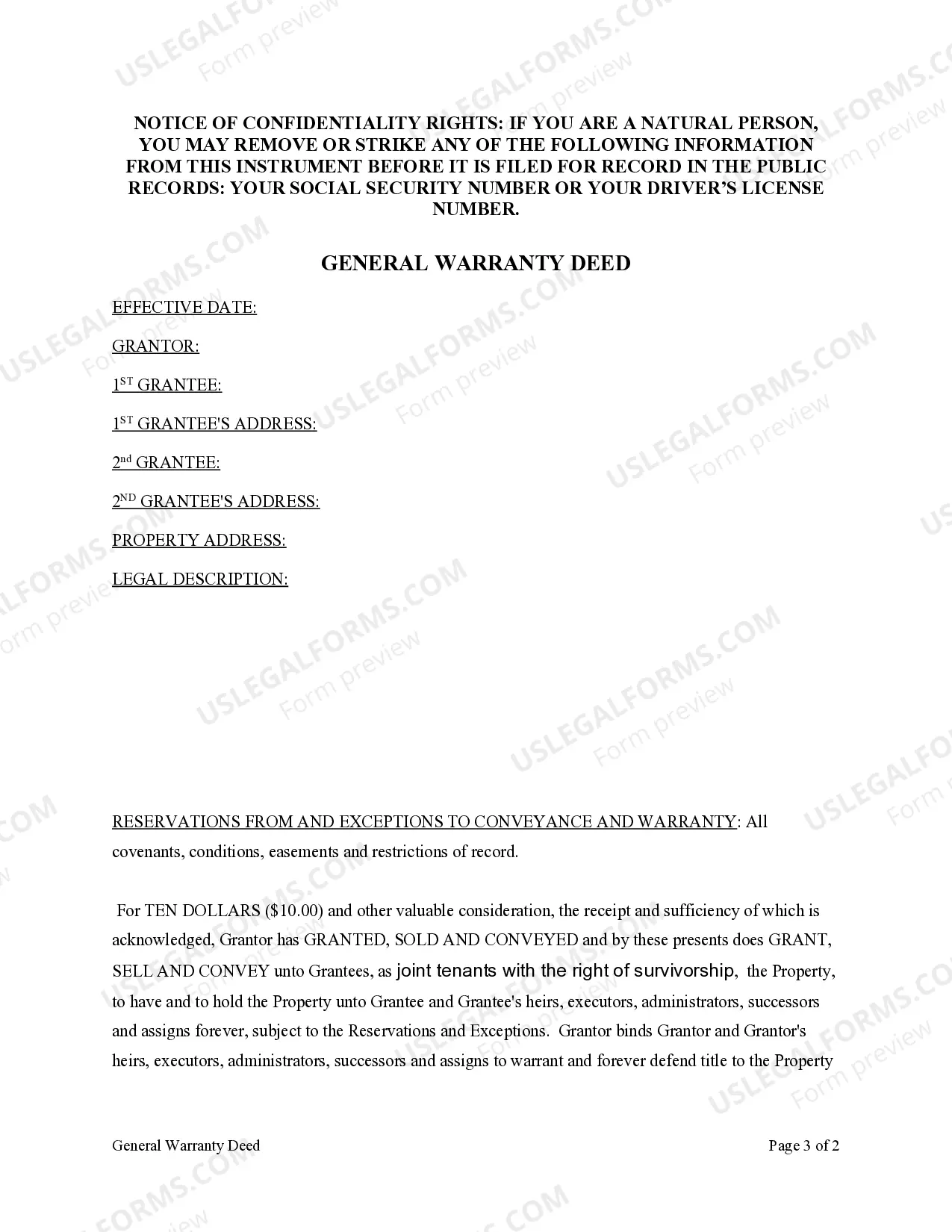

This form is a Warranty Deed where the grantor is the husband and the grantees are the husband and his wife. Grantor conveys and warrants the described property to grantees as joint tenants with rights of survivorship less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Houston Texas Warranty Deed from Husband to Himself and Wife

Description

How to fill out Texas Warranty Deed From Husband To Himself And Wife?

If you are in search of a pertinent form, it is incredibly difficult to find a superior location than the US Legal Forms website – likely the largest online collections.

With this collection, you can obtain countless templates for business and personal purposes organized by categories and areas, or keywords.

Utilizing our premium search functionality, locating the most current Houston Texas Warranty Deed from Husband to Himself and Wife is as straightforward as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the format and save it on your device.

- Moreover, the relevance of each document is validated by a team of experienced attorneys who frequently inspect the templates on our platform and update them according to the latest state and county laws.

- If you are already familiar with our system and possess a registered account, all you need to obtain the Houston Texas Warranty Deed from Husband to Himself and Wife is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have located the sample you desire. Review its description and use the Preview feature to view its content. If it doesn’t satisfy your needs, use the Search box at the top of the screen to find the required document.

- Confirm your choice. Click the Buy now button. Subsequently, select the desired subscription plan and provide your details to register for an account.

Form popularity

FAQ

If the wife's name is not on the deed, it doesn't matter. It's still marital property because it was bought during the marriage. This makes it marital property and is still split between both parties. The wife is entitled to receive either equal share or equitable share of the house.

