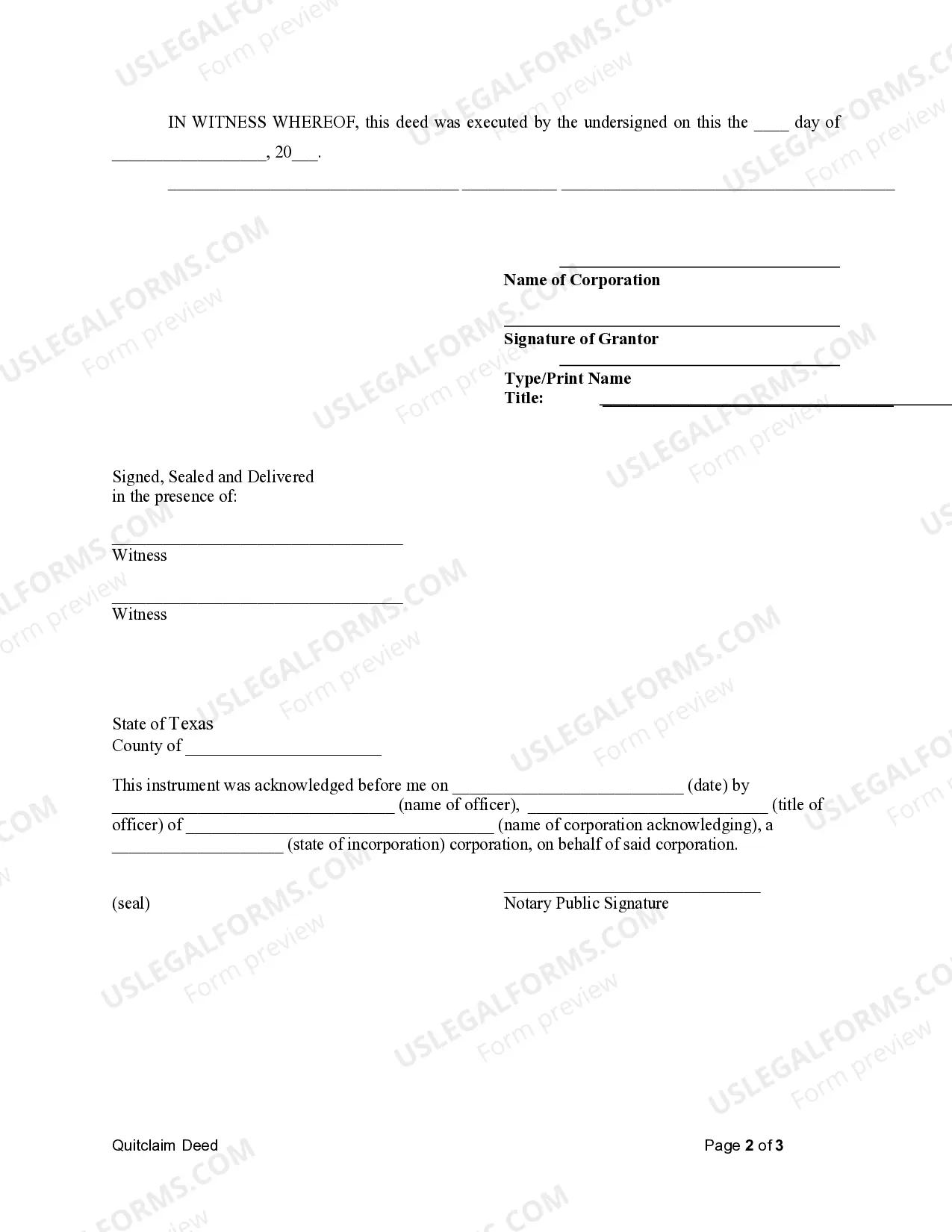

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A McAllen Texas Quitclaim Deed from Corporation to LLC is a legal document that facilitates the transfer of property ownership from a corporation to a limited liability company (LLC) located in McAllen, Texas. This type of deed allows the corporation to quit any claim or interest it may have in a property and transfer it to the LLC. This process involves transferring the property's title, rights, and interest without any warranties or guarantees from the corporation to the LLC. It is important to note that a quitclaim deed does not provide any guarantee of clear title or insurability, unlike a warranty deed. Thus, it is crucial for both parties to conduct thorough due diligence before executing this type of deed. In McAllen, Texas, there are different variations of Quitclaim Deeds from Corporation to LLC that can be identified based on specific scenarios or requirements. These include: 1. General Quitclaim Deed from Corporation to LLC: This is the most common type of quitclaim deed, typically used when a corporation wishes to transfer its ownership interest in a property to an LLC. 2. Special Warranty Quitclaim Deed from Corporation to LLC: In this case, the corporation may provide limited warranties to the LLC, guaranteeing that it has not encumbered the property during its ownership. However, this type of quitclaim deed still does not provide the same level of assurances as a warranty deed. 3. Reverse Quitclaim Deed from LLC to Corporation: In certain situations, an LLC may wish to transfer property back to the corporation. This type of deed allows for the reversal of ownership, with the LLC quitting its claim and the corporation reclaiming ownership. 4. Partial Quitclaim Deed from Corporation to LLC: This type of quitclaim deed is used when the corporation wants to transfer only a portion of its ownership interest in a property to the LLC, while retaining the remaining interest. Overall, a McAllen Texas Quitclaim Deed from Corporation to LLC enables the smooth transfer of property ownership between these two entities. However, it is essential to consult with an experienced attorney or real estate professional familiar with Texas real estate laws when executing such a transaction to ensure compliance and mitigate any potential legal risks.A McAllen Texas Quitclaim Deed from Corporation to LLC is a legal document that facilitates the transfer of property ownership from a corporation to a limited liability company (LLC) located in McAllen, Texas. This type of deed allows the corporation to quit any claim or interest it may have in a property and transfer it to the LLC. This process involves transferring the property's title, rights, and interest without any warranties or guarantees from the corporation to the LLC. It is important to note that a quitclaim deed does not provide any guarantee of clear title or insurability, unlike a warranty deed. Thus, it is crucial for both parties to conduct thorough due diligence before executing this type of deed. In McAllen, Texas, there are different variations of Quitclaim Deeds from Corporation to LLC that can be identified based on specific scenarios or requirements. These include: 1. General Quitclaim Deed from Corporation to LLC: This is the most common type of quitclaim deed, typically used when a corporation wishes to transfer its ownership interest in a property to an LLC. 2. Special Warranty Quitclaim Deed from Corporation to LLC: In this case, the corporation may provide limited warranties to the LLC, guaranteeing that it has not encumbered the property during its ownership. However, this type of quitclaim deed still does not provide the same level of assurances as a warranty deed. 3. Reverse Quitclaim Deed from LLC to Corporation: In certain situations, an LLC may wish to transfer property back to the corporation. This type of deed allows for the reversal of ownership, with the LLC quitting its claim and the corporation reclaiming ownership. 4. Partial Quitclaim Deed from Corporation to LLC: This type of quitclaim deed is used when the corporation wants to transfer only a portion of its ownership interest in a property to the LLC, while retaining the remaining interest. Overall, a McAllen Texas Quitclaim Deed from Corporation to LLC enables the smooth transfer of property ownership between these two entities. However, it is essential to consult with an experienced attorney or real estate professional familiar with Texas real estate laws when executing such a transaction to ensure compliance and mitigate any potential legal risks.