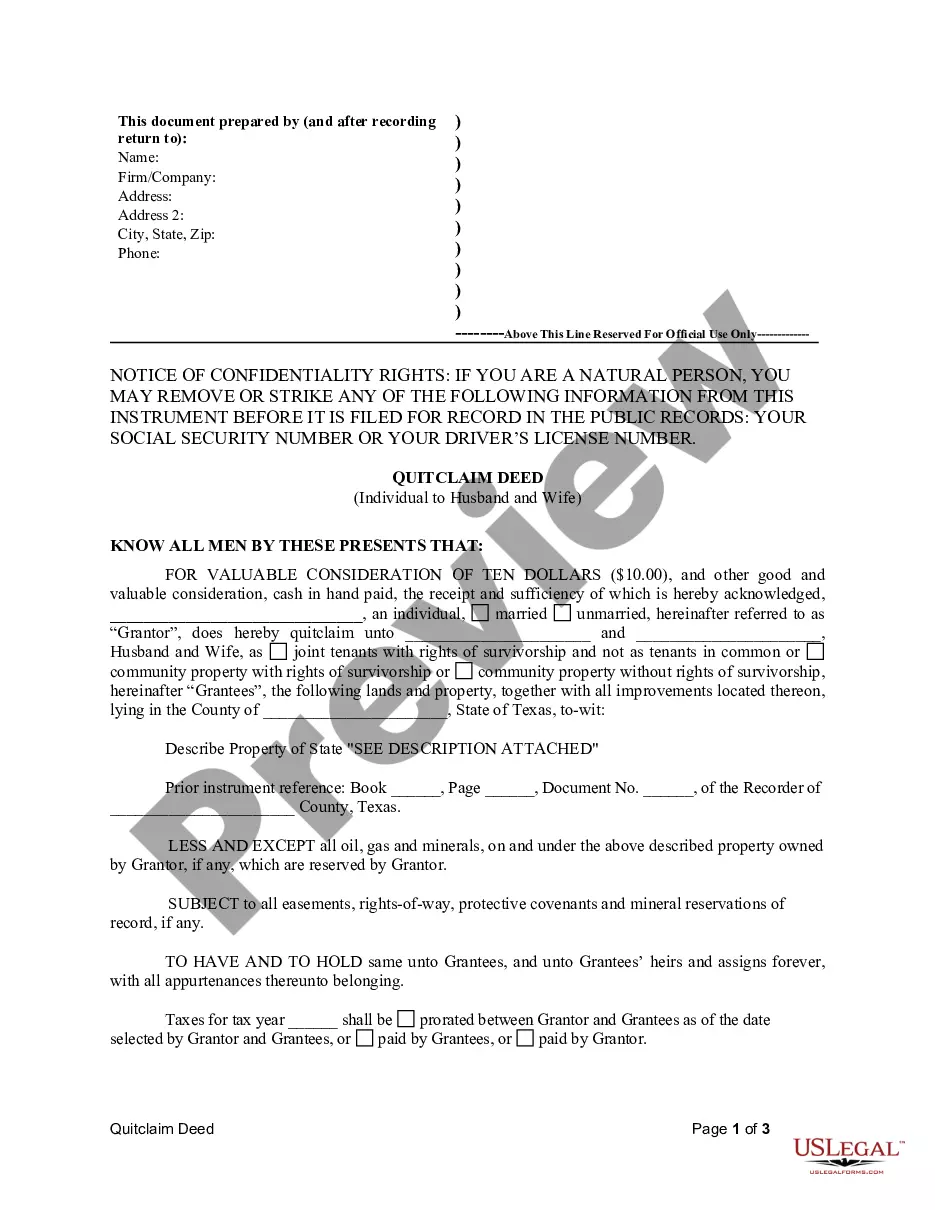

This Quitclaim Deed from Individual to Husband and Wife form is a Quitclaim Deed where the Grantor is an individual and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees, less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

Title: Understanding Tarrant Texas Quitclaim Deed from Individual to Husband and Wife Keywords: Tarrant Texas Quitclaim Deed, individual to husband and wife, types of quitclaim deeds, property transfer, legal documentation, real estate ownership, marital property, real estate transactions Introduction: A Tarrant Texas Quitclaim Deed from Individual to Husband and Wife is a legal document used to transfer ownership of a property from an individual to a married couple. This deed type allows for the transfer of any interest or claim the individual has in the property to both spouses. Let's explore the different types of Tarrant Texas Quitclaim Deeds from Individual to Husband and Wife: 1. Tarrant Texas Joint Tenancy Quitclaim Deed: This type of quitclaim deed establishes joint tenancy by granting equal ownership rights to both spouses. Joint tenancy means that both spouses have an undivided and equal interest in the property, with the right of survivorship. In the event of the death of one spouse, the surviving spouse automatically inherits the deceased spouse's interest without the need for probate. 2. Tarrant Texas Tenancy in Common Quitclaim Deed: With a Tenancy in Common Quitclaim Deed, the individual transferring the property to a husband and wife grants them ownership as tenants in common. In this arrangement, each spouse has a distinct and transferable share of the property, which does not include the right of survivorship. If one spouse passes away, their share will be passed on to their heirs or recipients through probate. 3. Tarrant Texas Community Property Quitclaim Deed: In community property states like Texas, this type of quitclaim deed is commonly used when a husband and wife want to transfer a property from an individual owner to the marital community. A community property quitclaim deed ensures that both spouses have an equal interest in the property, and upon death, the property automatically transfers to the surviving spouse without the need for probate. Important Considerations: — Properly execute and notarize the quitclaim deed to ensure its validity. — Complete the legal descriptions accurately to identify the property in question. — Consult with a real estate attorney or legal professional to ensure compliance with local laws and regulations. — Understand the potential implications regarding tax, liability, and future ownership disputes. Conclusion: A Tarrant Texas Quitclaim Deed from Individual to Husband and Wife allows for an individual to transfer ownership of a property to a married couple. Whether establishing joint tenancy, tenancy in common, or community property ownership, it's crucial to understand the legal implications and consult with professionals to ensure a smooth and properly executed transaction. Properly executing this legal