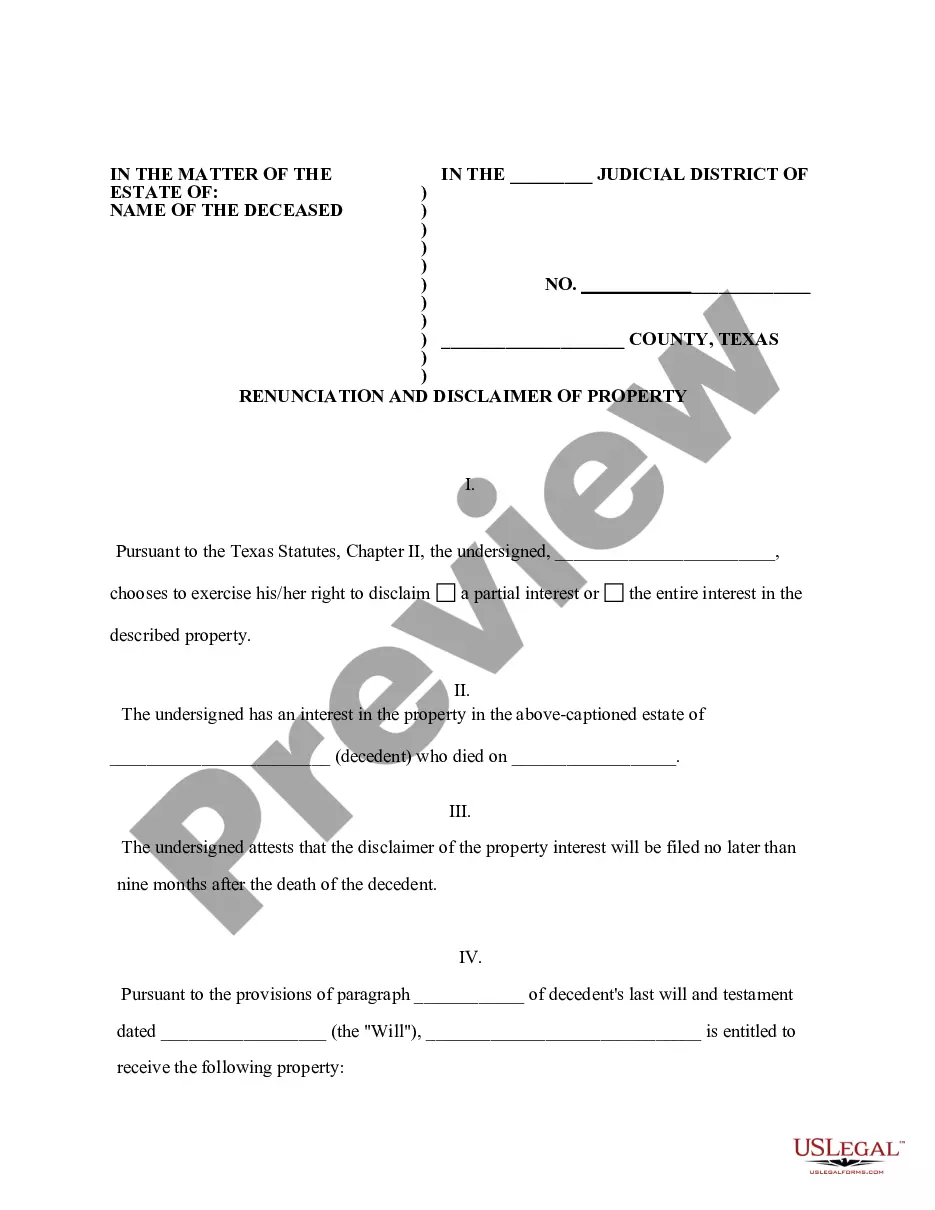

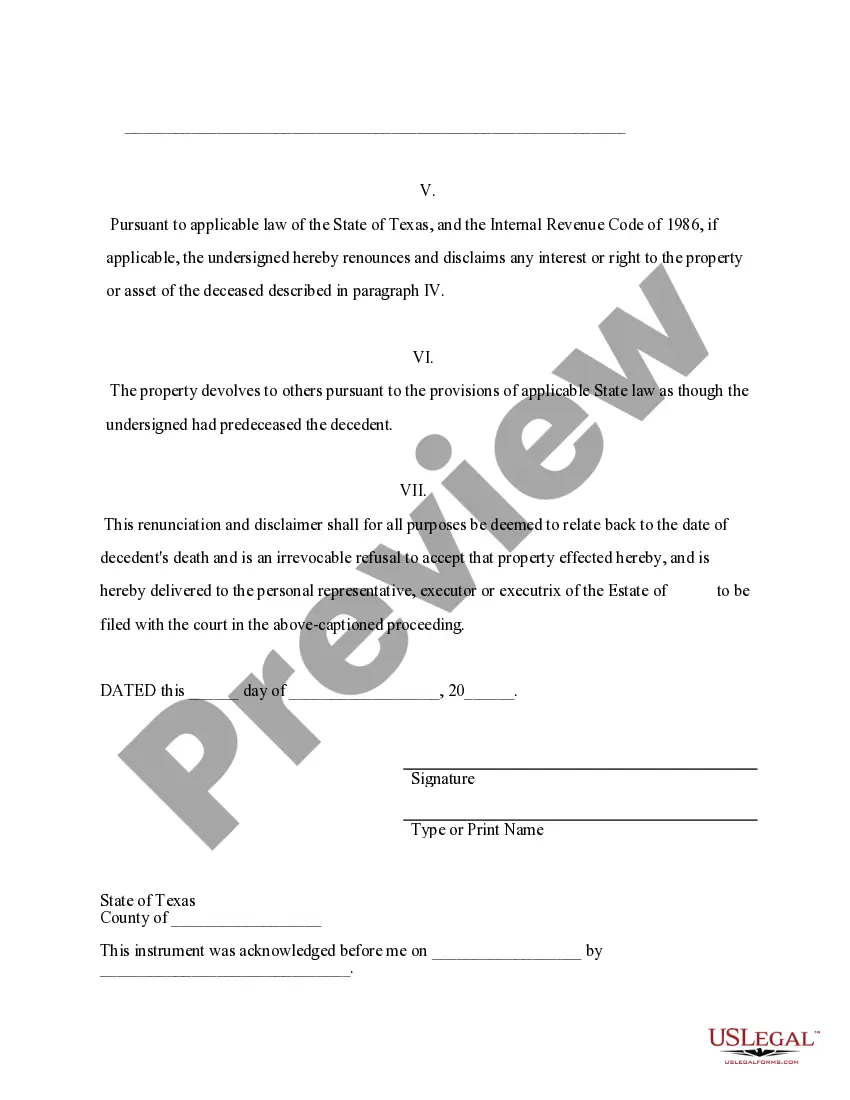

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent where the beneficiary gained an interest in the property upon the death of the decedent, but, will terminate a portion of or the entire interest of the property pursuant to the Texas Statutes, Chapter II. The beneficiary attests that he/she will file the disclaimer no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate of delivery.

Harris Texas Renunciation And Disclaimer of Property from Will by Testate is a legal process that allows a beneficiary named in a will to voluntarily give up their rights to inherit specific or all assets mentioned in the will. This renunciation and disclaimer can be done for various reasons, such as tax planning, avoiding legal complications, or simply because the beneficiary does not wish to accept the inheritance. Under Harris Texas law, there are two types of renunciation and disclaimer of property from a will buy testate: partial renunciation and complete renunciation. 1. Partial Renunciation: This type of renunciation allows a beneficiary to renounce only a portion of the assets devolving to them from a will. By renouncing a portion, the beneficiary will not inherit the assets they have renounced, and those assets will be distributed as if the beneficiary predeceased the testator (the person who made the will). The disclaimer is limited to specific items, particular bequests, or determined shares of the estate as mentioned in the will. 2. Complete Renunciation: In this type of renunciation, the beneficiary renounces their right to inherit the entire estate or all the assets they would have otherwise received. By completely renouncing their inheritance, the beneficiary will have no claim to any part of the estate. The disclaimed assets will be distributed as if the beneficiary predeceased the testator. It is important to note that the renunciation and disclaimer of property from a will buy testate must typically be done within a specific timeframe after the testator's death. In Harris Texas, beneficiaries usually have a limited period of nine months from the time of the testator's death to complete their renunciation and disclaimer of property. The renunciation and disclaimer process generally involve filing a written renunciation with the appropriate Harris Texas probate court. To ensure the renunciation is valid and legally recognized, it is advisable to consult an attorney specializing in estate planning or probate law. Additionally, the renunciation could have potential legal and tax consequences, so seeking professional advice is essential to understand the implications and make informed decisions. In summary, the Harris Texas Renunciation And Disclaimer of Property from Will by Testate provides beneficiaries with the option to renounce or