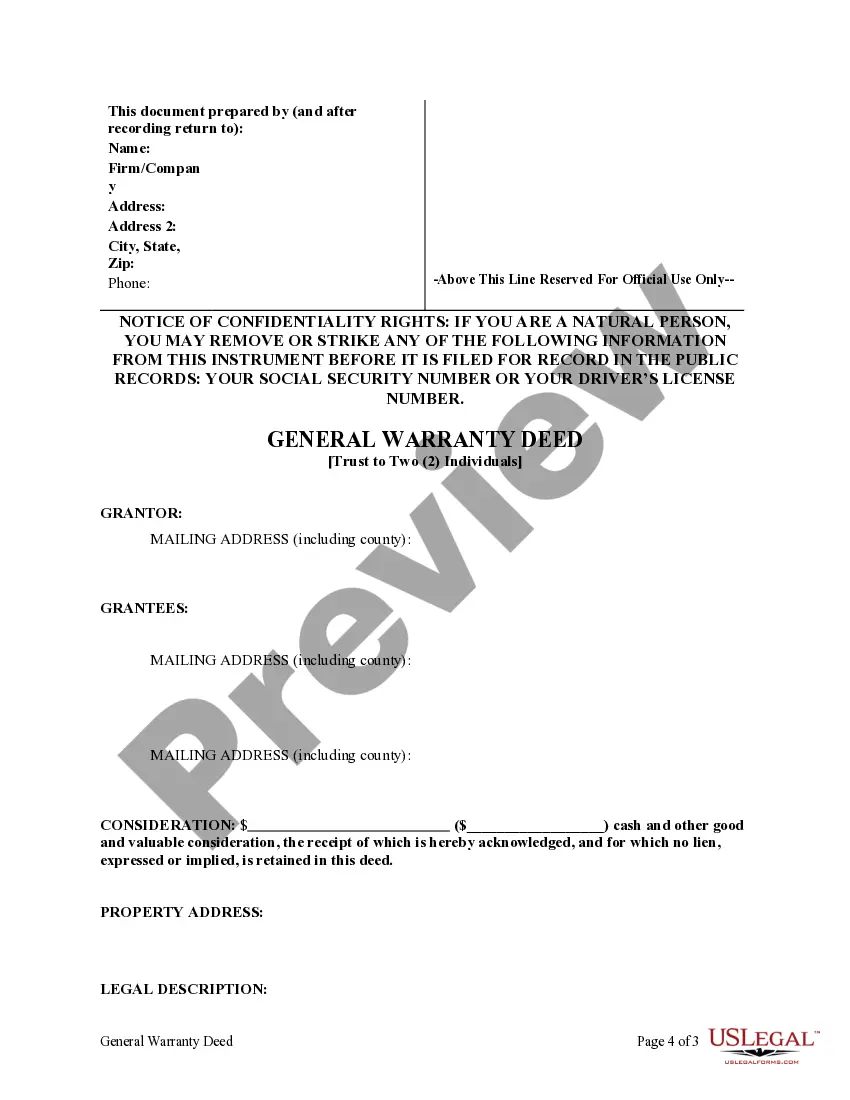

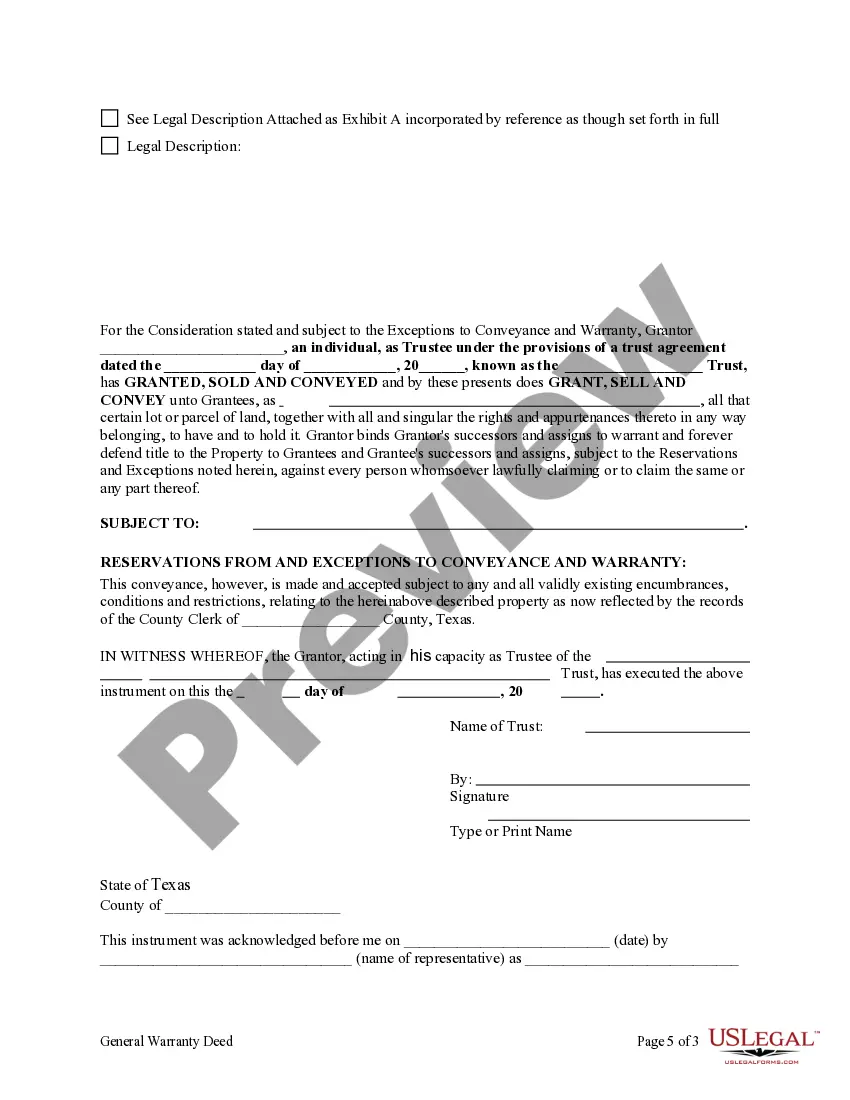

This form is a Warranty Deed where the Grantor is a Trust and the Grantees are two Individuals. Grantor conveys and warrants the described property to the Grantees. This deed complies with all state statutory laws.

A Waco Texas General Warranty Deed from Trust to Two Individuals is a legal document used to transfer ownership of real estate property from a trust to two individuals. This type of deed provides a comprehensive warranty of title, meaning that the seller (trust) guarantees that they have clear and valid ownership of the property and that there are no outstanding liens or encumbrances on the property. In Waco, Texas, there are several variations of the General Warranty Deed from Trust to Two Individuals, each catering to specific situations: 1. Joint Tenancy with Right of Survivorship: This type of deed is commonly used when two individuals wish to have equal ownership interest in the property, and as such, have the right of survivorship. In case one owner passes away, the surviving owner automatically inherits the deceased owner's share. 2. Tenants in Common: This deed type allows two individuals to have ownership in the property with unequal shares. Each person holds a specific percentage of ownership, and in case of death, their ownership interest is passed down according to their individual wills or state laws of intestacy. 3. Married Couple: If the two individuals are married, a special deed type called "Waco Texas General Warranty Deed from Trust to Married Couple" is used. This deed acknowledges the marital relationship and may include additional provisions related to the protection and division of property rights, considering Texas' community property laws. When drafting a Waco Texas General Warranty Deed from Trust to Two Individuals, important information needs to be included. This includes the names and addresses of the two individuals acquiring the property, a detailed legal description of the property, the name of the trust, the amount of consideration paid, and the signatures of the trustees or trustees' representatives. It is crucial to consult with a qualified real estate attorney when dealing with such complex legal transfers to ensure all necessary provisions are included and the deed is properly executed.