This form is a Gift Deed where the Grantors ate Husband and Wife, or Two Individuals, and the Grantees are Husband and Wife, or Two Individuals. Grantors convey and warrant the described property to the Grantees. This deed complies with all state statutory laws.

Sugar Land Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals.

Description

How to fill out Texas Gift Deed Gift Deed From Husband And Wife, Or Two Individuals, To Husband And Wife, Or Two Individuals.?

Are you searching for a dependable and cost-effective legal documents provider to purchase the Sugar Land Texas Gift Deed from Spouses, or Two Persons, to Spouses, or Two Persons? US Legal Forms is your perfect choice.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a collection of papers to facilitate your separation or divorce through the legal system, we've got you covered. Our platform offers over 85,000 current legal document templates for personal and business purposes.

All templates that we provide are not generic and are structured according to the regulations of specific states and regions.

To obtain the form, you must Log In to your account, find the desired template, and click the Download button adjacent to it. Please remember that you can download your previously acquired document templates at any time from the My documents section.

Now you can create your account. Next, choose the subscription option and move forward to payment. Once the payment is processed, download the Sugar Land Texas Gift Deed from Spouses, or Two Persons, to Spouses, or Two Persons in any available file type. You can revisit the website at any time and redownload the form without any cost.

Locating current legal documents has never been simpler. Give US Legal Forms a try today, and put an end to spending hours searching for legal paperwork online once and for all.

- Is this your first visit to our site? No worries.

- You can set up an account in just a few minutes, but before doing that, ensure you.

- Verify if the Sugar Land Texas Gift Deed from Spouses, or Two Persons, to Spouses, or Two Persons is in accordance with the laws of your state and locality.

- Review the specifics of the form (if accessible) to understand who and what the form is designed for.

- Restart the search if the template does not suit your particular situation.

Form popularity

FAQ

When you add someone to your deed, you effectively change the ownership structure of the property. This can streamline access to the property for both parties but may also complicate financial or legal obligations. A Sugar Land Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals can help manage these changes and ensure that both parties understand their rights.

Gift tax can apply to spouses, but there are specific exceptions. Transfers between spouses typically fall under the unlimited marital deduction, meaning they may not incur gift tax. However, for large gifts and complex situations, consulting a legal expert familiar with the Sugar Land Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals, is advisable.

Yes, adding a spouse to a deed can influence your tax situation. The transfer may be subject to gift tax if the property's value is above the annual exclusion limit. To navigate these complexities, using a Sugar Land Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals can help ensure you meet all legal requirements and minimize any tax fallout.

Yes, adding a spouse to a deed can be considered a gift for legal and tax purposes. When you transfer ownership, it may trigger gift tax implications, especially if the property value exceeds certain limits. The Sugar Land Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals, provides a pathway to clarify these transactions to avoid confusion.

Adding your spouse to the deed can create complications in the event of a divorce or separation. It may complicate ownership rights if disagreements arise in the future. Additionally, some people prefer to keep their assets separate for inheritance purposes. This is important when considering a Sugar Land Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals.

