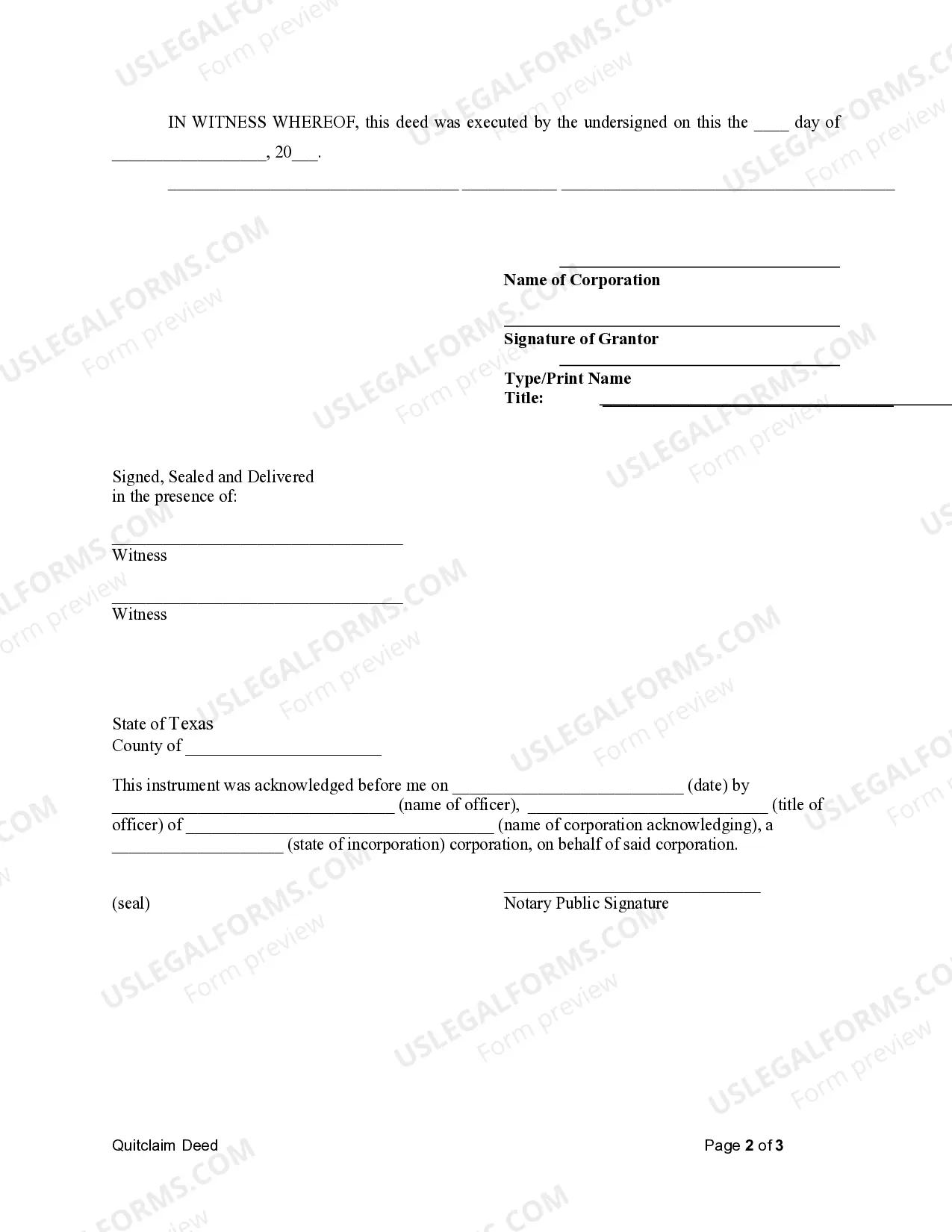

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Bexar Texas Quitclaim Deed from Corporation to LLC is a legal document that facilitates the transfer of property ownership from a corporation to a limited liability company (LLC) in Bexar County, Texas. This deed serves as evidence of the corporation's intent to quitclaim or release any interest it holds in the property to the LLC. In this type of transfer, all rights, title, and interest in the property are transferred without any warranties or guarantees. Unlike a warranty deed, a quitclaim deed offers no protection against potential defects in title or ownership. It only transfers whatever rights the corporation has, if any, with no assurance of clear ownership. There are several types of Bexar Texas Quitclaim Deed from Corporation to LLC that may vary depending on the specific circumstances and situations. Some common variations include: 1. Standard Bexar Texas Quitclaim Deed: This is the general term for a standard quitclaim deed used to transfer property ownership from a corporation to an LLC in Bexar County, Texas. It outlines the legal description of the property, identifies the parties involved, and details the transfer of ownership. 2. Bexar County Texas Quitclaim Deed with Consideration: This type of quitclaim deed includes a monetary consideration or payment in exchange for the transfer of property ownership from the corporation to the LLC. The consideration may be in the form of cash, stocks, or other assets. 3. Non-Warranty Bexar Texas Quitclaim Deed: This variation of the quitclaim deed explicitly states that no warranties or guarantees are provided by the corporation regarding the property's title or condition. The LLC accepts the property "as-is," assuming any potential risks or defects. 4. Bexar County Texas Quitclaim Deed with Reservations: This type of quitclaim deed allows the corporation to retain certain rights, interests, or reservations even after transferring the property to the LLC. These reservations could include easements, rights of way, or specific restrictions on the property's use. It's important to note that the specific requirements and language may vary depending on Bexar County's local laws, regulations, and guidelines. It is advisable to consult with a qualified attorney or legal professional to ensure all necessary legal formalities and considerations are met in the drafting and execution of the Bexar Texas Quitclaim Deed from Corporation to LLC.Bexar Texas Quitclaim Deed from Corporation to LLC is a legal document that facilitates the transfer of property ownership from a corporation to a limited liability company (LLC) in Bexar County, Texas. This deed serves as evidence of the corporation's intent to quitclaim or release any interest it holds in the property to the LLC. In this type of transfer, all rights, title, and interest in the property are transferred without any warranties or guarantees. Unlike a warranty deed, a quitclaim deed offers no protection against potential defects in title or ownership. It only transfers whatever rights the corporation has, if any, with no assurance of clear ownership. There are several types of Bexar Texas Quitclaim Deed from Corporation to LLC that may vary depending on the specific circumstances and situations. Some common variations include: 1. Standard Bexar Texas Quitclaim Deed: This is the general term for a standard quitclaim deed used to transfer property ownership from a corporation to an LLC in Bexar County, Texas. It outlines the legal description of the property, identifies the parties involved, and details the transfer of ownership. 2. Bexar County Texas Quitclaim Deed with Consideration: This type of quitclaim deed includes a monetary consideration or payment in exchange for the transfer of property ownership from the corporation to the LLC. The consideration may be in the form of cash, stocks, or other assets. 3. Non-Warranty Bexar Texas Quitclaim Deed: This variation of the quitclaim deed explicitly states that no warranties or guarantees are provided by the corporation regarding the property's title or condition. The LLC accepts the property "as-is," assuming any potential risks or defects. 4. Bexar County Texas Quitclaim Deed with Reservations: This type of quitclaim deed allows the corporation to retain certain rights, interests, or reservations even after transferring the property to the LLC. These reservations could include easements, rights of way, or specific restrictions on the property's use. It's important to note that the specific requirements and language may vary depending on Bexar County's local laws, regulations, and guidelines. It is advisable to consult with a qualified attorney or legal professional to ensure all necessary legal formalities and considerations are met in the drafting and execution of the Bexar Texas Quitclaim Deed from Corporation to LLC.