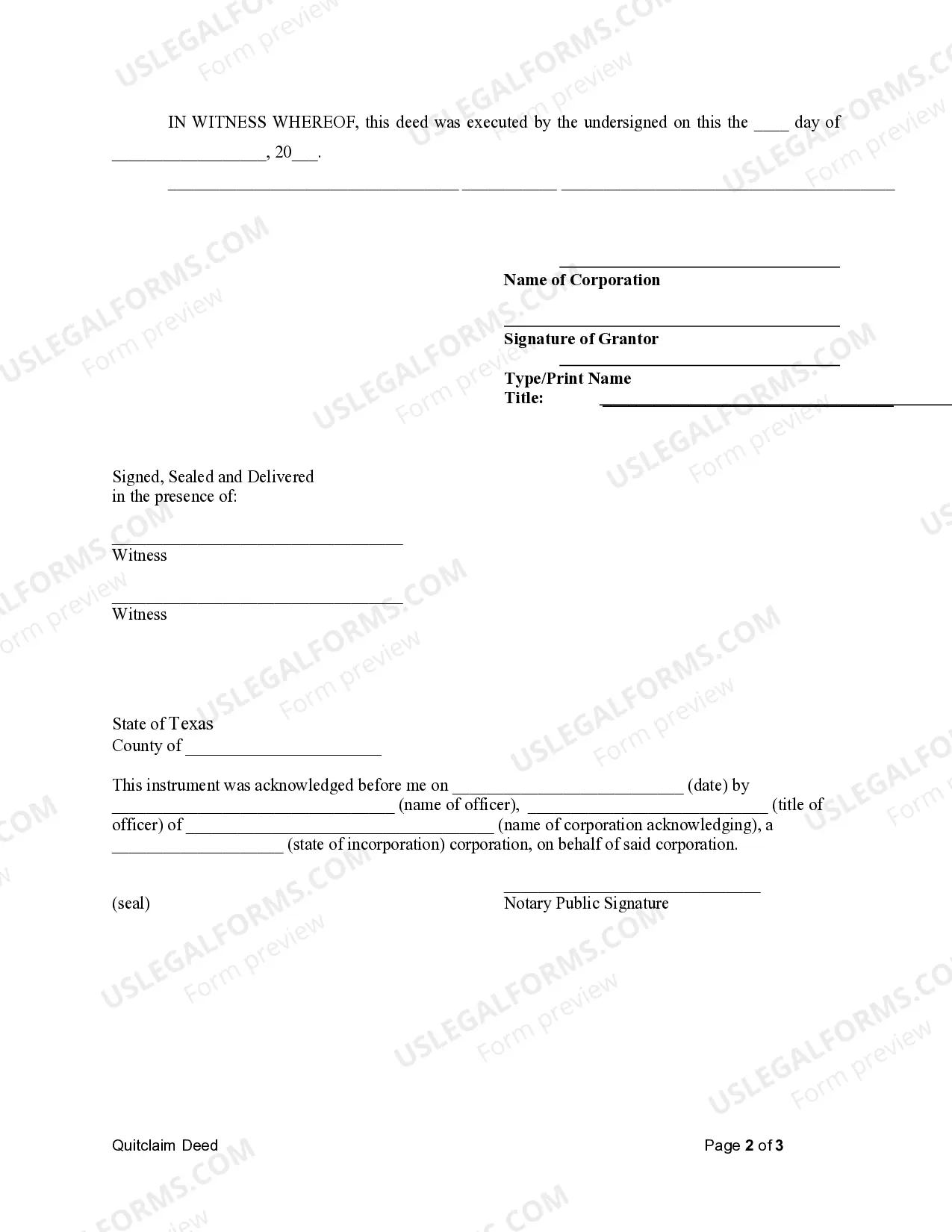

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Dallas Texas Quitclaim Deed from Corporation to LLC refers to the legal transfer of real estate ownership between a corporation and a limited liability company (LLC) in Dallas, Texas. This type of deed is commonly used when a corporation wishes to transfer property to an LLC entity, usually for the purpose of asset protection or business restructuring. A Quitclaim Deed is a legal document typically used in real estate transactions to convey ownership rights from one party, referred to as the granter (in this case, the corporation), to another party, known as the grantee (the LLC). Unlike a warranty deed, a quitclaim deed does not provide any guarantee or warranty regarding the property title's validity or any potential claims or liens existing on the property. In Dallas, Texas, there are different variants or specific types of Quitclaim Deeds that can be used when transferring property ownership from a corporation to an LLC. These may include: 1. General Quitclaim Deed: This is the most common type of Quitclaim Deed used in Dallas, Texas. It transfers all ownership rights and interest in the property from the corporation to the LLC. 2. Special Purpose Quitclaim Deed: This type of deed may include specific conditions, restrictions, or covenants related to the transfer. For instance, it might include limitations on the use of the property or any obligations the LLC must adhere to based on the terms set by the corporation. 3. Trust Quitclaim Deed: If the corporation holds the property in a trust, this type of deed is used to transfer ownership from the trust to the LLC. The LLC then becomes the new trustee, responsible for managing the property. 4. Intellectual Property Quitclaim Deed: In certain cases, corporations may wish to transfer intellectual property rights or assets to an LLC. This type of deed facilitates the transfer of intellectual property rights, copyrights, trademarks, or patents from the corporation to the LLC. When preparing a Dallas Texas Quitclaim Deed from Corporation to LLC, it is essential to follow proper legal procedures, ensuring the deed is accurately drafted, signed by authorized parties, notarized, and filed with the appropriate Dallas County Recorder's office. It is advisable to consult with a qualified real estate attorney or a legal professional experienced in Texas real estate transactions to guide you through the process and ensure a smooth and