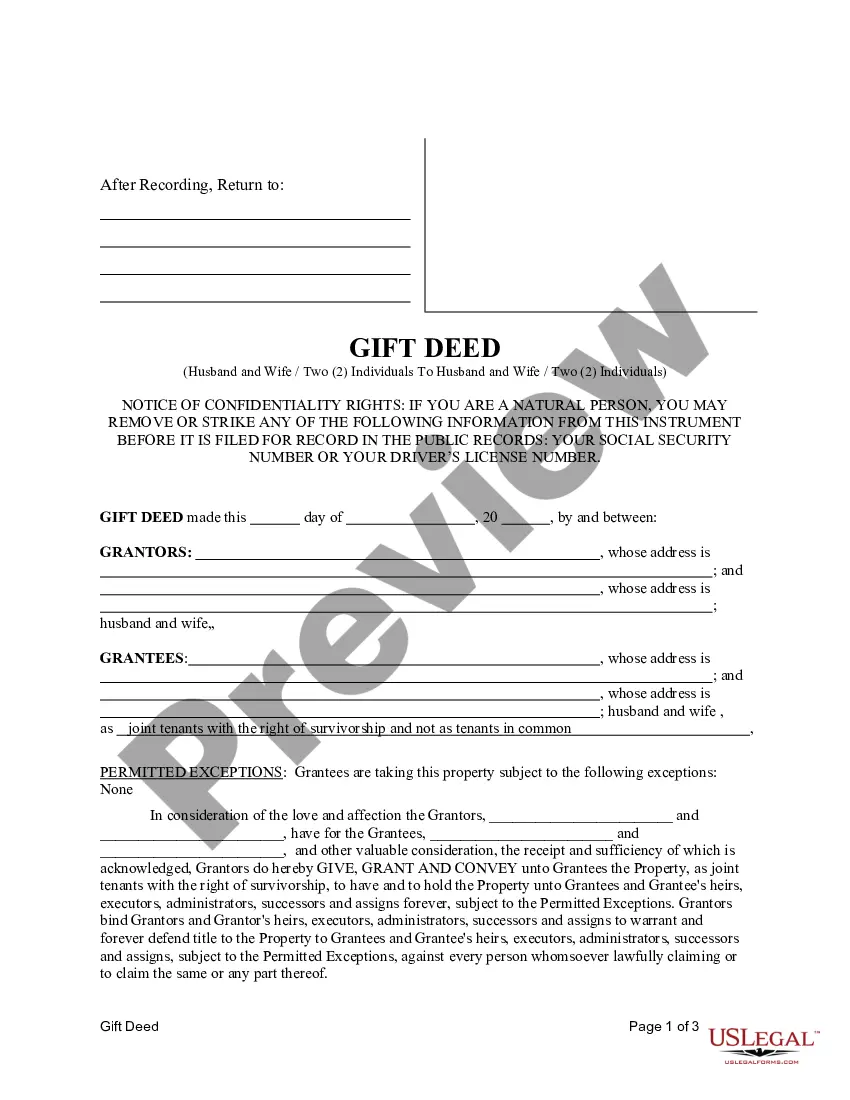

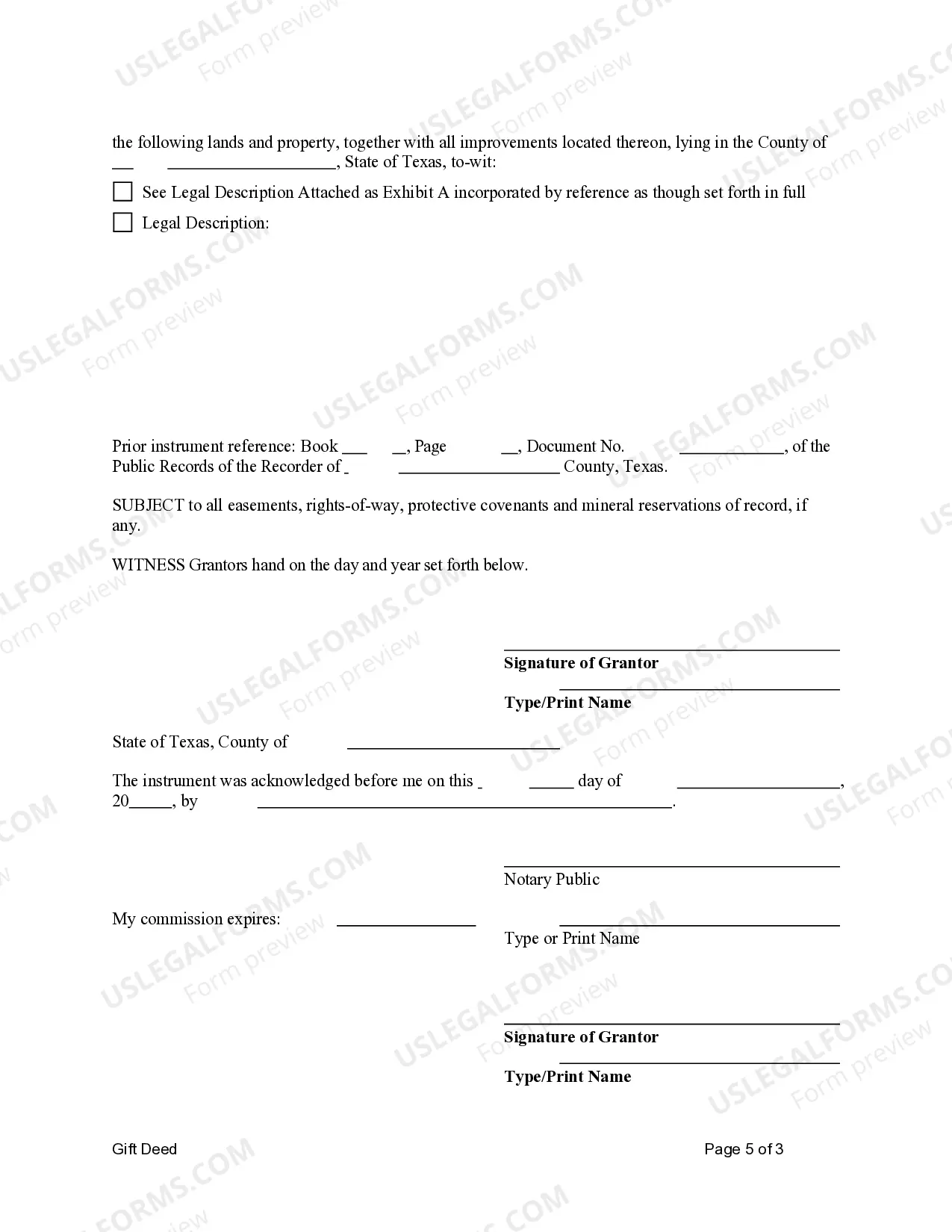

To gift land in Texas, start by drafting a gift deed that includes the necessary details of both the giver and the recipient, as well as a precise description of the property. It’s crucial to ensure that the deed states the transfer as a gift. Once completed, the deed must be signed and notarized before being filed with the local county recorder's office. By utilizing a Sugar Land Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals form, the gifting process can become more straightforward.

In Texas, the federal gift tax applies to significant gifts, including land, above the annual exclusion amount. As of 2023, this amount is $17,000 per recipient, allowing you to gift up to this figure without tax implications. If the value of the land exceeds this, a gift tax return may be necessary. However, using a Sugar Land Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals can help you manage the transfer legally and efficiently.

Gifting land to a family member in Texas involves creating a legally binding deed that specifies the gift. You should clearly identify yourself as the donor and the family member as the recipient, along with a description of the land. It's advisable to have the gift deed notarized and filed with the local county office to formalize the process. Utilizing a Sugar Land Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals will aid in ensuring the process is smooth and accurate.

To write a gift deed in Texas, you should begin by clearly identifying the parties involved, including the grantor and the grantee. Then, accurately describe the property being gifted, ensuring to include any relevant legal descriptions. Finally, you should include a statement indicating that the transfer is a gift, sign the document, and have it notarized. Using a Sugar Land Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals template can simplify this process.

Your wife does not necessarily need to be on the deed in Texas, but doing so can provide her with legal protection and rights associated with the property. Including her name simplifies future transactions or inheritance matters. If you choose to transfer property using a Sugar Land Texas Gift Deed Gift Deed from Husband and Wife, or Two Individuals, to Husband and Wife, or Two Individuals, her name should ideally appear on the deed for clear ownership.