This form is a General Warranty Deed where the Grantor is a limited liability company (LLC) and the Grantee is a limited liability company (LLC). Grantor conveys and generally warrants the described property to the Grantee. This deed complies with all state statutory laws.

Houston Texas General Warranty Deed from LLC to LLC

Description

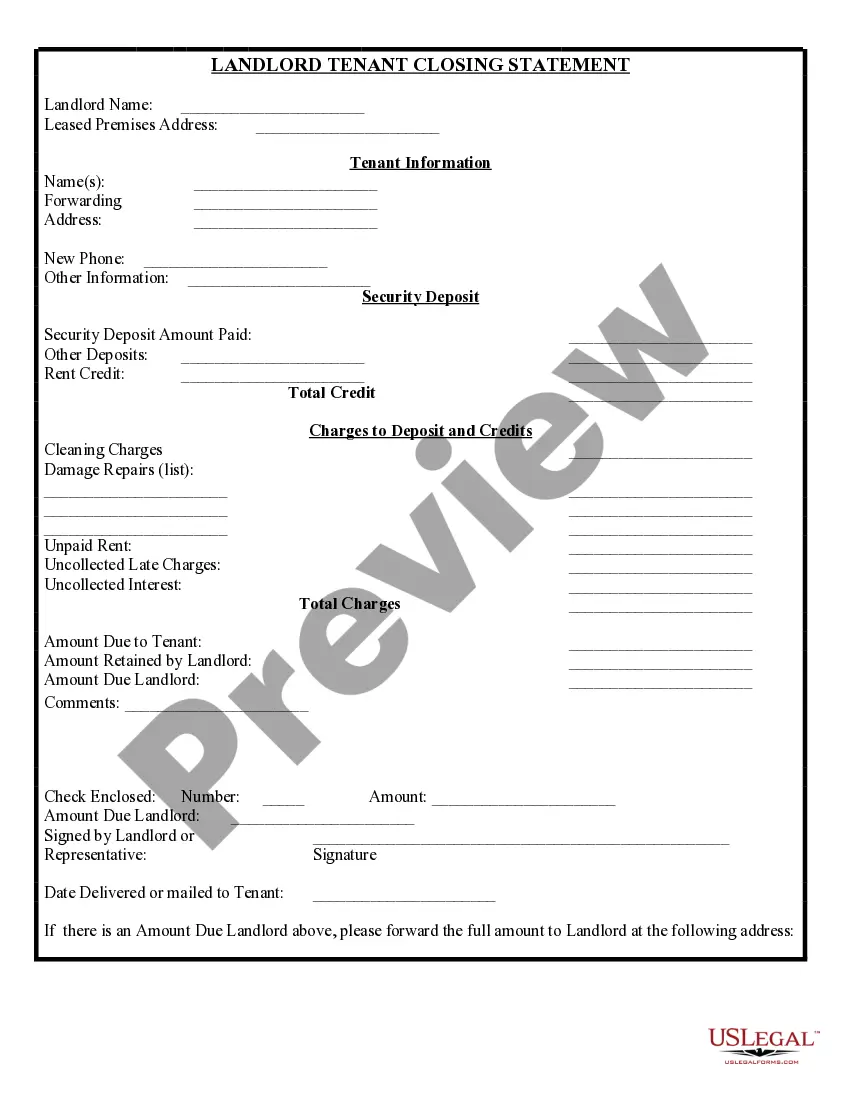

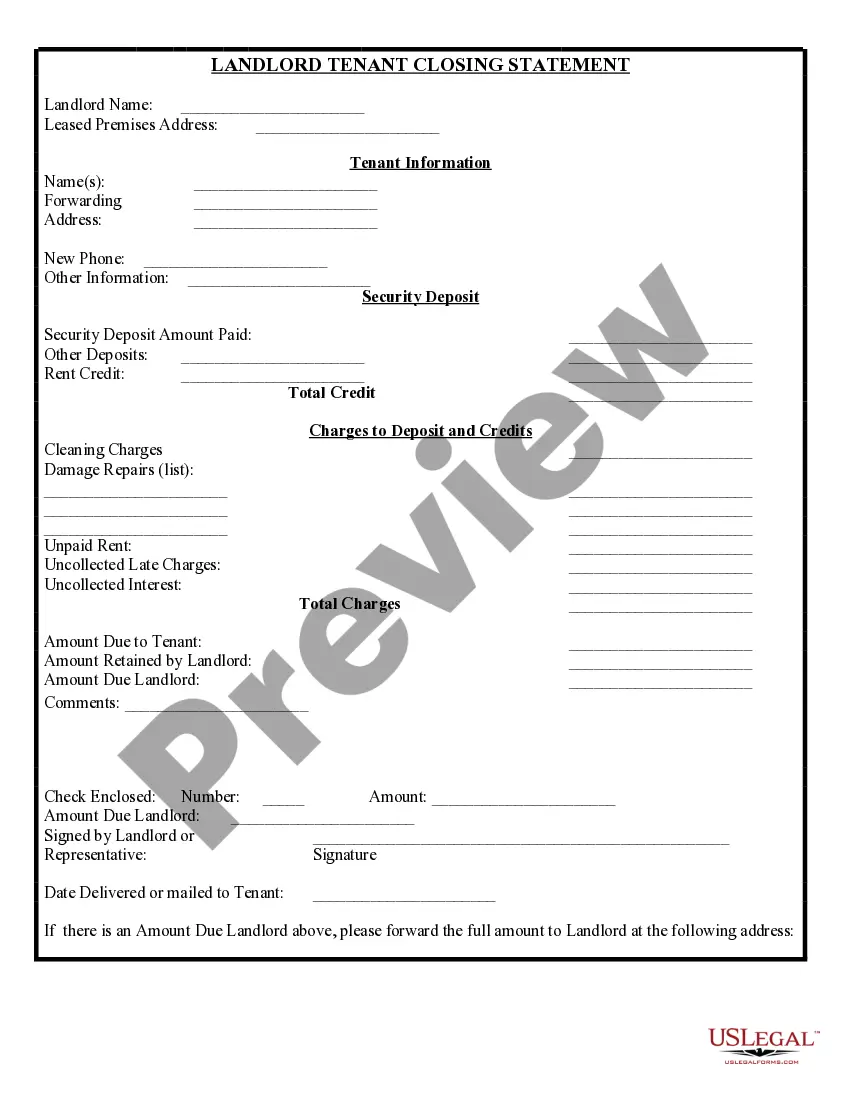

How to fill out Texas General Warranty Deed From LLC To LLC?

Utilize the US Legal Forms and gain instant access to any document you desire.

Our advantageous platform with a vast selection of templates streamlines the process of locating and acquiring nearly any document sample you need.

You can download, complete, and sign the Houston Texas General Warranty Deed from LLC to LLC in mere minutes instead of spending countless hours searching online for the appropriate template.

Using our catalog is an excellent method to enhance the security of your document submissions.

Open the page with the template you require. Ensure it is the document you were looking for: check its title and description, and use the Preview feature when available. Otherwise, use the Search bar to find the correct one.

Initiate the downloading process. Click Buy Now and choose the payment plan that fits you best. Then, register for an account and pay for your order using a credit card or PayPal.

- Our expert legal professionals frequently examine all records to confirm that the templates are applicable to a specific area and adhere to the latest laws and regulations.

- How can you acquire the Houston Texas General Warranty Deed from LLC to LLC.

- If you have an account, simply Log In to your account. The Download button will be active on all the documents you view.

- Furthermore, you can access all previously saved documents in the My documents section.

- If you haven’t created an account yet, follow the instructions outlined below.

