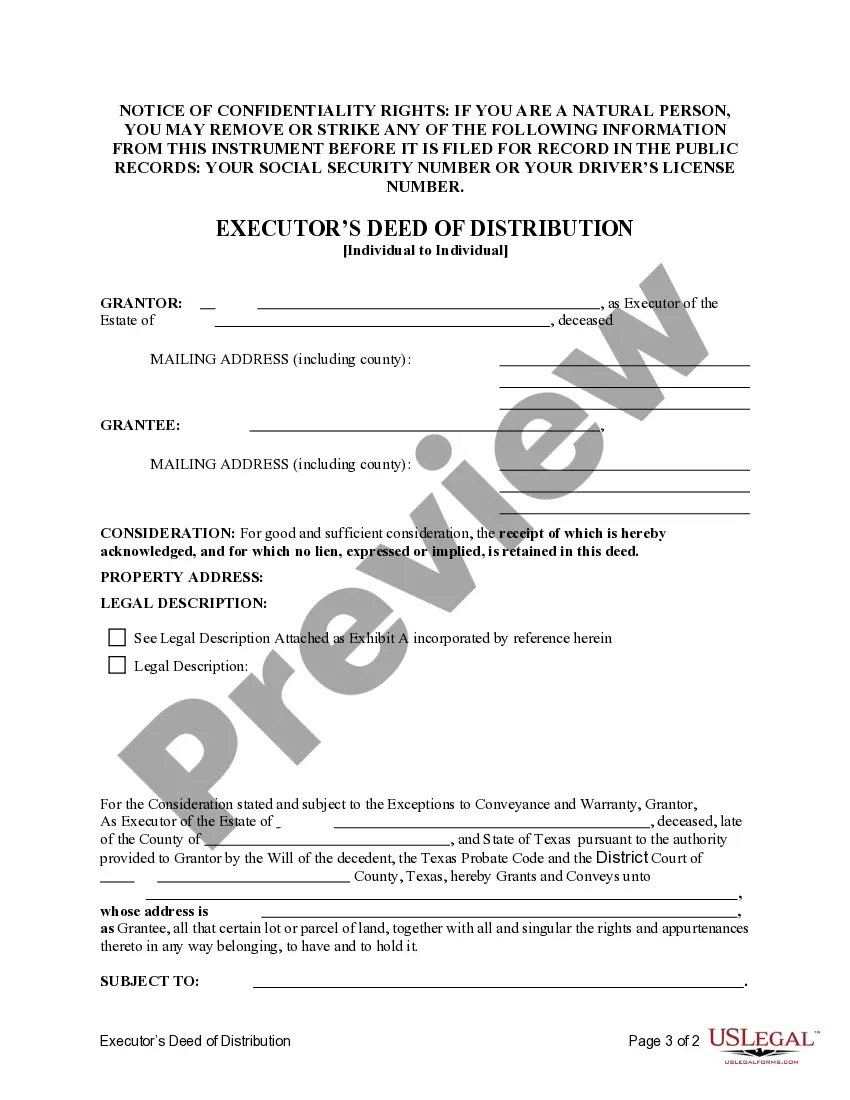

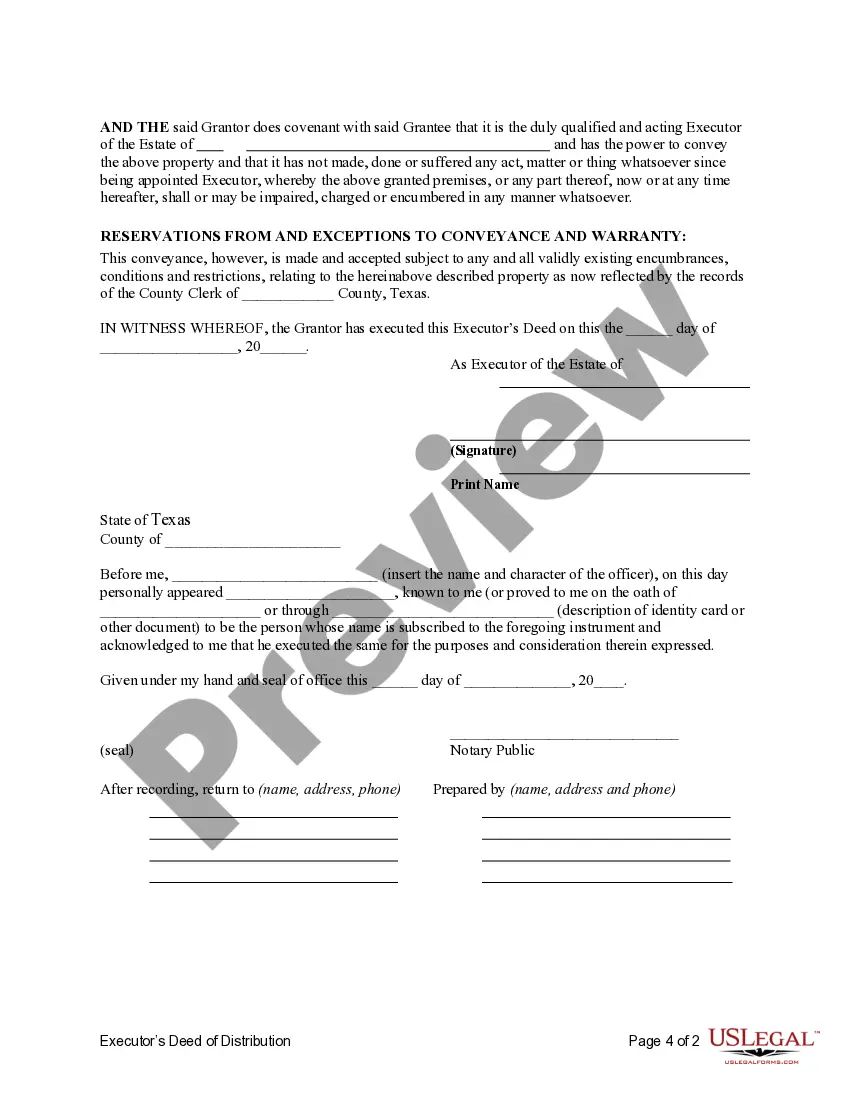

This form is an Executor's Deed of Distribution where the Grantor is the executor of an estate and the Grantee is the beneficiary entitled to the property according to the Will. Grantor conveys the described property to the Grantees. The grantor warrants the title only as to events and acts while the property is held by the Executor. This deed complies with all state statutory laws.

The Dallas Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary is a legal document that facilitates the transfer of property or assets from an individual executor to an individual beneficiary after the passing of a deceased person. This deed serves as proof of transfer and ensures that the beneficiary is legally entitled to receive the specified assets or property. In Dallas, Texas, there are different types of Executor's Deed of Distribution — Individual Executor to Individual Beneficiary depending on the nature of the assets or property being transferred. Some common types include: 1. Real Estate Executor's Deed: This type of deed is used when the assets being distributed are real estate properties, such as houses, land, or commercial buildings. The executor, who is responsible for administering the deceased person's estate, transfers ownership of the property to the designated individual beneficiary. 2. Financial Executor's Deed: This type of deed is used when the assets being distributed are financial in nature, such as bank accounts, stocks, or investments. The executor transfers the ownership or control of these assets to the individual beneficiary, ensuring proper distribution as outlined in the deceased person's will or estate plan. 3. Personal Property Executor's Deed: This type of deed is used when the assets being distributed include personal belongings, such as furniture, jewelry, artwork, or vehicles. The executor transfers ownership of these items to the individual beneficiary, ensuring they receive the designated properties based on the deceased person's wishes. When drafting a Dallas Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary, it is crucial to include certain key elements. These include: 1. Names and Contact Information: The deed should contain the full legal names, addresses, and contact information of both the executor and the beneficiary involved in the transfer. 2. Detailed Description of Assets: The deed should provide a comprehensive description of the assets being distributed, including any identifying information or relevant details like property addresses, account numbers, or serial numbers. 3. Executor's Authorization: The deed should clearly state that the executor has the legal authority to transfer the assets to the beneficiary, following the instructions in the deceased person's will or estate plan. 4. Beneficiary's Acceptance: The deed should include a section where the beneficiary acknowledges their acceptance of the assets being transferred to them. This helps avoid any future disputes or claims regarding the distribution. 5. Legal Signatures and Notarization: The deed must be signed by both the executor and the beneficiary in the presence of a notary public. Notarization ensures the document's authenticity and validity in legal proceedings. It's important to note that the specific requirements and procedures for creating a Dallas Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary may vary. It is advisable to consult with an attorney specializing in estate planning and probate law to ensure compliance with local regulations and to address any unique circumstances related to the distribution.

