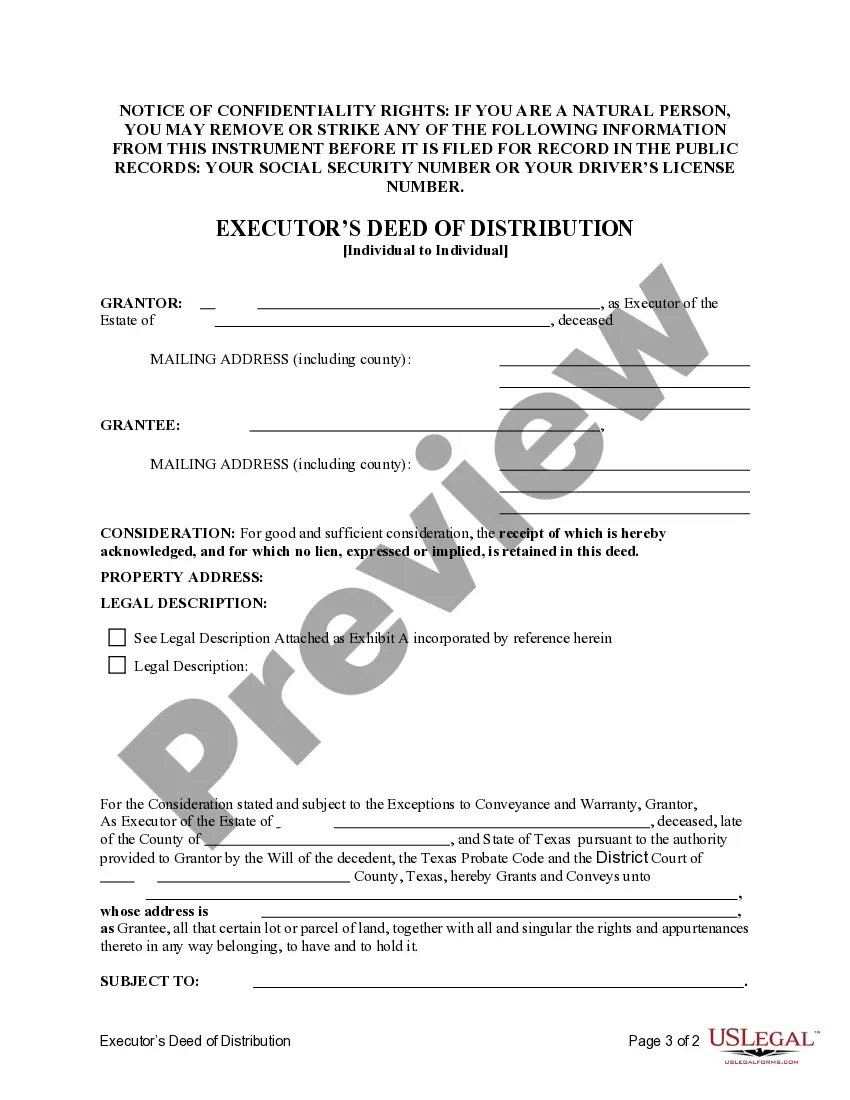

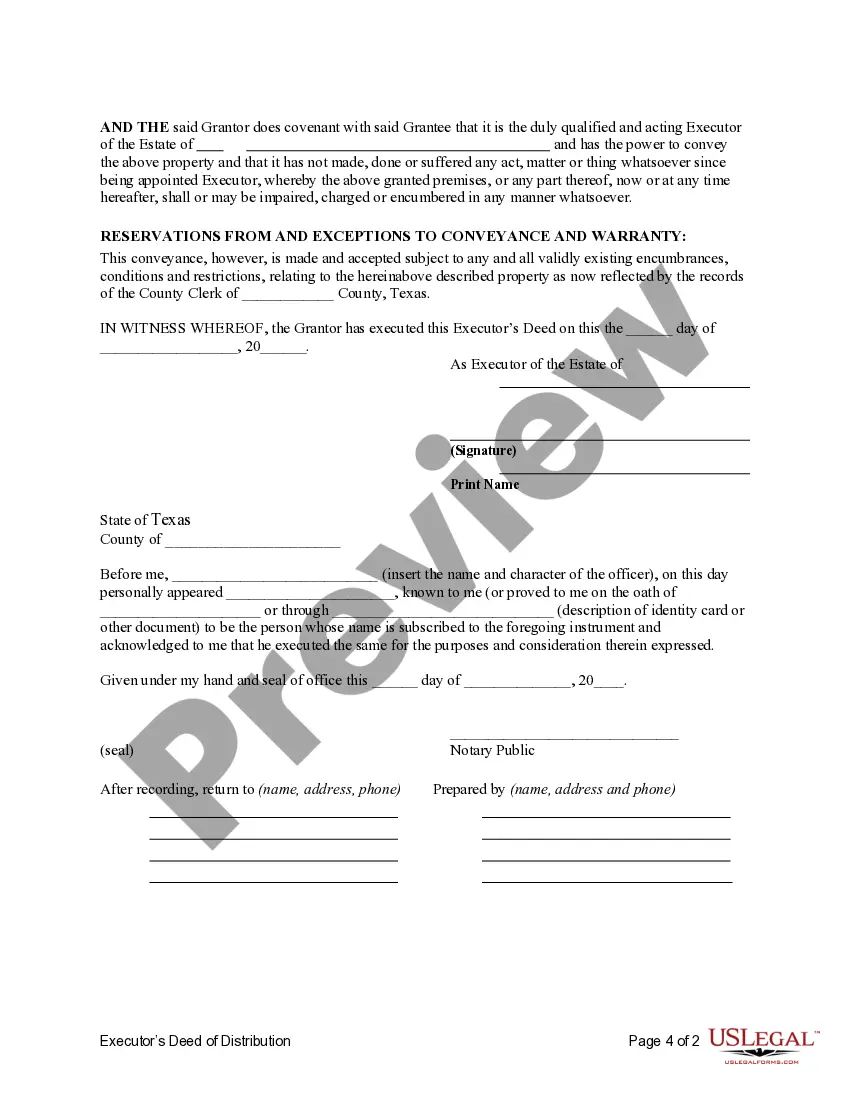

This form is an Executor's Deed of Distribution where the Grantor is the executor of an estate and the Grantee is the beneficiary entitled to the property according to the Will. Grantor conveys the described property to the Grantees. The grantor warrants the title only as to events and acts while the property is held by the Executor. This deed complies with all state statutory laws.

A Wichita Falls Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary is a legal document that transfers ownership of assets from the estate of a deceased person to a specific beneficiary. This type of deed is executed by an individual executor, who is responsible for administering the deceased person's estate, and is meant to ensure that the distribution of assets is carried out according to the decedent's wishes and in compliance with Texas state laws. The Executor's Deed of Distribution is a crucial document in the probate process, which involves the court-supervised administration of a deceased person's estate. It is typically used when the deceased individual has named a specific beneficiary to receive certain assets, such as real estate or personal property. Key aspects related to the Wichita Falls Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary: 1. Executor's Authority: This deed signifies the authority granted to the executor by the probate court to distribute assets to designated beneficiaries. The executor must follow the instructions laid out in the decedent's will or the court's instructions if there is no will. 2. Ownership Transfer: The Executor's Deed of Distribution legally transfers the ownership of assets from the estate to the individual beneficiary. This transfer ensures that the beneficiary becomes the rightful owner of the designated property or assets. 