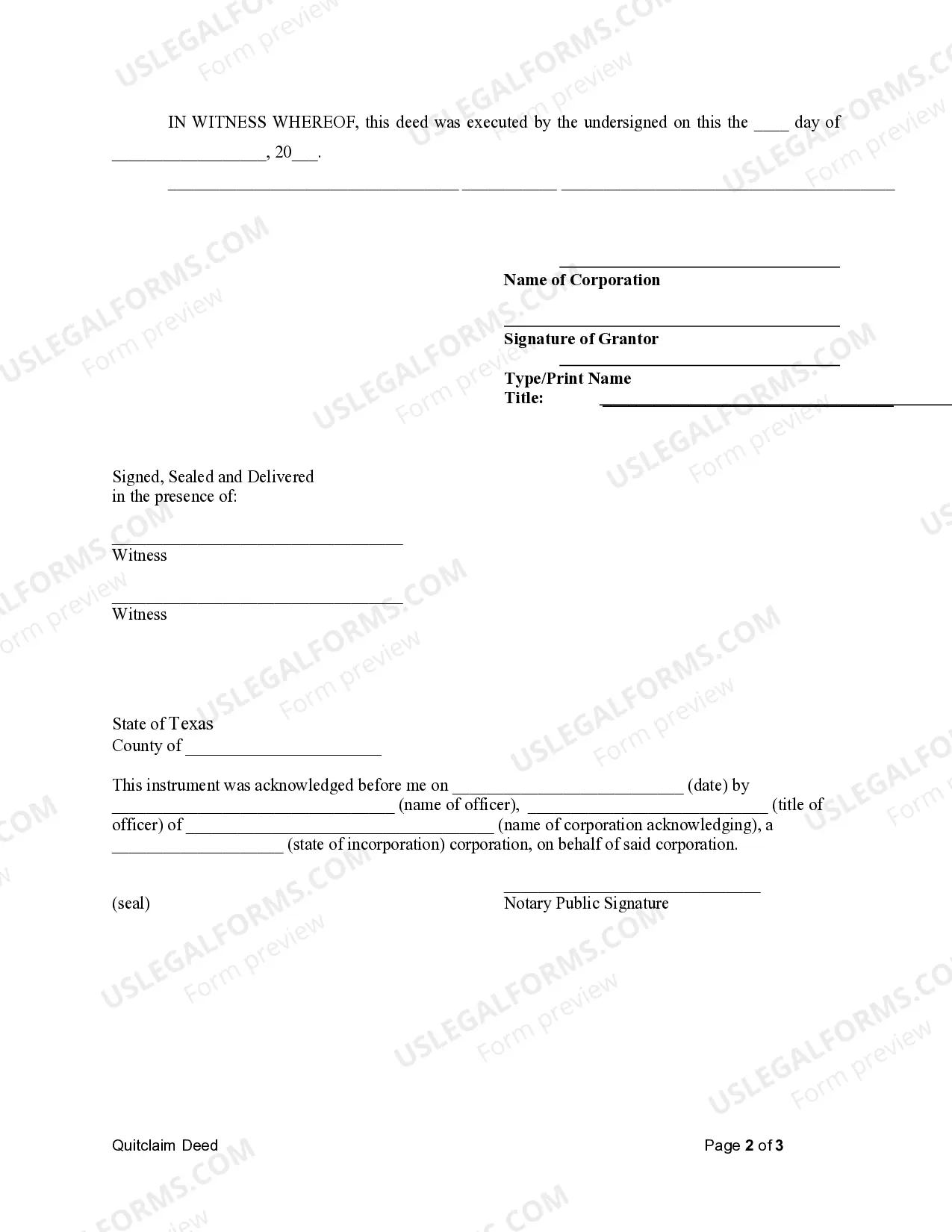

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Sugar Land Texas Quitclaim Deed from Corporation to LLC is a legal document used to transfer property ownership rights from a corporation to a limited liability company (LLC) situated in Sugar Land, Texas. This deed is commonly used in various business transactions, such as restructuring or real estate asset transfers, where the corporation intends to transfer ownership to an LLC for better liability protection or organizational purposes. The Sugar Land Texas Quitclaim Deed from Corporation to LLC serves as evidence of the transfer of property rights without providing any warranties or guarantees regarding the property's title. It essentially allows the corporation (granter) to relinquish its interest in the property and transfers those rights to the LLC (grantee). There are several types of Sugar Land Texas Quitclaim Deeds that can be executed based on specific circumstances and the parties involved. These include: 1. Sugar Land Texas Voluntary Quitclaim Deed from Corporation to LLC: This type of deed refers to a transfer initiated willingly by the corporation, usually due to strategic or organizational reasons. The corporation recognizes the LLC as the rightful owner of the property and legally transfers its interest through this voluntary quitclaim deed. 2. Sugar Land Texas Involuntary Quitclaim Deed from Corporation to LLC: In some cases, a transfer of property ownership from a corporation to an LLC may occur under legal compulsion or court order. This involuntary quitclaim deed is executed to comply with legal requirements and transfer the ownership rights of the property accordingly. 3. Sugar Land Texas Interspousal Quitclaim Deed from Corporation to LLC: In situations where a property owned by a corporation needs to be transferred to an LLC due to marriage or divorce arrangements, an interspousal quitclaim deed is used. This type of deed facilitates the transfer of property rights between spouses involved in the corporate and LLC entities. 4. Sugar Land Texas Gift Quitclaim Deed from Corporation to LLC: Occasionally, a corporation may choose to gift its property assets to an LLC, such as in situations where the corporation wishes to restructure its holdings or benefit from tax advantages. The gift quitclaim deed is an appropriate legal document used to signify the voluntary transfer of property without any monetary exchange. When executing a Sugar Land Texas Quitclaim Deed from Corporation to LLC, it is crucial to consult with legal professionals experienced in property and corporate law. These experts can provide guidance throughout the process, ensuring that the deed complies with