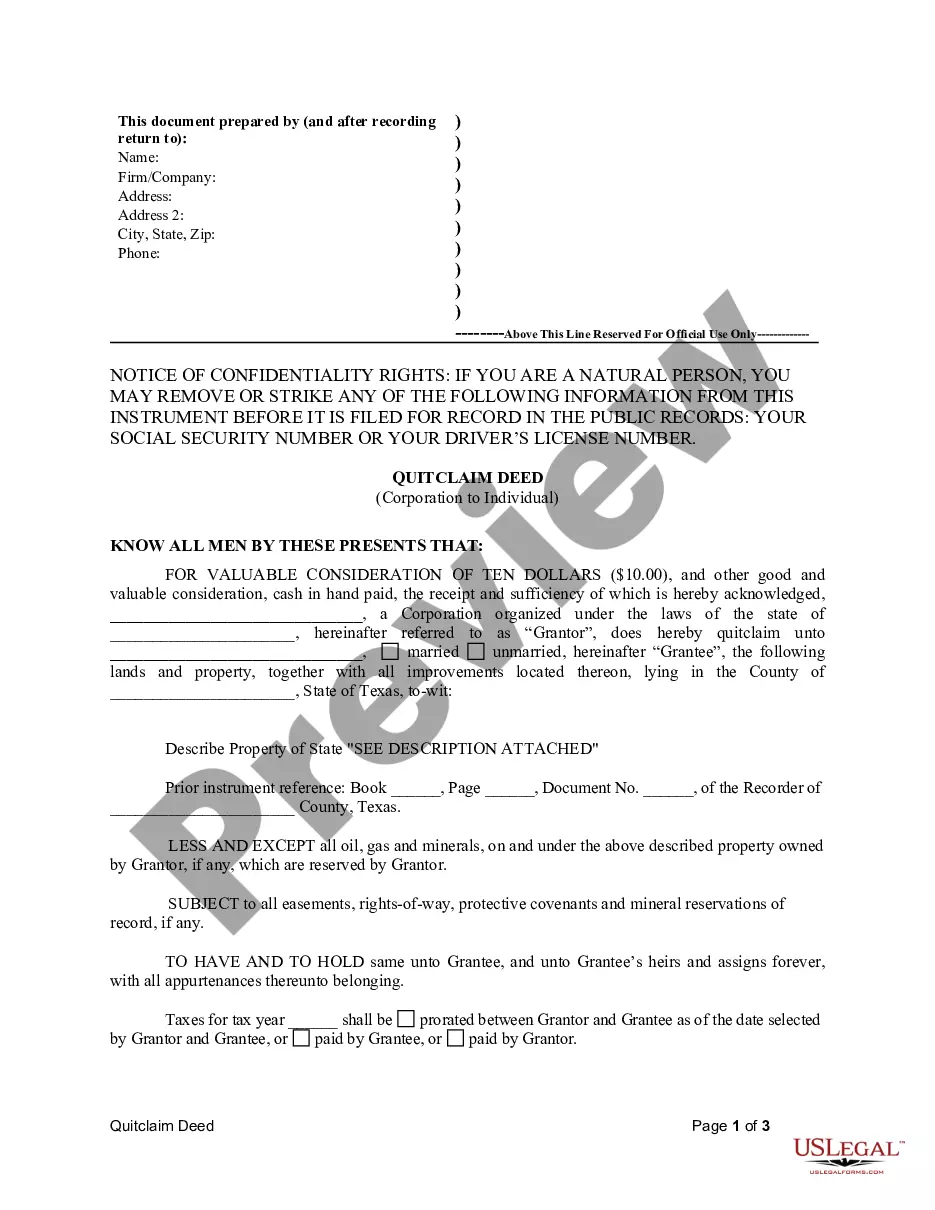

This Quitclaim Deed from Corporation to Individual form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

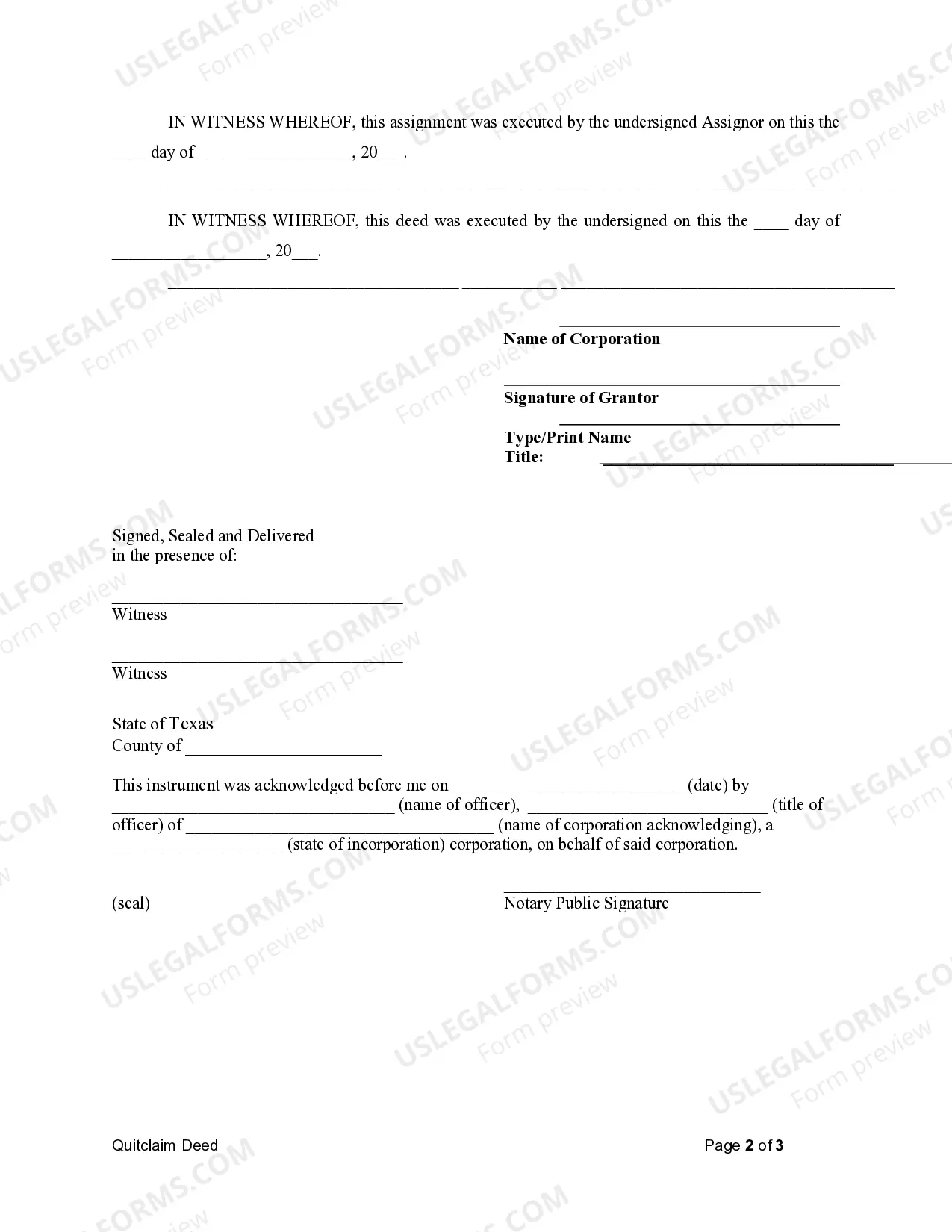

Title: Tarrant Texas Quitclaim Deed from Corporation to Individual: Understanding the Process and Types Introduction: A Tarrant Texas Quitclaim Deed from Corporation to an Individual refers to a legal document used to transfer property ownership from a corporation to an individual, allowing the individual to claim full ownership rights. This detailed description aims to provide a comprehensive understanding of the process, significance, and various types of quitclaim deeds in Tarrant, Texas. 1. What is a Quitclaim Deed? A quitclaim deed is a legal instrument used for transferring interest or ownership rights in a property, excluding any warranties or guarantees. This type of deed is often utilized in non-traditional property transfer scenarios, such as transfers within family members, divorces, or in this case, from a corporation to an individual. 2. Tarrant Texas Quitclaim Deed from Corporation to Individual: A Tarrant Texas Quitclaim Deed from Corporation to Individual is a specific type of quitclaim deed that allows a corporation to transfer its ownership interest in a property to an individual. This conveyance occurs in situations where the corporation wishes to transfer a property into the hands of an individual associated with the corporation, such as an employee, director, or shareholder. 3. Understanding the Process: To execute a Tarrant Texas Quitclaim Deed from Corporation to Individual, the following steps are generally involved: a. Drafting the deed: The corporation's legal team prepares the quitclaim deed, including a detailed description of the property and the granting language to transfer ownership from the corporation to the individual. b. Corporate Resolution: A corporate resolution is passed, authorizing the transfer and signing of the quitclaim deed by the corporation's authorized representative. This ensures compliance with legal formalities. c. Execution: The authorized representative of the corporation signs the deed in the presence of a notary public. d. Recording the Deed: The completed and notarized quitclaim deed is then filed with the County Clerk's Office in Tarrant County, Texas, to ensure public record of the transfer. 