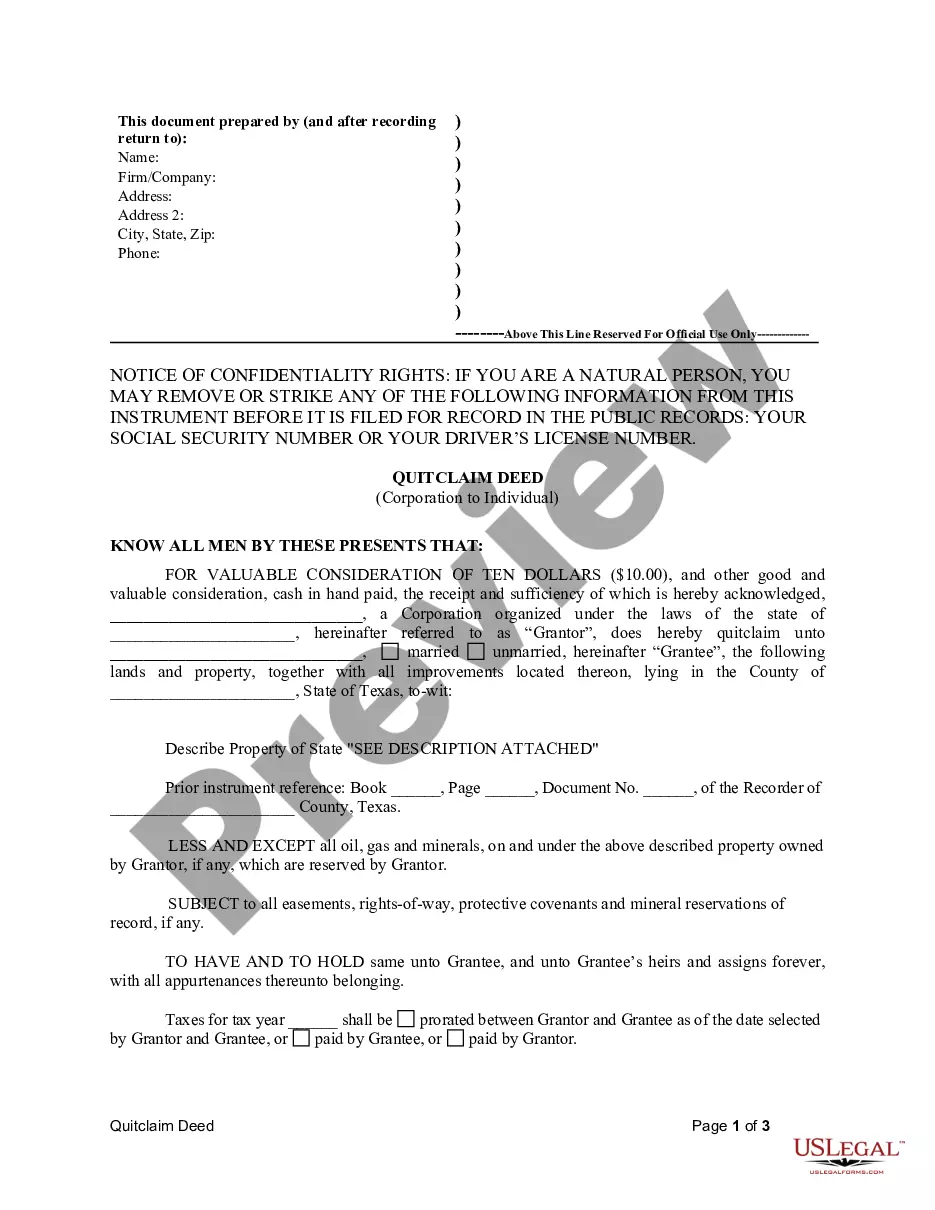

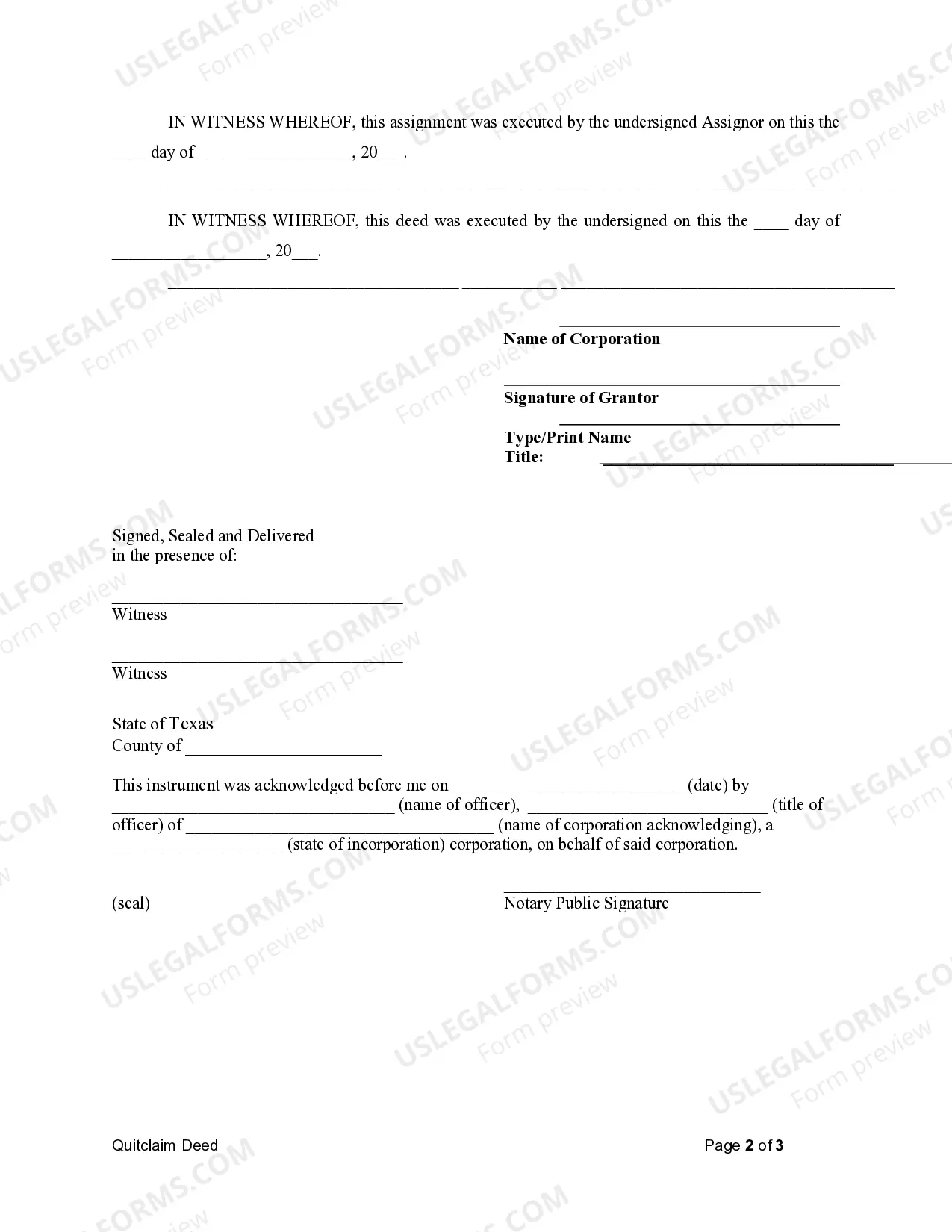

This Quitclaim Deed from Corporation to Individual form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Quitclaim Deed is a legal document used to transfer ownership of real property from one party (in this case, a corporation) to another party (an individual) without any representation or warranty regarding the title. In the context of Austin, Texas, a Quitclaim Deed from a Corporation to an Individual is a specific type of deed that facilitates the transfer of property from a corporate entity to an individual. This type of deed is commonly used when a corporation wants to transfer ownership of a property it owns to an individual, whether it be a shareholder, employee, or outside buyer. The Quitclaim Deed serves as evidence of the corporation's intention to transfer its interest in the property to the individual. The Austin Texas Quitclaim Deed from Corporation to Individual establishes the legal framework for the transfer, documenting the key details such as the names and addresses of both the corporation and the individual, the property description, and the consideration (usually the amount of money paid, if any, for the transfer). It is important to note that a Quitclaim Deed from a Corporation to an Individual in Austin, Texas does not provide any guarantee or representation that the title to the property is clear or free from any potential liens, claims, or encumbrances. As such, it is always recommended for individuals to conduct a thorough title search and obtain title insurance to protect their interests. Although there may not be distinct types of Quitclaim Deeds to individual in Austin, Texas based on their purpose or legal implications, there can be variations based on the specific circumstances of the transfer, such as whether it is a transfer of fee simple ownership or partial interest, or whether it involves a change in ownership due to a merger or acquisition. In summary, an Austin Texas Quitclaim Deed from Corporation to Individual is a legal document that enables the transfer of property ownership from a corporation to an individual, without providing any guarantees or warranties of the title. It is recommended to consult with a qualified attorney or real estate professional familiar with Austin's laws and regulations when drafting or executing such a deed to ensure compliance and protect the interests of the involved parties.