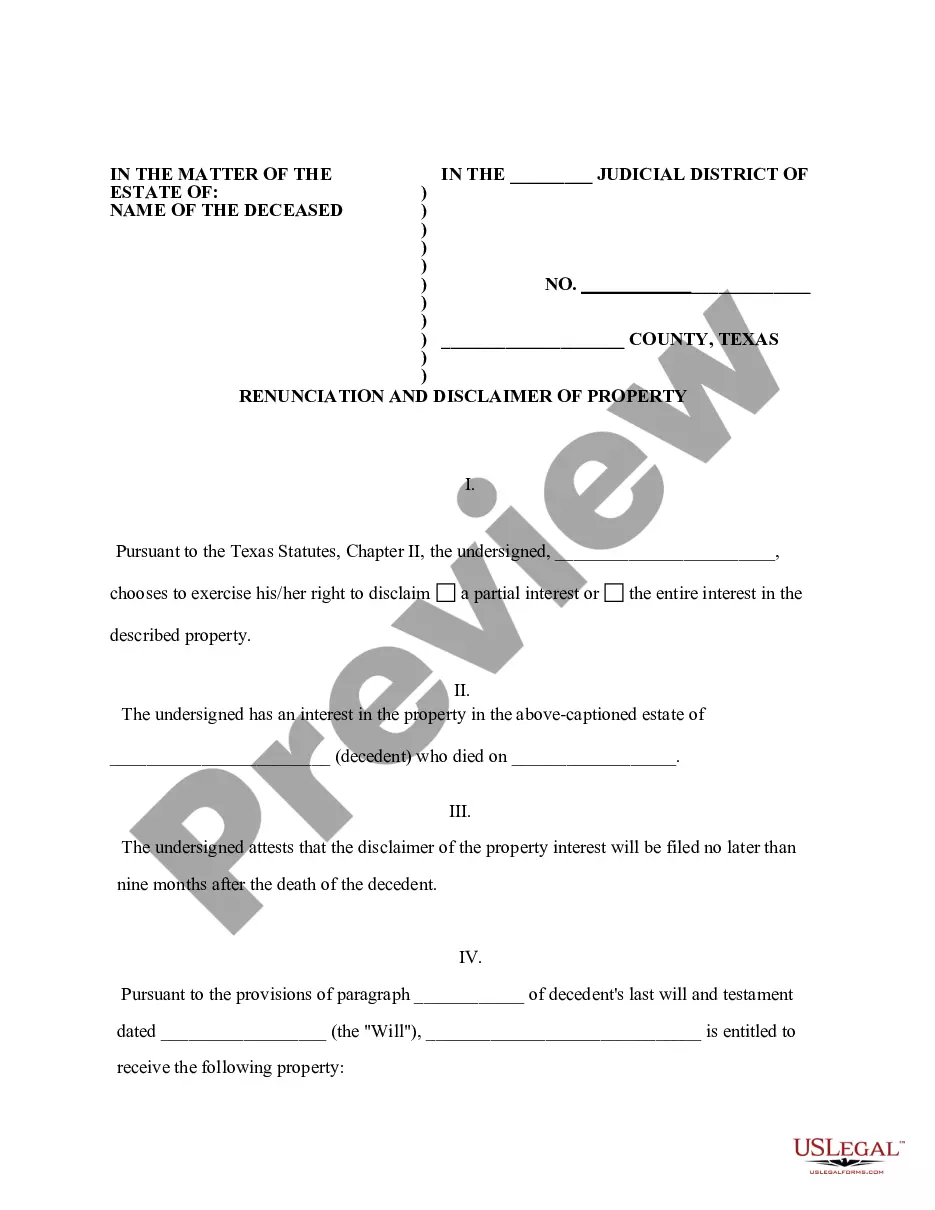

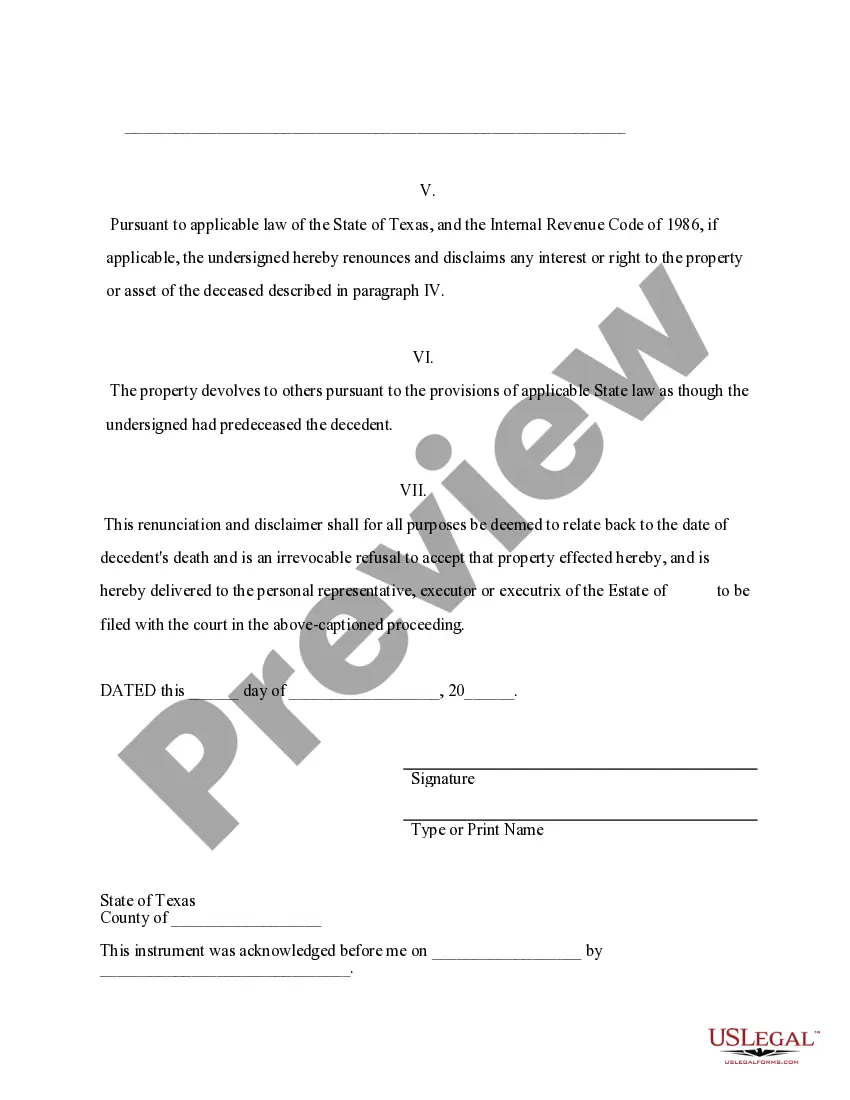

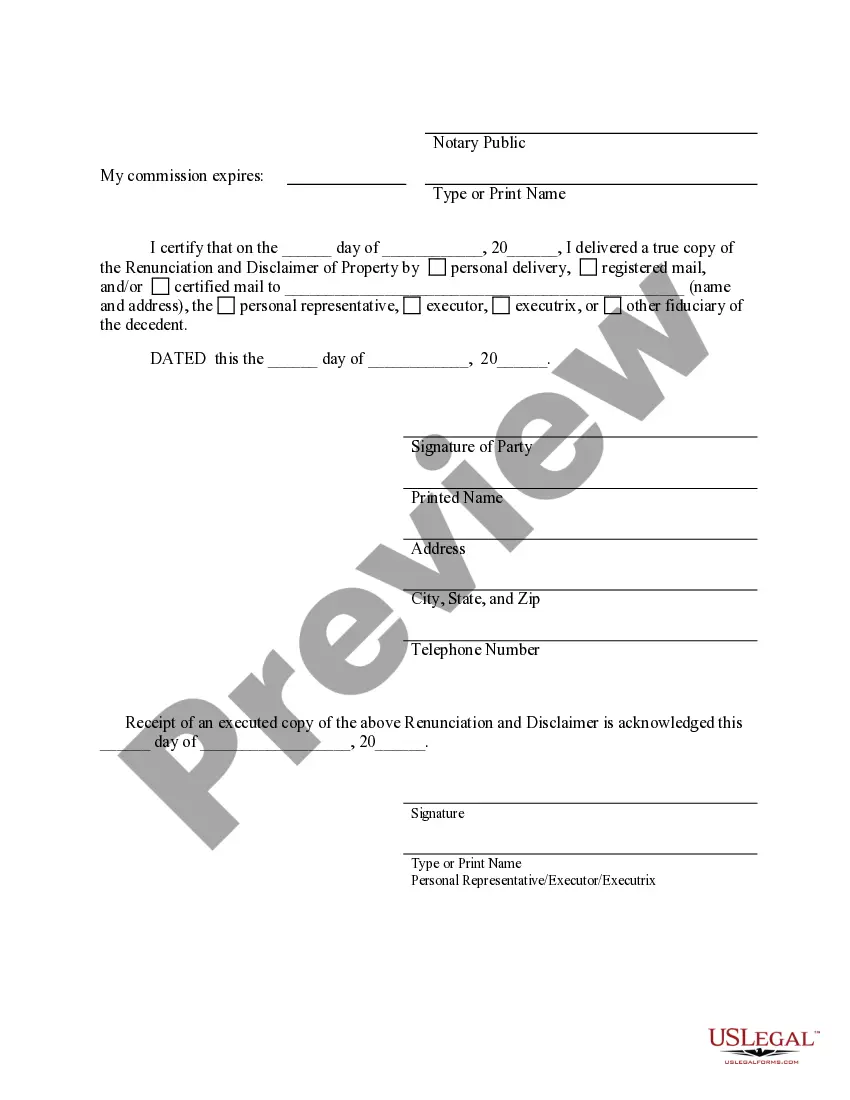

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent where the beneficiary gained an interest in the property upon the death of the decedent, but, will terminate a portion of or the entire interest of the property pursuant to the Texas Statutes, Chapter II. The beneficiary attests that he/she will file the disclaimer no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate of delivery.

