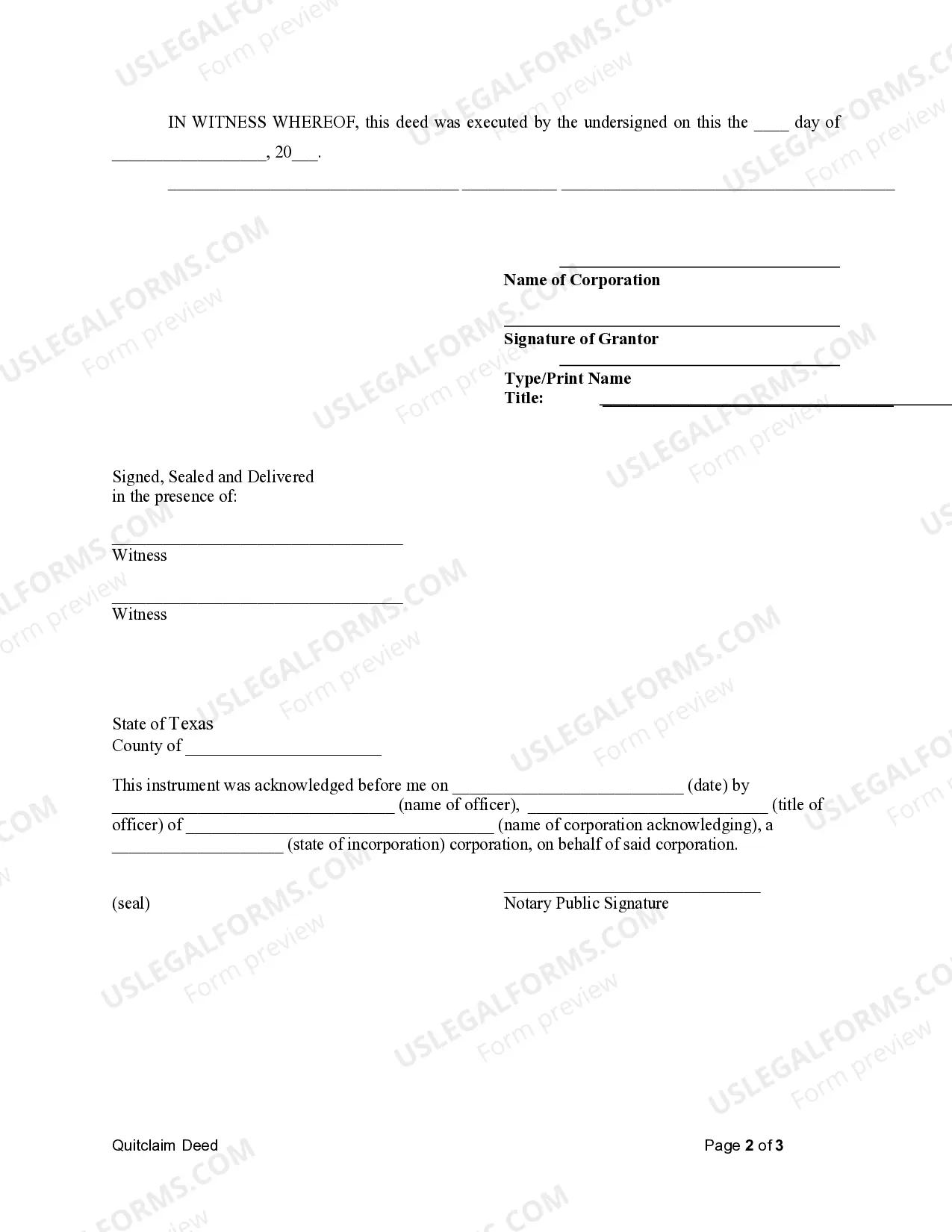

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Houston Texas Quitclaim Deed from Corporation to LLC is a legal document used to transfer ownership of a property from a corporation to a limited liability company (LLC) within the jurisdiction of Houston, Texas. This deed serves as evidence of the corporation's intention to release any existing interest or claims it may have on the property in favor of the LLC. The transfer via a quitclaim deed, unlike a warranty deed, does not provide any guarantees or warranties about the property's title. There are two common types of Houston Texas Quitclaim Deeds from Corporation to LLC: 1. General Quitclaim Deed: This type of deed transfers all rights, title, and interest that the corporation possesses on the property to the LLC. It is typically used when the corporation wants to transfer its entire ownership stake in the property to the LLC without any reservations or restrictions. 2. Partial Quitclaim Deed: In some cases, the corporation may only wish to transfer a specific portion or interest in the property to the LLC. This could be due to various reasons, such as restructuring its assets or transferring ownership of a particular section of the property. A partial quitclaim deed outlines the specific portion or interest being transferred, allowing for a more targeted transfer of ownership. The Houston Texas Quitclaim Deed from Corporation to LLC must include certain essential information. This includes the names and contact details of both the corporation and the LLC, along with their legal entities. The deed should reference the original deed where the corporation acquired the property and include an accurate legal description of the property being transferred. Additionally, the deed must include appropriate language, stating the intent to transfer the property without warranties, and signed by the corporation's authorized representative. Filing the Houston Texas Quitclaim Deed from Corporation to LLC with the county clerk's office is essential to establish public record of the transfer and provide notice to other parties. It is advisable to consult with a qualified attorney or real estate professional to ensure the deed is properly drafted, executed, and filed according to Houston, Texas, and state laws.A Houston Texas Quitclaim Deed from Corporation to LLC is a legal document used to transfer ownership of a property from a corporation to a limited liability company (LLC) within the jurisdiction of Houston, Texas. This deed serves as evidence of the corporation's intention to release any existing interest or claims it may have on the property in favor of the LLC. The transfer via a quitclaim deed, unlike a warranty deed, does not provide any guarantees or warranties about the property's title. There are two common types of Houston Texas Quitclaim Deeds from Corporation to LLC: 1. General Quitclaim Deed: This type of deed transfers all rights, title, and interest that the corporation possesses on the property to the LLC. It is typically used when the corporation wants to transfer its entire ownership stake in the property to the LLC without any reservations or restrictions. 2. Partial Quitclaim Deed: In some cases, the corporation may only wish to transfer a specific portion or interest in the property to the LLC. This could be due to various reasons, such as restructuring its assets or transferring ownership of a particular section of the property. A partial quitclaim deed outlines the specific portion or interest being transferred, allowing for a more targeted transfer of ownership. The Houston Texas Quitclaim Deed from Corporation to LLC must include certain essential information. This includes the names and contact details of both the corporation and the LLC, along with their legal entities. The deed should reference the original deed where the corporation acquired the property and include an accurate legal description of the property being transferred. Additionally, the deed must include appropriate language, stating the intent to transfer the property without warranties, and signed by the corporation's authorized representative. Filing the Houston Texas Quitclaim Deed from Corporation to LLC with the county clerk's office is essential to establish public record of the transfer and provide notice to other parties. It is advisable to consult with a qualified attorney or real estate professional to ensure the deed is properly drafted, executed, and filed according to Houston, Texas, and state laws.