This form is a Oil, Gas and Mineral Deed reflecting the sale of mineral interest from Trust by Two Trustees to an individual Grantee. Grantor conveys and grants the described property to the Grantee. This deed complies with all state statutory laws.

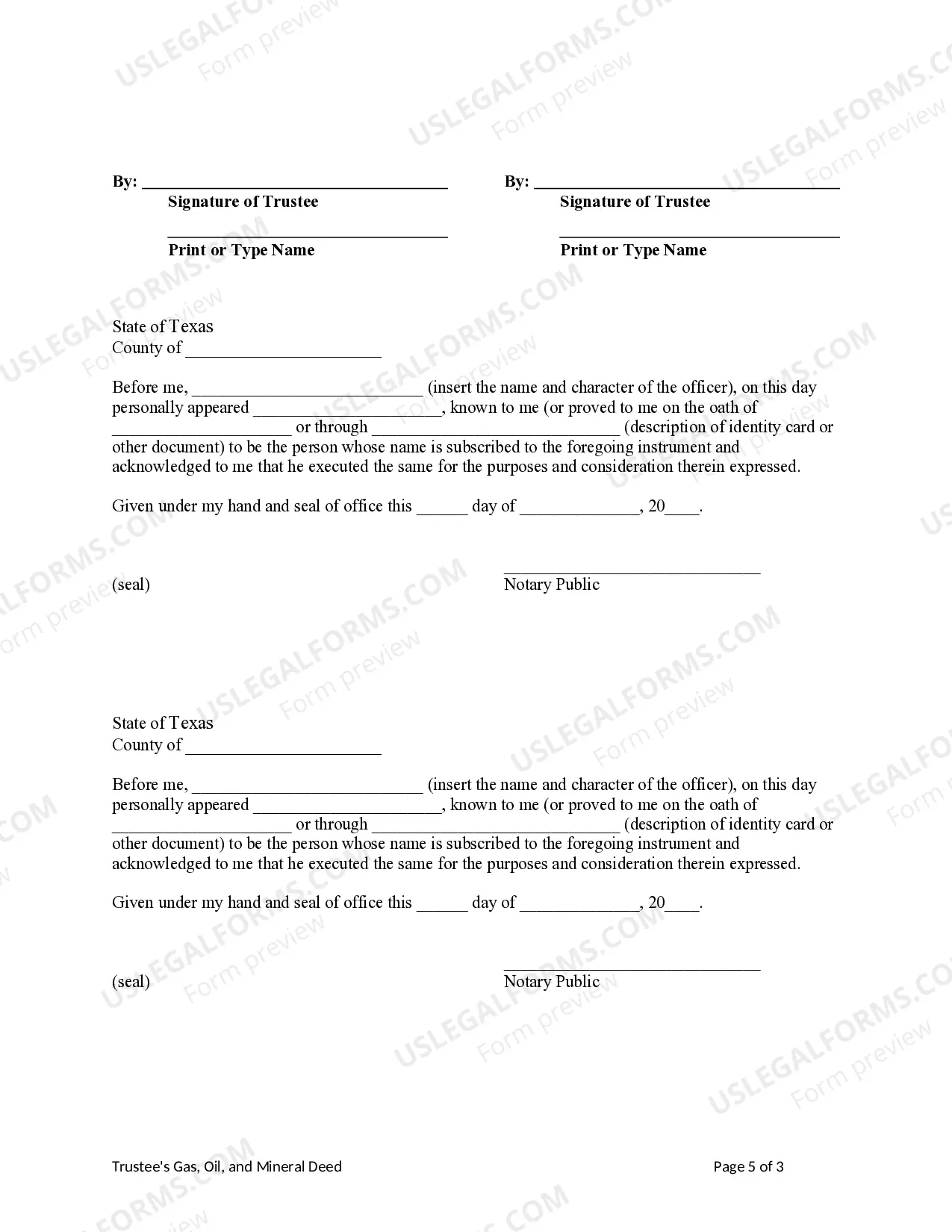

A Harris Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee refers to a legally binding document that transfers ownership of oil, gas, and mineral rights from a trust to an individual. It is a significant transaction in the realm of natural resource ownership and typically involves two trustees overseeing the process. One type of Harris Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee is the "Partial Sale of Interest" deed. This type of deed allows the trust to sell a portion of its ownership rights in the oil, gas, and mineral assets to the individual while still maintaining a stake in the resources. Another variant is the "Full Sale of Interest" deed, which transfers the entire ownership of oil, gas, and mineral rights from the trust to the individual. This deed signifies a complete divestment of the trust's interest in the resources and grants the individual sole ownership. When engaging in such transactions, it is crucial for all parties involved to ensure clear and precise documentation. The Harris Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee should include specific provisions and details regarding: 1. Parties Involved: Clearly identify the trust, individual, and the two trustees involved in the transaction. 2. Granting Clause: State the intention of the trust to transfer the ownership rights to the individual. 3. Description of Interests: Clearly define the extent and nature of the oil, gas, and mineral interests being transferred, including any specific tracts or locations involved. 4. Consideration: Specify the financial compensation or consideration the individual is providing to the trust in exchange for the ownership rights. 5. Warranties: Include any warranties or guarantees made by the trust regarding the ownership and transferability of the interests being conveyed. 6. Covenants: Outline any additional promises or commitments made by the trust or individuals involved, such as ensuring the title is clear of any encumbrances or third-party claims. 7. Signatures and Notarization: All parties should sign the deed, and it should be duly notarized for validity and enforceability. It is crucial to consult with legal professionals well-versed in oil, gas, and mineral transactions in Harris, Texas, to ensure compliance with local laws and regulations. Expert advice can help navigate the complexities and intricacies of these types of deeds, ensuring a smooth and legally sound transfer of ownership rights.A Harris Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee refers to a legally binding document that transfers ownership of oil, gas, and mineral rights from a trust to an individual. It is a significant transaction in the realm of natural resource ownership and typically involves two trustees overseeing the process. One type of Harris Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee is the "Partial Sale of Interest" deed. This type of deed allows the trust to sell a portion of its ownership rights in the oil, gas, and mineral assets to the individual while still maintaining a stake in the resources. Another variant is the "Full Sale of Interest" deed, which transfers the entire ownership of oil, gas, and mineral rights from the trust to the individual. This deed signifies a complete divestment of the trust's interest in the resources and grants the individual sole ownership. When engaging in such transactions, it is crucial for all parties involved to ensure clear and precise documentation. The Harris Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee should include specific provisions and details regarding: 1. Parties Involved: Clearly identify the trust, individual, and the two trustees involved in the transaction. 2. Granting Clause: State the intention of the trust to transfer the ownership rights to the individual. 3. Description of Interests: Clearly define the extent and nature of the oil, gas, and mineral interests being transferred, including any specific tracts or locations involved. 4. Consideration: Specify the financial compensation or consideration the individual is providing to the trust in exchange for the ownership rights. 5. Warranties: Include any warranties or guarantees made by the trust regarding the ownership and transferability of the interests being conveyed. 6. Covenants: Outline any additional promises or commitments made by the trust or individuals involved, such as ensuring the title is clear of any encumbrances or third-party claims. 7. Signatures and Notarization: All parties should sign the deed, and it should be duly notarized for validity and enforceability. It is crucial to consult with legal professionals well-versed in oil, gas, and mineral transactions in Harris, Texas, to ensure compliance with local laws and regulations. Expert advice can help navigate the complexities and intricacies of these types of deeds, ensuring a smooth and legally sound transfer of ownership rights.