By default, the married couple will own the property as community property without rights of survivorship. If the couple wants to hold title as community property with right of survivorship, the couple must sign?in addition to the deed?a Community Property Survivorship Agreement.

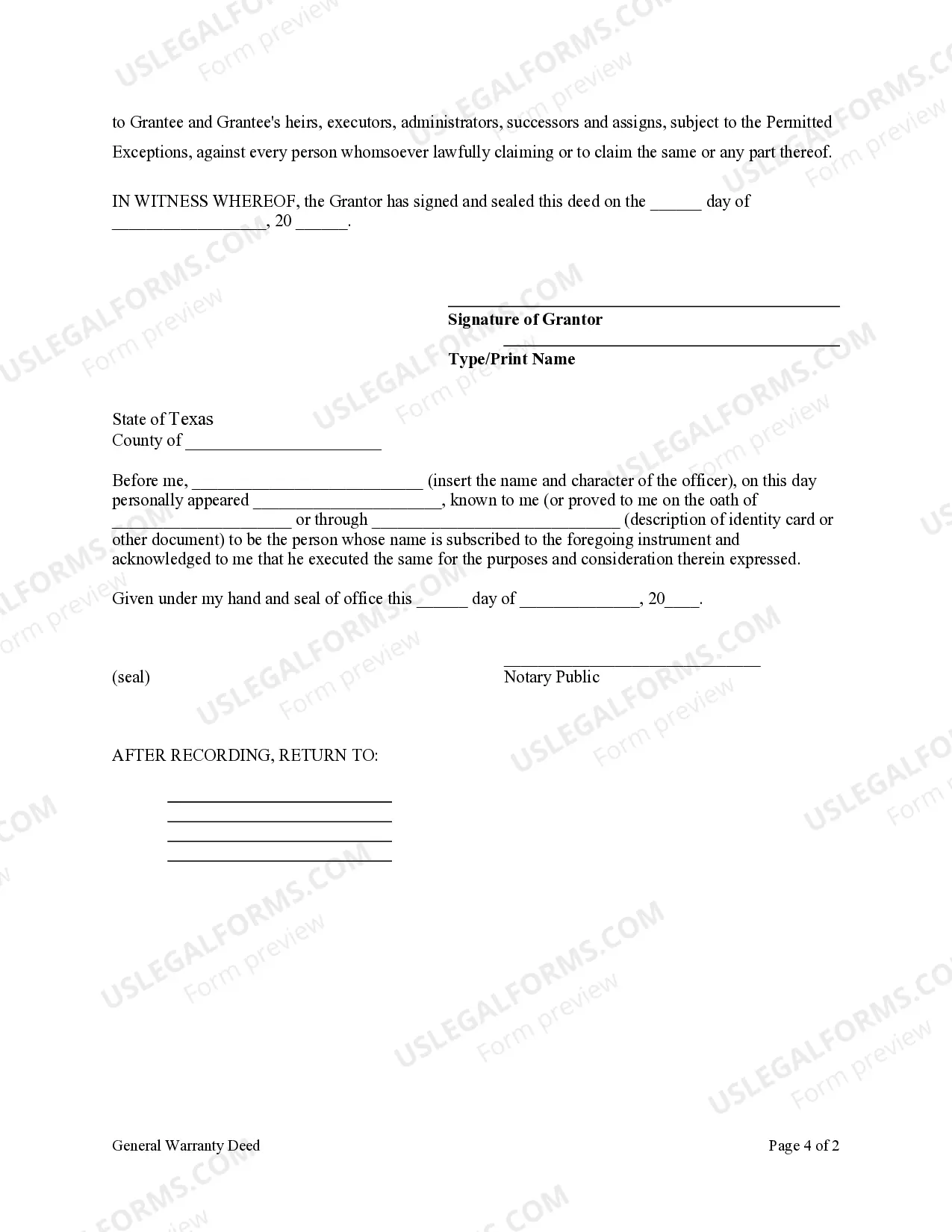

As a property owner and grantor, you can obtain a warranty deed for the transfer of real estate through a local realtor's office, or with an online search for a template. To make the form legally binding, you must sign it in front of a notary public.

Control and Ownership of Separate Property The signature of both spouses is required to convey Texas homestead, even if the property used as the marital home is actually owned by only one spouse.

In every sale transaction a title company is required to determine if the seller of the property is married. If they are married, their spouse is typically required to sign a document at closing and the document changes depending on the classification of the property as homestead or investment.

Process of transfer property from husband to wife So he explained that the Transfer of Property Act allows transfer of immovable property through gift deeds in such cases. The catch is that the property should have been registered with the local magistrate or registrar in the presence of two witnesses.

The most recognized form for a married couple is to own their home as Tenants by the Entirety. A tenancy by the entirety is ownership in real estate under the fictional assumption that a husband and wife are considered one person for legal purposes. This method of ownership conveys the property to them as one person.

One good reason to add a spouse to the deed of your home is for estate planning purposes, which may allow the property to transfer to your spouse outside the probate process, depending on the transfer language utilized in the granting clause. Another reason is for creditor purposes.

Most mortgage applications require information about the marital status of the applicant. However, you can technically apply for a mortgage without your spouse. This may make sense where one spouse has significantly better credit than the other.

Control and Ownership of Separate Property The signature of both spouses is required to convey Texas homestead, even if the property used as the marital home is actually owned by only one spouse.