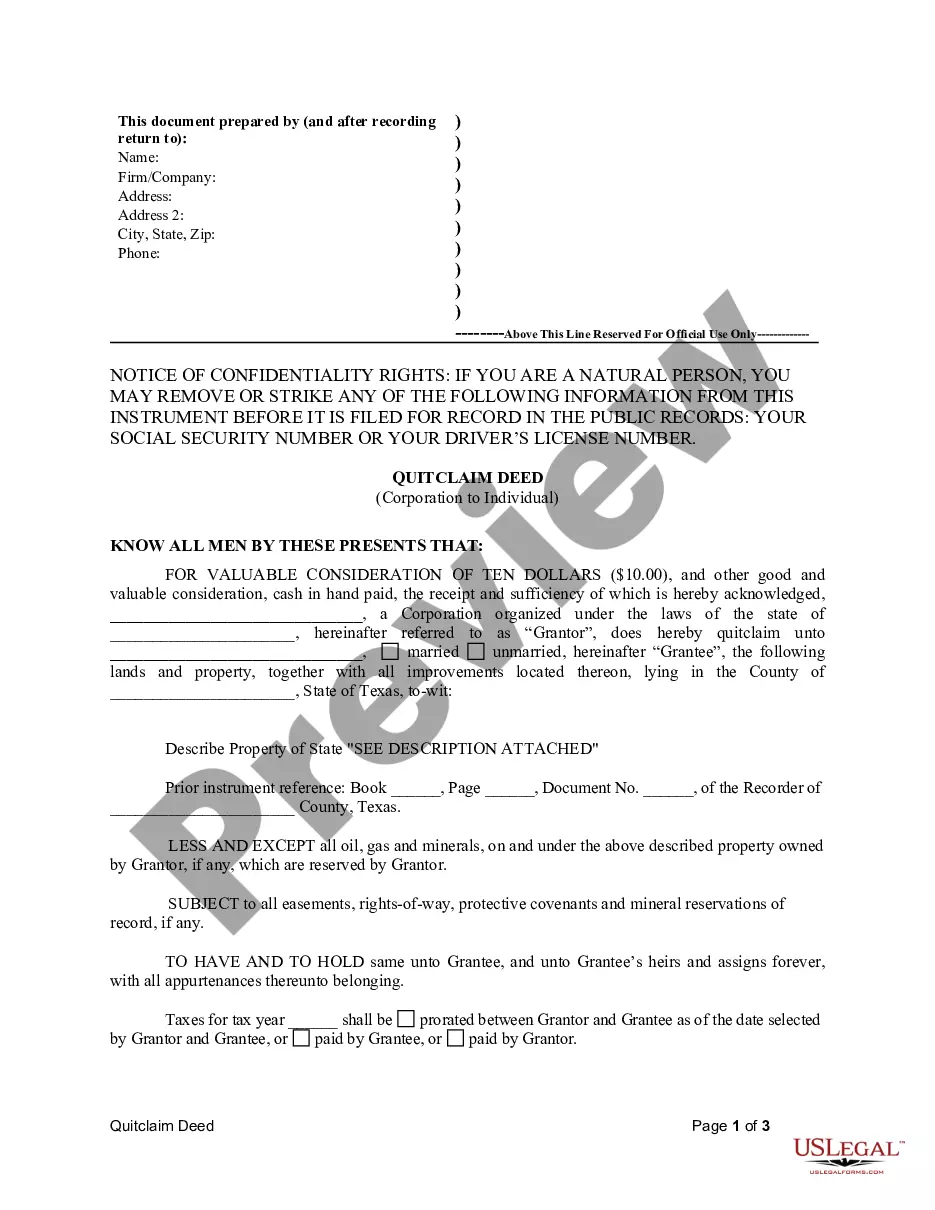

This Quitclaim Deed from Corporation to Individual form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Pasadena Texas quitclaim deed from corporation to an individual is a legal document that transfers property ownership rights from a corporation to an individual without any warranties or guarantees. This type of deed is commonly used when a corporation wishes to transfer ownership of a property to an individual without assuming any liability for the property. In a Pasadena Texas quitclaim deed from corporation to an individual, the corporation gives up any claim it may have on the property and transfers its interest to the individual. This deed is typically used in situations where the corporation needs to dispose of assets or when an individual shareholder or partner desires to acquire ownership of a property for personal use. It is important to note that a quitclaim deed does not provide any assurances or guarantees regarding the title or condition of the property being transferred. The individual receiving the property through a quitclaim deed accepts it "as is" and bears any risks or liabilities associated with it. There may be different types of Pasadena Texas quitclaim deeds from corporation to an individual, depending on the specific circumstances and arrangements. Some examples include: 1. Individual Shareholder or Partner Transfer: This type of quitclaim deed occurs when a corporation transfers a property to one of its individual shareholders or partners. It may happen during a business dissolution, buyout, or personal arrangement. 2. Employee Ownership Transfer: In certain cases, a corporation may transfer property ownership to an employee as part of a compensation package or incentive program. This type of quitclaim deed allows the employee to acquire the property without any further obligations towards the corporation. 3. Asset Disposal: Corporations may use quitclaim deeds to dispose of surplus or unwanted properties. It enables a quick and straightforward transfer to an individual without the need for extensive legal processes. 4. Estate Planning: Quitclaim deeds can also be utilized as part of estate planning strategies to transfer ownership of corporate properties to individual family members or beneficiaries. When conducting any transactions involving quitclaim deeds, it is crucial to consult with a qualified real estate attorney or professional to ensure compliance with local laws and regulations. This will help protect the interests of both the corporation and the individual involved in the transfer.A Pasadena Texas quitclaim deed from corporation to an individual is a legal document that transfers property ownership rights from a corporation to an individual without any warranties or guarantees. This type of deed is commonly used when a corporation wishes to transfer ownership of a property to an individual without assuming any liability for the property. In a Pasadena Texas quitclaim deed from corporation to an individual, the corporation gives up any claim it may have on the property and transfers its interest to the individual. This deed is typically used in situations where the corporation needs to dispose of assets or when an individual shareholder or partner desires to acquire ownership of a property for personal use. It is important to note that a quitclaim deed does not provide any assurances or guarantees regarding the title or condition of the property being transferred. The individual receiving the property through a quitclaim deed accepts it "as is" and bears any risks or liabilities associated with it. There may be different types of Pasadena Texas quitclaim deeds from corporation to an individual, depending on the specific circumstances and arrangements. Some examples include: 1. Individual Shareholder or Partner Transfer: This type of quitclaim deed occurs when a corporation transfers a property to one of its individual shareholders or partners. It may happen during a business dissolution, buyout, or personal arrangement. 2. Employee Ownership Transfer: In certain cases, a corporation may transfer property ownership to an employee as part of a compensation package or incentive program. This type of quitclaim deed allows the employee to acquire the property without any further obligations towards the corporation. 3. Asset Disposal: Corporations may use quitclaim deeds to dispose of surplus or unwanted properties. It enables a quick and straightforward transfer to an individual without the need for extensive legal processes. 4. Estate Planning: Quitclaim deeds can also be utilized as part of estate planning strategies to transfer ownership of corporate properties to individual family members or beneficiaries. When conducting any transactions involving quitclaim deeds, it is crucial to consult with a qualified real estate attorney or professional to ensure compliance with local laws and regulations. This will help protect the interests of both the corporation and the individual involved in the transfer.