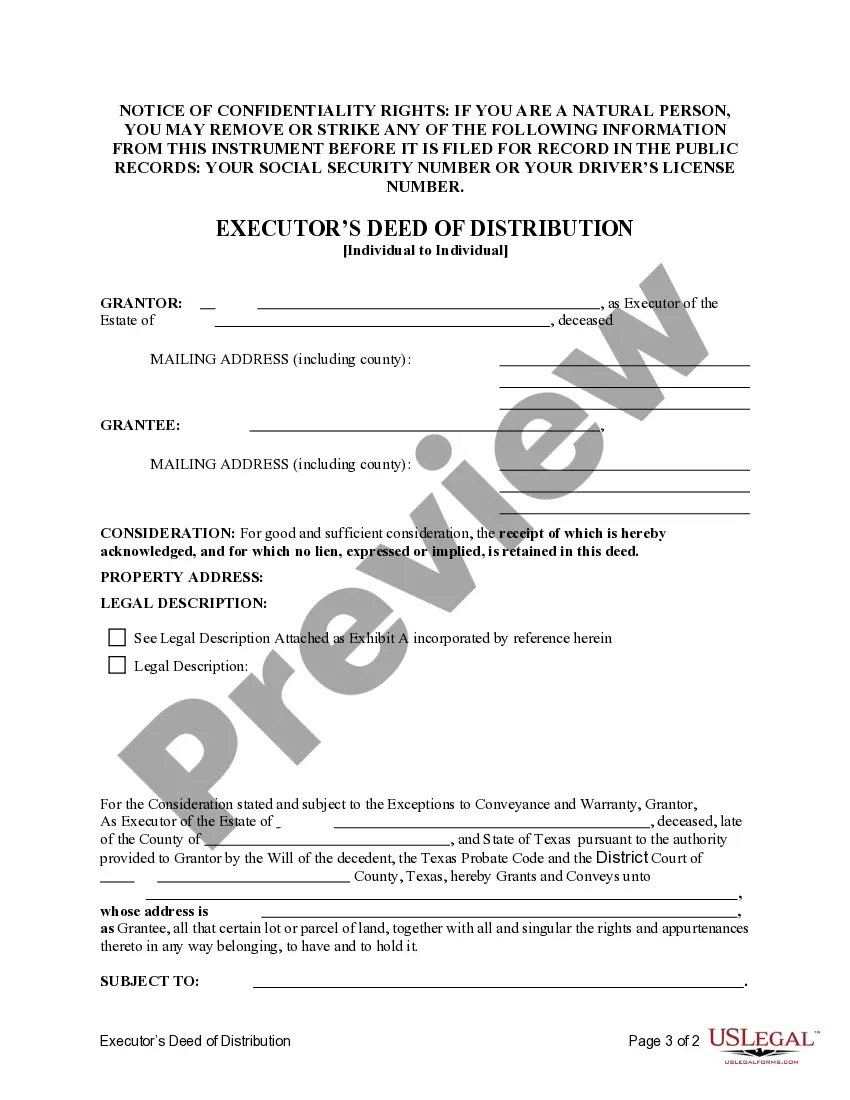

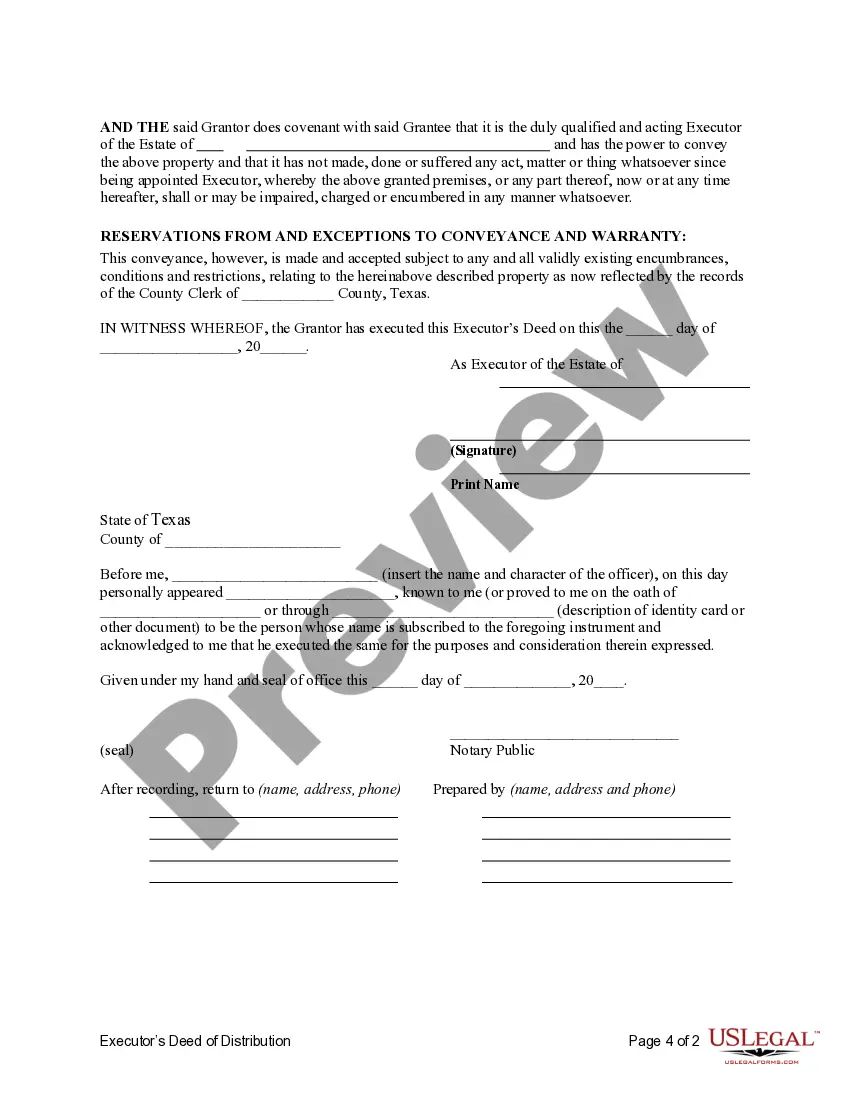

This form is an Executor's Deed of Distribution where the Grantor is the executor of an estate and the Grantee is the beneficiary entitled to the property according to the Will. Grantor conveys the described property to the Grantees. The grantor warrants the title only as to events and acts while the property is held by the Executor. This deed complies with all state statutory laws.

Waco Texas Executor's Deed of Distribution - Individual Executor to Individual Beneficiary

Description

How to fill out Texas Executor's Deed Of Distribution - Individual Executor To Individual Beneficiary?

Locating authenticated templates relevant to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It’s an online compilation of over 85,000 legal documents catering to both personal and professional requirements and various real-world situations.

All the files are systematically arranged by category and jurisdiction, making it as straightforward as ABC to find the Waco Texas Executor's Deed of Distribution - Individual Executor to Individual Beneficiary.

Maintaining organized paperwork that complies with legal standards is crucial. Take advantage of the US Legal Forms library to have essential document templates readily available for any requirements right at your fingertips!

- Review the Preview mode and document description.

- Ensure you’ve chosen the right one that fulfills your needs and fully aligns with your local jurisdiction criteria.

- Search for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to locate the correct one. If it meets your criteria, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Technically speaking, there aren't any legal beneficiary rights, as such. What they do have is the ability to force the executor to perform their duties, and with that comes the understanding that beneficiaries can't act on behalf of the executor. They don't have the same authority.

