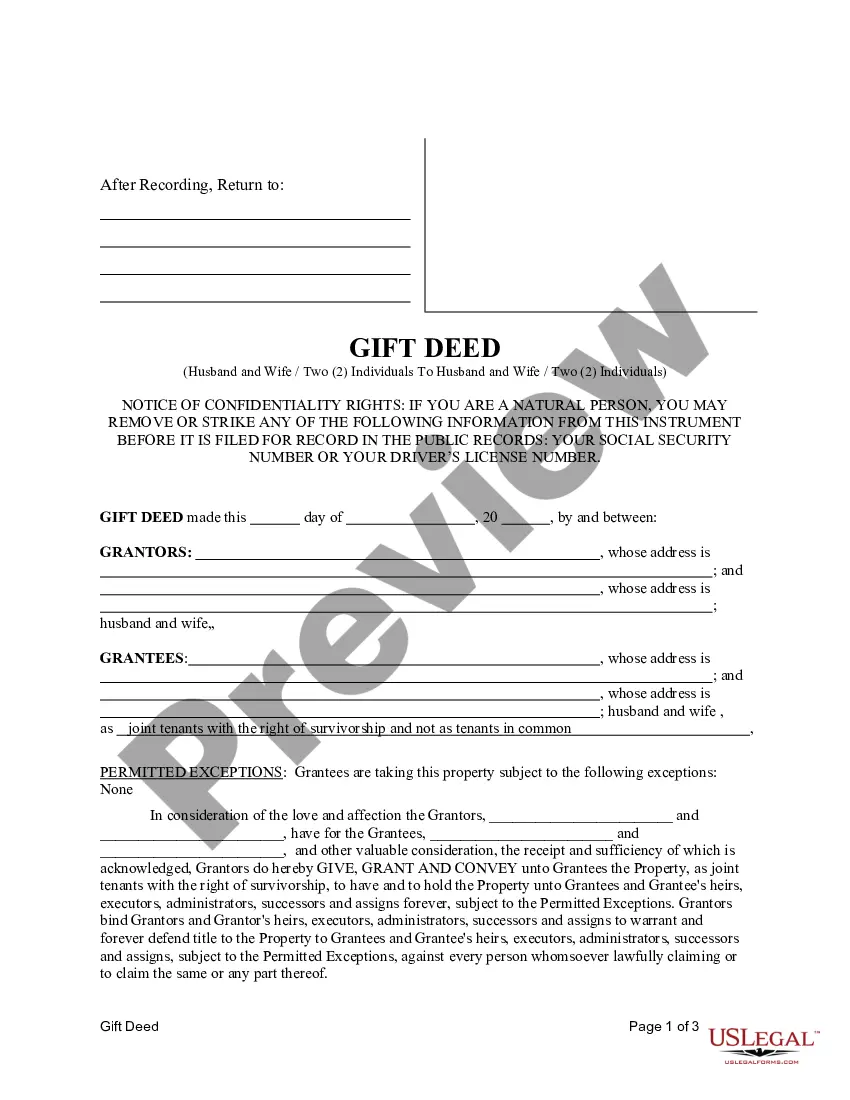

This form is a Gift Deed where the Grantors ate Husband and Wife, or Two Individuals, and the Grantees are Husband and Wife, or Two Individuals. Grantors convey and warrant the described property to the Grantees. This deed complies with all state statutory laws.