documentation ensures the clarity of property ownership rights and promotes peace of mind for all parties involved in real estate transactions.Title: Understanding Tarrant Texas Quitclaim Deed from Individual to Husband and Wife Keywords: Tarrant Texas Quitclaim Deed, individual to husband and wife, types of quitclaim deeds, property transfer, legal documentation, real estate ownership, marital property, real estate transactions Introduction: A Tarrant Texas Quitclaim Deed from Individual to Husband and Wife is a legal document used to transfer ownership of a property from an individual to a married couple. This deed type allows for the transfer of any interest or claim the individual has in the property to both spouses. Let's explore the different types of Tarrant Texas Quitclaim Deeds from Individual to Husband and Wife: 1. Tarrant Texas Joint Tenancy Quitclaim Deed: This type of quitclaim deed establishes joint tenancy by granting equal ownership rights to both spouses. Joint tenancy means that both spouses have an undivided and equal interest in the property, with the right of survivorship. In the event of the death of one spouse, the surviving spouse automatically inherits the deceased spouse's interest without the need for probate. 2. Tarrant Texas Tenancy in Common Quitclaim Deed: With a Tenancy in Common Quitclaim Deed, the individual transferring the property to a husband and wife grants them ownership as tenants in common. In this arrangement, each spouse has a distinct and transferable share of the property, which does not include the right of survivorship. If one spouse passes away, their share will be passed on to their heirs or recipients through probate. 3. Tarrant Texas Community Property Quitclaim Deed: In community property states like Texas, this type of quitclaim deed is commonly used when a husband and wife want to transfer a property from an individual owner to the marital community. A community property quitclaim deed ensures that both spouses have an equal interest in the property, and upon death, the property automatically transfers to the surviving spouse without the need for probate. Important Considerations: — Properly execute and notarize the quitclaim deed to ensure its validity. — Complete the legal descriptions accurately to identify the property in question. — Consult with a real estate attorney or legal professional to ensure compliance with local laws and regulations. — Understand the potential implications regarding tax, liability, and future ownership disputes. Conclusion: A Tarrant Texas Quitclaim Deed from Individual to Husband and Wife allows for an individual to transfer ownership of a property to a married couple. Whether establishing joint tenancy, tenancy in common, or community property ownership, it's crucial to understand the legal implications and consult with professionals to ensure a smooth and properly executed transaction. Properly executing this legal documentation ensures the clarity of property ownership rights and promotes peace of mind for all parties involved in real estate transactions.