The Dallas Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary is a legal document that facilitates the transfer of property or assets from an individual executor to an individual beneficiary after the passing of a deceased person. This deed serves as proof of transfer and ensures that the beneficiary is legally entitled to receive the specified assets or property. In Dallas, Texas, there are different types of Executor's Deed of Distribution — Individual Executor to Individual Beneficiary depending on the nature of the assets or property being transferred. Some common types include: 1. Real Estate Executor's Deed: This type of deed is used when the assets being distributed are real estate properties, such as houses, land, or commercial buildings. The executor, who is responsible for administering the deceased person's estate, transfers ownership of the property to the designated individual beneficiary. 2. Financial Executor's Deed: This type of deed is used when the assets being distributed are financial in nature, such as bank accounts, stocks, or investments. The executor transfers the ownership or control of these assets to the individual beneficiary, ensuring proper distribution as outlined in the deceased person's will or estate plan. 3. Personal Property Executor's Deed: This type of deed is used when the assets being distributed include personal belongings, such as furniture, jewelry, artwork, or vehicles. The executor transfers ownership of these items to the individual beneficiary, ensuring they receive the designated properties based on the deceased person's wishes. When drafting a Dallas Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary, it is crucial to include certain key elements. These include: 1. Names and Contact Information: The deed should contain the full legal names, addresses, and contact information of both the executor and the beneficiary involved in the transfer. 2. Detailed Description of Assets: The deed should provide a comprehensive description of the assets being distributed, including any identifying information or relevant details like property addresses, account numbers, or serial numbers. 3. Executor's Authorization: The deed should clearly state that the executor has the legal authority to transfer the assets to the beneficiary, following the instructions in the deceased person's will or estate plan. 4. Beneficiary's Acceptance: The deed should include a section where the beneficiary acknowledges their acceptance of the assets being transferred to them. This helps avoid any future disputes or claims regarding the distribution. 5. Legal Signatures and Notarization: The deed must be signed by both the executor and the beneficiary in the presence of a notary public. Notarization ensures the document's authenticity and validity in legal proceedings. It's important to note that the specific requirements and procedures for creating a Dallas Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary may vary. It is advisable to consult with an attorney specializing in estate planning and probate law to ensure compliance with local regulations and to address any unique circumstances related to the distribution.