Form popularity

FAQ

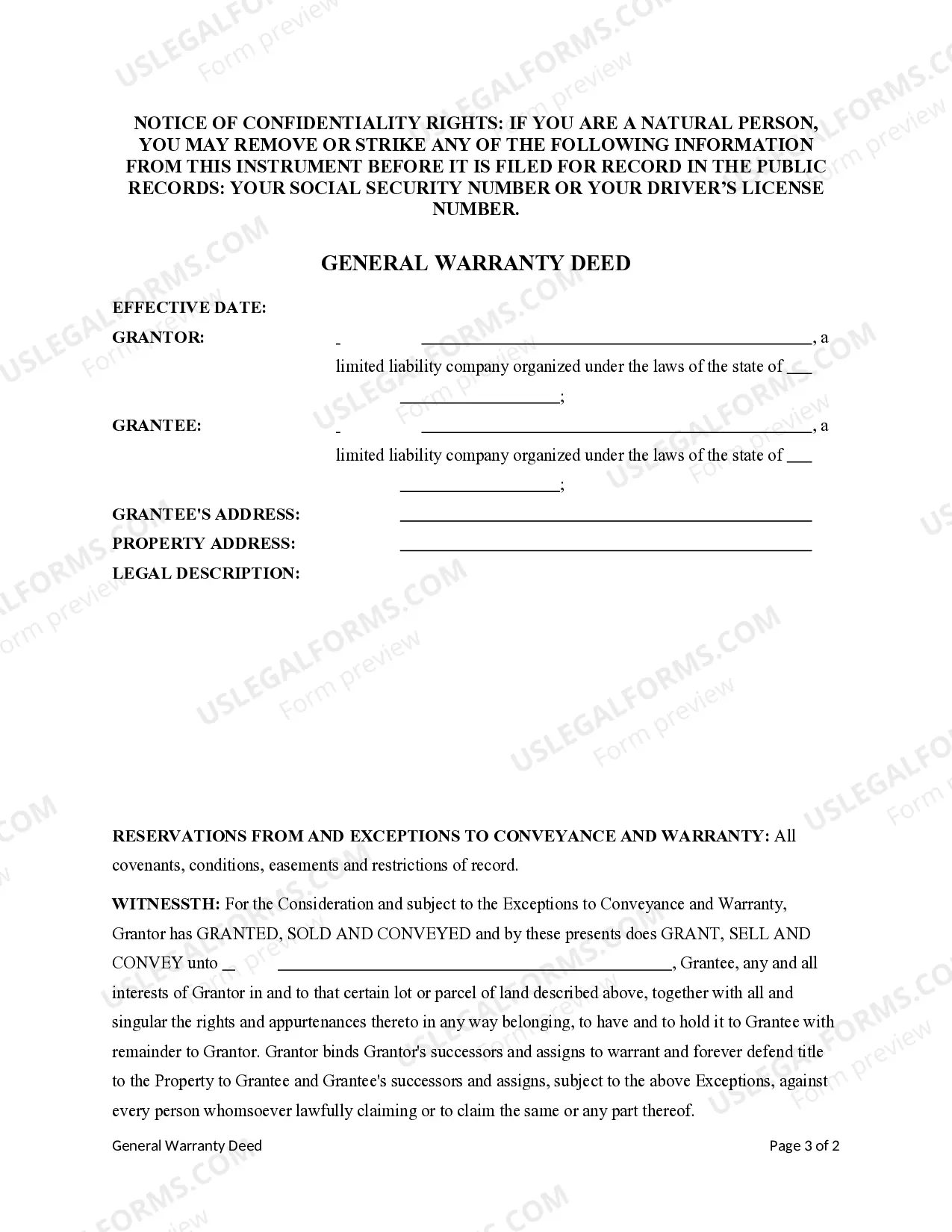

How to Transfer Texas Real Estate Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor).Create a new deed.Sign and notarize the deed.File the documents in the county land records.

In Texas, a deed must be in writing and signed by the person transferring the land. We call this the ?grantor.? The person the grantor transfers the land to is the ?grantee.? You do not have to use particular words to constitute a legally effective transfer.

It is not just a case of forming a limited company and transferring your property by signing it over. You must sell your property to your new company at the market value, and this will attract some costs, for example: Capital Gains Tax. Stamp Duty Land Tax.

General Warranty Deed prepared for $195.

Sometime you can live in the property owner by your limited company. This depends on your mortgage. If you have a buy to let mortgage, most lenders expressly forbid you from living in the property. Check with your lender.

SPECIAL Warranty Deed prepared for $195 Board Certified by the Texas Board of Legal Specialization in Residential Real Estate Law.

Here are eight steps on how to transfer property title to an LLC: Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

Think about the capital gains tax implications; a transfer of property to a company is chargeable to Capital Gain Tax (CGT) at the deemed Market Value of the property. Even if you are gifting property to limited company or transferring it at a lower value, it is chargeable to CGT.

