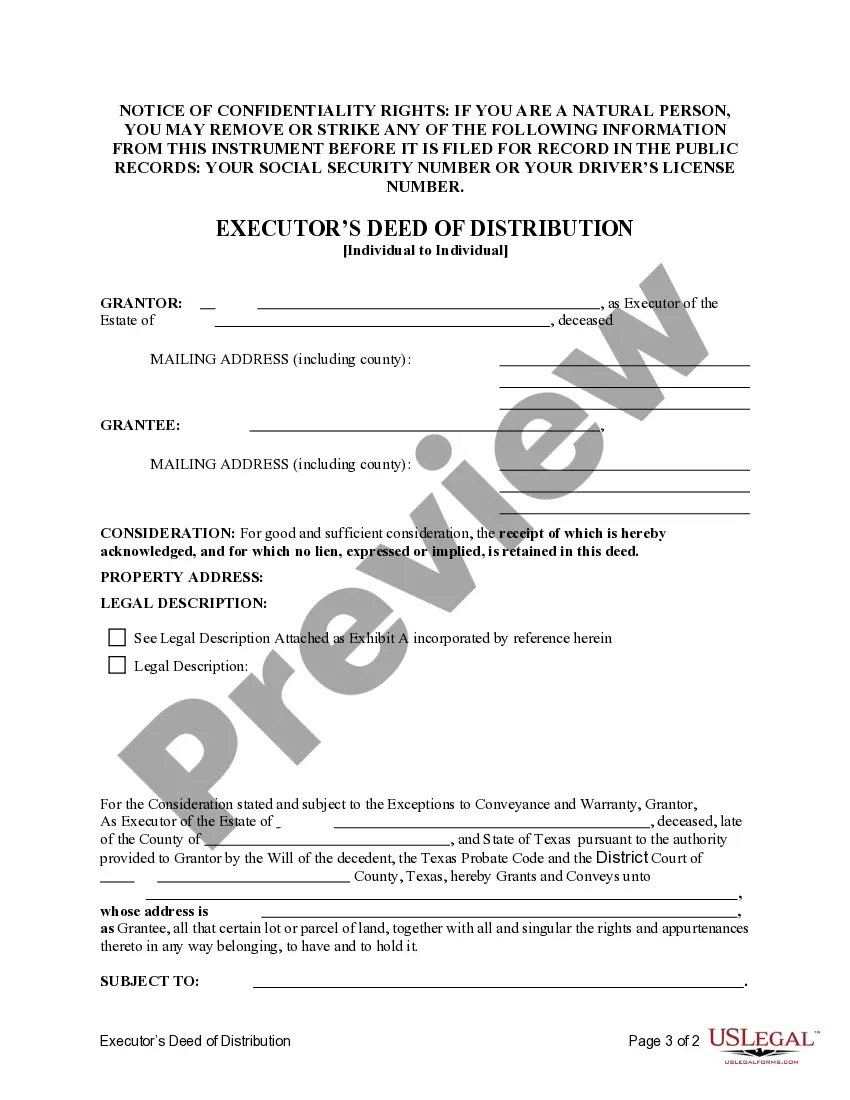

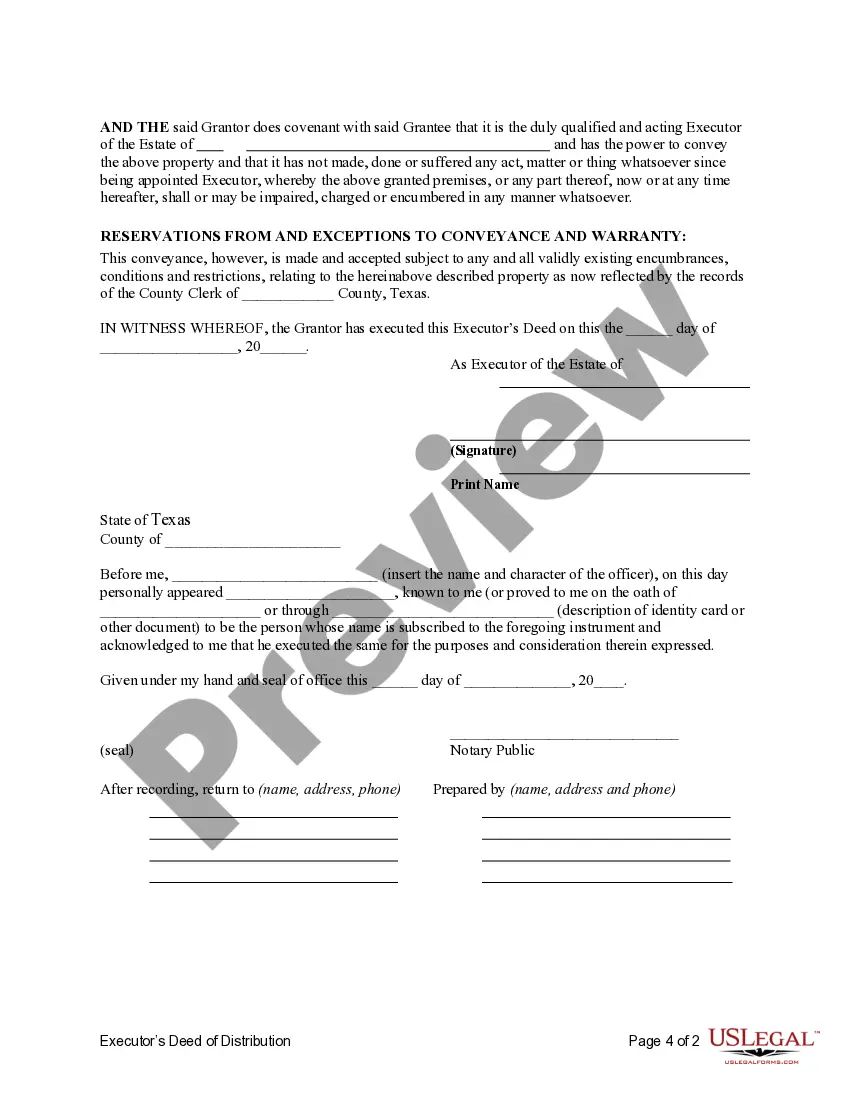

This form is an Executor's Deed of Distribution where the Grantor is the executor of an estate and the Grantee is the beneficiary entitled to the property according to the Will. Grantor conveys the described property to the Grantees. The grantor warrants the title only as to events and acts while the property is held by the Executor. This deed complies with all state statutory laws.

The Grand Prairie Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary is a legal document that transfers property ownership from an individual executor to an individual beneficiary. This deed is commonly used in estate administration cases in Grand Prairie, Texas, and ensures the proper distribution of assets according to a decedent's will or state laws of intestacy. When an individual passes away in Grand Prairie, Texas, leaving behind property, assets, or investments, the estate must go through a legal process known as probate. During probate, the court appoints an executor to manage and administer the deceased person's estate. The executor's main role is to distribute the assets as per the instructions provided in the decedent's will or in accordance with state laws if there is no valid will. In cases where the executor needs to distribute property or assets to an individual beneficiary, they utilize the Grand Prairie Texas Executor's Deed of Distribution. This deed serves as a legal instrument to transfer ownership from the estate to the beneficiary, allowing them to become the rightful owner. There are multiple types of Grand Prairie Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary that may be used, depending on the circumstances of the probate case. Some of these variations may include: 1. Grand Prairie Texas Executor's Deed of Distribution — Real Property: This type of deed is specifically used when the property being transferred is real estate, such as residential homes, commercial properties, or land. It outlines the legal description of the property and ensures the proper transfer of ownership from the estate to the beneficiary. 2. Grand Prairie Texas Executor's Deed of Distribution — Personal Property: Personal property refers to movable assets like furniture, vehicles, jewelry, or other possessions. This variation of the deed is used when the executor needs to distribute personal property to an individual beneficiary as specified in the will or by state law. 3. Grand Prairie Texas Executor's Deed of Distribution — Financial Assets: Financial assets can include bank accounts, investments, stocks, bonds, or retirement accounts. In cases where the executor needs to transfer financial assets to an individual beneficiary, this type of deed is utilized. It ensures a smooth and lawful transition of ownership. Regardless of the specific variation used, the Grand Prairie Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary is a crucial legal document that provides clarity and legitimacy to the transfer process. It helps protect the rights of both the executor and the beneficiary involved, ensuring the rightful distribution of assets in accordance with the deceased person's wishes or state laws.