth distribution of the deceased person's property among the remaining beneficiaries in line with their wishes.