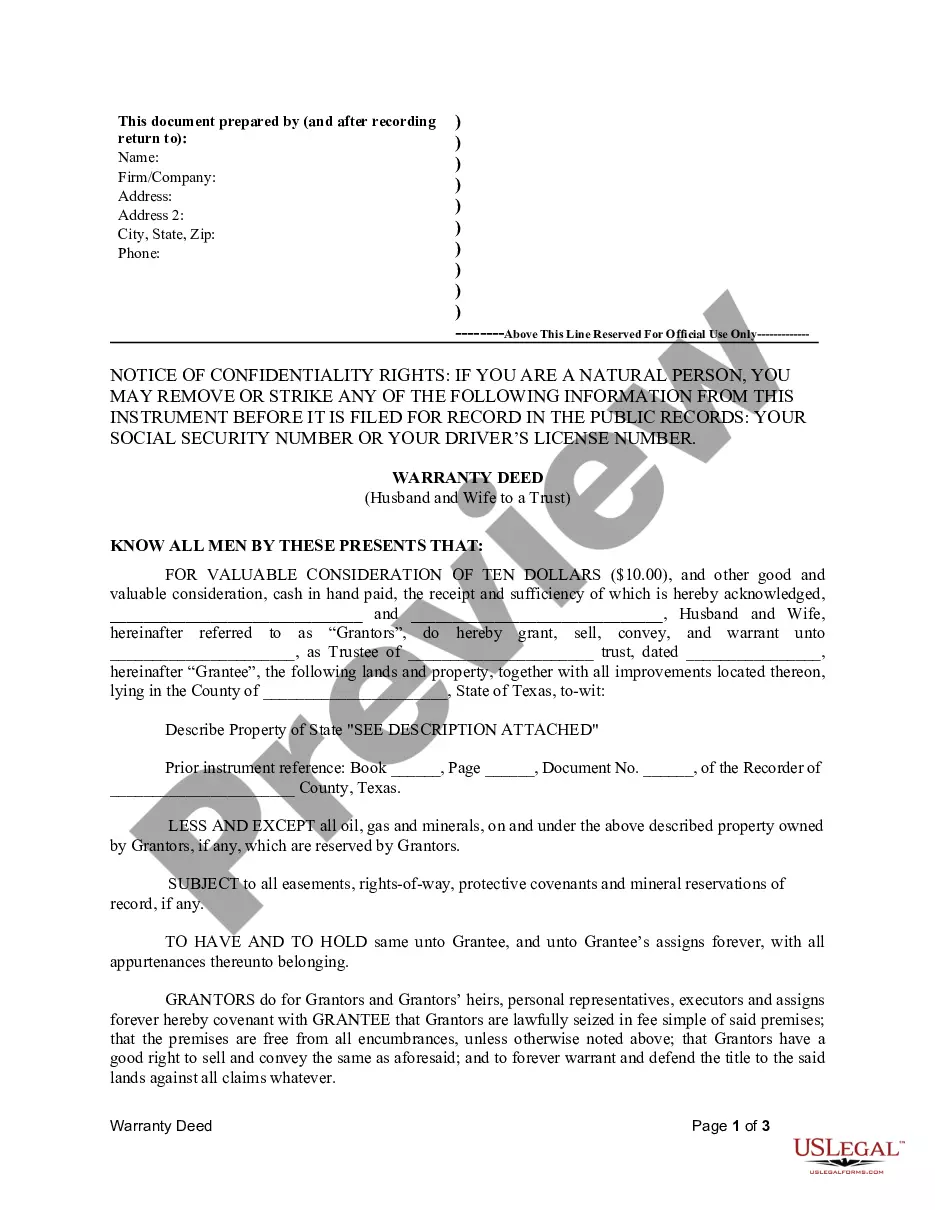

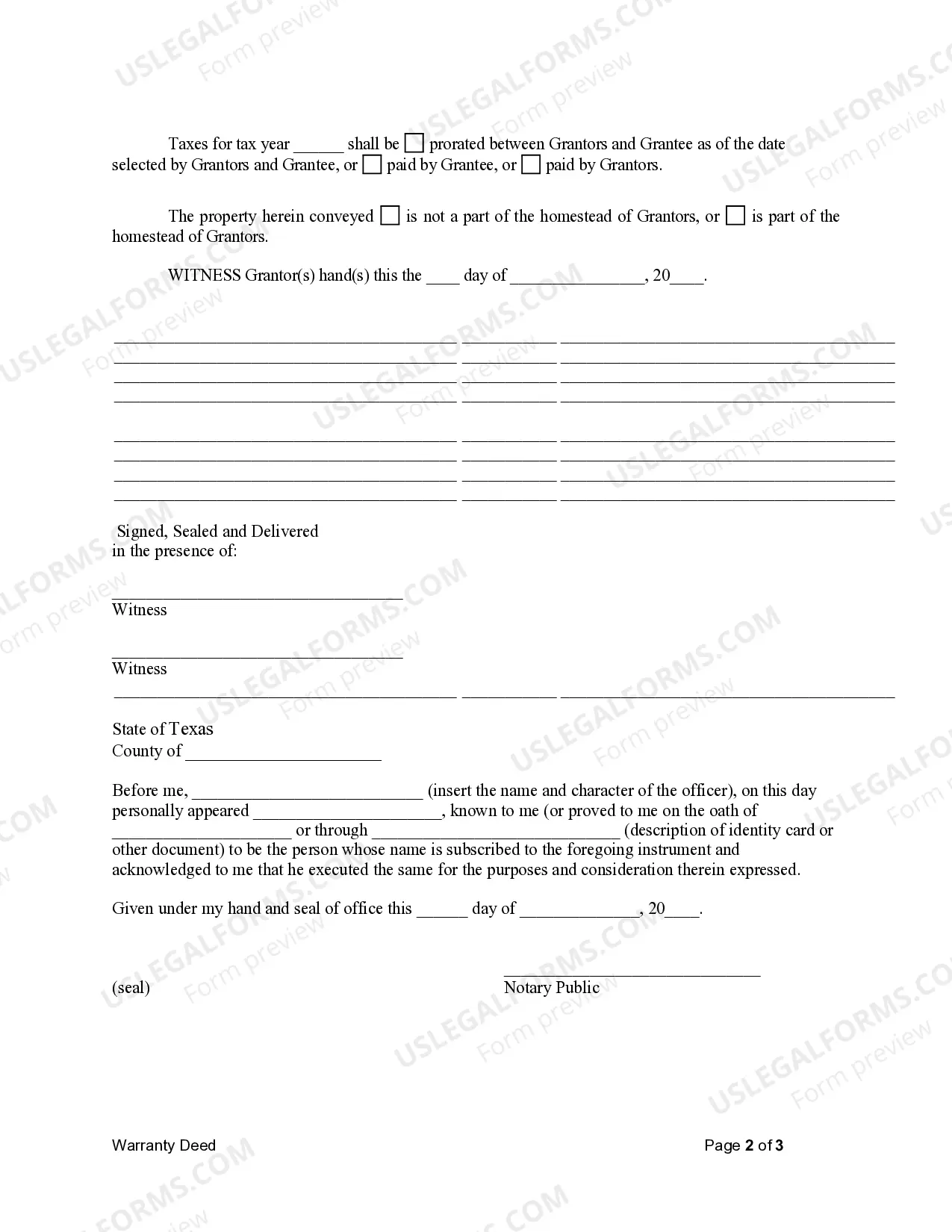

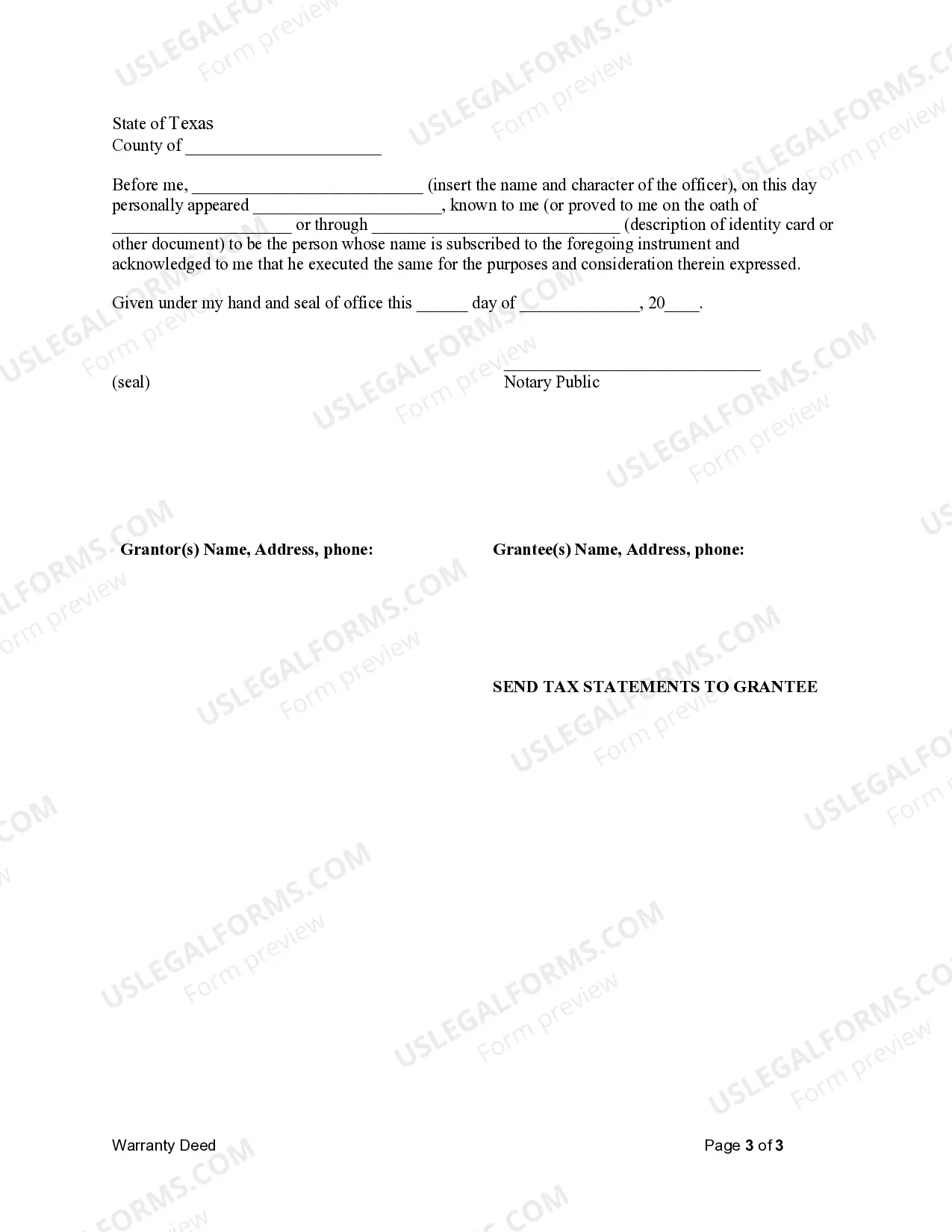

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Title: Understanding the Edinburg Texas Warranty Deed from Husband and Wife to a Trust: Types and Detailed Description Intro: In Edinburg, Texas, urbanization has led to an increasing number of real estate ownership arrangements, including transferring property from a husband and wife to a trust. This article aims to provide a comprehensive overview of the Edinburg Texas Warranty Deed from Husband and Wife to a Trust, its significance, and different variations. 1. Definition and Purpose of a Warranty Deed: A warranty deed is a legal document that establishes the transfer of real property ownership from the granters (husband and wife) to the trustee(s) of a trust. Through this deed, the granters assure the grantee (trust) that they hold clear title to the property and guarantee protection against any potential claims or encumbrances. 2. Importance of Establishing a Trust: Establishing a trust offers numerous benefits to property owners, such as asset protection, potential tax advantages, successor planning, and seamless property management. By transferring their property into a trust, married individuals can ensure its preservation, proper distribution, and avoidance of probate procedures. 3. Edinburg Texas Warranty Deed Types from Husband and Wife to a Trust: a. Revocable Living Trust Warranty Deed: This type of warranty deed allows the granters (husband and wife) to retain control over the trust's assets during their lifetimes while designating beneficiaries and ultimate asset distribution plans. A revocable living trust warranty deed safeguards the property from probate while