This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Round Rock Texas Quitclaim Deed from Corporation to LLC

Description

How to fill out Texas Quitclaim Deed From Corporation To LLC?

Utilize the US Legal Forms and gain instant access to any document you desire.

Our helpful website, featuring thousands of document templates, enables you to discover and acquire nearly any document sample you need.

You can download, fill out, and sign the Round Rock Texas Quitclaim Deed from Corporation to LLC in just a few minutes, rather than spending hours browsing the Internet in search of the correct template.

Using our collection is an excellent method to enhance the safety of your form submissions. Our experienced attorneys routinely review all documents to ensure that the templates are suitable for a specific state and comply with current laws and regulations.

US Legal Forms is likely one of the largest and most reliable document libraries online. We are always here to assist you in any legal procedure, even if it’s simply downloading the Round Rock Texas Quitclaim Deed from Corporation to LLC.

Don’t hesitate to take advantage of our service and simplify your document experience to the utmost!

- How can you obtain the Round Rock Texas Quitclaim Deed from Corporation to LLC.

- If you already possess an account, simply Log In to your profile. The Download option will be activated for all the documents you access. Moreover, you can retrieve all previously saved files in the My documents section.

- If you do not have an account yet, follow the steps below.

- Locate the form you need. Ensure it is the template you sought: check its title and description, and use the Preview option when available. Otherwise, use the Search bar to find the required one.

- Commence the saving process. Select Buy Now and choose your preferred pricing plan. Then, create an account and complete your payment with a credit card or PayPal.

- Download the document. Specify the format to receive the Round Rock Texas Quitclaim Deed from Corporation to LLC and edit, complete, or sign it according to your requirements.

Form popularity

FAQ

Yes, you can transfer your LLC to another person in Texas. This process typically involves selling the membership interests or shares to the new owner. After the transfer, update your LLC’s records and notify the Texas Secretary of State of the change. For an efficient transition and to handle associated paperwork, using the uslegalforms platform may be beneficial and can guide you through a Round Rock Texas Quitclaim Deed from Corporation to LLC.