You must sign the deed and get your signature notarized, and then record (file) the deed with the county clerk's office before your death. Otherwise, it won't be valid. The beneficiary's rights. The person you name in the TOD deed to inherit the property has no legal right to it until your death.

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

MYTH: An heir cannot sell his or her interest in heirs property without the consent of the other heirs. FACT: An heir can sell his or her interest in heirs property to any non-family or family member and does not need the consent of any other heir.

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized, Have a legal description of the property (The description is found on the deed to the property or in the deed records.Have the name and address of one or more beneficiaries, State that the transfer will happen at the owner's death,

In Texas, state and local court rules govern the various time periods that the executor must follow in probating a will. The general rule in Texas is that the executor has four years from the date of death of the testator (person who drafted the will) to file for probate.

What Is A Distribution Deed? A distribution deed is another way in which to legally transfer real property when the party who is supposed to receive the property cannot be determined from the decedent's will.

As an executor, you will have a duty to ensure that you are selling the property for the best possible price, for the benefit of the estate. For example, you must not sell the property at an undervalue to yourself, a member of your family, or indeed to one of the beneficiaries in the will.

Since the heirs own the real estate when the decedent dies, all the heirs must join in selling the property, including signing the real estate contract, deed of sale and other documents incidental to a sales transaction.

Unless the will explicitly states otherwise, inheriting a house with siblings means that ownership of the property is distributed equally. The siblings can negotiate whether the house will be sold and the profits divided, whether one will buy out the others' shares, or whether ownership will continue to be shared.