providing flexibility and potential tax benefits. b. Irrevocable Trust Warranty Deed: Unlike a revocable living trust, an irrevocable trust warranty deed transfers absolute ownership of the property to the trust, and the granters relinquish control over it. This type of trust is often utilized for estate tax planning, creditor protection, Medicaid eligibility, or preserving eligibility for government assistance programs. c. Qualified Personnel Residence Trust (PRT) Warranty Deed: PRT is a unique type of irrevocable trust designed specifically for safeguarding and transferring a residence or vacation home. This trust allows the granters to retain the right to reside in the property for a specified period. By utilizing this trust, homeowners can reduce potential estate taxes while preserving the property's use and maintaining control over its eventual disposition. 4. Legal Procedures and Considerations: Transferring property from a husband and wife to a trust requires compliance with Texas state laws and regulations. Engaging an experienced real estate attorney is crucial to ensure proper documentation, filing, and adherence to legal requirements. The involved parties must also consider essential aspects such as tax implications, property valuation, and any existing mortgage or lien on the property. Conclusion: The Edinburg Texas Warranty Deed from Husband and Wife to a Trust facilitates the smooth transfer of property ownership to a trust, ensuring asset protection, distribution control, and potential tax benefits. With various types of warranty deeds available, including revocable living trusts, irrevocable trusts, and Parts, individuals can choose the most suitable option based on their goals and circumstances. Consulting a reliable real estate attorney