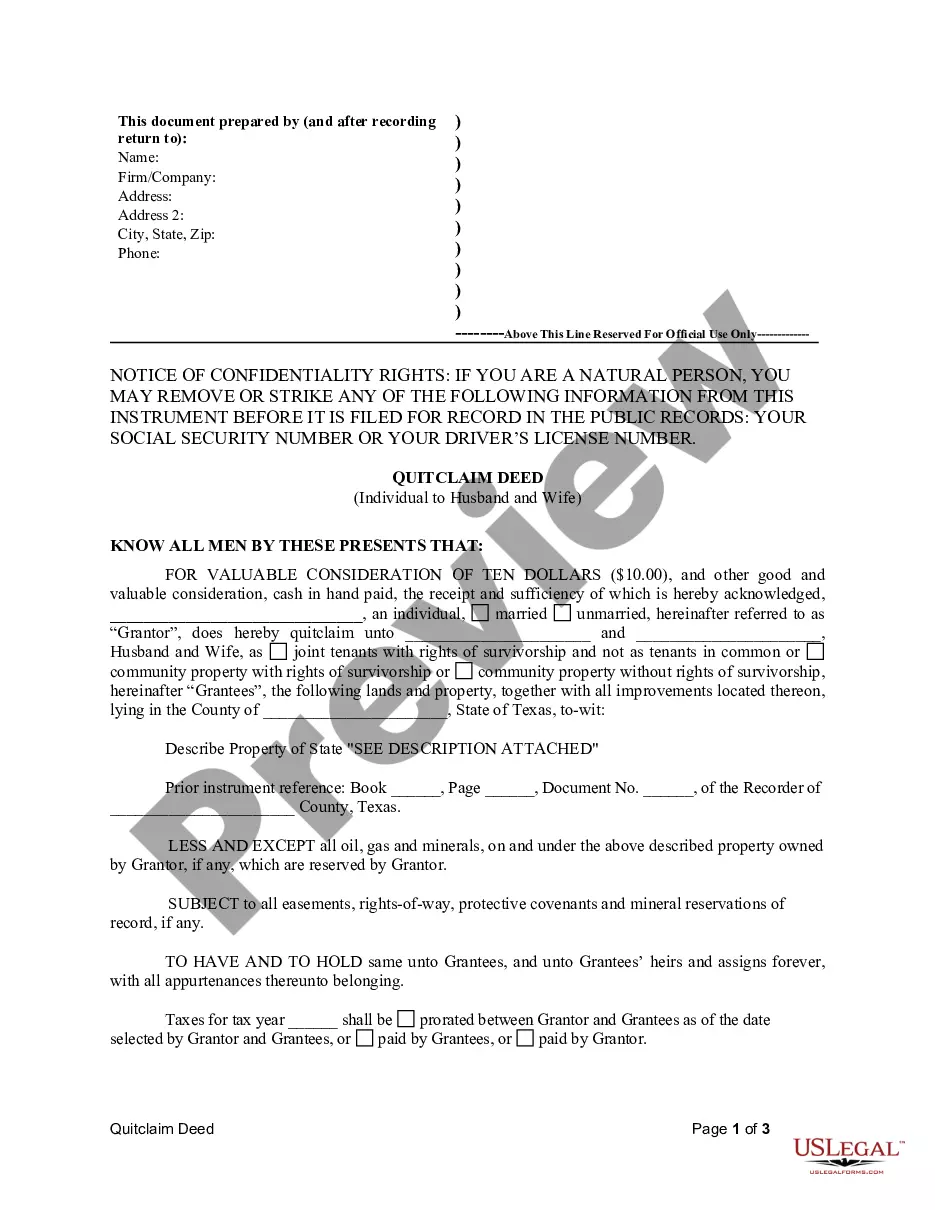

This Quitclaim Deed from Individual to Husband and Wife form is a Quitclaim Deed where the Grantor is an individual and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees, less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

A Corpus Christi Texas Quitclaim Deed from Individual to Husband and Wife is a legal document used to transfer ownership of real estate property from an individual to a married couple, with the intent of relinquishing any claims or rights the granter (individual) may have on the property. This type of deed allows for a smooth and straightforward transfer of ownership without any guarantees or warranties regarding the property's title. In Corpus Christi, Texas, there are two main types of Quitclaim Deeds from Individual to Husband and Wife: 1. Sole Ownership Quitclaim Deed: This type of deed is used when the individual granter is the sole owner of the property and intends to transfer ownership to both spouses, who will then hold joint ownership of the property. It is typically utilized in cases where the couple wishes to have equal ownership rights and responsibilities for the property. 2. Tenancy in Common Quitclaim Deed: This type of deed is utilized when the individual granter is the sole owner of the property and intends to transfer ownership to both spouses as tenants in common. With this type of ownership, each spouse holds a separate and undivided interest in the property. In the event of one spouse's death, their share will pass to their heirs or beneficiaries, rather than automatically transferring to the surviving spouse. When executing a Corpus Christi Texas Quitclaim Deed from Individual to Husband and Wife, it is crucial to include the following information: 1. Names and addresses of the granter (individual) and the grantee (husband and wife). 2. A precise legal description of the property, including the address and any specific details required to identify the property uniquely. 3. Details about the consideration exchanged for the deed, such as a nominal amount or a statement confirming that the transfer is a gift. 4. A clear statement of the granter's intention to transfer the property to the husband and wife as joint owners or tenants in common. 