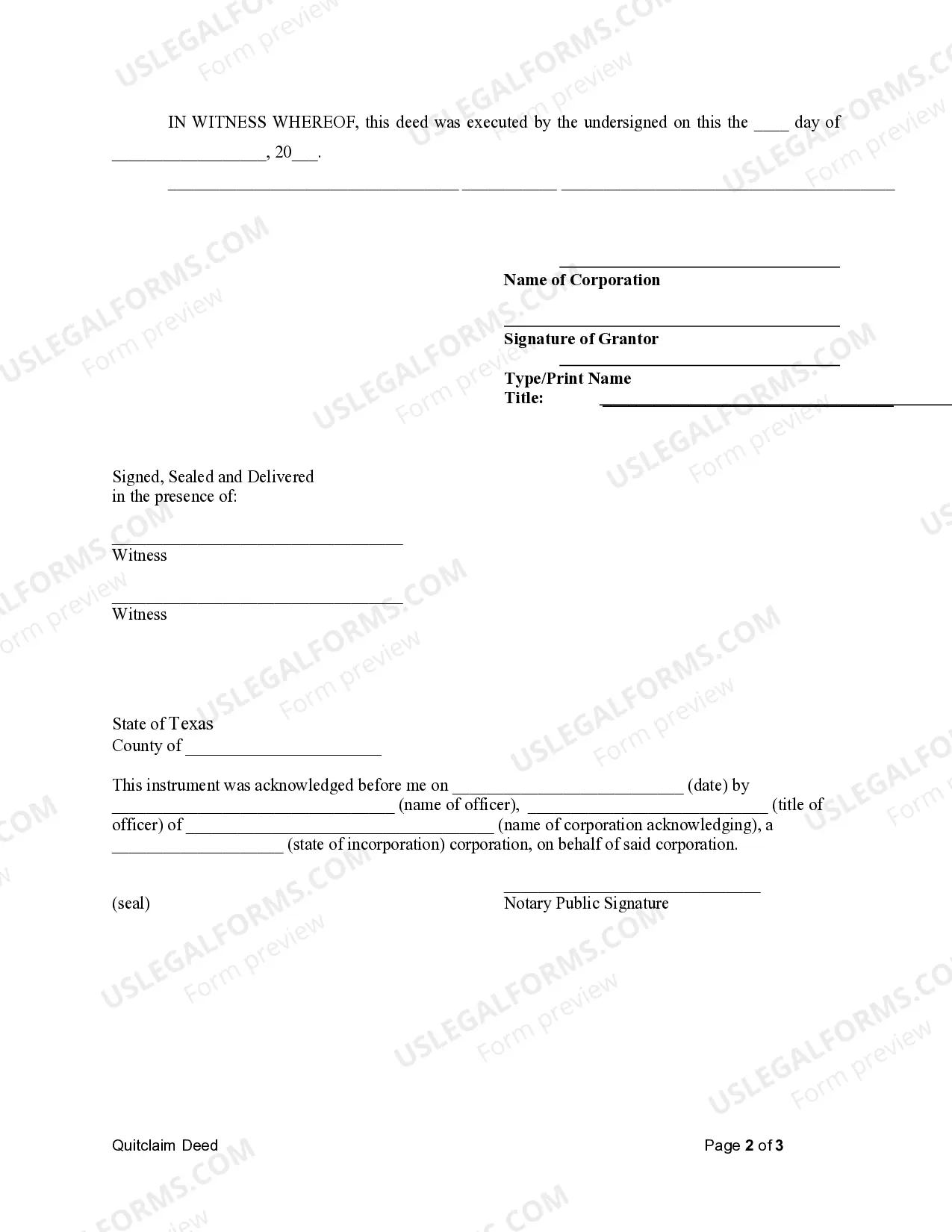

Filing a quitclaim deed in Texas starts by obtaining the appropriate form, which you can find online or at local government offices. Fill out the deed, providing all required information like the property description and party names. Next, sign the document in the presence of a notary public and file it with the county clerk’s office. For assistance and to ensure you understand the connection to a Round Rock Texas Quitclaim Deed from Corporation to LLC, consider exploring uslegalforms.

Removing an owner from an LLC in Texas requires checking your operating agreement for specific procedures. Generally, most LLCs allow for removal through a vote or mutual agreement. You must then file an updated certificate of formation with the Texas Secretary of State. Utilizing the uslegalforms platform can help you navigate these steps confidently and efficiently, especially in relation to a Round Rock Texas Quitclaim Deed from Corporation to LLC.

To change a member of an LLC in Texas, you must first review your operating agreement to verify the process. Typically, this involves a vote or consent from the existing members. After you finalize the decision, update any records with the Texas Secretary of State. If necessary, consult uslegalforms to ensure compliance and streamline the process of using a Round Rock Texas Quitclaim Deed from Corporation to LLC.

Filling out a quit claim deed requires careful attention to detail. Begin by clearly stating the names of the grantor and grantee, along with the legal description of the property being transferred. Use a template for a Round Rock Texas Quitclaim Deed from Corporation to LLC for guidance. After ensuring that all information is accurate, sign the deed and file it with your local county clerk to finalize the transfer.

To transfer your property to an LLC in Texas, begin with drafting a Round Rock Texas Quitclaim Deed from Corporation to LLC. Clearly detail the property involved and both parties in the deed. After signing it, file the document with the proper county office for record-keeping. This transfer solidifies the LLC's ownership and creates legal protection for you as a property owner.

While hiring a lawyer is not mandatory for transferring a deed in Texas, it is often recommended to ensure compliance with local laws. A knowledgeable attorney can provide guidance on the Round Rock Texas Quitclaim Deed from Corporation to LLC process, helping you avoid potential pitfalls. Legal assistance ensures that all paperwork is filed correctly and can simplify the transfer of property ownership.

To transfer personal assets to an LLC in Round Rock, Texas, you typically use a Round Rock Texas Quitclaim Deed from Corporation to LLC. Start by drafting the quitclaim deed, ensuring that it clearly identifies the assets and both entities. After completing the deed, sign it and file it with the Harris County Clerk's office. This process effectively transfers ownership and protects your personal assets under the LLC.

To transfer a deed to an LLC in Texas, first draft a quitclaim deed that includes relevant property details and the LLC's information. You must then sign and notarize the deed before submitting it to the county clerk's office where the property is located. This process is crucial and the Round Rock Texas Quitclaim Deed from Corporation to LLC serves as an effective method for this transfer.

People often place property into an LLC to limit personal liability, protect assets, and simplify estate planning. By doing this, the LLC becomes the legal owner of the property, which can help separate personal finances from business concerns. Utilizing a Round Rock Texas Quitclaim Deed from Corporation to LLC is a strategic way to achieve this.