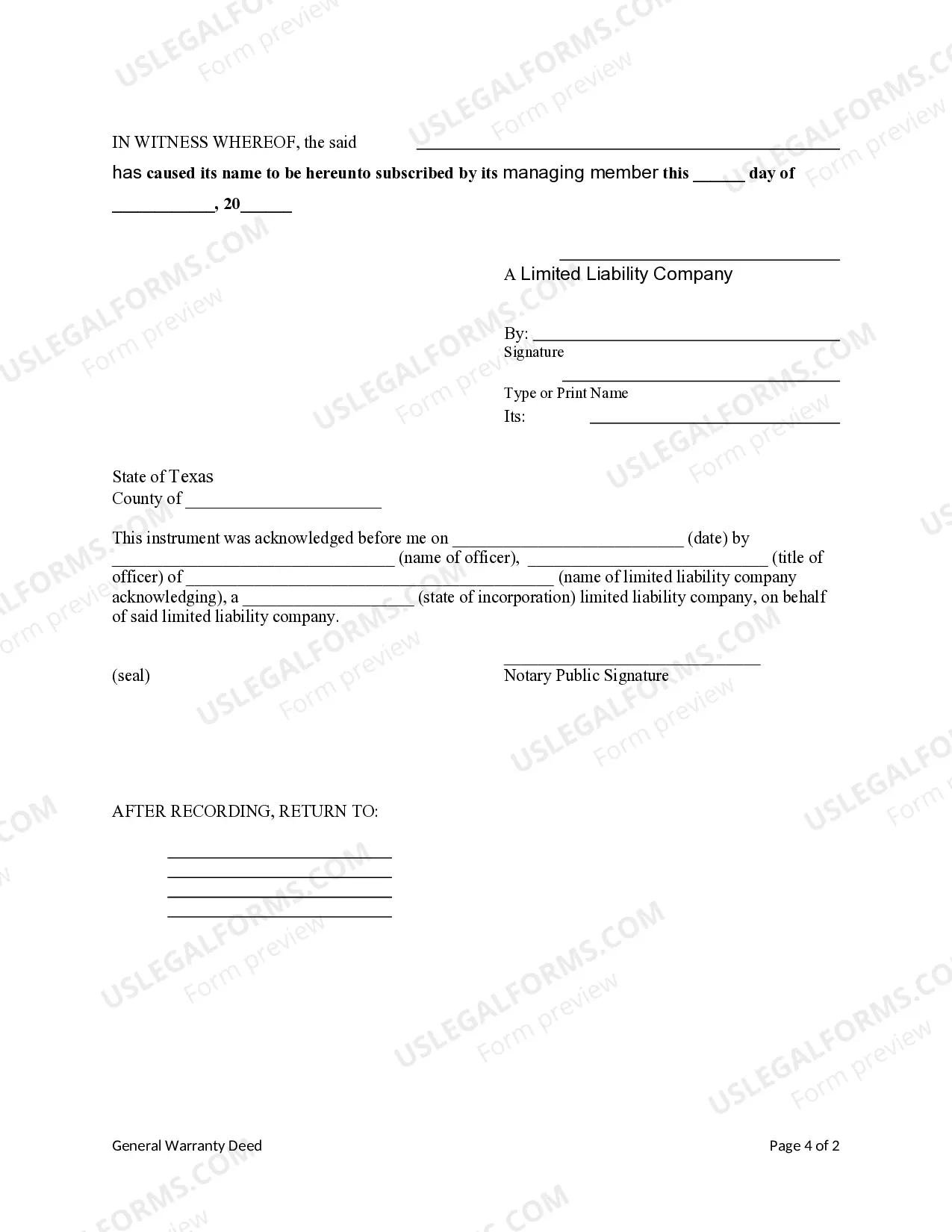

As a property owner and grantor, you can obtain a warranty deed for the transfer of real estate through a local realtor's office, or with an online search for a template. To make the form legally binding, you must sign it in front of a notary public.

Your deed will be prepared by a Texas licensed attorney in about an hour. This fee does not include the county recording fee. The county recording fee is approximately $15 to $40, depending on the county the property is located in.