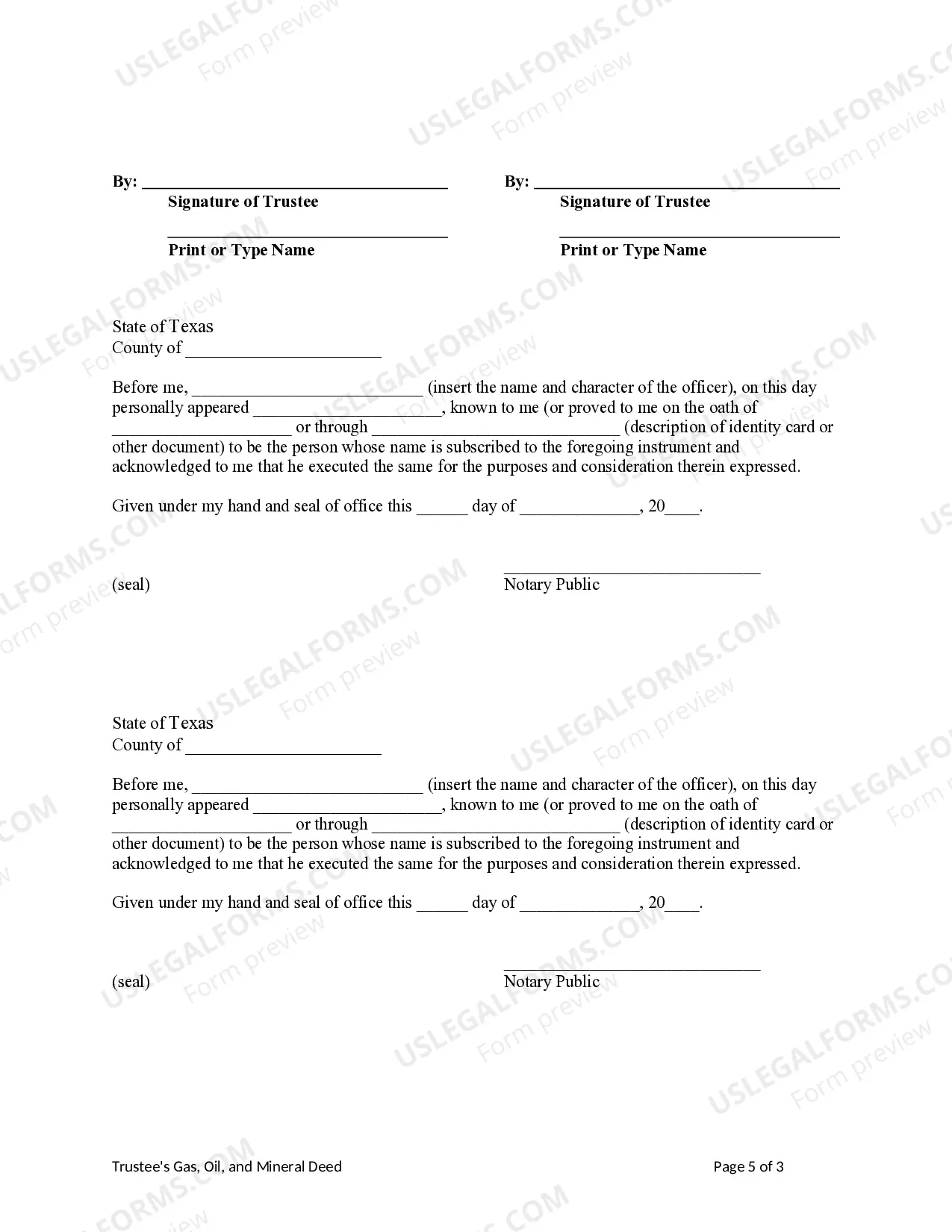

This form is a Oil, Gas and Mineral Deed reflecting the sale of mineral interest from Trust by Two Trustees to an individual Grantee. Grantor conveys and grants the described property to the Grantee. This deed complies with all state statutory laws.

