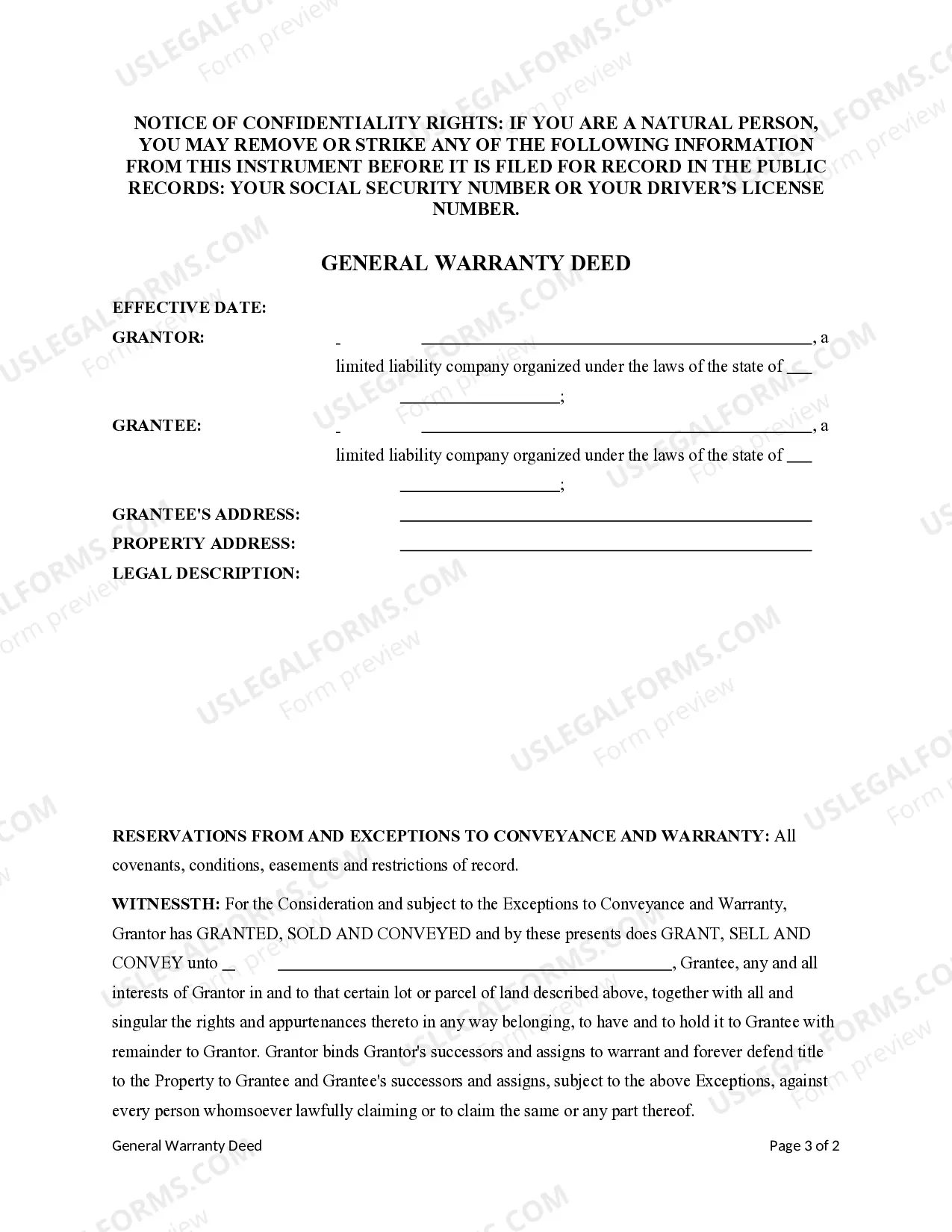

This form is a General Warranty Deed where the Grantor is a limited liability company (LLC) and the Grantee is a limited liability company (LLC). Grantor conveys and generally warrants the described property to the Grantee. This deed complies with all state statutory laws.

Austin Texas General Warranty Deed from LLC to LLC

Description

How to fill out Texas General Warranty Deed From LLC To LLC?

If you are in pursuit of a legitimate document, it’s unattainable to select a superior service than the US Legal Forms site – likely the most comprehensive repositories on the internet.

Here you can obtain a wide array of document samples for business and personal use by categories and regions, or keywords.

With our enhanced search functionality, acquiring the latest Austin Texas General Warranty Deed from LLC to LLC is as simple as 1-2-3.

Complete the transaction. Utilize your credit card or PayPal account to finalize the registration process.

Obtain the document. Choose the file format and download it to your device.

- Moreover, the validity of every single document is verified by a team of professional lawyers who routinely assess the templates on our platform and update them according to the latest state and county regulations.

- If you are already familiar with our service and possess a registered account, all that is required to obtain the Austin Texas General Warranty Deed from LLC to LLC is to Log In to your account and click the Download button.

- For those using US Legal Forms for the first time, simply adhere to the guidelines listed below.

- Ensure you have selected the document you desire. Review its description and use the Preview option (if available) to inspect its content. If it does not meet your requirements, utilize the Search field at the top of the screen to locate the necessary document.

- Verify your choice. Click the Buy now button. Afterward, choose your preferred subscription plan and provide the necessary details to register for an account.

