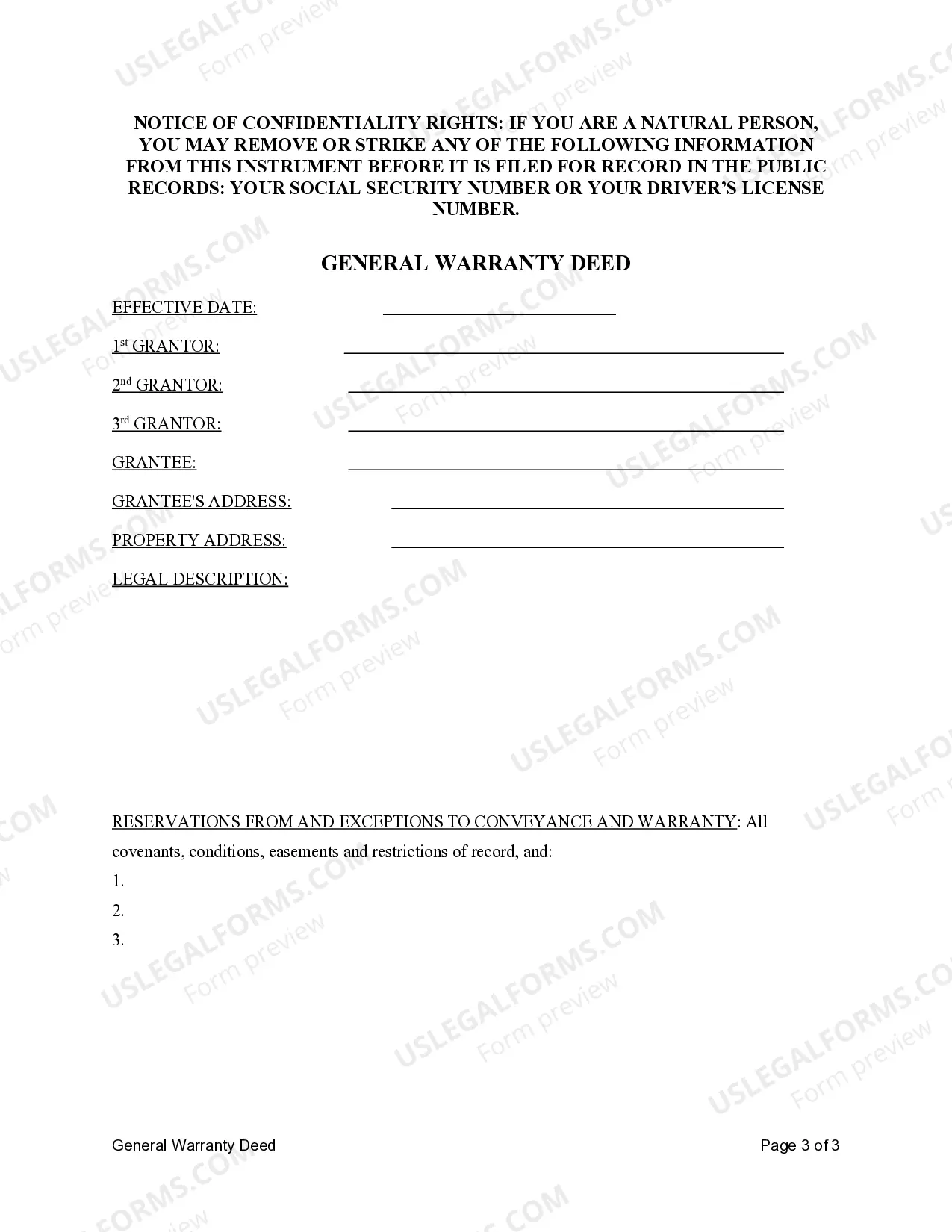

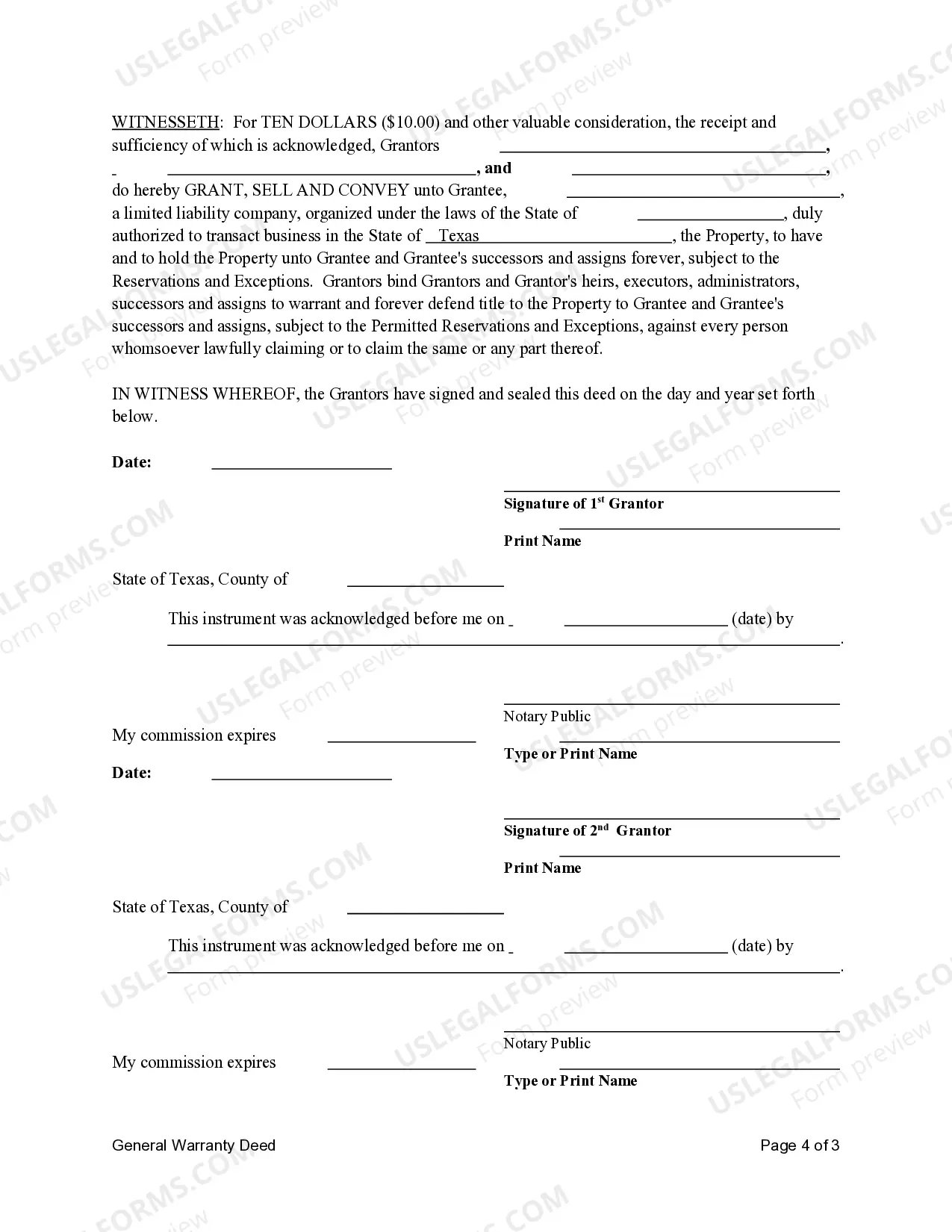

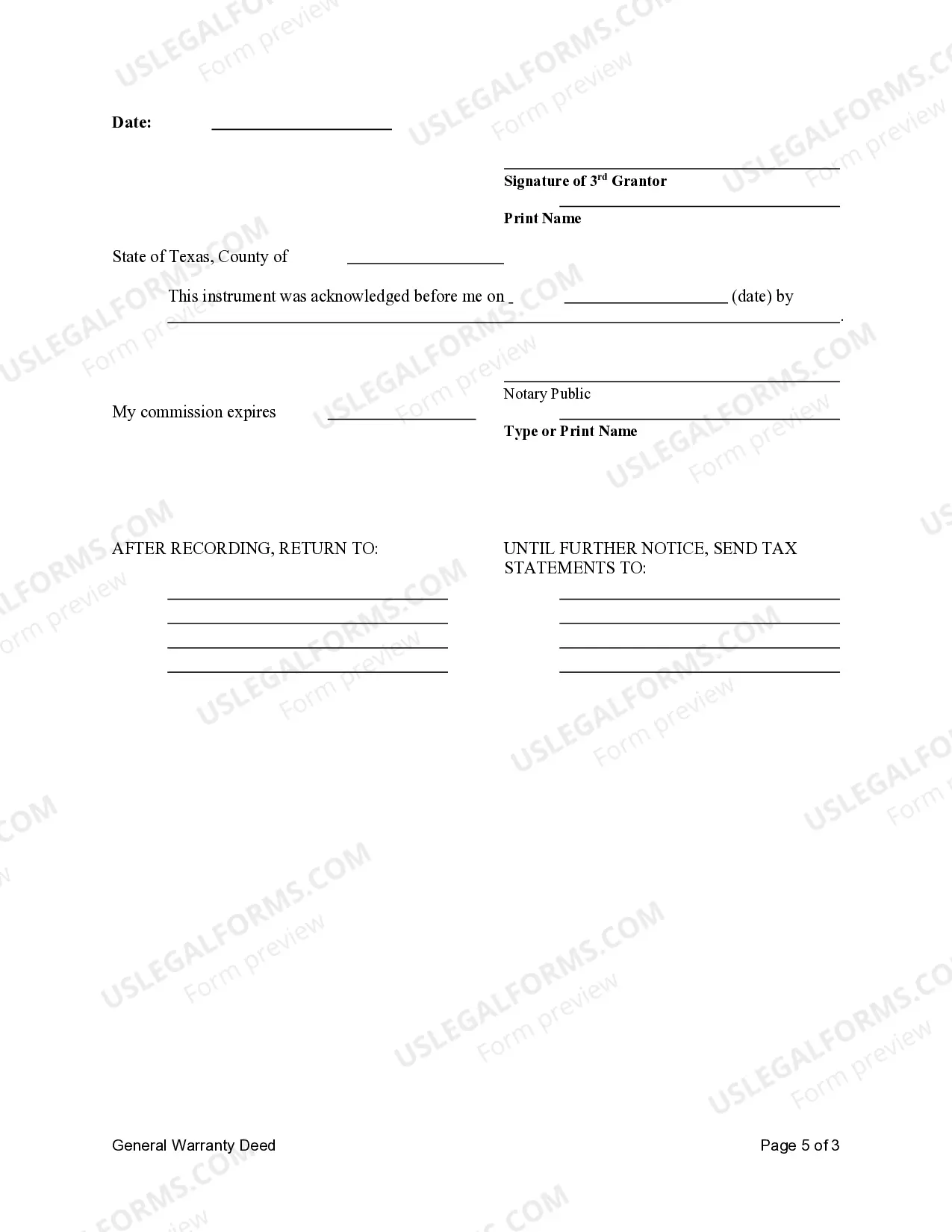

This form is a General Warranty Deed where the Grantors are three individuals and the Grantee is a limited liability company. Grantors convey and generally warrant the described property to the Grantee. This deed complies with all state statutory laws.

A General Warranty Deed is a legal document commonly used in real estate transactions that transfers ownership of a property from three individuals to a Limited Liability Company (LLC) in Frisco, Texas. This type of deed provides a guarantee that the property is free and clear of any liens or encumbrances, and the sellers (three individuals) promise to defend the buyer (LLC) against any future claims on the property. In Frisco, Texas, there are several types of General Warranty Deeds that can be used when transferring property ownership from three individuals to an LLC: 1. Statutory Form: This is the most common type of Frisco Texas General Warranty Deed used in real estate transactions. It follows the standard format set forth by the Texas Property Code and includes specific language required by state laws. 2. Special Warranty Deed: While less common, a Special Warranty Deed is another option that can be utilized in Frisco, Texas. This type of deed provides a guarantee only against claims that arose during the time the sellers (three individuals) owned the property, as