is pivotal throughout this process to ensure a seamless and legally binding transaction.Title: Understanding the Edinburg Texas Warranty Deed from Husband and Wife to a Trust: Types and Detailed Description Intro: In Edinburg, Texas, urbanization has led to an increasing number of real estate ownership arrangements, including transferring property from a husband and wife to a trust. This article aims to provide a comprehensive overview of the Edinburg Texas Warranty Deed from Husband and Wife to a Trust, its significance, and different variations. 1. Definition and Purpose of a Warranty Deed: A warranty deed is a legal document that establishes the transfer of real property ownership from the granters (husband and wife) to the trustee(s) of a trust. Through this deed, the granters assure the grantee (trust) that they hold clear title to the property and guarantee protection against any potential claims or encumbrances. 2. Importance of Establishing a Trust: Establishing a trust offers numerous benefits to property owners, such as asset protection, potential tax advantages, successor planning, and seamless property management. By transferring their property into a trust, married individuals can ensure its preservation, proper distribution, and avoidance of probate procedures. 3. Edinburg Texas Warranty Deed Types from Husband and Wife to a Trust: a. Revocable Living Trust Warranty Deed: This type of warranty deed allows the granters (husband and wife) to retain control over the trust's assets during their lifetimes while designating beneficiaries and ultimate asset distribution plans. A revocable living trust warranty deed safeguards the property from probate while providing flexibility and potential tax benefits. b. Irrevocable Trust Warranty Deed: