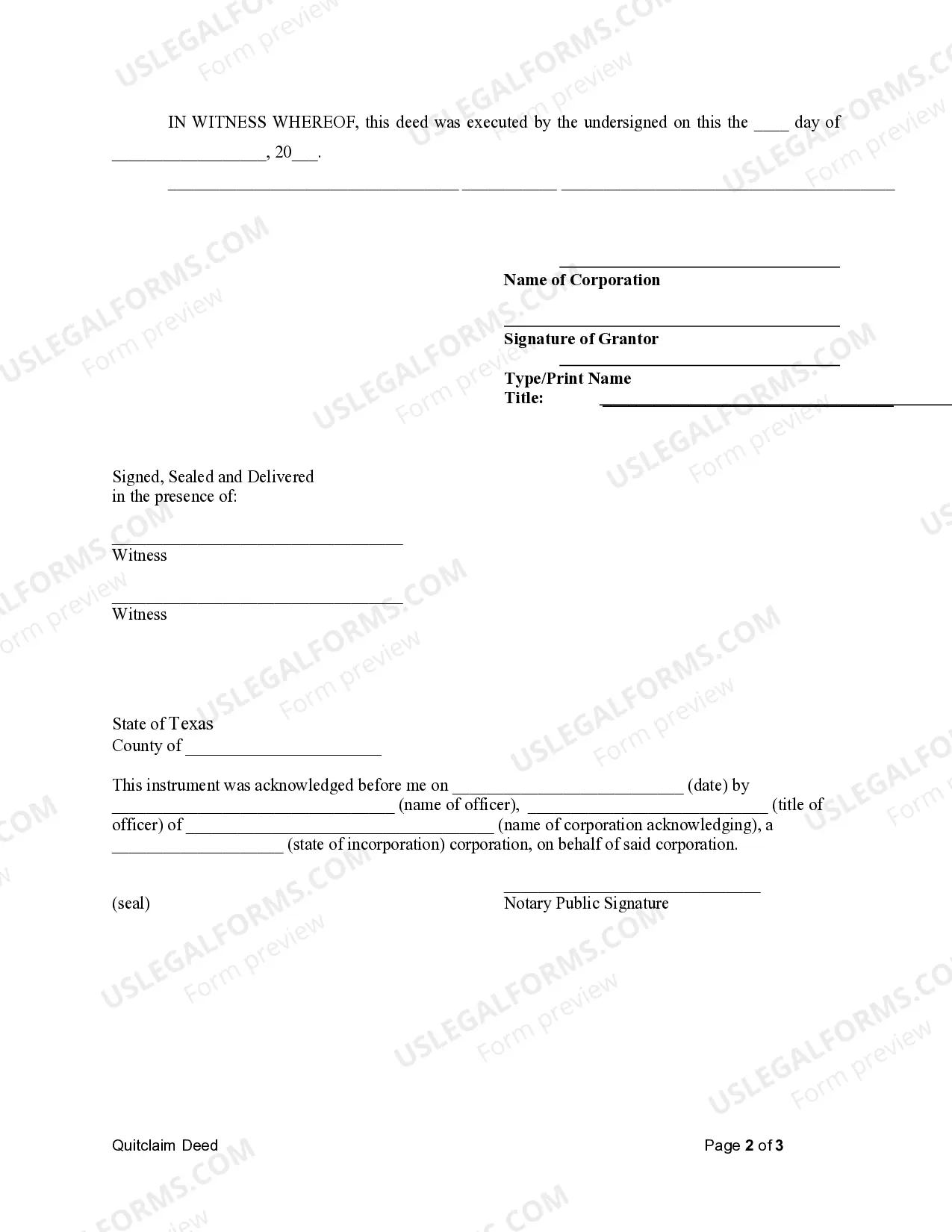

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Travis Texas Quitclaim Deed from Corporation to LLC is a legally binding document that facilitates the transfer of property ownership from a corporation to a limited liability company (LLC) in Travis County, Texas. This deed serves as a means to officially record the transfer and establish the LLC as the new owner of the property. The primary purpose of executing a quitclaim deed is to transfer the corporation's interest in a particular property to the LLC without providing any warranties or guarantees regarding the property's title or condition. This means that the corporation is essentially relinquishing any claims or rights to the property, and the LLC assumes full ownership and responsibility. There are variations of the Travis Texas Quitclaim Deed from Corporation to LLC that are commonly used, depending on the specific circumstances of the transfer. These may include: 1. Standard Quitclaim Deed: This is the most common form of quitclaim deed used in Travis County, Texas. It outlines the transfer of property ownership from the corporation to the LLC, including legal descriptions of the property, details of the corporation, and the LLC's information. 2. Special Warranty Deed from Corporation to LLC: In some cases, the parties involved may opt for a special warranty deed instead of a quitclaim deed. While a quitclaim deed offers no warranties, a special warranty deed provides limited warranties from the corporation to the LLC. These warranties typically cover only the period when the corporation owned the property and not any previous ownership. 3. Enhanced Life Estate Deed from Corporation to LLC: Occasionally, a corporation may own property through enhanced life estate deeds, which grant life tenancy to a specific individual. In such cases, if the corporation wants to transfer the property to an LLC, an enhanced life estate deed from the corporation to the LLC is utilized to document the transfer while still maintaining the life estate for the designated individual. It is crucial to consult with legal professionals or a real estate attorney when drafting a Travis Texas Quitclaim Deed from Corporation to LLC to ensure compliance with local laws and regulations. These professionals can guide through the process, verify the accuracy of the document, and ensure a smooth transfer of property ownership.