legally valid transfer of property ownership.A Dallas Texas Quitclaim Deed from Corporation to LLC refers to the legal transfer of real estate ownership between a corporation and a limited liability company (LLC) in Dallas, Texas. This type of deed is commonly used when a corporation wishes to transfer property to an LLC entity, usually for the purpose of asset protection or business restructuring. A Quitclaim Deed is a legal document typically used in real estate transactions to convey ownership rights from one party, referred to as the granter (in this case, the corporation), to another party, known as the grantee (the LLC). Unlike a warranty deed, a quitclaim deed does not provide any guarantee or warranty regarding the property title's validity or any potential claims or liens existing on the property. In Dallas, Texas, there are different variants or specific types of Quitclaim Deeds that can be used when transferring property ownership from a corporation to an LLC. These may include: 1. General Quitclaim Deed: This is the most common type of Quitclaim Deed used in Dallas, Texas. It transfers all ownership rights and interest in the property from the corporation to the LLC. 2. Special Purpose Quitclaim Deed: This type of deed may include specific conditions, restrictions, or covenants related to the transfer. For instance, it might include limitations on the use of the property or any obligations the LLC must adhere to based on the terms set by the corporation. 3. Trust Quitclaim Deed: If the corporation holds the property in a trust, this type of deed is used to transfer ownership from the trust to the LLC. The LLC then becomes the new trustee, responsible for managing the property. 4. Intellectual Property Quitclaim Deed: In certain cases, corporations may wish to transfer intellectual property rights or assets to an LLC. This type of deed facilitates the transfer of intellectual property rights, copyrights, trademarks, or patents from the corporation to the LLC. When preparing a Dallas Texas Quitclaim Deed from Corporation to LLC, it is essential to follow proper legal procedures, ensuring the deed is accurately drafted, signed by authorized parties, notarized, and filed with the appropriate Dallas County Recorder's office. It is advisable to consult with a qualified real estate attorney or a legal professional experienced in Texas real estate transactions to guide you through the process and ensure a smooth and legally valid transfer of property ownership.