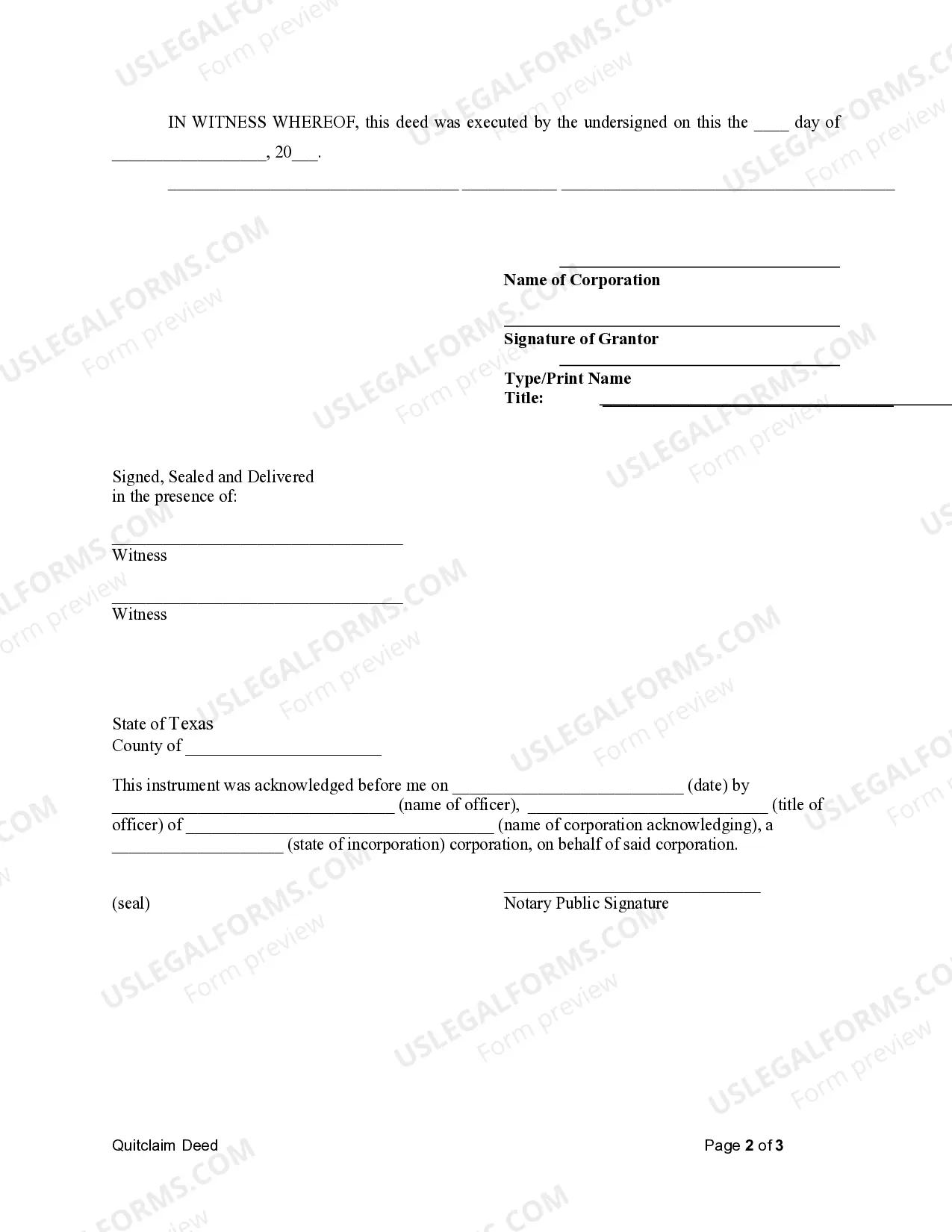

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Collin Texas Quitclaim Deed from Corporation to LLC is a legal document that transfers ownership of a property from a corporation to a Limited Liability Company (LLC) in Collin County, Texas. This type of deed is commonly used when a corporation wants to transfer its property assets to an LLC that it owns or controls. A Quitclaim Deed is a type of deed that conveys the interests and rights the granter (in this case, the corporation) has in the property to the grantee (the LLC). This means that the corporation is "quitting" or terminating any claim it may have on the property, and transferring it to the LLC. There are different types of Collin Texas Quitclaim Deeds from Corporation to LLC that can be used based on specific circumstances: 1. General Collin Texas Quitclaim Deed from Corporation to LLC: This is the most common type of quitclaim deed used in Collin County, Texas. It transfers the corporation's full interest in the property to the LLC without any warranties or guarantees. It simply transfers whatever interest the corporation has, whether it is fee simple absolute ownership or a lesser interest. 2. Special Collin Texas Quitclaim Deed from Corporation to LLC: This type of quitclaim deed specifies certain special conditions or limitations on the transfer of the property from the corporation to the LLC. These conditions could include restrictions on land use, development rights, or specific obligations and responsibilities that the LLC must adhere to. 3. Collin Texas Quitclaim Deed with Covenant against Granter's Acts: This type of quitclaim deed includes an additional provision called a covenant against granter's acts. This covenant assures the grantee (the LLC) that the granter (the corporation) has not done anything that would affect the title or interest in the property. It provides some level of assurance to the LLC against any potential defects in the title. When preparing a Collin Texas Quitclaim Deed from Corporation to LLC, it is essential to consult an experienced real estate attorney to ensure that all legal requirements are met, and the transfer is executed properly. The deed must be properly executed, notarized, and filed with the Collin County Clerk's Office to make it legally binding. In conclusion, a Collin Texas Quitclaim Deed from Corporation to LLC is a legal document used to transfer ownership of a property from a corporation to an LLC. Different types of quitclaim deeds, including general, special, and those with covenants against granter's acts, may be used depending on the specific circumstances of the transfer. Seeking professional legal advice is crucial to ensure compliance with all