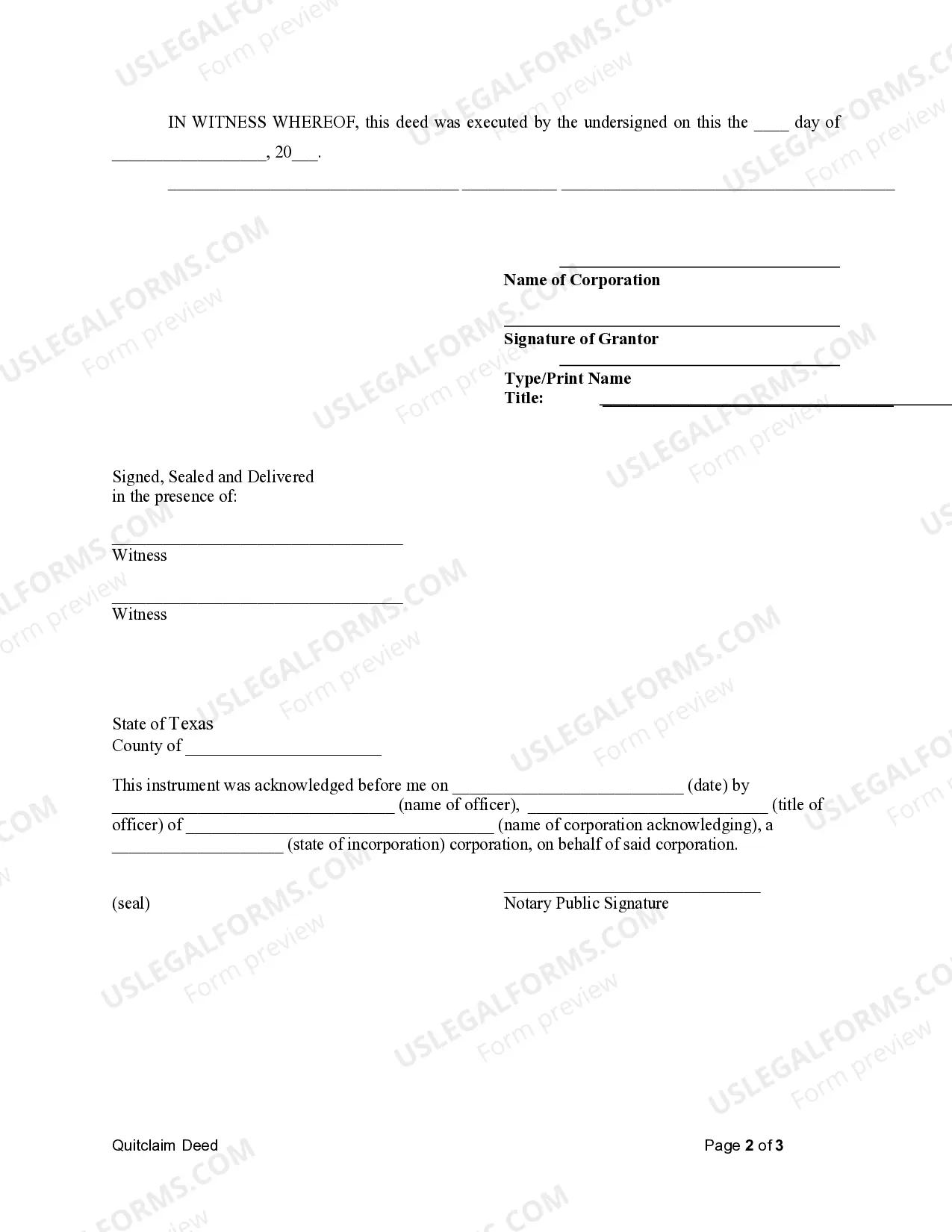

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Austin Texas Quitclaim Deed from Corporation to LLC

Description

How to fill out Texas Quitclaim Deed From Corporation To LLC?

Take advantage of the US Legal Forms and gain immediate access to any document you need.

Our user-friendly website featuring thousands of documents streamlines the process to discover and obtain nearly any document sample you need.

You can download, complete, and sign the Austin Texas Quitclaim Deed from Corporation to LLC in just a few minutes instead of spending hours browsing the Internet for a suitable template.

Utilizing our catalog is an excellent method to enhance the security of your file submissions.

If you haven’t created an account yet, follow the instructions below.

- Our experienced legal experts routinely review all the documents to ensure that the forms adhere to state-specific requirements and comply with updated laws and regulations.

- How can you access the Austin Texas Quitclaim Deed from Corporation to LLC.

- If you already have a subscription, simply Log In to your account.

- The Download option will be visible for all documents you access.

- Moreover, you can retrieve all your previously saved documents in the My documents section.

Form popularity

FAQ

Although you own the property, you cannot sell it at a discount to your limited company. This is because it is a sale and purchase transaction and tax implications must be considered. Consequently, the property must be sold at open market value.

Think about the capital gains tax implications; a transfer of property to a company is chargeable to Capital Gain Tax (CGT) at the deemed Market Value of the property. Even if you are gifting property to limited company or transferring it at a lower value, it is chargeable to CGT.

It is not just a case of forming a limited company and transferring your property by signing it over. You must sell your property to your new company at the market value, and this will attract some costs, for example: Capital Gains Tax. Stamp Duty Land Tax.

A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

All property deeds ? $195 Any Property Deed needed to transfer real estate in Texas. Prepared by an attorney licensed in the state of Texas.

Here are eight steps on how to transfer property title to an LLC: Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

Sometime you can live in the property owner by your limited company. This depends on your mortgage. If you have a buy to let mortgage, most lenders expressly forbid you from living in the property. Check with your lender.

A Limited Liability Company, also known as an LLC, is a common type of entity which may be used to own real estate. A Texas LLC for real estate offers a number of benefits for property owners.