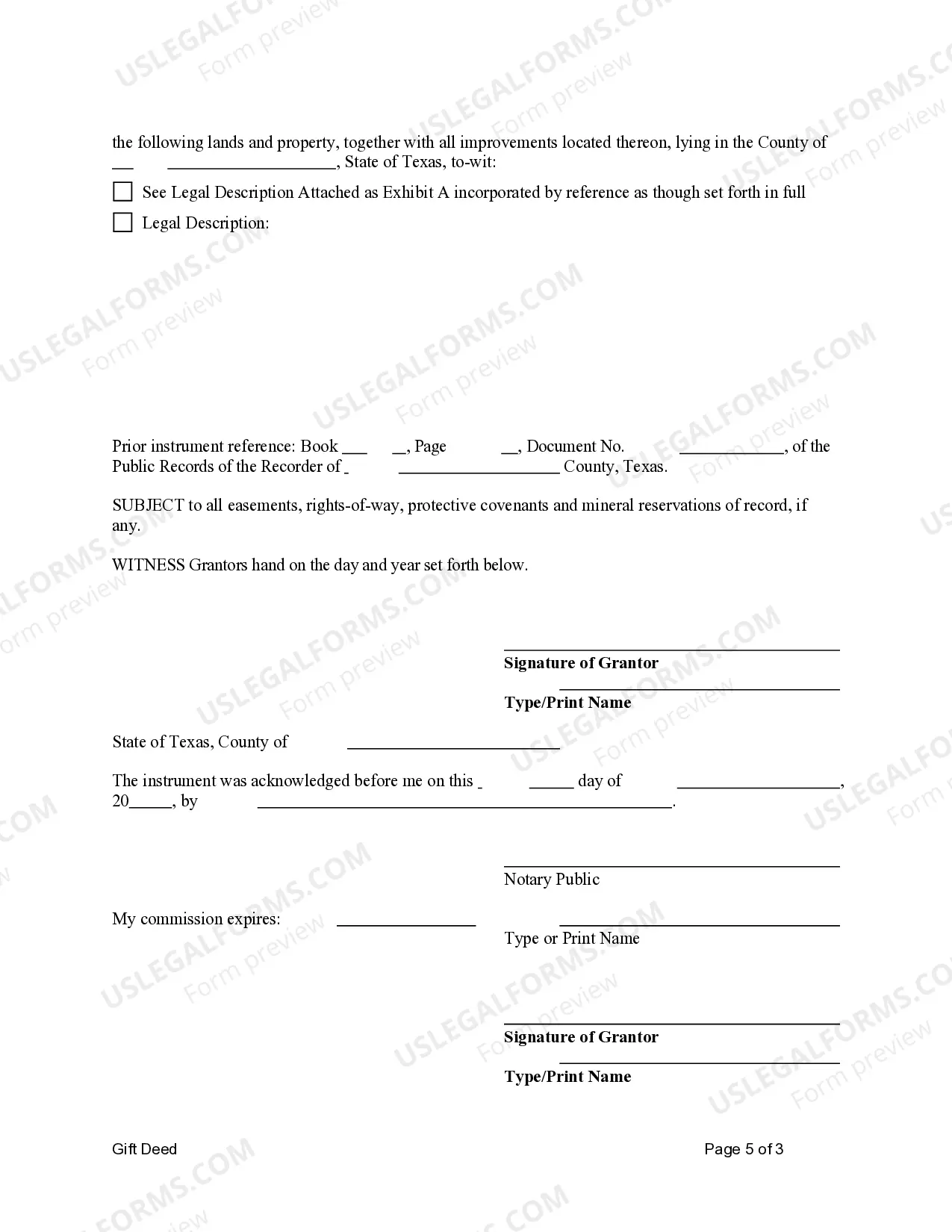

This form is a Gift Deed where the Grantors ate Husband and Wife, or Two Individuals, and the Grantees are Husband and Wife, or Two Individuals. Grantors convey and warrant the described property to the Grantees. This deed complies with all state statutory laws.

