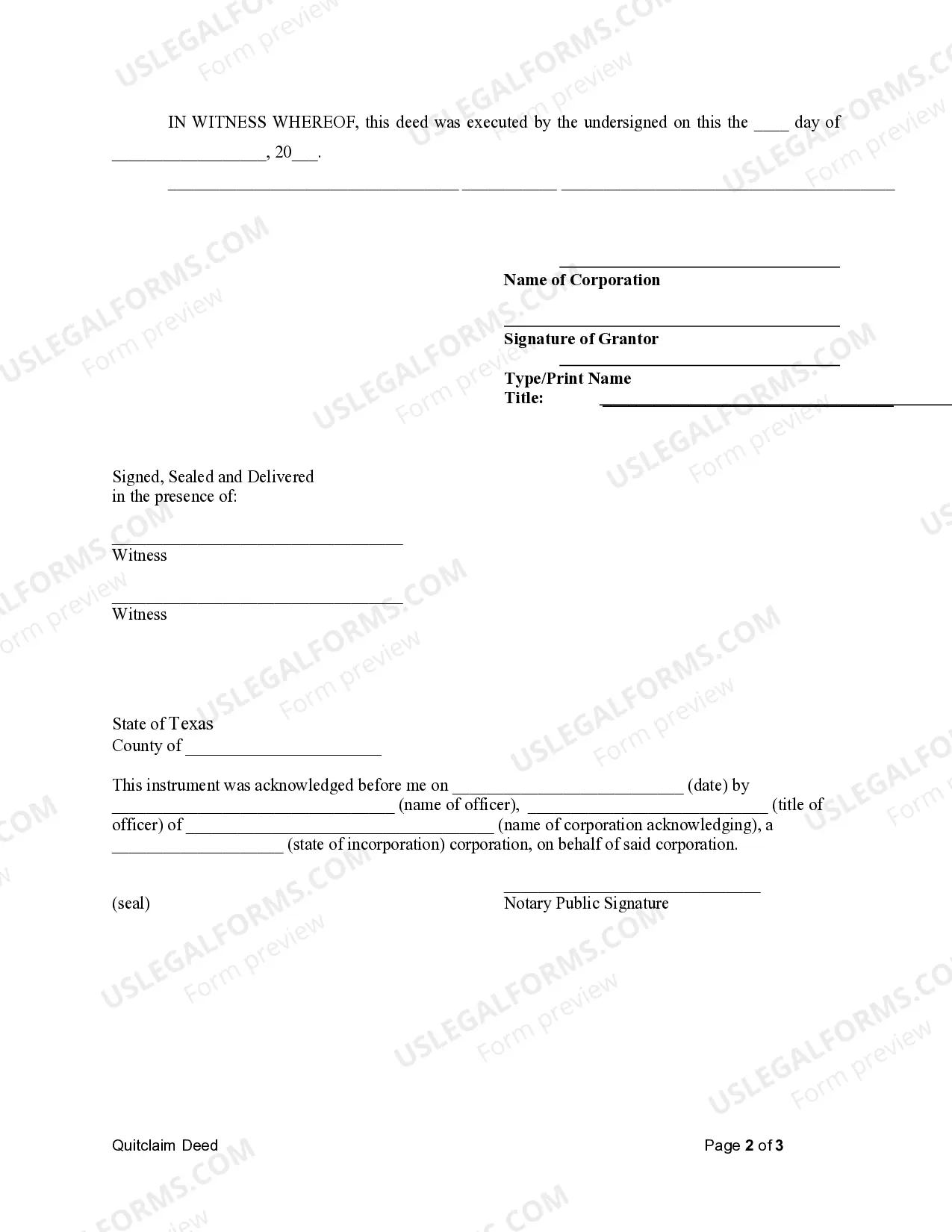

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Frisco Texas Quitclaim Deed from Corporation to LLC is a legal document that transfers ownership of a property from a corporation to a Limited Liability Company (LLC) in Frisco, Texas. This deed is commonly used when a corporation wishes to transfer the ownership of a property it owns to an LLC it has formed or has an interest in. This type of deed is typically used when there is a need for restructuring a business or to separate the ownership of a property from the corporation's business activities. The transfer is made by the corporation relinquishing any claims or interests it has in the property, transferring them to the LLC. There are different types of Frisco Texas Quitclaim Deeds from Corporation to LLC, including but not limited to: 1. General Frisco Texas Quitclaim Deed from Corporation to LLC: This is a typical deed that transfers the ownership of the property, including all rights, title, and interest in the property, from the corporation to the LLC. The corporation gives up any claims it might have on the property, and the LLC becomes the new owner. 2. Exempt Frisco Texas Quitclaim Deed from Corporation to LLC: This is a specialized deed that exempts the transfer of the property from certain taxes or fees. It may be used in specific situations where the transfer is exempt from certain legal requirements or governmental fees. 3. Warranty Frisco Texas Quitclaim Deed from Corporation to LLC: This type of deed guarantees that the property being transferred is free of any liens, encumbrances, or claims, both from the corporation and any previous owners. It provides additional protection to the LLC by ensuring clear title to the property. 4. Affidavit of Title Frisco Texas Quitclaim Deed from Corporation to LLC: This is an accompanying document that states that the corporation has clear title to the property being transferred and that it has the legal right to transfer it to the LLC. It is often required by title companies or lenders before completing a sale or refinancing transaction. It is important to consult with a real estate attorney or experienced professionals to ensure the proper execution of a Frisco Texas Quitclaim Deed from Corporation to LLC. Keywords relevant to this topic include Frisco Texas, Quitclaim Deed, Corporation, LLC, property transfer, ownership transfer, legal document, restructuring, business activities, rights, title, interest, taxes, fees, liens, encumbrances, claims, warranty, clear title, affidavit of title, real