4. Types of Tarrant Texas Quitclaim Deed from Corporation to Individual: a. General Quitclaim Deed: This type of quitclaim deed transfers the property interest held by the corporation to an individual without any specific conditions or limitations. b. Special Purpose Quitclaim Deed: In cases where the transfer is subject to specific conditions or restrictions, such as encumbrances, liens, or limitations on use, a special purpose quitclaim deed may be employed to address these unique circumstances. c. Tax-Free Quitclaim Deed: If the transfer of property from the corporation to an individual meets certain criteria outlined by the Internal Revenue Code, a tax-free quitclaim deed may be utilized, permitting the transfer to occur without triggering tax implications. Conclusion: A Tarrant Texas Quitclaim Deed from Corporation to Individual is a legal instrument that facilitates the transfer of property ownership from a corporation to an individual. By following the required steps and understanding the nuances of the different types of quitclaim deeds, corporations and individuals can effectively navigate the property transfer process while ensuring legal compliance.Title: Tarrant Texas Quitclaim Deed from Corporation to Individual: Understanding the Process and Types Introduction: A Tarrant Texas Quitclaim Deed from Corporation to an Individual refers to a legal document used to transfer property ownership from a corporation to an individual, allowing the individual to claim full ownership rights. This detailed description aims to provide a comprehensive understanding of the process, significance, and various types of quitclaim deeds in Tarrant, Texas. 1. What is a Quitclaim Deed? A quitclaim deed is a legal instrument used for transferring interest or ownership rights in a property, excluding any warranties or guarantees. This type of deed is often utilized in non-traditional property transfer scenarios, such as transfers within family members, divorces, or in this case, from a corporation to an individual. 