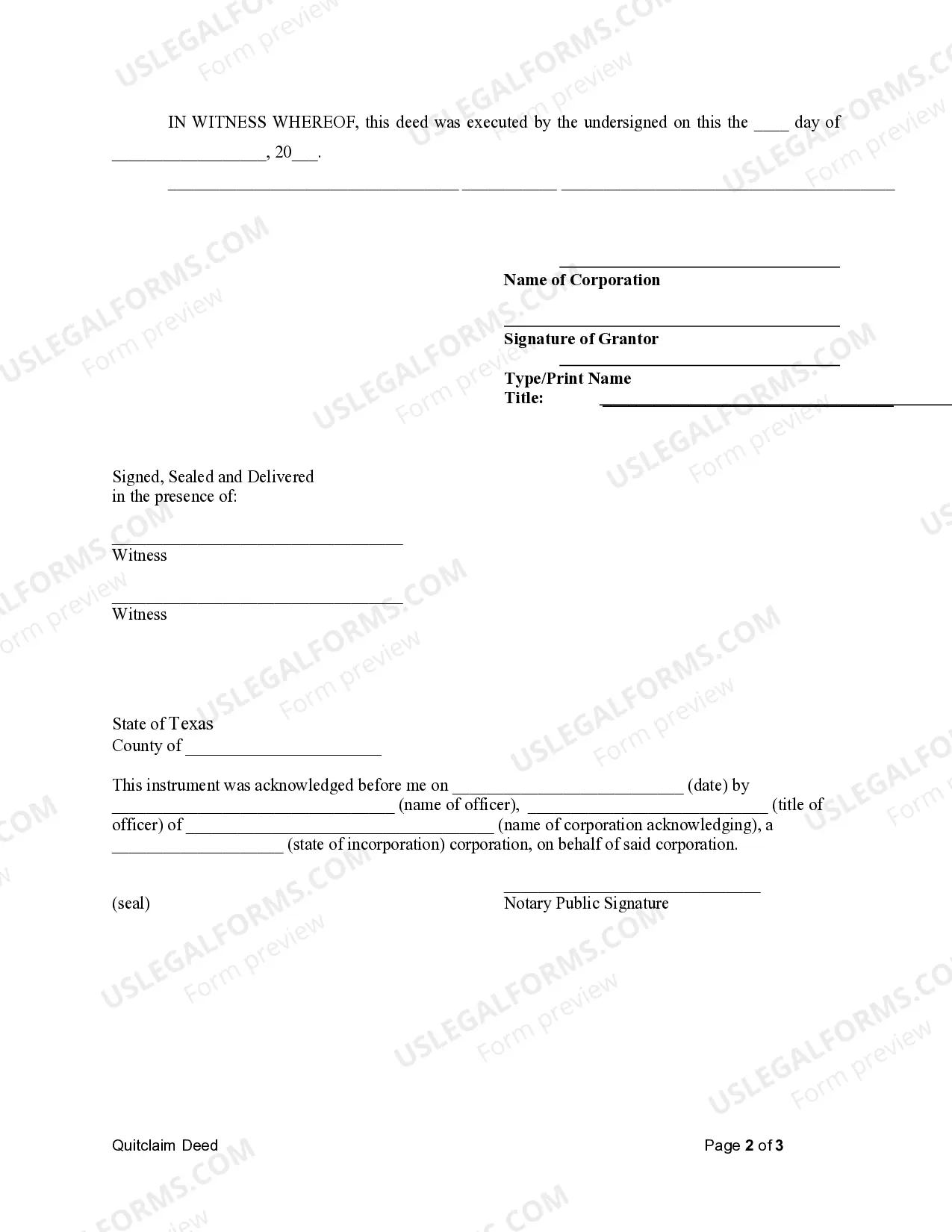

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Brownsville Texas Quitclaim Deed from Corporation to LLC is a legal document used to transfer ownership or interest in a property from a corporation to a limited liability company (LLC) in the city of Brownsville, Texas. This type of transfer is often done when a corporation wants to restructure its business or consolidate assets within an LLC owned by the same individuals or entities. This quitclaim deed serves as a legal proof of the transfer, ensuring that the corporation relinquishes all rights, title, and interest it had in the property to the LLC. It provides clear and transparent information about the transfer, outlining the specific details such as the names of the parties involved, the property description, and the date of transfer. There are a few different types of Brownsville Texas Quitclaim Deeds from Corporation to LLC, each with its specific purposes and considerations: 1. Brownsville Texas Quitclaim Deed for Business Restructuring: This type of quitclaim deed is commonly used when a corporation wants to restructure its operations and transfer ownership of real estate assets to an LLC controlled by the same individuals or entities. It allows for a seamless transition of ownership while maintaining separate legal entities. 2. Brownsville Texas Quitclaim Deed for Liability Protection: Sometimes, corporations transfer property to an LLC to limit liability. By transferring assets to an LLC, owners can protect their personal assets and separate them from potential risks and liabilities associated with the corporation. 3. Brownsville Texas Quitclaim Deed for Tax Efficiency: Transferring real estate from a corporation to an LLC may also be done for tax purposes. This type of quitclaim deed can help streamline tax planning, as LCS often offer more flexibility in terms of pass-through taxation and deductions. It is important to note that the specific requirements and regulations for a Brownsville Texas Quitclaim Deed may vary, and it is always recommended consulting with a qualified real estate attorney or legal professional to ensure compliance with local laws and regulations.A Brownsville Texas Quitclaim Deed from Corporation to LLC is a legal document used to transfer ownership or interest in a property from a corporation to a limited liability company (LLC) in the city of Brownsville, Texas. This type of transfer is often done when a corporation wants to restructure its business or consolidate assets within an LLC owned by the same individuals or entities. This quitclaim deed serves as a legal proof of the transfer, ensuring that the corporation relinquishes all rights, title, and interest it had in the property to the LLC. It provides clear and transparent information about the transfer, outlining the specific details such as the names of the parties involved, the property description, and the date of transfer. There are a few different types of Brownsville Texas Quitclaim Deeds from Corporation to LLC, each with its specific purposes and considerations: 1. Brownsville Texas Quitclaim Deed for Business Restructuring: This type of quitclaim deed is commonly used when a corporation wants to restructure its operations and transfer ownership of real estate assets to an LLC controlled by the same individuals or entities. It allows for a seamless transition of ownership while maintaining separate legal entities. 2. Brownsville Texas Quitclaim Deed for Liability Protection: Sometimes, corporations transfer property to an LLC to limit liability. By transferring assets to an LLC, owners can protect their personal assets and separate them from potential risks and liabilities associated with the corporation. 3. Brownsville Texas Quitclaim Deed for Tax Efficiency: Transferring real estate from a corporation to an LLC may also be done for tax purposes. This type of quitclaim deed can help streamline tax planning, as LCS often offer more flexibility in terms of pass-through taxation and deductions. It is important to note that the specific requirements and regulations for a Brownsville Texas Quitclaim Deed may vary, and it is always recommended consulting with a qualified real estate attorney or legal professional to ensure compliance with local laws and regulations.