5. The granter's signature, which should be notarized to ensure its legal validity. A Corpus Christi Texas Quitclaim Deed from Individual to Husband and Wife serves as evidence of the transfer of property ownership. It should be recorded with the appropriate county clerk's office to provide notice to the public and protect the new owners' rights. It is recommended that individuals seeking to execute or utilize a quitclaim deed consult with a legal professional to ensure its validity and compliance with relevant laws and regulations.A Corpus Christi Texas Quitclaim Deed from Individual to Husband and Wife is a legal document used to transfer ownership of real estate property from an individual to a married couple, with the intent of relinquishing any claims or rights the granter (individual) may have on the property. This type of deed allows for a smooth and straightforward transfer of ownership without any guarantees or warranties regarding the property's title. In Corpus Christi, Texas, there are two main types of Quitclaim Deeds from Individual to Husband and Wife: 1. Sole Ownership Quitclaim Deed: This type of deed is used when the individual granter is the sole owner of the property and intends to transfer ownership to both spouses, who will then hold joint ownership of the property. It is typically utilized in cases where the couple wishes to have equal ownership rights and responsibilities for the property. 2. Tenancy in Common Quitclaim Deed: This type of deed is utilized when the individual granter is the sole owner of the property and intends to transfer ownership to both spouses as tenants in common. With this type of ownership, each spouse holds a separate and undivided interest in the property. In the event of one spouse's death, their share will pass to their heirs or beneficiaries, rather than automatically transferring to the surviving spouse. When executing a Corpus Christi Texas Quitclaim Deed from Individual to Husband and Wife, it is crucial to include the following information: 1. Names and addresses of the granter (individual) and the grantee (husband and wife). 2. A precise legal description of the property, including the address and any specific details required to identify the property uniquely. 3. Details about the consideration exchanged for the deed, such as a nominal amount or a statement confirming that the transfer is a gift. 4. A clear statement of the granter's intention to transfer the property to the husband and wife as joint owners or tenants in common. 5. The granter's signature, which should be notarized to ensure its legal validity. A Corpus Christi Texas Quitclaim Deed from Individual to Husband and Wife serves as evidence of the transfer of property ownership. It should be recorded with the appropriate county clerk's office to provide notice to the public and protect the new owners' rights. It is recommended that individuals seeking to execute or utilize a quitclaim deed consult with a legal professional to ensure its validity and compliance with relevant laws and regulations.