requirements and proper execution of the deed.A Collin Texas Quitclaim Deed from Corporation to LLC is a legal document that transfers ownership of a property from a corporation to a Limited Liability Company (LLC) in Collin County, Texas. This type of deed is commonly used when a corporation wants to transfer its property assets to an LLC that it owns or controls. A Quitclaim Deed is a type of deed that conveys the interests and rights the granter (in this case, the corporation) has in the property to the grantee (the LLC). This means that the corporation is "quitting" or terminating any claim it may have on the property, and transferring it to the LLC. There are different types of Collin Texas Quitclaim Deeds from Corporation to LLC that can be used based on specific circumstances: 1. General Collin Texas Quitclaim Deed from Corporation to LLC: This is the most common type of quitclaim deed used in Collin County, Texas. It transfers the corporation's full interest in the property to the LLC without any warranties or guarantees. It simply transfers whatever interest the corporation has, whether it is fee simple absolute ownership or a lesser interest. 2. Special Collin Texas Quitclaim Deed from Corporation to LLC: This type of quitclaim deed specifies certain special conditions or limitations on the transfer of the property from the corporation to the LLC. These conditions could include restrictions on land use, development rights, or specific obligations and responsibilities that the LLC must adhere to. 3. Collin Texas Quitclaim Deed with Covenant against Granter's Acts: This type of quitclaim deed includes an additional provision called a covenant against granter's acts. This covenant assures the grantee (the LLC) that the granter (the corporation) has not done anything that would affect the title or interest in the property. It provides some level of assurance to the LLC against any potential defects in the title. When preparing a Collin Texas Quitclaim Deed from Corporation to LLC, it is essential to consult an experienced real estate attorney to ensure that all legal requirements are met, and the transfer is executed properly. The deed must be properly executed, notarized, and filed with the Collin County Clerk's Office to make it legally binding. In conclusion, a Collin Texas Quitclaim Deed from Corporation to LLC is a legal document used to transfer ownership of a property from a corporation to an LLC. Different types of quitclaim deeds, including general, special, and those with covenants against granter's acts, may be used depending on the specific circumstances of the transfer. Seeking professional legal advice is crucial to ensure compliance with all requirements and proper execution of the deed.