2. Tarrant Texas Quitclaim Deed from Corporation to Individual: A Tarrant Texas Quitclaim Deed from Corporation to Individual is a specific type of quitclaim deed that allows a corporation to transfer its ownership interest in a property to an individual. This conveyance occurs in situations where the corporation wishes to transfer a property into the hands of an individual associated with the corporation, such as an employee, director, or shareholder. 3. Understanding the Process: To execute a Tarrant Texas Quitclaim Deed from Corporation to Individual, the following steps are generally involved: a. Drafting the deed: The corporation's legal team prepares the quitclaim deed, including a detailed description of the property and the granting language to transfer ownership from the corporation to the individual. b. Corporate Resolution: A corporate resolution is passed, authorizing the transfer and signing of the quitclaim deed by the corporation's authorized representative. This ensures compliance with legal formalities. c. Execution: The authorized representative of the corporation signs the deed in the presence of a notary public. d. Recording the Deed: The completed and notarized quitclaim deed is then filed with the County Clerk's Office in Tarrant County, Texas, to ensure public record of the transfer. 4. Types of Tarrant Texas Quitclaim Deed from Corporation to Individual: a. General Quitclaim Deed: This type of quitclaim deed transfers the property interest held by the corporation to an individual without any specific conditions or limitations. b. Special Purpose Quitclaim Deed: In cases where the transfer is subject to specific conditions or restrictions, such as encumbrances, liens, or limitations on use, a special purpose quitclaim deed may be employed to address these unique circumstances. c. Tax-Free Quitclaim Deed: If the transfer of property from the corporation to an individual meets certain criteria outlined by the Internal Revenue Code, a tax-free quitclaim deed may be utilized, permitting the transfer to occur without triggering tax implications. Conclusion: A Tarrant Texas Quitclaim Deed from Corporation to Individual is a legal instrument that facilitates the transfer of property ownership from a corporation to an individual. By following the required steps and understanding the nuances of the different types of quitclaim deeds, corporations and individuals can effectively navigate the property transfer process while ensuring legal compliance.