This form is a Oil, Gas and Mineral Deed reflecting the sale of mineral interest from Trust by a single Trustee to an individual Grantee. Grantor conveys and grants the described property to the Grantee. This deed complies with all state statutory laws.

Austin Texas Oil, Gas, and Mineral deed from Trust to an Individual - Sale of Interest - Single Trustee

Description

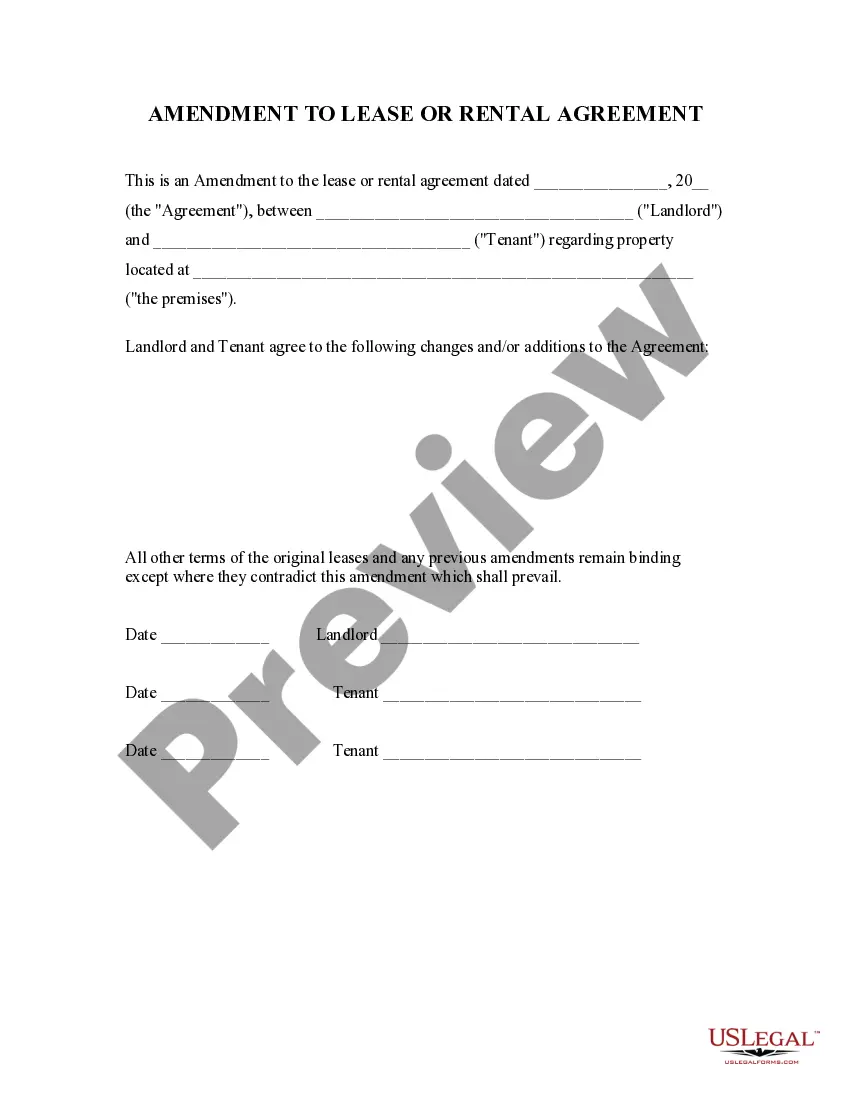

How to fill out Texas Oil, Gas, And Mineral Deed From Trust To An Individual - Sale Of Interest - Single Trustee?

If you are looking for a pertinent document, it’s incredibly challenging to find a more suitable location than the US Legal Forms site – likely the most comprehensive collections on the web.

With this collection, you can acquire thousands of templates for both organizational and personal use categorized by types and regions, or keywords.

With our sophisticated search capability, obtaining the latest Austin Texas Oil, Gas, and Mineral deed from Trust to an Individual - Sale of Interest - Single Trustee is as straightforward as 1-2-3.

Obtain the document. Specify the format and download it to your device.

Make adjustments. Complete, modify, print, and sign the downloaded Austin Texas Oil, Gas, and Mineral deed from Trust to an Individual - Sale of Interest - Single Trustee.

- If you are already acquainted with our platform and possess an account, all you need to do to obtain the Austin Texas Oil, Gas, and Mineral deed from Trust to an Individual - Sale of Interest - Single Trustee is to Log In to your user profile and select the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the guidelines outlined below.

- Ensure you have accessed the document you need. Review its details and use the Preview feature (if available) to assess its content. If it doesn’t fulfill your needs, utilize the Search bar located at the top of the screen to locate the suitable file.

- Validate your choice. Click the Buy now button. Subsequently, select your desired subscription plan and provide information to register for an account.

- Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

A Texas mineral deed with special warranty conveying all of the grantor's oil, gas, and other minerals under real property subject to limited warranties from the grantor. This Standard Document has integrated notes with important explanations and drafting tips.

A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate. It is often used as part of a real estate transaction that includes a Warranty Deed with a Vendor's Lien and a Promissory Note.

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

The only way to determine your rights is to conduct a search of the public land records in the county where the property is located. All the deeds conveying the property must be reviewed. This is known as reviewing the property's Chain of Title.

In Texas, Oklahoma, Colorado and Montana, mineral owners can own the mineral rights indefinitely and there is no way for them to passively revert to the surface owner. If a surface owner wants to own the mineral rights under their land, they must find and contact the mineral owners and offer to purchase them.

It may appear from the use of the word ?royalty? that X intends to convey to Y a royalty interest?an interest in the share of production. However, the phrase ?in and under? is typically utilized in conjunction with the conveyance or reservation of a mineral interest.

Mineral interests are defined by the Texas Property Tax Code as real property and are subject to taxes the same as all other real property.

One quick and dirty approach is the ?rule of thumb.? Those following the rule of thumb say that mineral rights are worth a multiple of three to five times the yearly income produced. For example, a mineral right that produces $1,000 a year in royalties would be worth between $3,000 and $5,000 under the rule of thumb.

Like surface interests, mineral interests are passed down by inheritance. If there is a valid will, it controls who gets the property. If not, Texas laws of heirship controls.

Conveying (selling or otherwise transferring) the land but retaining the mineral rights. (This is accomplished by including a statement in the deed conveying the land that reserves all rights to the minerals to the seller.) Conveying the mineral rights and retaining the land.