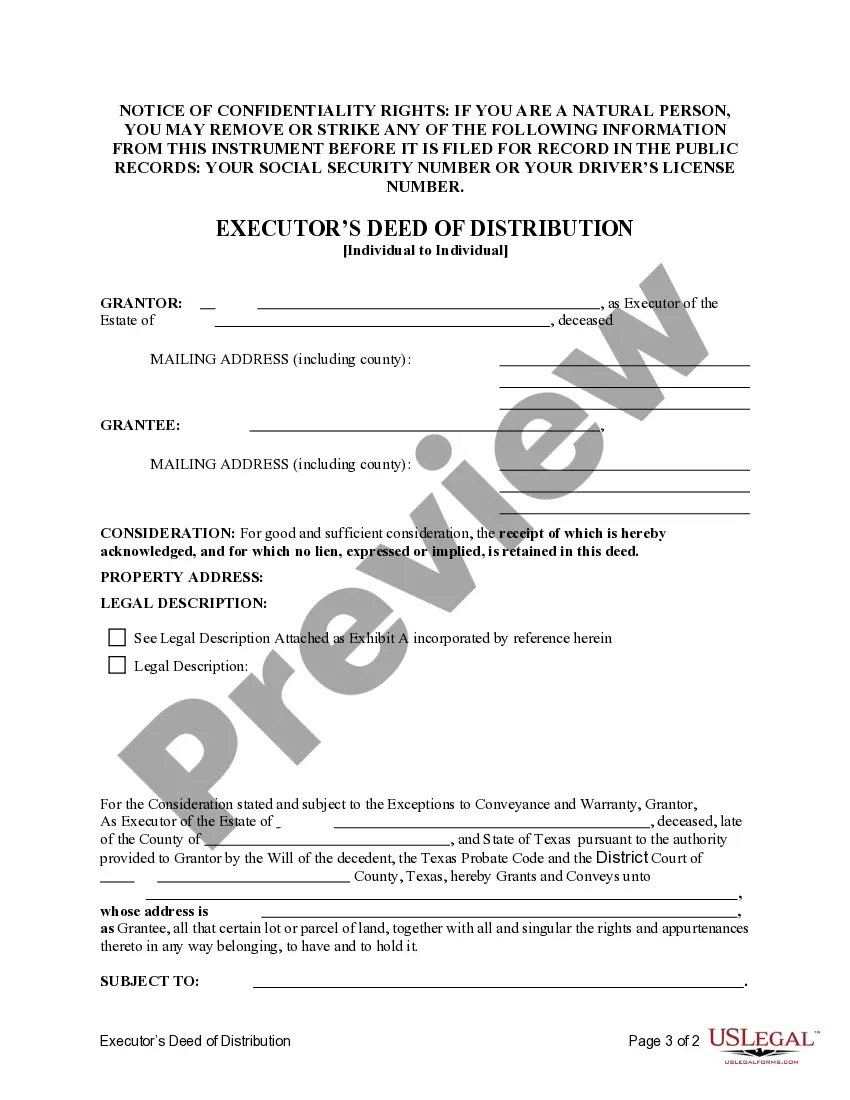

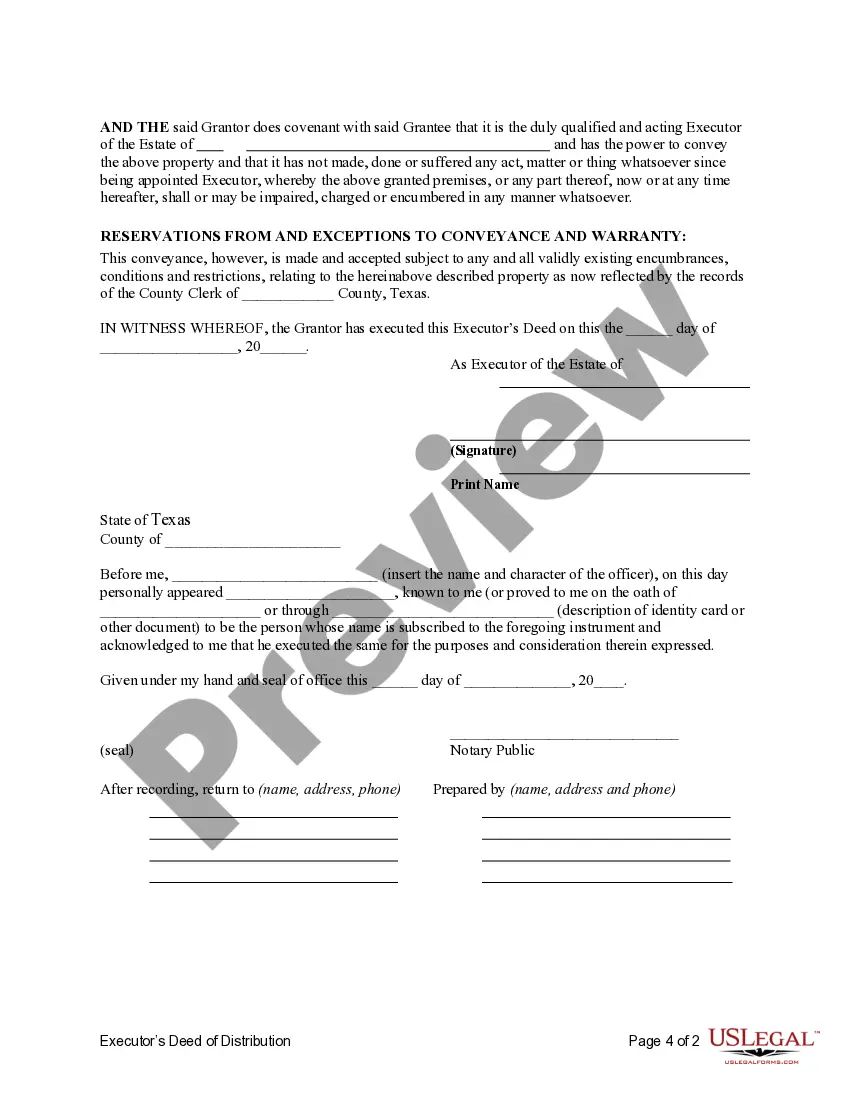

This form is an Executor's Deed of Distribution where the Grantor is the executor of an estate and the Grantee is the beneficiary entitled to the property according to the Will. Grantor conveys the described property to the Grantees. The grantor warrants the title only as to events and acts while the property is held by the Executor. This deed complies with all state statutory laws.

A McKinney Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary is a legal document that transfers ownership rights of assets or properties from an individual executor to an individual beneficiary. This type of deed is used when an estate is being distributed and there are specific individuals named as beneficiaries. The executor is the person responsible for managing the affairs of the deceased person's estate. They have the authority to handle financial matters, pay debts, and distribute assets to the rightful beneficiaries based on the decedent's will or the state's laws of intestate succession. A McKinney Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary serves as a legal proof of the transfer of property rights and ensures that the beneficiary receives their rightful inheritance. The deed typically includes important details such as the names of the executor and beneficiary, a detailed description of the property being transferred, and any conditions or restrictions associated with the transfer. In McKinney, Texas, there may be different types of Executor's Deeds of Distribution based on specific scenarios or circumstances. Some possible variations could include: 1. McKinney Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary with Clear Title: This type of deed is used when the property being transferred has a clear title, meaning there are no outstanding liens, encumbrances, or disputes regarding ownership. 2. McKinney Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary with Disputed Title: In cases where there are disputes or conflicting claims on the property's title, this type of deed may be required. It helps to clarify the beneficiary's ownership rights and address any potential legal challenges. 3. McKinney Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary with Encumbered Title: If the property being transferred has existing encumbrances such as mortgages, liens, or easements, this type of deed would be used. It ensures that the beneficiary receives the property subject to these encumbrances. 4. McKinney Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary with Restricted Transfer: In some cases, the decedent's will or other legal documents may impose certain restrictions on the transfer of property. This type of deed will specify any conditions or limitations that the beneficiary must adhere to. Overall, a McKinney Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary is a crucial legal document that facilitates the transfer of property from the executor to the beneficiary. It ensures a smooth distribution process and protects the rights of all parties involved.