opposed to the more comprehensive guarantee offered by a General Warranty Deed. 3. Quitclaim Deed: Though not as commonly used for property transfers involving three individuals to an LLC, a Quitclaim Deed is another alternative. Unlike a General Warranty Deed, a Quitclaim Deed does not provide any warranties or guarantees regarding the property's title. It simply transfers the sellers' (three individuals) rights or interests in the property to the buyer (LLC), if any. In summary, when three individuals in Frisco, Texas transfer property ownership to a Limited Liability Company, they may use a General Warranty Deed, Special Warranty Deed, or Quitclaim Deed. The General Warranty Deed is the most frequently used type, offering a comprehensive guarantee against any claims on the property. However, the other two options provide different levels of protection depending on the specific circumstances of the transaction.A General Warranty Deed is a legal document commonly used in real estate transactions that transfers ownership of a property from three individuals to a Limited Liability Company (LLC) in Frisco, Texas. This type of deed provides a guarantee that the property is free and clear of any liens or encumbrances, and the sellers (three individuals) promise to defend the buyer (LLC) against any future claims on the property. In Frisco, Texas, there are several types of General Warranty Deeds that can be used when transferring property ownership from three individuals to an LLC: 1. Statutory Form: This is the most common type of Frisco Texas General Warranty Deed used in real estate transactions. It follows the standard format set forth by the Texas Property Code and includes specific language required by state laws. 2. Special Warranty Deed: While less common, a Special Warranty Deed is another option that can be utilized in Frisco, Texas. This type of deed provides a guarantee only against claims that arose during the time the sellers (three individuals) owned the property, as opposed to the more comprehensive guarantee offered by a General Warranty Deed. 3. Quitclaim Deed: Though not as commonly used for property transfers involving three individuals to an LLC, a Quitclaim Deed is another alternative. Unlike a General Warranty Deed, a Quitclaim Deed does not provide any warranties or guarantees regarding the property's title. It simply transfers the sellers' (three individuals) rights or interests in the property to the buyer (LLC), if any. In summary, when three individuals in Frisco, Texas transfer property ownership to a Limited Liability Company, they may use a General Warranty Deed, Special Warranty Deed, or Quitclaim Deed. The General Warranty Deed is the most frequently used type, offering a comprehensive guarantee against any claims on the property. However, the other two options provide different levels of protection depending on the specific circumstances of the transaction.