Form popularity

FAQ

It is not just a case of forming a limited company and transferring your property by signing it over. You must sell your property to your new company at the market value, and this will attract some costs, for example: Capital Gains Tax. Stamp Duty Land Tax.

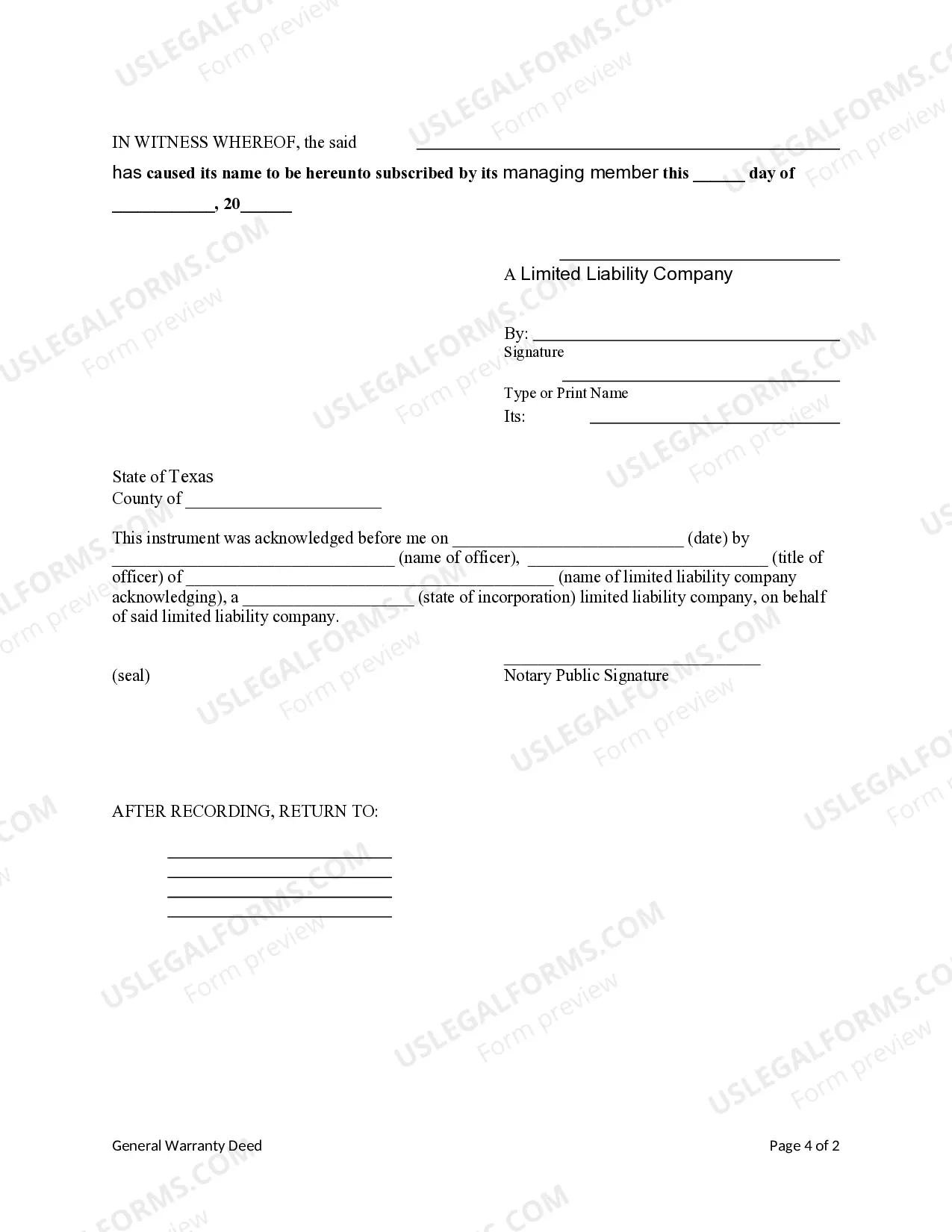

As a property owner and grantor, you can obtain a warranty deed for the transfer of real estate through a local realtor's office, or with an online search for a template. To make the form legally binding, you must sign it in front of a notary public.

It is not just a case of forming a limited company and transferring your property by signing it over. You must sell your property to your new company at the market value, and this will attract some costs, for example: Capital Gains Tax. Stamp Duty Land Tax.

General Warranty Deed prepared for $195.

How to Transfer Texas Real Estate Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor).Create a new deed.Sign and notarize the deed.File the documents in the county land records.

A Limited Liability Company, also known as an LLC, is a common type of entity which may be used to own real estate. A Texas LLC for real estate offers a number of benefits for property owners.

Here are eight steps on how to transfer property title to an LLC: Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

All property deeds ? $195 Any Property Deed needed to transfer real estate in Texas. Prepared by an attorney licensed in the state of Texas.

Avoiding Personal Liability This is the major advantage of an LLC. You want the best option for limiting your personal liability should an unforeseen circumstance arise relating to your property. LLCs provide that protection.

Your deed will be prepared by a Texas licensed attorney in about an hour. This fee does not include the county recording fee. The county recording fee is approximately $15 to $40, depending on the county the property is located in.