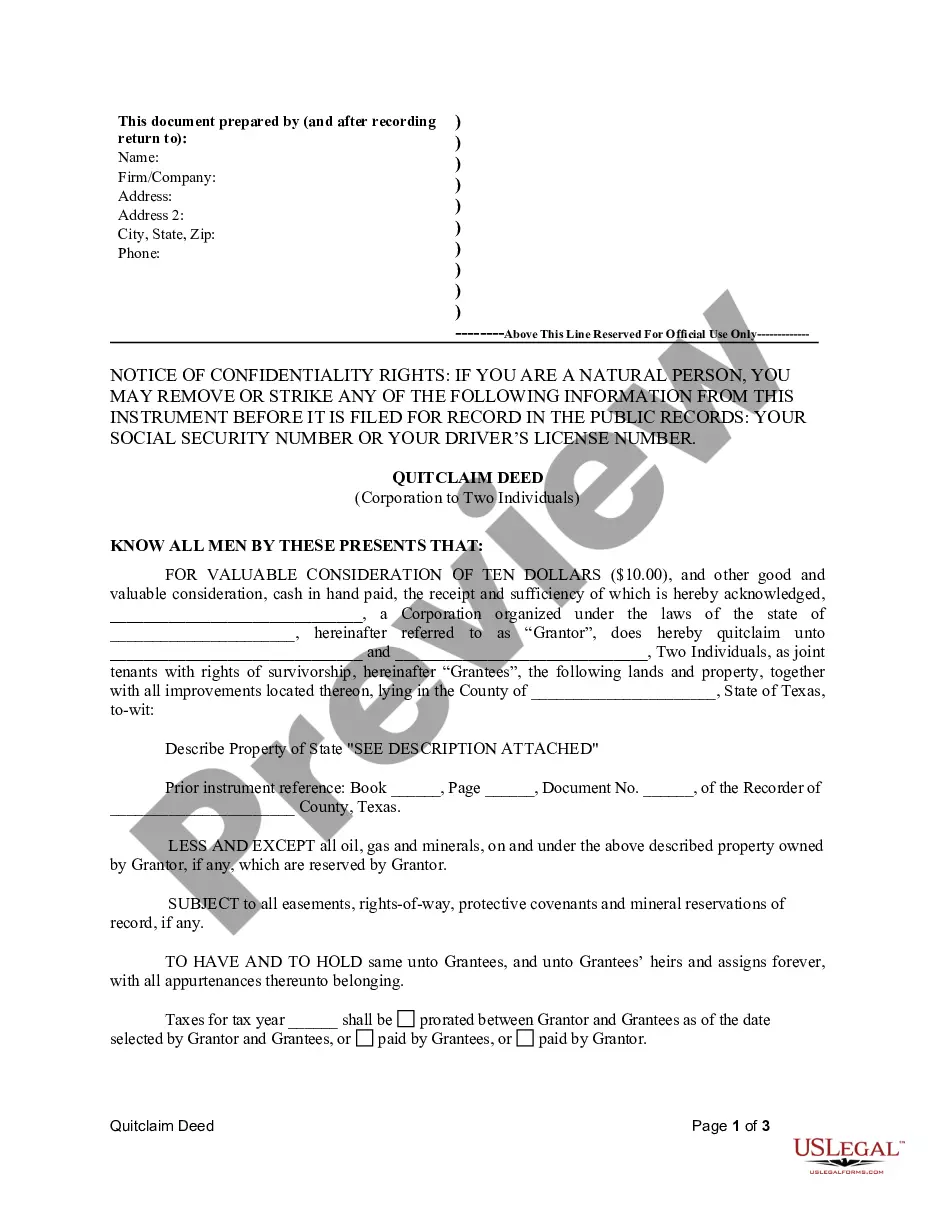

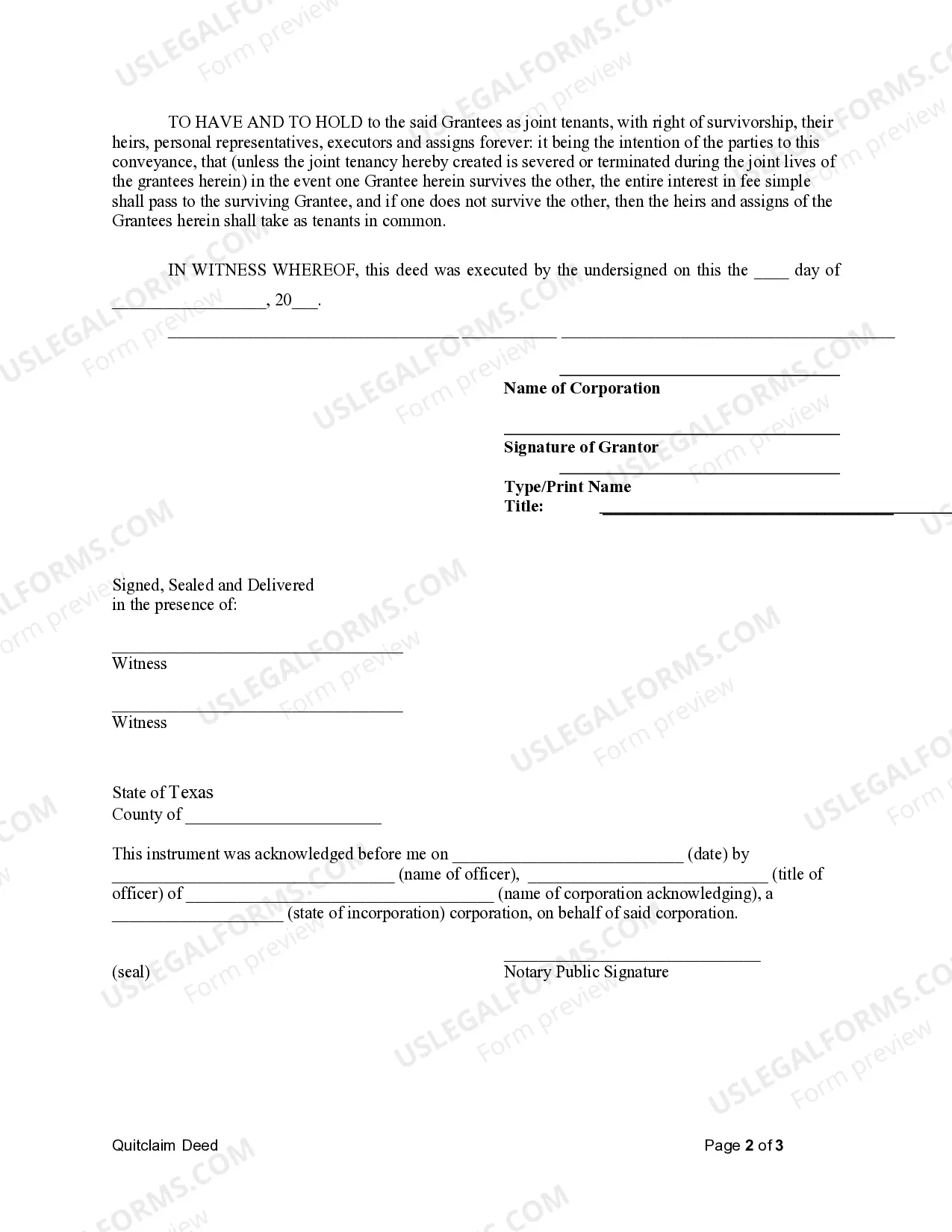

This Quitclaim Deed from Corporation to Two Individuals form is a Quitclaim Deed where the Grantor is a corporation and the Grantees are two individuals. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Dallas Texas Quitclaim Deed from Corporation to Two Individuals is a legal document that transfers ownership of property from a corporation to two individuals without any warranties or guarantees. This type of deed is commonly used in real estate transactions when a corporation wants to release its interest or ownership rights in a property to two individuals. The Dallas Texas Quitclaim Deed from Corporation to Two Individuals follows specific guidelines and requirements set by the state, ensuring that the transfer of property is lawful and valid. It is important for both the corporation and the two individuals to understand the implications and consequences of executing such a deed, as it relinquishes any present and future claims to the property. There are different variations or subtypes of Dallas Texas Quitclaim Deed from Corporation to Two Individuals, including: 1. Residential Property Transfer: This type of quitclaim deed is used when the corporation owns residential property, such as a house or condominium, and wishes to transfer its ownership to two individuals. 2. Commercial Property Transfer: In cases where the corporation owns commercial property, such as office buildings or retail spaces, this subtype of quitclaim deed is utilized to transfer ownership to two individuals. 3. Land Transfer: This subtype of quitclaim deed is used when the corporation owns vacant land or undeveloped property and intends to transfer the ownership to two individuals for various purposes, such as development or investment. 4. Inheritance Transfer: If the corporation has obtained property through inheritance, it can execute a quitclaim deed to transfer ownership to two individuals as per the terms of the inherited property. When drafting a Dallas Texas Quitclaim Deed from Corporation to Two Individuals, it is essential to include relevant information such as the legal description of the property, the names and addresses of both parties involved, the date of transfer, and any other specific terms or conditions agreed upon by the corporation and the individuals. It is advisable to consult with a real estate attorney or a legal professional experienced in such transactions to ensure accuracy and compliance with state laws.