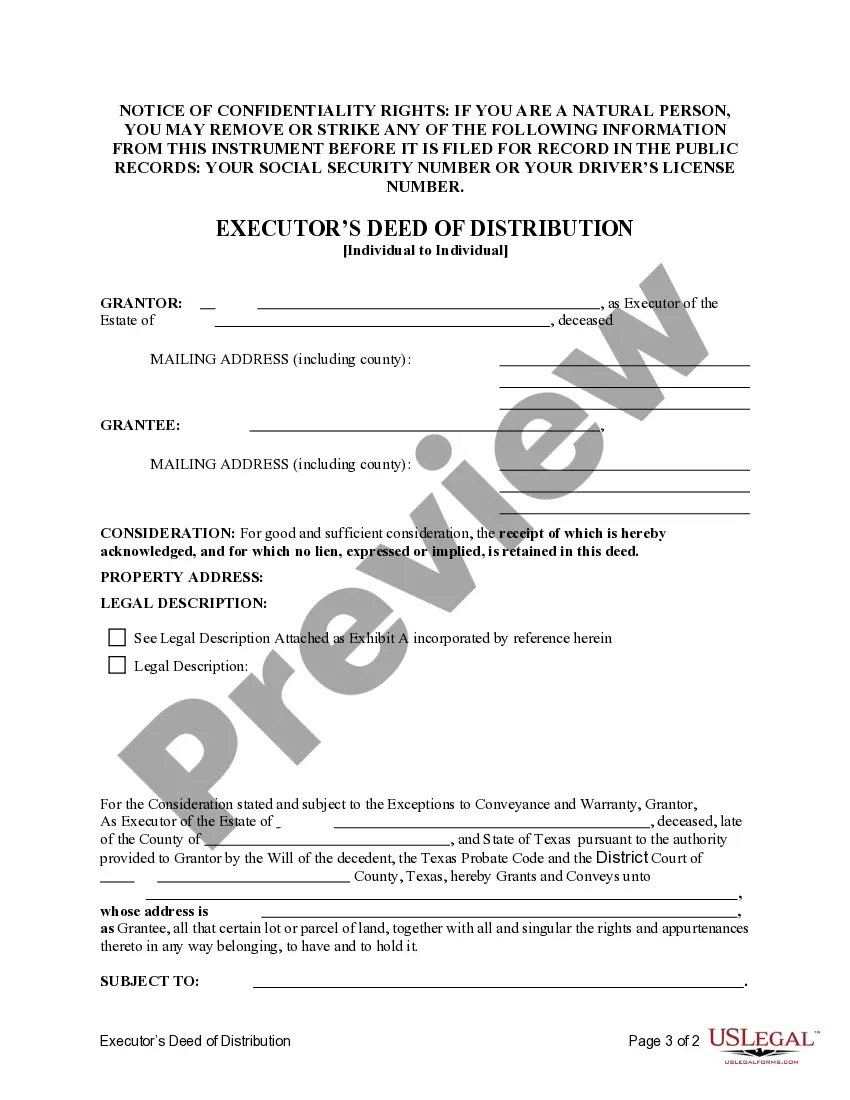

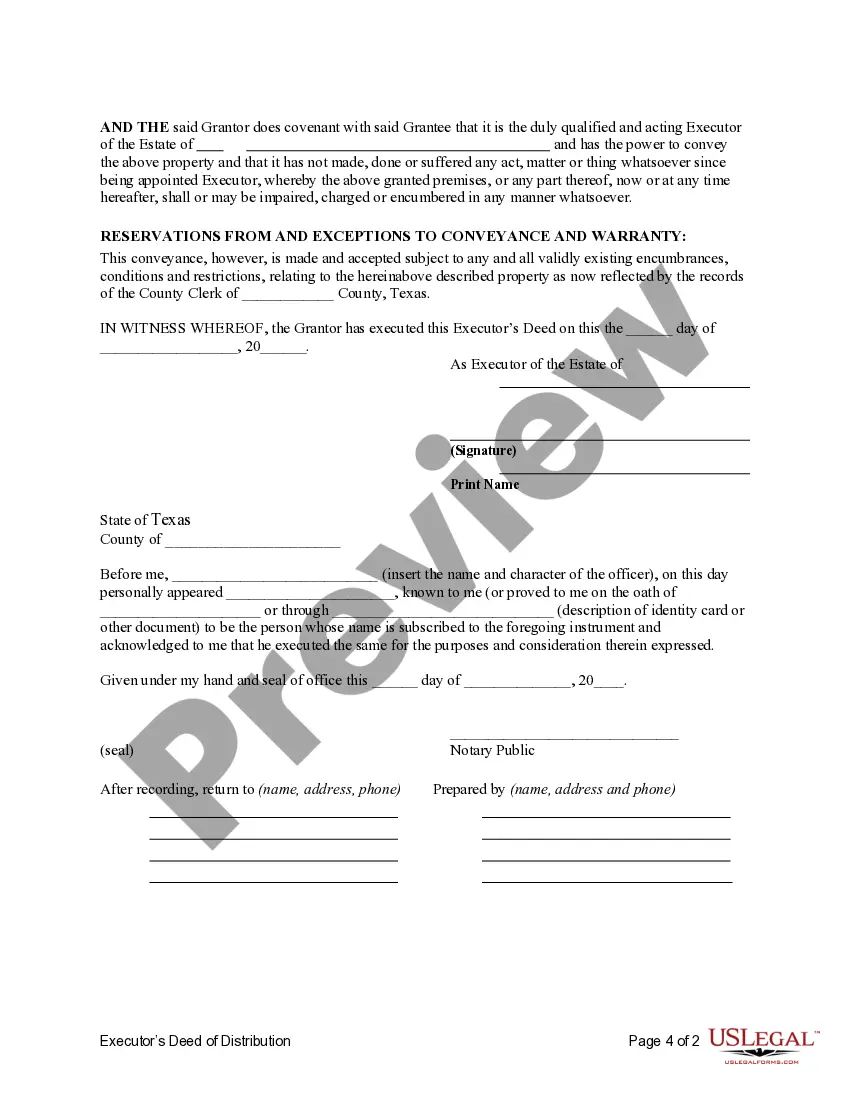

This form is an Executor's Deed of Distribution where the Grantor is the executor of an estate and the Grantee is the beneficiary entitled to the property according to the Will. Grantor conveys the described property to the Grantees. The grantor warrants the title only as to events and acts while the property is held by the Executor. This deed complies with all state statutory laws.

A Harris Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary is a legally binding document that facilitates the transfer of assets and property from a deceased person's estate to their designated individual beneficiaries. This deed is specifically used in Harris County, Texas, and is executed by an individual executor who has been appointed by the court to administer the estate. Keywords: Harris Texas Executor's Deed of Distribution, Individual Executor, Individual Beneficiary, estate, assets, property, legally binding, transfer, deceased person, appointed, court, administer. There are different types of Harris Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary based on the specific circumstances of the estate and the beneficiaries involved. Some of these variations include: 1. General Executor's Deed of Distribution: This type of deed is used when there is a clear and unambiguous distribution plan outlined in the deceased person's will or by court order. The individual executor distributes the assets and property according to these predetermined instructions. 2. Executor's Deed with Independent Administration: In cases where the deceased person's will specifically grant the executor independent administration powers, this type of deed allows the executor to distribute the assets and property without obtaining court approval for each distribution. 3. Executor's Deed with Dependent Administration: If the deceased person's will does not grant the executor independent administration powers, this type of deed requires the executor to obtain court approval for each distribution of assets and property. 4. Executor's Deed for Real Property: Specifically used when the assets being distributed are real estate properties. This type of deed transfers ownership of the property from the estate to the individual beneficiary, ensuring a legitimate and lawful transfer. 