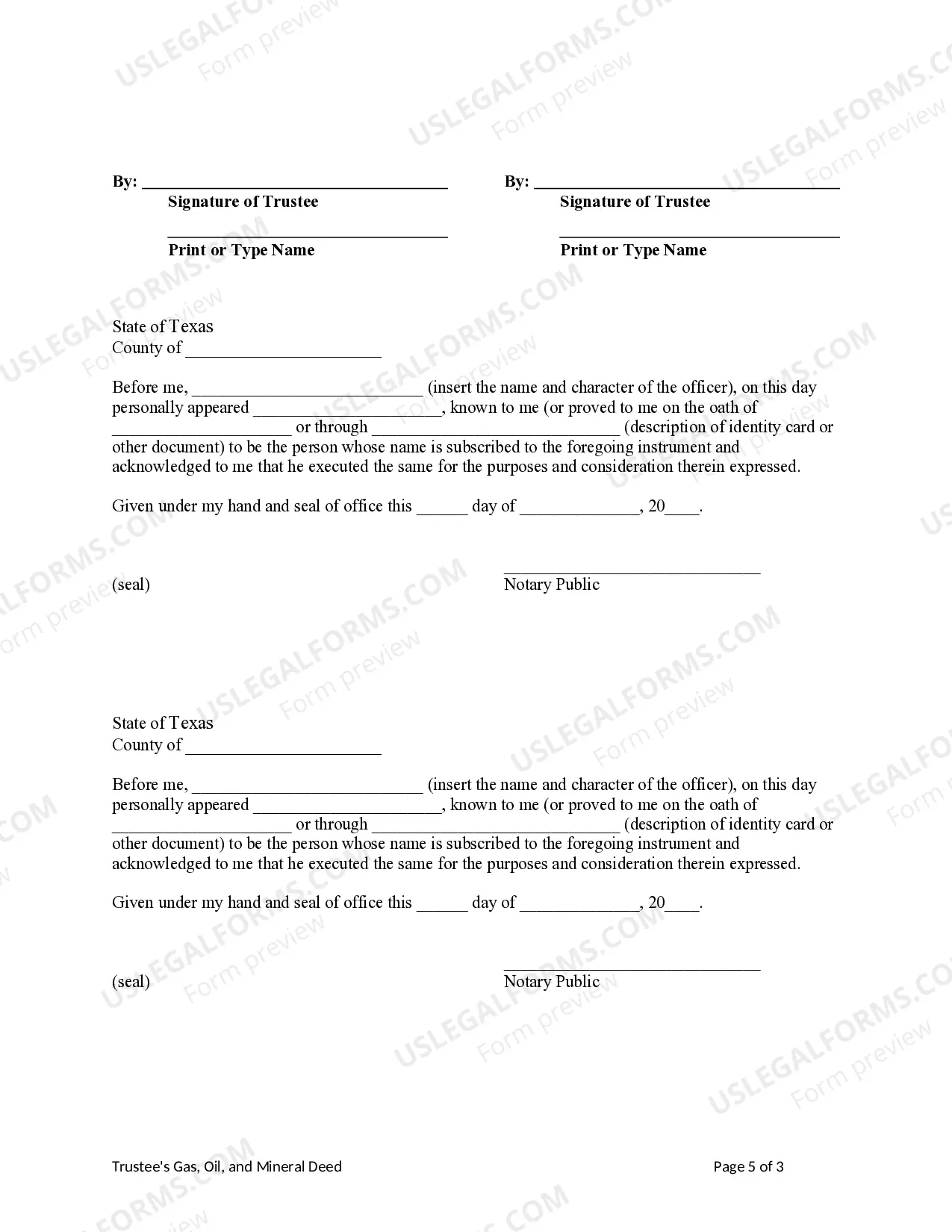

This form is a Oil, Gas and Mineral Deed reflecting the sale of mineral interest from Trust by Two Trustees to an individual Grantee. Grantor conveys and grants the described property to the Grantee. This deed complies with all state statutory laws.

A Collin Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee refers to a legal document that transfers ownership of certain oil, gas, and mineral rights from a trust to an individual, with two trustees involved in the transaction. This type of deed is commonly used in the state of Texas for conveying interests in valuable natural resources. It is essential to understand the intricate details of such a deed to ensure a smooth transfer of ownership. There are several types of Collin Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee, distinguished primarily by the specific interests being transferred. These variations include: 1. Surface Interest Deed: This type of deed transfers only the surface rights to the individual, allowing them to utilize and own the land above the oil, gas, and mineral deposits. The trust retains the rights to any resources beneath the surface. 2. Mineral Interest Deed: With this deed, the trust conveys only the mineral rights to the individual, enabling them to extract and profit from the minerals located beneath the land's surface. The surface rights typically remain with the trust. 3. Royalty Interest Deed: This type of deed grants the individual the right to receive a percentage of the revenues generated from the extraction of oil, gas, or minerals from the land. The trust retains the ownership of the resources themselves. 4. Working Interest Deed: In a working interest deed, the individual gains both the rights to extract and profit from the resources, as well as a share of the associated costs and risks of exploration, drilling, and production. The trust may still retain a portion of the interests. The aforementioned deed types allow individuals to acquire specific rights and interests in Collin, Texas, regarding oil, gas, and mineral resources. It is crucial for both parties involved to thoroughly review the terms and conditions of the deed, including the extent of the interests being transferred, any limitations or restrictions, and the financial arrangements related to the sale. Understanding the nuances of Collin Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee is essential to protect the interests of all parties involved and ensure a legally binding transfer of ownership. Seeking guidance from experienced legal professionals familiar with Texas state laws and regulations concerning natural resource transactions is highly recommended navigating the complexities of such deeds effectively.A Collin Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee refers to a legal document that transfers ownership of certain oil, gas, and mineral rights from a trust to an individual, with two trustees involved in the transaction. This type of deed is commonly used in the state of Texas for conveying interests in valuable natural resources. It is essential to understand the intricate details of such a deed to ensure a smooth transfer of ownership. There are several types of Collin Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee, distinguished primarily by the specific interests being transferred. These variations include: 1. Surface Interest Deed: This type of deed transfers only the surface rights to the individual, allowing them to utilize and own the land above the oil, gas, and mineral deposits. The trust retains the rights to any resources beneath the surface. 2. Mineral Interest Deed: With this deed, the trust conveys only the mineral rights to the individual, enabling them to extract and profit from the minerals located beneath the land's surface. The surface rights typically remain with the trust. 3. Royalty Interest Deed: This type of deed grants the individual the right to receive a percentage of the revenues generated from the extraction of oil, gas, or minerals from the land. The trust retains the ownership of the resources themselves. 4. Working Interest Deed: In a working interest deed, the individual gains both the rights to extract and profit from the resources, as well as a share of the associated costs and risks of exploration, drilling, and production. The trust may still retain a portion of the interests. The aforementioned deed types allow individuals to acquire specific rights and interests in Collin, Texas, regarding oil, gas, and mineral resources. It is crucial for both parties involved to thoroughly review the terms and conditions of the deed, including the extent of the interests being transferred, any limitations or restrictions, and the financial arrangements related to the sale. Understanding the nuances of Collin Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee is essential to protect the interests of all parties involved and ensure a legally binding transfer of ownership. Seeking guidance from experienced legal professionals familiar with Texas state laws and regulations concerning natural resource transactions is highly recommended navigating the complexities of such deeds effectively.