Irving Texas Renunciation And Disclaimer of Property from Will by Testate is a legal process through which an individual named in a will as a beneficiary voluntarily relinquishes their right to inherit specific assets or property. This renunciation is done by filing a formal document with the appropriate court or estate administration authority in Irving, Texas. By renouncing the property, the beneficiary is essentially stating that they do not wish to accept their share of the assets as stated in the deceased person's will. There are several reasons why someone might choose to enunciate their inheritance. It could be due to personal circumstances, financial considerations, or potential conflicts of interest. Regardless of the reasons, it is essential to understand the process and implications of renunciation in Irving, Texas. In Irving, Texas, there are different types of renunciation and disclaimers of property from a will buy testate that individuals can pursue, including: 1. Full Renunciation: This type of renunciation involves the complete refusal of the assets allocated to the beneficiary in the will, relinquishing any claim to them. The beneficiary essentially opts out of inheriting any portion of the deceased person's estate. 2. Partial Renunciation: In some cases, a beneficiary may choose to enunciate only a part of their inheritance while accepting the remainder. This option allows the beneficiary to waive their rights to particular assets or a specific percentage of the estate, while still retaining the rest. 3. Qualified Disclaimer: A qualified disclaimer is a specialized form of renunciation where the beneficiary chooses not to accept the inheritance, but instead allows it to pass to an alternate beneficiary or heirs designated in the will. By doing this, the renouncing beneficiary avoids incurring any tax liability or other legal obligations associated with accepting the inheritance. It is important to note that renunciation and disclaimers of property from a will buy testate have legal implications and must be done in accordance with the laws and regulations of Irving, Texas. It is advisable to seek the guidance of an experienced estate planning attorney or legal professional to understand the specific requirements and implications of renunciation in Irving, Texas. The attorney can guide individuals through the process, ensure compliance with legal protocols, and provide advice based on their unique circumstances.Irving Texas Renunciation And Disclaimer of Property from Will by Testate is a legal process through which an individual named in a will as a beneficiary voluntarily relinquishes their right to inherit specific assets or property. This renunciation is done by filing a formal document with the appropriate court or estate administration authority in Irving, Texas. By renouncing the property, the beneficiary is essentially stating that they do not wish to accept their share of the assets as stated in the deceased person's will. There are several reasons why someone might choose to enunciate their inheritance. It could be due to personal circumstances, financial considerations, or potential conflicts of interest. Regardless of the reasons, it is essential to understand the process and implications of renunciation in Irving, Texas. In Irving, Texas, there are different types of renunciation and disclaimers of property from a will buy testate that individuals can pursue, including: 1. Full Renunciation: This type of renunciation involves the complete refusal of the assets allocated to the beneficiary in the will, relinquishing any claim to them. The beneficiary essentially opts out of inheriting any portion of the deceased person's estate. 2. Partial Renunciation: In some cases, a beneficiary may choose to enunciate only a part of their inheritance while accepting the remainder. This option allows the beneficiary to waive their rights to particular assets or a specific percentage of the estate, while still retaining the rest. 3. Qualified Disclaimer: A qualified disclaimer is a specialized form of renunciation where the beneficiary chooses not to accept the inheritance, but instead allows it to pass to an alternate beneficiary or heirs designated in the will. By doing this, the renouncing beneficiary avoids incurring any tax liability or other legal obligations associated with accepting the inheritance. It is important to note that renunciation and disclaimers of property from a will buy testate have legal implications and must be done in accordance with the laws and regulations of Irving, Texas. It is advisable to seek the guidance of an experienced estate planning attorney or legal professional to understand the specific requirements and implications of renunciation in Irving, Texas. The attorney can guide individuals through the process, ensure compliance with legal protocols, and provide advice based on their unique circumstances.