Title: Understanding the Variants of Harris Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals Introduction: A Harris Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals is a legal document that allows for the transfer of property ownership as a gift. This comprehensive guide will delve into the details of this deed and outline different types to provide a clearer understanding. 1. Basic Overview: A Harris Texas Gift Deed is a legal instrument used to transfer ownership of real property willingly and voluntarily from one party (donor) to another (grantee) without any monetary exchange. This deed solidifies the intentions and ensures the transfer of property is legally binding. 2. Harris Texas Gift Deed from Husband and Wife: This specific type of gift deed involves the transfer of ownership from a married couple to either another married couple or two individuals. The property can range from residential homes to vacant land, providing a means for the donors to gift their property to the recipients jointly. 3. Harris Texas Gift Deed from Two Individuals: Alternatively, a gift deed can involve the transfer of property from two individual owners, who can then gift it to either a married couple or two individuals. This variation allows for flexibility in transferring ownership between unrelated parties. 4. Enhanced Life Estate Deed (Harris Texas): The Enhanced Life Estate Deed, also called a Lady Bird Deed, is a specific type of gift deed. It grants the donor the right to retain control and possession of the property throughout their lifetime while simultaneously designating a remainder man (recipient) who will automatically gain full ownership upon the donor's death, bypassing probate. 5. Requirements for a Valid Gift Deed: — Must be in writing, signed, and notarized by the donor(s). — The deed must contain an accurate property description with the county's recording district. — Acceptance of the gift must be noted by the grantee(s) for the deed to be effective. 6. Benefits of a Gift Deed: — The donor can transfer ownership without any monetary consideration. — It helps minimize potential inheritance disputes and probate procedures. — The recipient(s) gain immediate legal ownership rights. — Beneficial for estate planning and tax purposes. Conclusion: The Harris Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals serves as a powerful legal instrument to transfer property ownership as a gift. By understanding the various types available and their unique features, individuals can make informed decisions while transferring real estate and ensure a smooth, legally binding transaction.Title: Understanding the Variants of Harris Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals Introduction: A Harris Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals is a legal document that allows for the transfer of property ownership as a gift. This comprehensive guide will delve into the details of this deed and outline different types to provide a clearer understanding. 1. Basic Overview: A Harris Texas Gift Deed is a legal instrument used to transfer ownership of real property willingly and voluntarily from one party (donor) to another (grantee) without any monetary exchange. This deed solidifies the intentions and ensures the transfer of property is legally binding. 2. Harris Texas Gift Deed from Husband and Wife: This specific type of gift deed involves the transfer of ownership from a married couple to either another married couple or two individuals. The property can range from residential homes to vacant land, providing a means for the donors to gift their property to the recipients jointly. 3. Harris Texas Gift Deed from Two Individuals: Alternatively, a gift deed can involve the transfer of property from two individual owners, who can then gift it to either a married couple or two individuals. This variation allows for flexibility in transferring ownership between unrelated parties. 4. Enhanced Life Estate Deed (Harris Texas): The Enhanced Life Estate Deed, also called a Lady Bird Deed, is a specific type of gift deed. It grants the donor the right to retain control and possession of the property throughout their lifetime while simultaneously designating a remainder man (recipient) who will automatically gain full ownership upon the donor's death, bypassing probate. 5. Requirements for a Valid Gift Deed: — Must be in writing, signed, and notarized by the donor(s). — The deed must contain an accurate property description with the county's recording district. — Acceptance of the gift must be noted by the grantee(s) for the deed to be effective. 6. Benefits of a Gift Deed: — The donor can transfer ownership without any monetary consideration. — It helps minimize potential inheritance disputes and probate procedures. — The recipient(s) gain immediate legal ownership rights. — Beneficial for estate planning and tax purposes. Conclusion: The Harris Texas Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals serves as a powerful legal instrument to transfer property ownership as a gift. By understanding the various types available and their unique features, individuals can make informed decisions while transferring real estate and ensure a smooth, legally binding transaction.