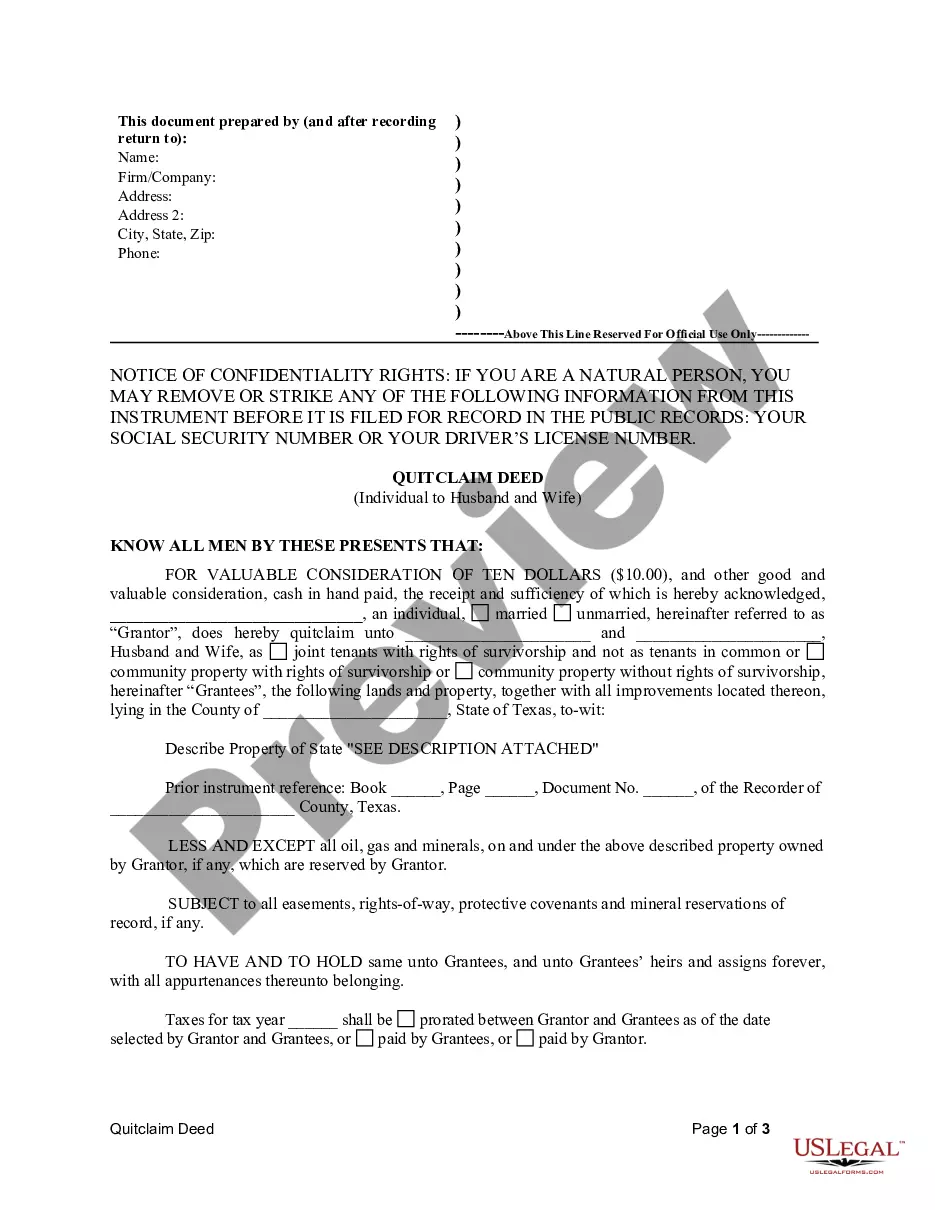

This Quitclaim Deed from Individual to Husband and Wife form is a Quitclaim Deed where the Grantor is an individual and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees, less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

A Harris Texas Quitclaim Deed from Individual to Husband and Wife is a legal document used to transfer ownership in real estate from an individual to a married couple. This type of deed ensures that both spouses hold joint ownership rights and responsibilities in the property. In Harris County, Texas, there are different variations of Quitclaim Deeds tailored specifically for transfers between an individual and a husband and wife. These include: 1. Harris Texas Quitclaim Deed from Individual to Husband and Wife with Right of Survivorship: This type of deed grants joint ownership to the husband and wife, allowing the surviving spouse to automatically inherit the deceased spouse's share of the property upon their death. It ensures that the property remains jointly owned, even in the event of one spouse's passing. 2. Harris Texas Quitclaim Deed from Individual to Husband and Wife as Tenants in Common: With this particular deed, the husband and wife become joint owners of the property, but their ownership shares are not necessarily equal. Each spouse holds a distinct and transferable portion of the property, and in case of death, the deceased spouse's share does not automatically transfer to the surviving spouse. Instead, it becomes an asset that can be passed on through a will or inheritance. 3. Harris Texas Quitclaim Deed from Individual to Husband and Wife as Community Property: This deed creates joint ownership where both spouses have equal shares in the property. Harris County, being part of a community property state, recognizes the concept of community property. This means that any assets acquired during the marriage are considered equally owned by both spouses, including real estate. In the event of a divorce or death, the property is usually divided equally between the spouses. When executing a Harris Texas Quitclaim Deed from Individual to Husband and Wife, it is essential to ensure the accuracy and completeness of the document. All parties involved should consult with legal professionals familiar with the specific laws and regulations concerning real estate transfers in Harris County and Texas as a whole. Keywords: Harris Texas Quitclaim Deed, Individual to Husband and Wife, Real Estate, Joint Ownership, Right of Survivorship, Tenants in Common, Community Property, Harris County, Texas.A Harris Texas Quitclaim Deed from Individual to Husband and Wife is a legal document used to transfer ownership in real estate from an individual to a married couple. This type of deed ensures that both spouses hold joint ownership rights and responsibilities in the property. In Harris County, Texas, there are different variations of Quitclaim Deeds tailored specifically for transfers between an individual and a husband and wife. These include: 1. Harris Texas Quitclaim Deed from Individual to Husband and Wife with Right of Survivorship: This type of deed grants joint ownership to the husband and wife, allowing the surviving spouse to automatically inherit the deceased spouse's share of the property upon their death. It ensures that the property remains jointly owned, even in the event of one spouse's passing. 2. Harris Texas Quitclaim Deed from Individual to Husband and Wife as Tenants in Common: With this particular deed, the husband and wife become joint owners of the property, but their ownership shares are not necessarily equal. Each spouse holds a distinct and transferable portion of the property, and in case of death, the deceased spouse's share does not automatically transfer to the surviving spouse. Instead, it becomes an asset that can be passed on through a will or inheritance. 3. Harris Texas Quitclaim Deed from Individual to Husband and Wife as Community Property: This deed creates joint ownership where both spouses have equal shares in the property. Harris County, being part of a community property state, recognizes the concept of community property. This means that any assets acquired during the marriage are considered equally owned by both spouses, including real estate. In the event of a divorce or death, the property is usually divided equally between the spouses. When executing a Harris Texas Quitclaim Deed from Individual to Husband and Wife, it is essential to ensure the accuracy and completeness of the document. All parties involved should consult with legal professionals familiar with the specific laws and regulations concerning real estate transfers in Harris County and Texas as a whole. Keywords: Harris Texas Quitclaim Deed, Individual to Husband and Wife, Real Estate, Joint Ownership, Right of Survivorship, Tenants in Common, Community Property, Harris County, Texas.