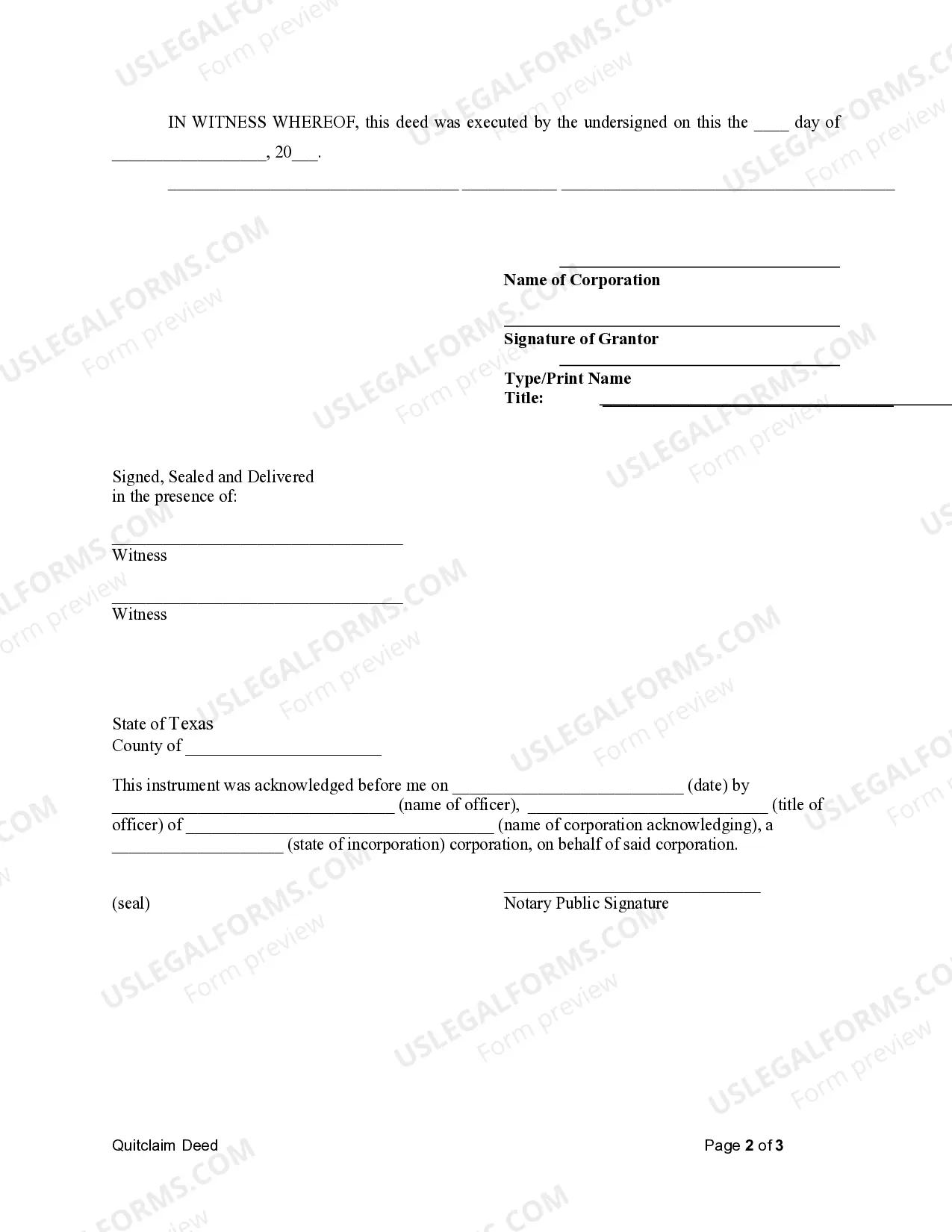

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Harris Texas Quitclaim Deed from Corporation to LLC is a legal document used to transfer ownership of real estate from a corporation to a limited liability company (LLC) in Harris County, Texas. This type of transaction may occur when a corporation wants to reorganize its assets or transfer property to an LLC for various reasons, such as liability protection or tax benefits. The Harris Texas Quitclaim Deed from Corporation to LLC is a binding agreement that outlines the details of the property transfer, including the legal description of the property, the names of the corporation and LLC involved, and any considerations exchanged during the transaction. It is important to note that such a deed only transfers the interest the corporation has in the property, and any existing liens or encumbrances will still remain attached to the property unless explicitly stated otherwise. Several types of Harris Texas Quitclaim Deeds from Corporation to LLC may exist based on specific circumstances or requirements: 1. Standard Harris Texas Quitclaim Deed from Corporation to LLC: This is the most common type of deed used in the transfer of real estate from a corporation to an LLC. It transfers the corporation's interest in the property without any warranties or guarantees regarding its title or condition. 2. Harris Texas Quitclaim Deed with Covenants: Sometimes, a corporation may choose to provide certain assurances regarding the property's title, known as covenants. This type of deed includes specific warranties related to the legal ownership of the property. 3. Harris Texas Quitclaim Deed with Consideration: In some cases, the transfer may involve the exchange of money or other valuable considerations between the corporation and LLC. A quitclaim deed with consideration documents this agreed-upon exchange, ensuring clarity and legal validity. It is crucial for both the corporation and LLC to seek professional legal advice and ensure compliance with all relevant Texas laws and regulations when preparing and executing a Harris Texas Quitclaim Deed from Corporation to LLC.A Harris Texas Quitclaim Deed from Corporation to LLC is a legal document used to transfer ownership of real estate from a corporation to a limited liability company (LLC) in Harris County, Texas. This type of transaction may occur when a corporation wants to reorganize its assets or transfer property to an LLC for various reasons, such as liability protection or tax benefits. The Harris Texas Quitclaim Deed from Corporation to LLC is a binding agreement that outlines the details of the property transfer, including the legal description of the property, the names of the corporation and LLC involved, and any considerations exchanged during the transaction. It is important to note that such a deed only transfers the interest the corporation has in the property, and any existing liens or encumbrances will still remain attached to the property unless explicitly stated otherwise. Several types of Harris Texas Quitclaim Deeds from Corporation to LLC may exist based on specific circumstances or requirements: 1. Standard Harris Texas Quitclaim Deed from Corporation to LLC: This is the most common type of deed used in the transfer of real estate from a corporation to an LLC. It transfers the corporation's interest in the property without any warranties or guarantees regarding its title or condition. 2. Harris Texas Quitclaim Deed with Covenants: Sometimes, a corporation may choose to provide certain assurances regarding the property's title, known as covenants. This type of deed includes specific warranties related to the legal ownership of the property. 3. Harris Texas Quitclaim Deed with Consideration: In some cases, the transfer may involve the exchange of money or other valuable considerations between the corporation and LLC. A quitclaim deed with consideration documents this agreed-upon exchange, ensuring clarity and legal validity. It is crucial for both the corporation and LLC to seek professional legal advice and ensure compliance with all relevant Texas laws and regulations when preparing and executing a Harris Texas Quitclaim Deed from Corporation to LLC.