disclaim their rights to inherit specific or all assets mentioned in a will. Whether opting for a partial or complete renunciation, it is crucial to consult an attorney to navigate the legal process and comprehend the potential consequences.Harris Texas Renunciation And Disclaimer of Property from Will by Testate is a legal process that allows a beneficiary named in a will to voluntarily give up their rights to inherit specific or all assets mentioned in the will. This renunciation and disclaimer can be done for various reasons, such as tax planning, avoiding legal complications, or simply because the beneficiary does not wish to accept the inheritance. Under Harris Texas law, there are two types of renunciation and disclaimer of property from a will buy testate: partial renunciation and complete renunciation. 1. Partial Renunciation: This type of renunciation allows a beneficiary to renounce only a portion of the assets devolving to them from a will. By renouncing a portion, the beneficiary will not inherit the assets they have renounced, and those assets will be distributed as if the beneficiary predeceased the testator (the person who made the will). The disclaimer is limited to specific items, particular bequests, or determined shares of the estate as mentioned in the will. 2. Complete Renunciation: In this type of renunciation, the beneficiary renounces their right to inherit the entire estate or all the assets they would have otherwise received. By completely renouncing their inheritance, the beneficiary will have no claim to any part of the estate. The disclaimed assets will be distributed as if the beneficiary predeceased the testator. It is important to note that the renunciation and disclaimer of property from a will buy testate must typically be done within a specific timeframe after the testator's death. In Harris Texas, beneficiaries usually have a limited period of nine months from the time of the testator's death to complete their renunciation and disclaimer of property. The renunciation and disclaimer process generally involve filing a written renunciation with the appropriate Harris Texas probate court. To ensure the renunciation is valid and legally recognized, it is advisable to consult an attorney specializing in estate planning or probate law. Additionally, the renunciation could have potential legal and tax consequences, so seeking professional advice is essential to understand the implications and make informed decisions. In summary, the Harris Texas Renunciation And Disclaimer of Property from Will by Testate provides beneficiaries with the option to renounce or disclaim their rights to inherit specific or all assets mentioned in a will. Whether opting for a partial or complete renunciation, it is crucial to consult an attorney to navigate the legal process and comprehend the potential consequences.