5. Executor's Deed for Personal Property: Used to transfer ownership of personal belongings, such as jewelry, vehicles, furniture, or any other movable assets, from the deceased person's estate to the individual beneficiary. These variations of the Harris Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary ensure that the executor carries out their duties appropriately and in compliance with the deceased person's wishes or court orders, ultimately facilitating a smooth and efficient transfer of assets and property to the rightful beneficiaries.A Harris Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary is a legally binding document that facilitates the transfer of assets and property from a deceased person's estate to their designated individual beneficiaries. This deed is specifically used in Harris County, Texas, and is executed by an individual executor who has been appointed by the court to administer the estate. Keywords: Harris Texas Executor's Deed of Distribution, Individual Executor, Individual Beneficiary, estate, assets, property, legally binding, transfer, deceased person, appointed, court, administer. There are different types of Harris Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary based on the specific circumstances of the estate and the beneficiaries involved. Some of these variations include: 1. General Executor's Deed of Distribution: This type of deed is used when there is a clear and unambiguous distribution plan outlined in the deceased person's will or by court order. The individual executor distributes the assets and property according to these predetermined instructions. 2. Executor's Deed with Independent Administration: In cases where the deceased person's will specifically grant the executor independent administration powers, this type of deed allows the executor to distribute the assets and property without obtaining court approval for each distribution. 3. Executor's Deed with Dependent Administration: If the deceased person's will does not grant the executor independent administration powers, this type of deed requires the executor to obtain court approval for each distribution of assets and property. 4. Executor's Deed for Real Property: Specifically used when the assets being distributed are real estate properties. This type of deed transfers ownership of the property from the estate to the individual beneficiary, ensuring a legitimate and lawful transfer. 5. Executor's Deed for Personal Property: Used to transfer ownership of personal belongings, such as jewelry, vehicles, furniture, or any other movable assets, from the deceased person's estate to the individual beneficiary. These variations of the Harris Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary ensure that the executor carries out their duties appropriately and in compliance with the deceased person's wishes or court orders, ultimately facilitating a smooth and efficient transfer of assets and property to the rightful beneficiaries.