estate attorney, and professional advice.A Frisco Texas Quitclaim Deed from Corporation to LLC is a legal document that transfers ownership of a property from a corporation to a Limited Liability Company (LLC) in Frisco, Texas. This deed is commonly used when a corporation wishes to transfer the ownership of a property it owns to an LLC it has formed or has an interest in. This type of deed is typically used when there is a need for restructuring a business or to separate the ownership of a property from the corporation's business activities. The transfer is made by the corporation relinquishing any claims or interests it has in the property, transferring them to the LLC. There are different types of Frisco Texas Quitclaim Deeds from Corporation to LLC, including but not limited to: 1. General Frisco Texas Quitclaim Deed from Corporation to LLC: This is a typical deed that transfers the ownership of the property, including all rights, title, and interest in the property, from the corporation to the LLC. The corporation gives up any claims it might have on the property, and the LLC becomes the new owner. 2. Exempt Frisco Texas Quitclaim Deed from Corporation to LLC: This is a specialized deed that exempts the transfer of the property from certain taxes or fees. It may be used in specific situations where the transfer is exempt from certain legal requirements or governmental fees. 3. Warranty Frisco Texas Quitclaim Deed from Corporation to LLC: This type of deed guarantees that the property being transferred is free of any liens, encumbrances, or claims, both from the corporation and any previous owners. It provides additional protection to the LLC by ensuring clear title to the property. 4. Affidavit of Title Frisco Texas Quitclaim Deed from Corporation to LLC: This is an accompanying document that states that the corporation has clear title to the property being transferred and that it has the legal right to transfer it to the LLC. It is often required by title companies or lenders before completing a sale or refinancing transaction. It is important to consult with a real estate attorney or experienced professionals to ensure the proper execution of a Frisco Texas Quitclaim Deed from Corporation to LLC. Keywords relevant to this topic include Frisco Texas, Quitclaim Deed, Corporation, LLC, property transfer, ownership transfer, legal document, restructuring, business activities, rights, title, interest, taxes, fees, liens, encumbrances, claims, warranty, clear title, affidavit of title, real estate attorney, and professional advice.