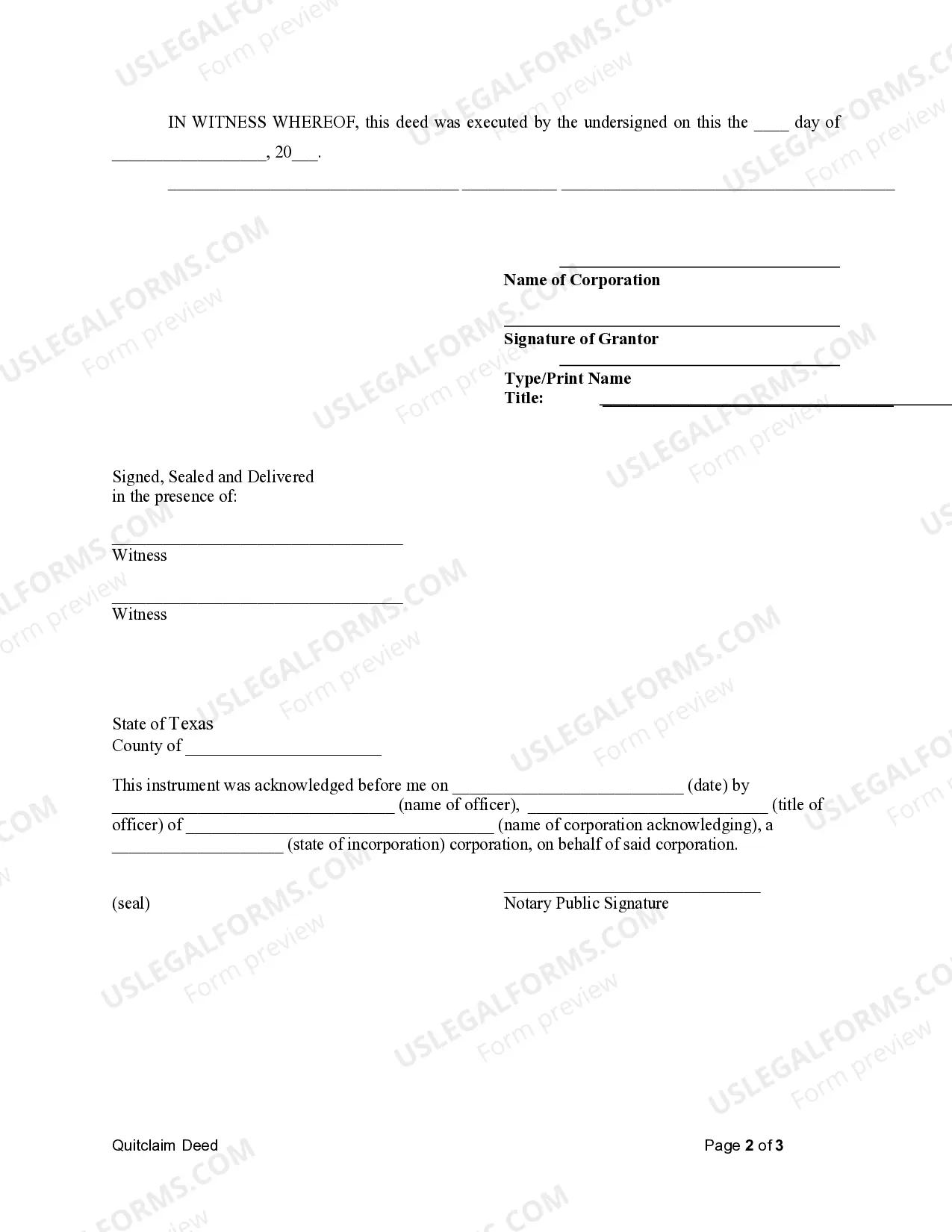

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

The Edinburg Texas Quitclaim Deed from Corporation to LLC is a legal document that allows a corporation to transfer ownership of a property to a limited liability company (LLC) through a quitclaim deed. This kind of transaction is common when a corporation wants to restructure its assets or transfer ownership to a separate business entity. The Edinburg Texas Quitclaim Deed from Corporation to LLC serves as evidence of the transfer of ownership from the corporation to the LLC. It outlines the details of the property being transferred, including its legal description, address, and any encumbrances or liens attached to the property. This type of deed guarantees that the corporation is releasing all its interest, rights, and claims to the property, including any unknown or undisclosed claims. However, it does not provide any warranties or guarantees regarding the property's title or condition. There are different variations of the Edinburg Texas Quitclaim Deed from Corporation to LLC, which may include: 1. Standard Edinburg Texas Quitclaim Deed from Corporation to LLC: This is the most common type of quitclaim deed used for transferring property ownership from a corporation to an LLC in Edinburg, Texas. 2. Special Edinburg Texas Quitclaim Deed from Corporation to LLC: This variation may include specific conditions or clauses tailored to the unique circumstances of the transfer. It can address restrictions or limitations on property use, rights granted to certain individuals, or any other special provisions deemed necessary. 3. Edinburg Texas Quitclaim Deed from Corporation to LLC with Financial Consideration: In some cases, a corporation may transfer property to an LLC in exchange for financial compensation or other valuable considerations. This type of quitclaim deed may include additional sections outlining the financial terms of the transaction. It is essential to consult with a qualified attorney or real estate professional familiar with Edinburg, Texas real estate laws before proceeding with such a transaction. They can provide guidance on which type of quitclaim deed is best suited for your specific scenario and ensure all legal requirements are met. Overall, the Edinburg Texas Quitclaim Deed from Corporation to LLC offers a streamlined process for transferring property ownership from a corporation to an LLC, providing both parties with legal proof of the transaction and facilitating efficient asset management.The Edinburg Texas Quitclaim Deed from Corporation to LLC is a legal document that allows a corporation to transfer ownership of a property to a limited liability company (LLC) through a quitclaim deed. This kind of transaction is common when a corporation wants to restructure its assets or transfer ownership to a separate business entity. The Edinburg Texas Quitclaim Deed from Corporation to LLC serves as evidence of the transfer of ownership from the corporation to the LLC. It outlines the details of the property being transferred, including its legal description, address, and any encumbrances or liens attached to the property. This type of deed guarantees that the corporation is releasing all its interest, rights, and claims to the property, including any unknown or undisclosed claims. However, it does not provide any warranties or guarantees regarding the property's title or condition. There are different variations of the Edinburg Texas Quitclaim Deed from Corporation to LLC, which may include: 1. Standard Edinburg Texas Quitclaim Deed from Corporation to LLC: This is the most common type of quitclaim deed used for transferring property ownership from a corporation to an LLC in Edinburg, Texas. 2. Special Edinburg Texas Quitclaim Deed from Corporation to LLC: This variation may include specific conditions or clauses tailored to the unique circumstances of the transfer. It can address restrictions or limitations on property use, rights granted to certain individuals, or any other special provisions deemed necessary. 3. Edinburg Texas Quitclaim Deed from Corporation to LLC with Financial Consideration: In some cases, a corporation may transfer property to an LLC in exchange for financial compensation or other valuable considerations. This type of quitclaim deed may include additional sections outlining the financial terms of the transaction. It is essential to consult with a qualified attorney or real estate professional familiar with Edinburg, Texas real estate laws before proceeding with such a transaction. They can provide guidance on which type of quitclaim deed is best suited for your specific scenario and ensure all legal requirements are met. Overall, the Edinburg Texas Quitclaim Deed from Corporation to LLC offers a streamlined process for transferring property ownership from a corporation to an LLC, providing both parties with legal proof of the transaction and facilitating efficient asset management.