Unlike a revocable living trust, an irrevocable trust warranty deed transfers absolute ownership of the property to the trust, and the granters relinquish control over it. This type of trust is often utilized for estate tax planning, creditor protection, Medicaid eligibility, or preserving eligibility for government assistance programs. c. Qualified Personnel Residence Trust (PRT) Warranty Deed: PRT is a unique type of irrevocable trust designed specifically for safeguarding and transferring a residence or vacation home. This trust allows the granters to retain the right to reside in the property for a specified period. By utilizing this trust, homeowners can reduce potential estate taxes while preserving the property's use and maintaining control over its eventual disposition. 4. Legal Procedures and Considerations: Transferring property from a husband and wife to a trust requires compliance with Texas state laws and regulations. Engaging an experienced real estate attorney is crucial to ensure proper documentation, filing, and adherence to legal requirements. The involved parties must also consider essential aspects such as tax implications, property valuation, and any existing mortgage or lien on the property. Conclusion: The Edinburg Texas Warranty Deed from Husband and Wife to a Trust facilitates the smooth transfer of property ownership to a trust, ensuring asset protection, distribution control, and potential tax benefits. With various types of warranty deeds available, including revocable living trusts, irrevocable trusts, and Parts, individuals can choose the most suitable option based on their goals and circumstances. Consulting a reliable real estate attorney is pivotal throughout this process to ensure a seamless and legally binding transaction.