Collin Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals: Explained In Collin, Texas, a Gift Deed is a legal document that allows for the transfer of ownership of property from one party to another without any exchange of monetary compensation. Specifically, a Collin Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals, involves the transfer of property ownership between two married individuals (a husband and wife) or two non-spousal individuals (two individuals). Gift Deeds are commonly used when individuals wish to gift a property as a gesture of goodwill, such as during inter-family transfers or charitable donations. This legal instrument ensures a smooth transfer of ownership and establishes clear ownership rights. Key provisions of a Collin Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals often include the following: 1. Parties: The Gift Deed identifies the parties involved in the transfer, specifically the granters (the individuals giving the property) and the grantees (the individuals receiving the property). In this case, it would be either a husband and wife or two non-spousal individuals. 2. Property Description: The legal description of the property being transferred is provided in detail. It includes the address, boundary descriptions, and other identifiable information that accurately defines the property. 3. Consideration: Since it is a gift, the consideration for the transfer is stated as "love and affection" or "for nominal consideration." This signifies that no monetary value is exchanged in this transaction. 4. Granting Clause: This clause explicitly states the granters' intention to gift their property to the grantees. 5. Delivery and Acceptance: The Gift Deed should include a provision stating that the granters have delivered the deed to the grantees and that the grantees have accepted the transfer. 6. Covenants: The deed may also contain certain covenants, such as a warranty of title, ensuring that the granters have a valid title to the property and that they have the right to transfer it. Different types of Collin Texas Gift Deeds from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals, can include: — General Gift Deed: This type of deed allows for the transfer of property ownership without any conditions or restrictions. — Gift Deed with Reservation of Life Estate: In this case, the granters retain a life estate, meaning they can continue to reside on or use the transferred property until their death, after which the ownership fully transfers to the grantees. — Gift Deed with Conditions: This type of Gift Deed may contain specific conditions that the grantees must fulfill to retain ownership of the gifted property. For example, the granters may require the grantees to maintain the property in good condition or utilize it for a particular purpose. Overall, a Collin Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals, serves as a legal tool to facilitate the transfer of property ownership without monetary consideration, ensuring a transparent and documented transaction. It is advised to consult with a qualified attorney or legal professional to create and execute a Gift Deed properly.Collin Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals: Explained In Collin, Texas, a Gift Deed is a legal document that allows for the transfer of ownership of property from one party to another without any exchange of monetary compensation. Specifically, a Collin Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals, involves the transfer of property ownership between two married individuals (a husband and wife) or two non-spousal individuals (two individuals). Gift Deeds are commonly used when individuals wish to gift a property as a gesture of goodwill, such as during inter-family transfers or charitable donations. This legal instrument ensures a smooth transfer of ownership and establishes clear ownership rights. Key provisions of a Collin Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals often include the following: 1. Parties: The Gift Deed identifies the parties involved in the transfer, specifically the granters (the individuals giving the property) and the grantees (the individuals receiving the property). In this case, it would be either a husband and wife or two non-spousal individuals. 2. Property Description: The legal description of the property being transferred is provided in detail. It includes the address, boundary descriptions, and other identifiable information that accurately defines the property. 3. Consideration: Since it is a gift, the consideration for the transfer is stated as "love and affection" or "for nominal consideration." This signifies that no monetary value is exchanged in this transaction. 4. Granting Clause: This clause explicitly states the granters' intention to gift their property to the grantees. 5. Delivery and Acceptance: The Gift Deed should include a provision stating that the granters have delivered the deed to the grantees and that the grantees have accepted the transfer. 6. Covenants: The deed may also contain certain covenants, such as a warranty of title, ensuring that the granters have a valid title to the property and that they have the right to transfer it. Different types of Collin Texas Gift Deeds from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals, can include: — General Gift Deed: This type of deed allows for the transfer of property ownership without any conditions or restrictions. — Gift Deed with Reservation of Life Estate: In this case, the granters retain a life estate, meaning they can continue to reside on or use the transferred property until their death, after which the ownership fully transfers to the grantees. — Gift Deed with Conditions: This type of Gift Deed may contain specific conditions that the grantees must fulfill to retain ownership of the gifted property. For example, the granters may require the grantees to maintain the property in good condition or utilize it for a particular purpose. Overall, a Collin Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals, serves as a legal tool to facilitate the transfer of property ownership without monetary consideration, ensuring a transparent and documented transaction. It is advised to consult with a qualified attorney or legal professional to create and execute a Gift Deed properly.