In Sugar Land, Texas, the process of transferring ownership of oil, gas, and mineral rights from a trust to an individual is known as a "Sugar Land Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee." This type of deed plays a crucial role in the lucrative oil and gas industry, ensuring the smooth transfer of ownership and the exploitation of valuable resources. Here are some of the different types or variations of this deed: 1. Irrevocable Trust: An irrevocable trust refers to a legal arrangement where the trust or transfers ownership of their oil, gas, and mineral rights to the trust for the benefit of the beneficiaries. In a "Sugar Land Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee" involving an irrevocable trust, the deed facilitates the transfer of these rights from the trust to an individual beneficiary. 2. Revocable Trust: Unlike an irrevocable trust, a revocable trust allows the trust or to modify or revoke the trust at any time during their lifetime. In the context of an oil, gas, and mineral deed, a "Sugar Land Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee" involving a revocable trust helps in transferring the interests from the trust to an individual beneficiary while retaining the trust's flexibility. 3. Grantor-Trustee Relationship: A Sugar Land Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee" may involve a deed transferring interests from a trust with two trustees to an individual beneficiary. In this scenario, the trust agreement may specify that both trustees must sign off on the sale and transfer of oil, gas, and mineral rights to safeguard the trust's assets and ensure fair distribution. 4. Partial Interest Sale: Sometimes, a trust may choose to sell only a portion of its ownership in oil, gas, and mineral rights. A "Sugar Land Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee" involving a partial interest sale allows the trustees to sell a specified percentage or fraction of the trust's overall rights, while the remaining interest is retained by the trust. 5. Full Interest Sale: Alternatively, a trust may decide to sell the entirety of its oil, gas, and mineral rights to an individual. In this case, the "Sugar Land Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee" document would facilitate the transfer of full ownership from the trust to the individual beneficiary, ensuring a comprehensive and final transfer of rights. These types of "Sugar Land Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee" provide essential legal documentation for the transfer of oil, gas, and mineral rights from a trust to an individual in Sugar Land, Texas. By following the proper legal protocols and including all relevant parties, these deeds ensure a transparent and lawful transfer process for the benefit of both the trust and the individual.In Sugar Land, Texas, the process of transferring ownership of oil, gas, and mineral rights from a trust to an individual is known as a "Sugar Land Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee." This type of deed plays a crucial role in the lucrative oil and gas industry, ensuring the smooth transfer of ownership and the exploitation of valuable resources. Here are some of the different types or variations of this deed: 1. Irrevocable Trust: An irrevocable trust refers to a legal arrangement where the trust or transfers ownership of their oil, gas, and mineral rights to the trust for the benefit of the beneficiaries. In a "Sugar Land Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee" involving an irrevocable trust, the deed facilitates the transfer of these rights from the trust to an individual beneficiary. 2. Revocable Trust: Unlike an irrevocable trust, a revocable trust allows the trust or to modify or revoke the trust at any time during their lifetime. In the context of an oil, gas, and mineral deed, a "Sugar Land Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee" involving a revocable trust helps in transferring the interests from the trust to an individual beneficiary while retaining the trust's flexibility. 3. Grantor-Trustee Relationship: A Sugar Land Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee" may involve a deed transferring interests from a trust with two trustees to an individual beneficiary. In this scenario, the trust agreement may specify that both trustees must sign off on the sale and transfer of oil, gas, and mineral rights to safeguard the trust's assets and ensure fair distribution. 4. Partial Interest Sale: Sometimes, a trust may choose to sell only a portion of its ownership in oil, gas, and mineral rights. A "Sugar Land Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee" involving a partial interest sale allows the trustees to sell a specified percentage or fraction of the trust's overall rights, while the remaining interest is retained by the trust. 5. Full Interest Sale: Alternatively, a trust may decide to sell the entirety of its oil, gas, and mineral rights to an individual. In this case, the "Sugar Land Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee" document would facilitate the transfer of full ownership from the trust to the individual beneficiary, ensuring a comprehensive and final transfer of rights. These types of "Sugar Land Texas Oil, Gas, and Mineral deed from Trust to an Individual — Salinterestedes— - Two Trustee" provide essential legal documentation for the transfer of oil, gas, and mineral rights from a trust to an individual in Sugar Land, Texas. By following the proper legal protocols and including all relevant parties, these deeds ensure a transparent and lawful transfer process for the benefit of both the trust and the individual.