all relevant legal requirements and provisions.A Sugar Land Texas Quitclaim Deed from Corporation to LLC is a legal document used to transfer property ownership rights from a corporation to a limited liability company (LLC) situated in Sugar Land, Texas. This deed is commonly used in various business transactions, such as restructuring or real estate asset transfers, where the corporation intends to transfer ownership to an LLC for better liability protection or organizational purposes. The Sugar Land Texas Quitclaim Deed from Corporation to LLC serves as evidence of the transfer of property rights without providing any warranties or guarantees regarding the property's title. It essentially allows the corporation (granter) to relinquish its interest in the property and transfers those rights to the LLC (grantee). There are several types of Sugar Land Texas Quitclaim Deeds that can be executed based on specific circumstances and the parties involved. These include: 1. Sugar Land Texas Voluntary Quitclaim Deed from Corporation to LLC: This type of deed refers to a transfer initiated willingly by the corporation, usually due to strategic or organizational reasons. The corporation recognizes the LLC as the rightful owner of the property and legally transfers its interest through this voluntary quitclaim deed. 2. Sugar Land Texas Involuntary Quitclaim Deed from Corporation to LLC: In some cases, a transfer of property ownership from a corporation to an LLC may occur under legal compulsion or court order. This involuntary quitclaim deed is executed to comply with legal requirements and transfer the ownership rights of the property accordingly. 3. Sugar Land Texas Interspousal Quitclaim Deed from Corporation to LLC: In situations where a property owned by a corporation needs to be transferred to an LLC due to marriage or divorce arrangements, an interspousal quitclaim deed is used. This type of deed facilitates the transfer of property rights between spouses involved in the corporate and LLC entities. 4. Sugar Land Texas Gift Quitclaim Deed from Corporation to LLC: Occasionally, a corporation may choose to gift its property assets to an LLC, such as in situations where the corporation wishes to restructure its holdings or benefit from tax advantages. The gift quitclaim deed is an appropriate legal document used to signify the voluntary transfer of property without any monetary exchange. When executing a Sugar Land Texas Quitclaim Deed from Corporation to LLC, it is crucial to consult with legal professionals experienced in property and corporate law. These experts can provide guidance throughout the process, ensuring that the deed complies with all relevant legal requirements and provisions.