3. Asset Verification: Before initiating the distribution process, the executor must conduct a thorough inventory and appraisal of the estate's assets. This includes documenting the value of real estate, personal property, financial assets, and any other relevant holdings. 4. Types of Executor's Deed of Distribution: While the general purpose of the Executor's Deed of Distribution remains the same, there may be variations based on the complexity and nature of the assets involved. For instance, there can be specific deeds designed for transferring real estate, personal property, bank accounts, investment portfolios, or even intellectual property rights. 5. Will Requirements: The Executor's Deed of Distribution depends on a valid will being in place. If the deceased individual did not leave a will, the probate court would distribute assets according to Texas intestate succession laws. 6. Beneficiary's Acceptance: Before finalizing the distribution, the individual beneficiary needs to signify their acceptance of the assets being transferred. Typically, this is done through a formal documentation process or by signing an acknowledgment of receipt. 7. Title Clearing: As part of the Executor's Deed of Distribution, any claims or liens against the assets must be addressed and cleared. This ensures a marketable title for the beneficiary and protects against future legal disputes. The Wichita Falls Texas Executor's Deed of Distribution — Individual Executor to Individual Beneficiary is a legal instrument that facilitates the efficient transfer of assets from the estate of a deceased person to a specific beneficiary. Proper execution of this deed helps ensure that the wishes of the deceased are respected, and the beneficiaries receive their rightful inheritances.